Overview

The article provides ten essential tips for financial planning that are crucial for new entrepreneurs to establish a strong financial foundation for their businesses. It emphasizes the importance of creating a detailed financial strategy, maintaining a separate business bank account, setting SMART financial goals, and seeking professional guidance, all of which are supported by statistics and research highlighting the risks of poor financial management and the benefits of strategic planning.

Introduction

In the dynamic world of entrepreneurship, establishing a robust financial foundation is not merely beneficial; it is essential for long-term success. New business owners often face a myriad of challenges, from cash flow management to navigating the complexities of tax obligations. As statistics reveal that a staggering 82% of business failures are attributed to cash flow issues, the significance of comprehensive financial planning becomes abundantly clear.

This article delves into the critical steps entrepreneurs must take to build a solid financial base, implement effective management strategies, and prepare for the unexpected. By understanding the intricacies of budgeting, risk management, and the value of professional guidance, aspiring business owners can equip themselves with the tools necessary to thrive in an increasingly competitive landscape.

Whether through meticulous planning or leveraging expert advice, a proactive approach to financial health is the cornerstone of entrepreneurial success.

Building a Strong Financial Foundation for Your Business

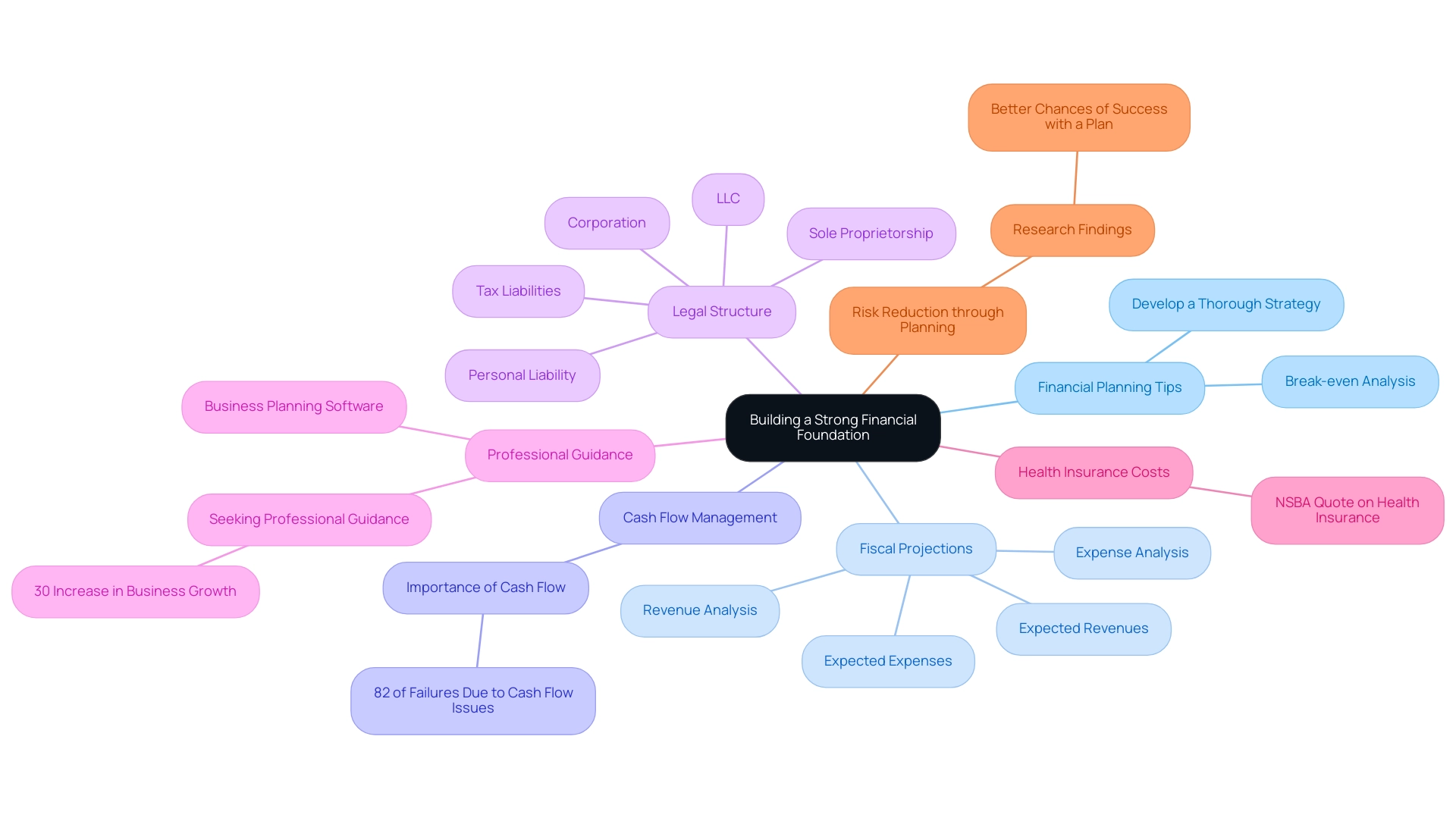

Building a strong monetary base is essential for new entrepreneurs, and it starts with the development of a thorough strategy that incorporates tips for financial planning for new entrepreneurs along with detailed fiscal projections. This plan should clearly outline expected revenues, expenses, and a break-even analysis, serving as essential tips for financial planning for new entrepreneurs to guide your monetary decisions. Significantly, studies show that in 2023, 82% of company failures arose from cash flow issues, which underscores the need for tips for financial planning for new entrepreneurs.

Moreover, establishing a separate commercial bank account is crucial; it not only aids in keeping clear monetary records but also streamlines tax preparation, enabling you to concentrate on growth. Additionally, the choice of legal structure—whether a sole proprietorship, LLC, or corporation—has significant implications for tax liabilities and personal liability. As mentioned by the NSBA, one of the greatest obstacles to the survival of small enterprises and startups is the expense of health insurance, which is a significant economic factor.

By laying this groundwork, you empower yourself with a comprehensive understanding of your financial landscape, which incorporates essential tips for financial planning for new entrepreneurs, positioning your venture for long-term success. Furthermore, research titled ‘Risk Reduction through Planning’ indicates that having a plan can reduce the likelihood of failure in enterprises. Remember, crafting a detailed plan that incorporates tips for financial planning for new entrepreneurs is not just about numbers; it’s about creating a roadmap that enhances your chances of success and reduces risks associated with entrepreneurship.

Seeking professional guidance or utilizing business planning software can also lead to a 30% increase in business growth, providing a contemporary perspective on the benefits of proper planning.

Essential Financial Management Strategies for Entrepreneurs

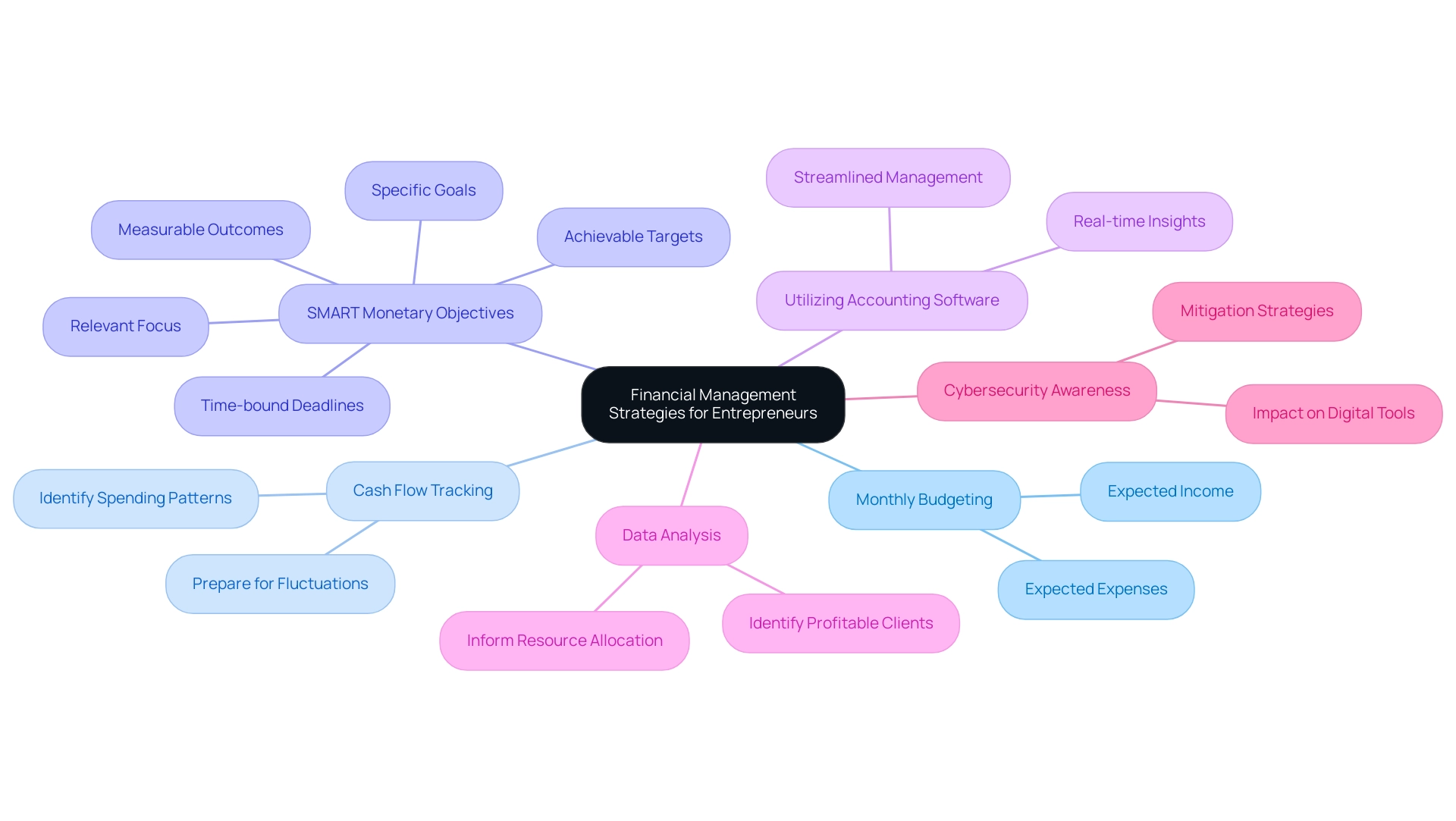

To prosper as an entrepreneur, it is crucial to adopt essential tips for financial planning for new entrepreneurs. A foundational step, as part of tips for financial planning for new entrepreneurs, is to create a monthly budget that outlines expected income and expenses, ensuring clarity in planning. As Angela Petulla, Director of Online Marketing at altLINE, highlights,

These small enterprise revenue statistics may make launching a company seem intimidating, but they are crucial to examine to assist you in making informed commercial and monetary planning choices.

Employing accounting software can significantly improve this process and provide valuable tips for financial planning for new entrepreneurs by offering streamlined management and real-time insights into your monetary health. In fact, with the advent of 2024, various advanced accounting tools have emerged, proving essential for small enterprises. Furthermore, meticulous cash flow tracking is essential; it helps identify spending patterns and prepare for potential fluctuations.

Establishing SMART (Specific, Measurable, Achievable, Relevant, Time-bound) monetary objectives is an essential approach that offers valuable tips for financial planning for new entrepreneurs, enabling them to concentrate their efforts and efficiently assess success. Routine evaluations of these approaches are essential to guarantee the company remains in sync with its monetary goals, particularly as tips for financial planning for new entrepreneurs become increasingly important in light of the troubling figure that 23.2% of U.S. small enterprises that launched in March 2022 were shut down by March 2023. Furthermore, it is crucial to acknowledge the substantial assistance accessible for small enterprises, as the SBA offered $27.5 billion through over 57,300 7(a) loans in fiscal year 2023, which underscores the importance of tips for financial planning for new entrepreneurs to effectively obtain funding.

Moreover, the case study on digital payment methods adoption highlights that 55% of small-business owners expect to digitize their payment acceptance methods, yet 56% report cybersecurity threats impacting their operations. This demonstrates the current trends and challenges that business leaders encounter. Utilizing data analysis is among the tips for financial planning for new entrepreneurs, as it helps business owners recognize their most lucrative clients, guiding resource distribution and monetary decision-making.

By applying these tips for financial planning for new entrepreneurs, business owners can manage economic uncertainties with enhanced assurance and steadiness.

Planning for the Unexpected: Emergency Funds and Risk Management

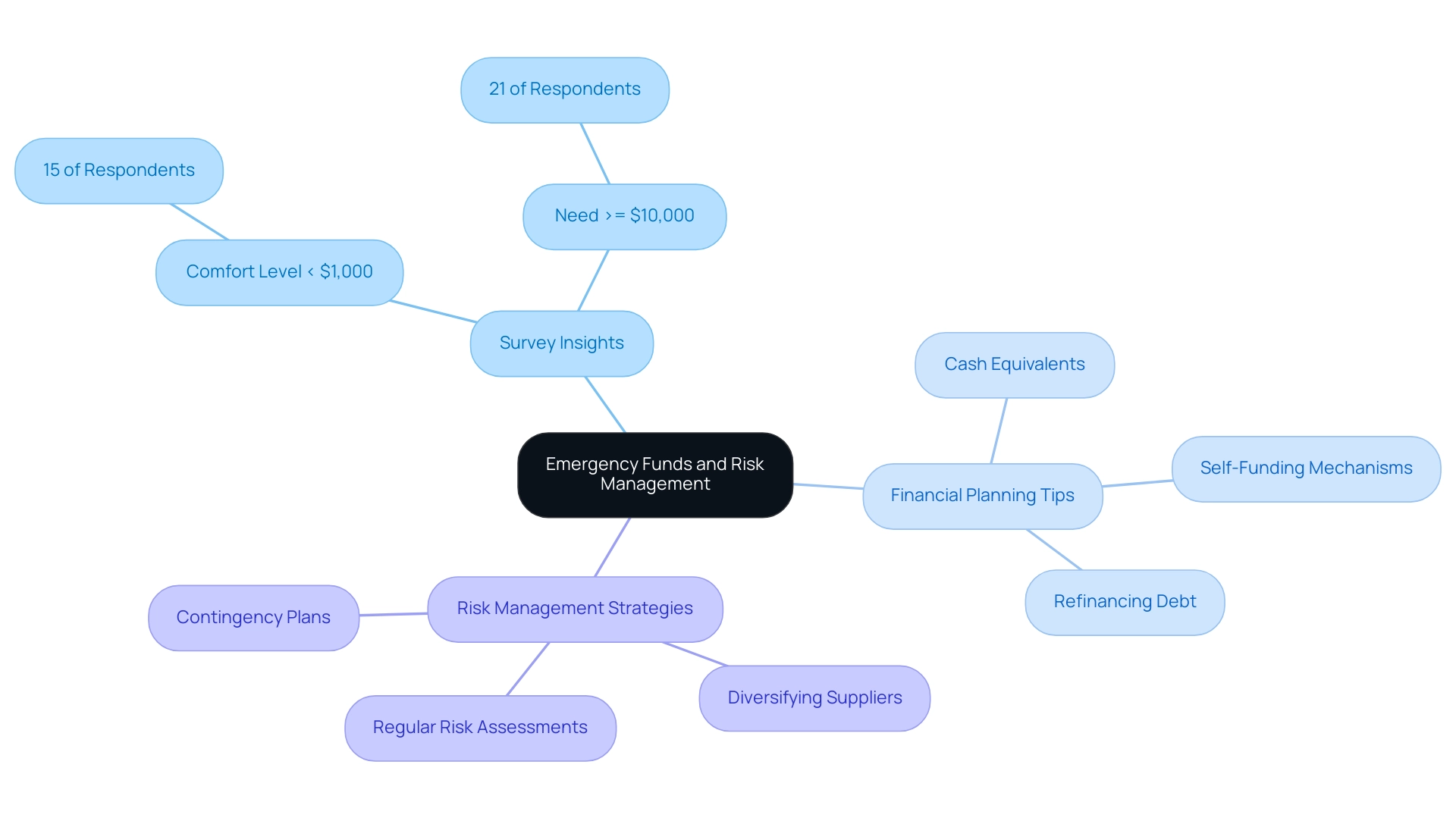

For business owners, establishing an emergency fund that can cover three to six months of operating expenses is crucial. This monetary buffer serves as a safeguard during challenging periods or unexpected downturns, allowing business owners to navigate uncertainties with greater confidence. A recent survey conducted by LendingTree, which included 2,002 U.S. consumers from November 6 to 9, 2023, revealed that:

- 15% of respondents feel comfortable with less than $1,000 saved.

- 21% believe they need at least $10,000 to achieve a sense of security.

Such insights highlight the differing views on monetary readiness among business owners. However, as Matt Schulz highlights, building those savings can be easier said than done, especially with stubborn inflation, rising interest rates, restarted student loan payments, and, well, life in general.

To bolster financial health, business owners should explore tips for financial planning for new entrepreneurs, including:

- Self-funding mechanisms through checking and savings accounts, which can provide a secure and accessible way to accumulate savings.

These accounts typically offer features like interest accrual and low fees, making them ideal for setting aside emergency funds. Additionally, exploring cash equivalents, such as money market accounts or short-term certificates of deposit, can enhance liquidity while earning a return on savings, which serves as valuable tips for financial planning for new entrepreneurs. Furthermore, entrepreneurs should look into funding options available from the U.S. Small Business Administration.

Refinancing debt to lower interest rates can free up funds for savings. It is also essential to assess potential risks your business may face, from market fluctuations to natural disasters. Creating a comprehensive risk management plan—complete with tips for financial planning for new entrepreneurs, insurance options, and strategies such as:

- Diversifying suppliers

- Conducting regular risk assessments

- Developing contingency plans

can help mitigate these risks.

Consistently examining and refreshing this plan guarantees that you stay ready for any circumstance, enabling you to focus on growth instead of being troubled by economic insecurity.

The Value of Professional Financial Guidance for New Entrepreneurs

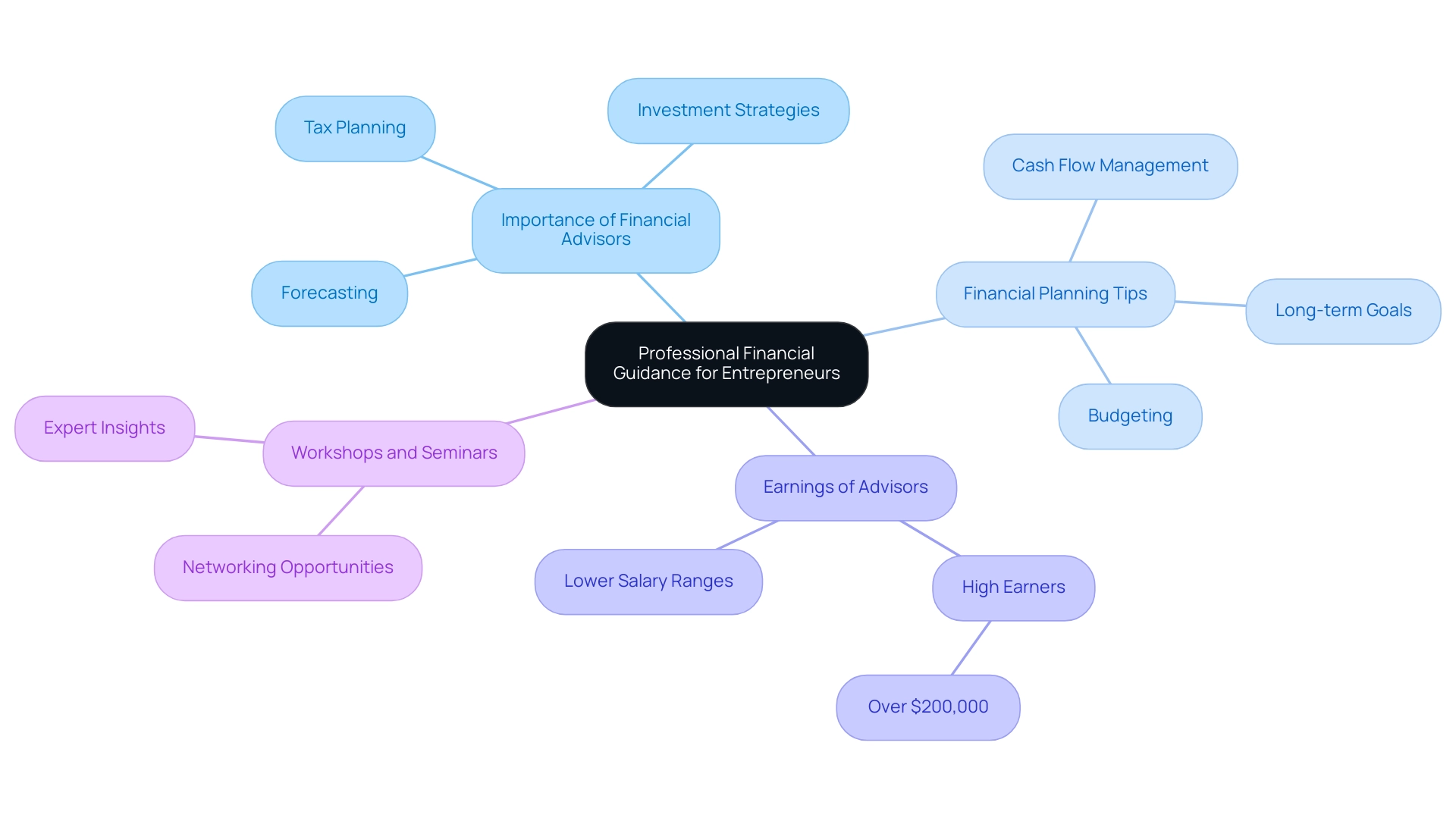

For new business owners, following tips for financial planning for new entrepreneurs and enlisting the assistance of a monetary advisor or accountant is a crucial step in effectively managing the complexities of company finances. These experts, who have an average age of 44.8 years, bring valuable knowledge in tax planning, investment strategies, and forecasting, which are essential for navigating the complex economic landscape. As Trevor Randall, President and CEO of Randall Wealth Management Group, emphasizes,

I prioritize hands-on care and detailed investment research to ensure every portfolio decision is accurate.

This level of attention can significantly influence an entrepreneur’s economic trajectory. Furthermore, recent statistics indicate that a substantial number of personal wealth advisors earn over $200,000 annually, while lower salary ranges have a smaller share compared to the overall labor force, highlighting the potential value they can provide. Participating in workshops or seminars conducted by finance experts can provide essential tips for financial planning for new entrepreneurs, yielding profound insights and creating invaluable networking opportunities.

With an estimated 285,000 planning clients currently engaging with state-registered advisers who offer diverse services and client engagement strategies, it’s clear that business owners can improve their success by utilizing tips for financial planning for new entrepreneurs to better align their decisions with long-term monetary objectives.

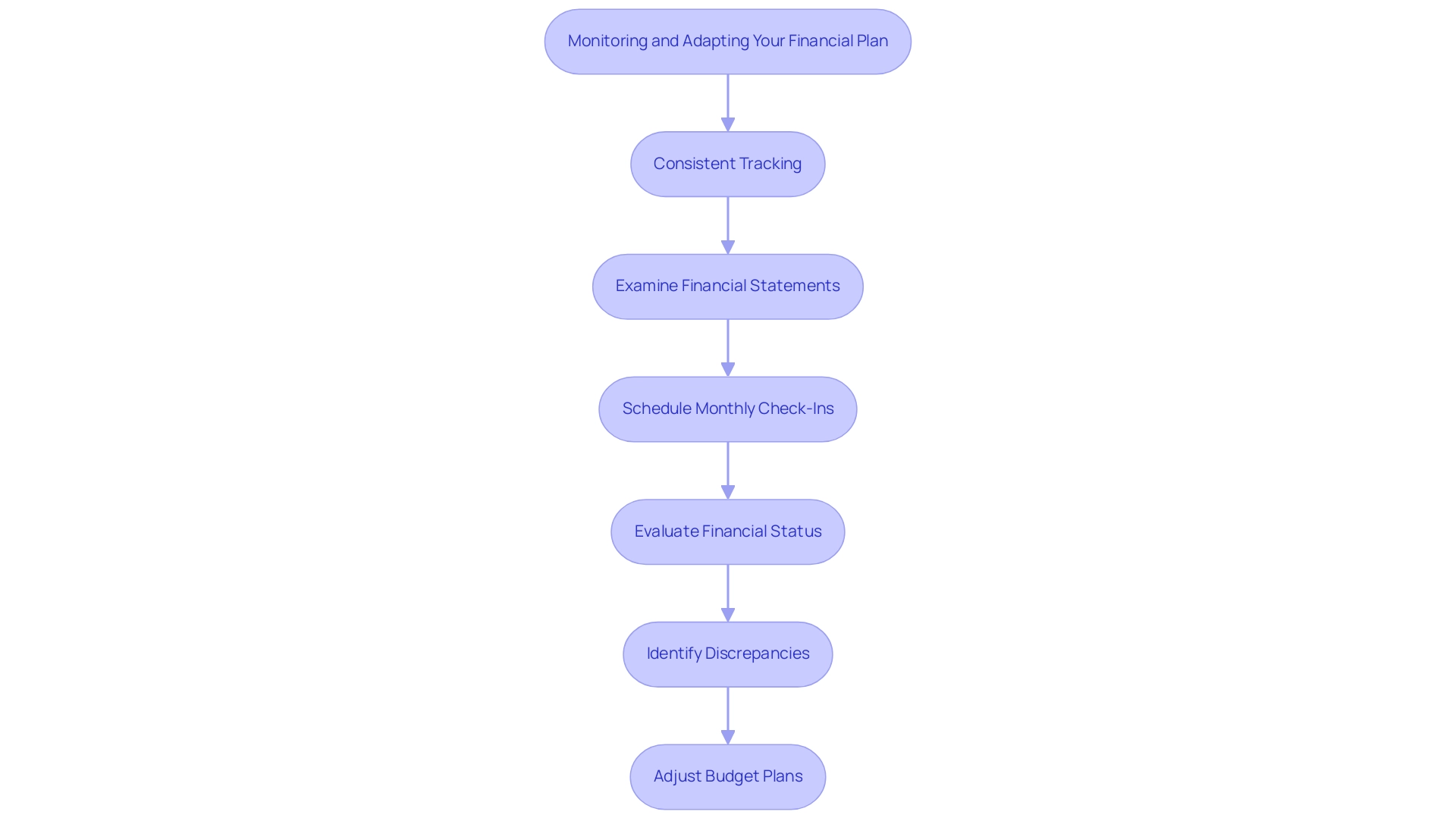

Monitoring and Adapting Your Financial Plan for Success

To guarantee continuous economic well-being, business owners must emphasize consistent tracking of their monetary advancement. This entails systematically examining monetary statements, budgets, and cash flow reports. Scheduling monthly check-ins can be an effective practice, allowing entrepreneurs to evaluate their monetary status, uncover discrepancies, and identify areas needing improvement.

As the business landscape is continually evolving, particularly in light of the significant 43% of businesses that have temporarily closed, adaptability is crucial. Adjustments to budget plans may be necessary to reflect shifts in the environment or personal circumstances, especially given the rising dissatisfaction with corporate jobs, which has surged by 27% since 2019. This trend is encouraging many individuals, including veterans, to consider entrepreneurship as a viable route towards economic independence and personal empowerment.

Indra Nooyi, former CEO of PepsiCo, wisely stated, ‘Just because you are CEO, don’t think you have landed. You must continually increase your learning, the way you think, and the way you approach the organization.’ This mindset is vital for successful money management.

By remaining attentive and proactive, business owners can manage challenges, take advantage of new opportunities, and align their monetary strategies with their evolving business objectives. Current best practices emphasize the importance of monitoring financial health, with successful entrepreneurs often utilizing tips for financial planning for new entrepreneurs to adjust their financial plans in response to changes in their operational landscape. To further support your journey, download your free Veteran Entrepreneur® Program presentation here.

Additionally, it’s essential to recognize the importance of transferable skills and address employability concerns as you transition into entrepreneurship, empowering you to create the lifestyle of your dreams.

Conclusion

Establishing a solid financial foundation is paramount for any entrepreneur seeking long-term success. From crafting a comprehensive business plan that includes detailed financial projections to setting up a dedicated business bank account, the initial steps taken can significantly influence future outcomes. The staggering statistic that 82% of business failures arise from cash flow issues underscores the necessity of robust financial planning and management. By adopting essential strategies such as:

- Budgeting

- Cash flow tracking

- Setting SMART goals

entrepreneurs can navigate the complexities of their financial landscape with greater confidence.

Moreover, preparing for the unexpected through the establishment of an emergency fund and a comprehensive risk management plan serves as a vital safeguard against unforeseen challenges. This proactive approach not only enhances financial security but also empowers entrepreneurs to focus on growth rather than merely surviving. The insights gained from professional financial guidance further amplify the potential for success, as experienced advisors can provide invaluable expertise in navigating intricate financial matters.

Ultimately, the journey of entrepreneurship demands continuous monitoring and adaptation of financial strategies to align with evolving circumstances. By committing to regular reviews and being responsive to changes, entrepreneurs can effectively position themselves to seize opportunities and overcome challenges. Embracing these principles lays the groundwork for a resilient and thriving business, reinforcing that a proactive and informed approach to financial health is indeed the cornerstone of entrepreneurial success.