Overview

The article addresses the common challenges in financial planning faced by new entrepreneurs, which include cash flow management, securing funding, budgeting, and understanding tax obligations. It emphasizes that effective strategies, such as separating personal and business finances, utilizing financial advisors, and establishing realistic budgets, are crucial for overcoming these challenges and ensuring the sustainable growth of a startup.

Introduction

Navigating the entrepreneurial landscape can be both exhilarating and daunting, especially for those embarking on a new venture. As startups continue to emerge in an increasingly competitive market, understanding the foundations of a successful business is paramount. From crafting a functional business model to managing cash flow effectively, each element plays a critical role in ensuring long-term sustainability.

Entrepreneurs must also grapple with:

- Securing adequate funding

- Separating personal and business finances

- Navigating complex tax obligations

With the right strategies and insights, new business owners can build a solid financial framework, empowering them to adapt and thrive in a dynamic environment. This article delves into essential aspects of entrepreneurship, offering practical guidance to help founders not only survive but flourish in their endeavors.

Building a Functional Business Model

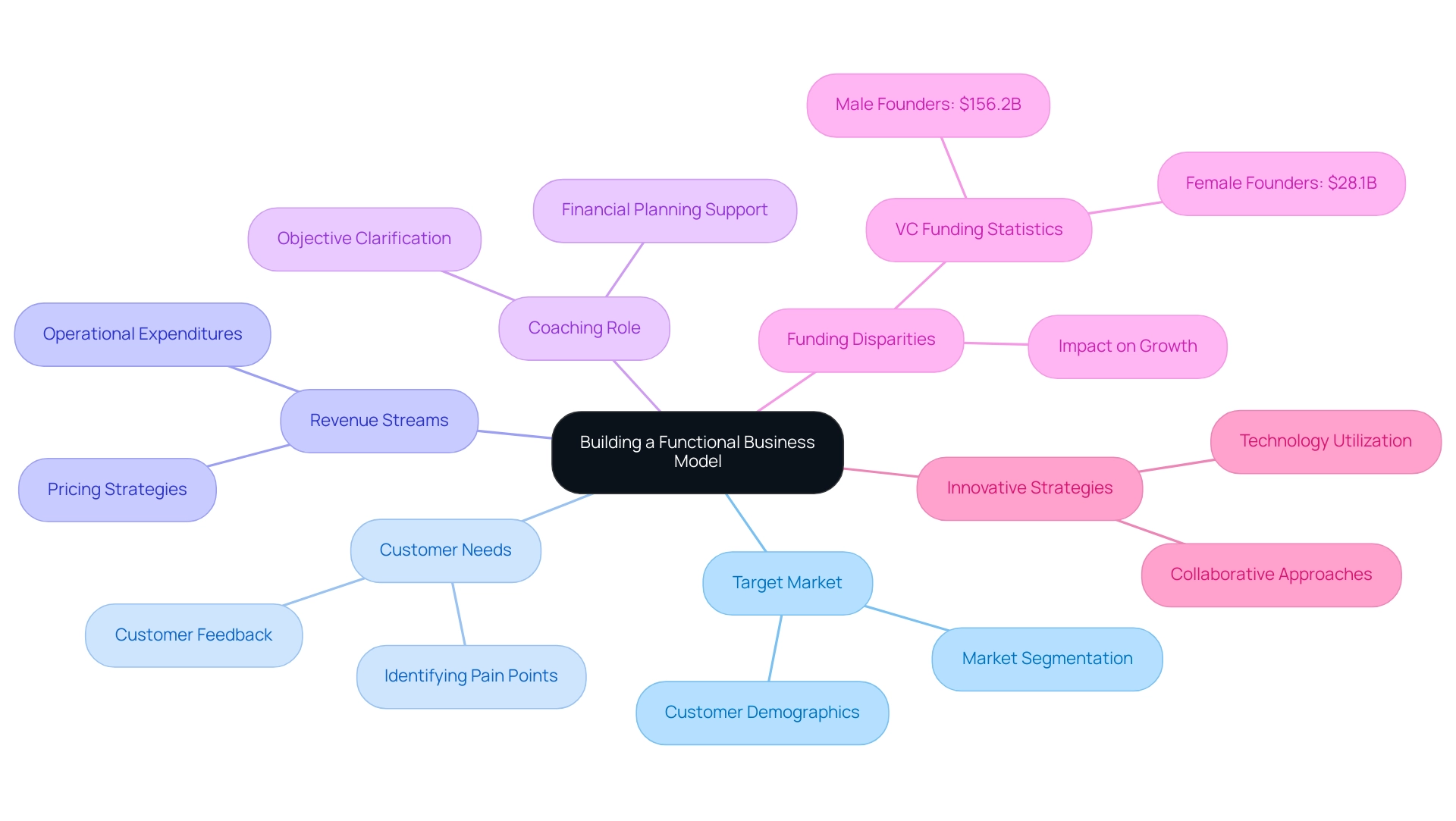

A functional business model serves as the blueprint for how a company creates, delivers, and captures value. For new business owners, it is crucial to clearly define their target market, grasp customer needs, and identify potential revenue streams. This clarity not only facilitates precise forecasting but also empowers informed decision-making regarding pricing strategies, marketing initiatives, and operational expenditures.

Coaching can play a crucial role in this process by assisting business owners in clarifying their objectives, fostering confidence in their decision-making, and overcoming challenges in financial planning for new entrepreneurs, such as budget management and strategic planning. Instruments such as the Business Model Canvas can be especially advantageous, enabling individuals to visualize their models effectively while ensuring alignment with both financial goals and changing market demands. As we look towards 2024, the emphasis on innovative model strategies is growing; startups are increasingly adopting collaborative approaches and advanced technologies to enhance their competitive edge.

Moreover, managing personal compensation expectations is crucial, as new founders should foresee a gradual increase linked to growth. Notably, in 2022, male founders secured $156.2 billion in VC funding compared to $28.1 billion for female founders, highlighting significant disparities in funding opportunities. The shift in startup dynamics, exemplified by a 1.2% increase in unicorns as of October 2022, signals a promising trend for those willing to adapt and innovate.

As Tony Hsieh, CEO of Zappos, wisely stated, ‘Chase the vision, not the money; the money will end up following you.’ This perspective is essential for entrepreneurs navigating today’s evolving landscape, especially as many founders are moving from Silicon Valley to the East Coast, seeking new opportunities and collaborative environments.

Navigating Cash Flow Management

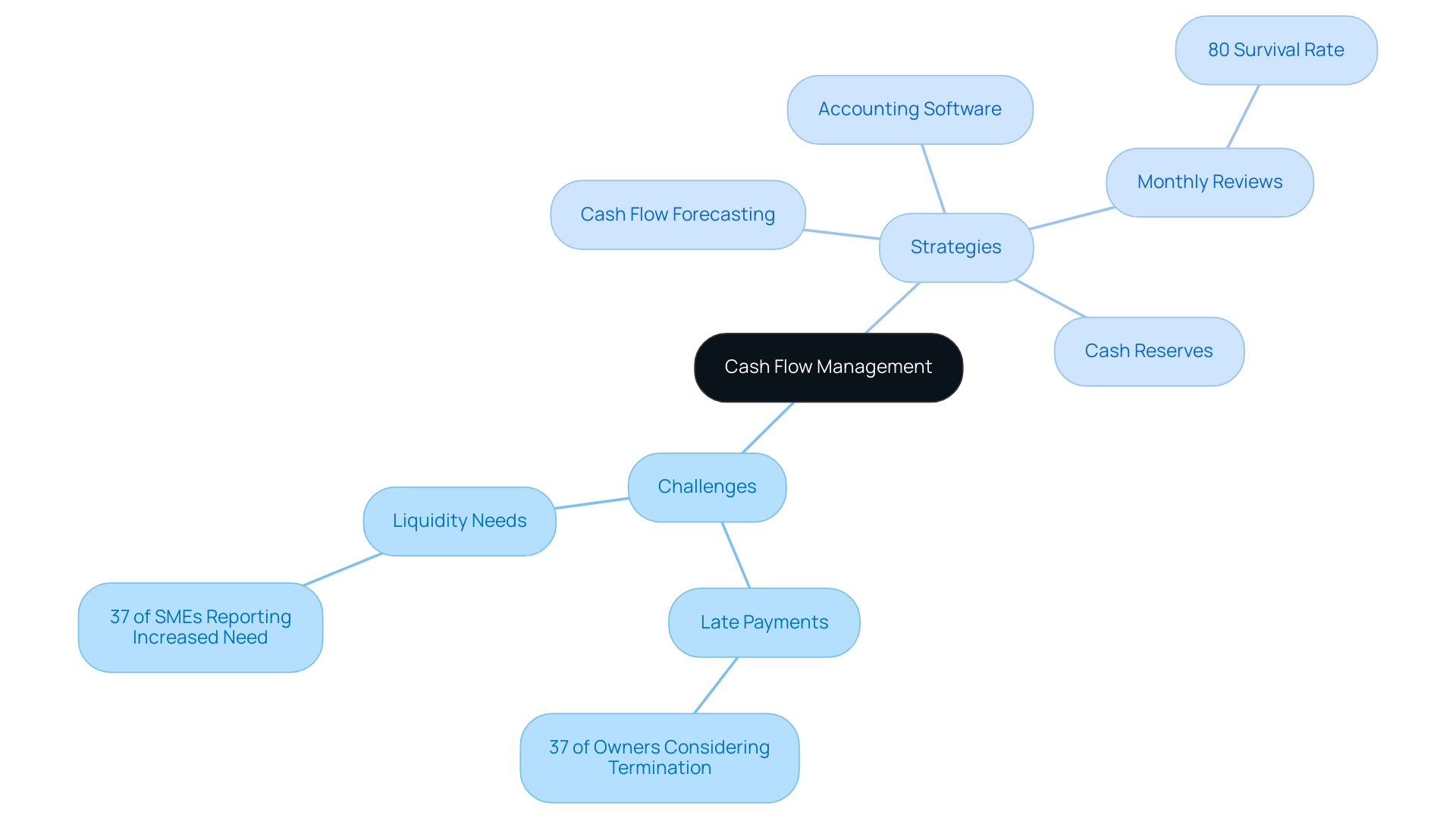

Effective cash flow management is essential for overcoming challenges in financial planning for new entrepreneurs, requiring meticulous tracking of income and expenses to ensure that obligations can be met. Entrepreneurs should prioritize cash flow forecasting to navigate the challenges in financial planning for new entrepreneurs, as it helps in anticipating potential shortfalls and planning for upcoming expenses. It is noteworthy that companies that review their cash flow monthly enjoy an impressive 80% survival rate, compared to a mere 36% for those that conduct annual reviews.

Alarmingly, 37% of small company owners have considered terminating their operations due to late payment issues, which highlights the challenges in financial planning for new entrepreneurs and the urgent need for effective cash flow management. Utilizing accounting software can further streamline this process, offering real-time insights into the financial health of the organization. Additionally, establishing a cash reserve acts as a buffer against unexpected expenses, which is crucial for addressing challenges in financial planning for new entrepreneurs and ensuring continuity even in challenging times.

As Harvey points out, ‘This differentiator made Harvey more attractive to the general contractors who sought his work because they could reliably bid shorter project times and reduce the logistics headache.’ These strategies are crucial, especially given the reported increase in liquidity needs among small businesses, as illustrated by the case study indicating that 37% of SMEs reported a significant increase in their need for better liquidity, attributed to factors such as poor cash management and cash being tied up.

Securing Adequate Funding for Growth

For aspiring business owners, understanding the challenges in financial planning for new entrepreneurs is crucial. It’s essential to consider a range of funding options, such as:

- Personal savings

- Loans

- Angel investors

- Crowdfunding

Each of these avenues presents unique advantages while also posing challenges in financial planning for new entrepreneurs.

For instance, while crowdfunding can democratize funding access, it often requires a compelling pitch to attract backers, whereas angel investors may offer not only capital but also mentorship. Notably, FinTech startups receive the most investment, indicating a strong interest in this sector, which is vital for entrepreneurs to consider. According to recent statistics, the average amount for Series C venture capital for startups hovers around $52 million, indicating that as companies mature, access to larger funding becomes feasible.

Furthermore, effective funding strategies must consider the challenges in financial planning for new entrepreneurs, relying on the development of a strong plan and precise financial projections. These documents serve as vital tools to showcase the viability of your business model to potential investors or lenders. Interacting with a network of like-minded individuals can also reveal valuable insights and resources, as shared experiences often illuminate effective funding strategies.

As highlighted by Forbes, understanding market conditions and having a product that meets a real need are pivotal for potential success in any funding journey. Additionally, it’s important to recognize that certain sectors, such as information startups, have a higher failure rate of 63%, which underscores the challenges in financial planning for new entrepreneurs when securing funding.

Separating Personal and Business Finances

For new owners, setting up a distinct bank account and using specialized accounting software is not merely a best practice; it’s an essential step towards monetary clarity. Recent statistics indicate that in 2024, a significant percentage of entrepreneurs who separate their personal and professional finances report a 25% increase in overall economic health compared to those who do not. This separation streamlines tax preparation and offers a clearer perspective of your enterprise’s economic landscape.

Mixing personal and business funds can lead to confusion and legal complications, detrimental to your startup’s success. For example, Cleveland, recognized as the least costly city for home purchases, illustrates how economic clarity can lead to better investment choices, while cities like San Jose demonstrate how high expenses can complicate budget planning. A staggering 17% of Americans erroneously believe it’s best to wait until their 40s to begin saving for retirement, underscoring the need for proactive financial management from the start.

By avoiding the temptation to use personal funds for expenses—and vice versa—you can safeguard your organization’s integrity and ensure smoother operations. As industry experts emphasize, ‘Separating personal and professional finances is essential for sustainable growth.’ Following current best practices in this area will not only help you navigate the challenges in financial planning for new entrepreneurs but also establish a solid foundation for long-term success.

Understanding Tax Obligations and Planning

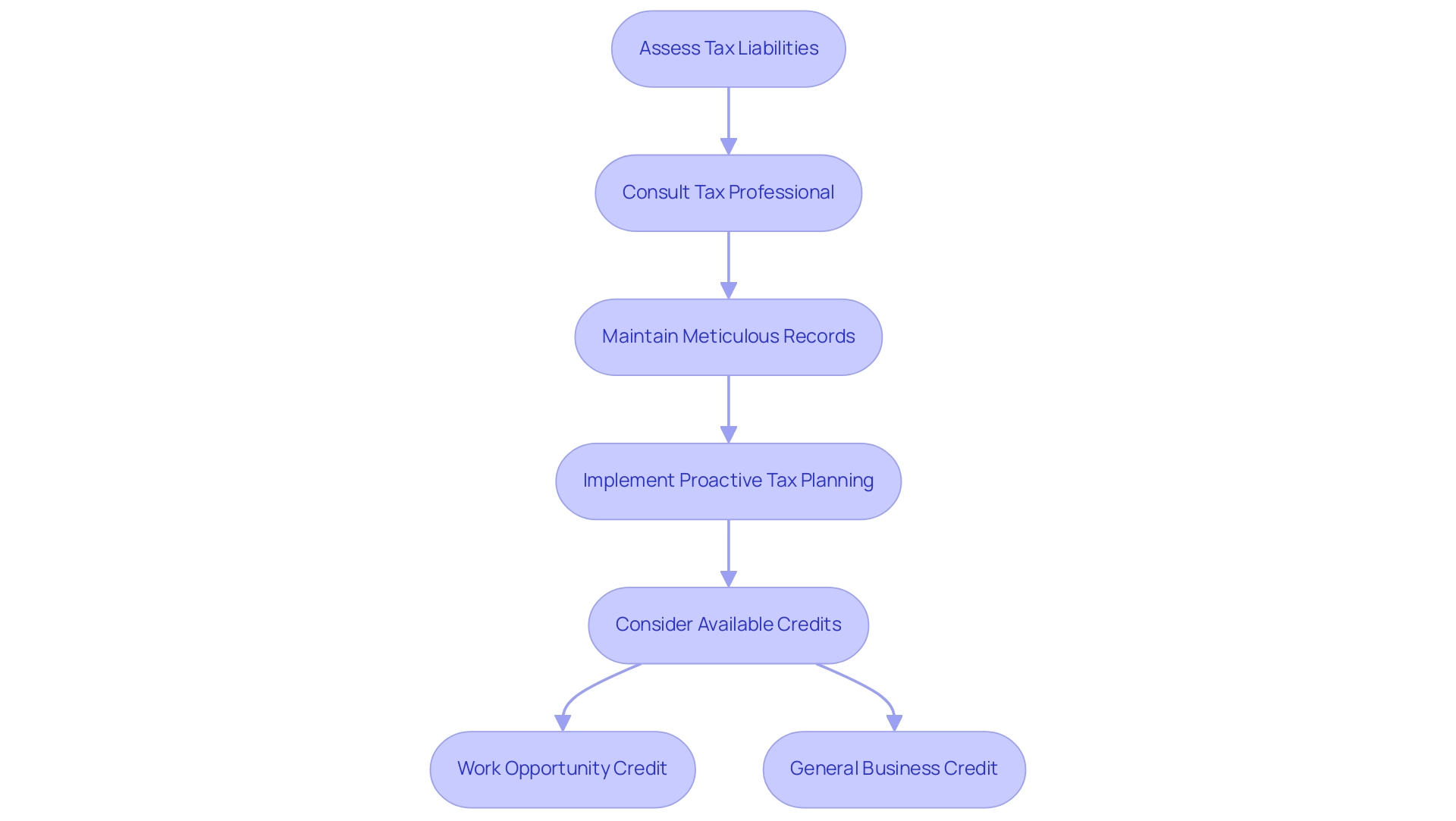

Managing fiscal responsibilities is essential for entrepreneurs, highlighting the challenges in financial planning for new entrepreneurs, as it necessitates a clear comprehension of the various levies applicable to their enterprise and the specific deadlines linked to them. For new entrepreneurs, consulting a tax professional is highly advisable to address the challenges in financial planning for new entrepreneurs and ensure compliance with local, state, and federal regulations. As emphasized by NerdWallet, “small enterprise owners should set aside approximately 30% of their income after deductions to cover federal and state taxes,” due to their responsibility for both income tax and self-employment tax.

Maintaining meticulous records of all expenses is not just a best practice; it is essential for maximizing deductions and minimizing tax liabilities. Furthermore, adopting a proactive tax planning strategy throughout the year can help mitigate challenges in financial planning for new entrepreneurs, leading to improved financial outcomes and reducing the risk of unexpected surprises. Given the current environment, where processing an amended return can take up to 16 weeks, the challenges in financial planning for new entrepreneurs become even more critical for small enterprise owners aiming for seamless tax compliance.

Moreover, individuals starting ventures should consider available credits, such as the Work Opportunity Credit, which encourages companies to hire individuals from targeted groups with high unemployment rates, further enhancing tax compliance strategies. Moreover, understanding the general business credit, which consists of carryforwards from prior years and current year business credits, can provide further opportunities for tax planning.

Establishing a Realistic Budget

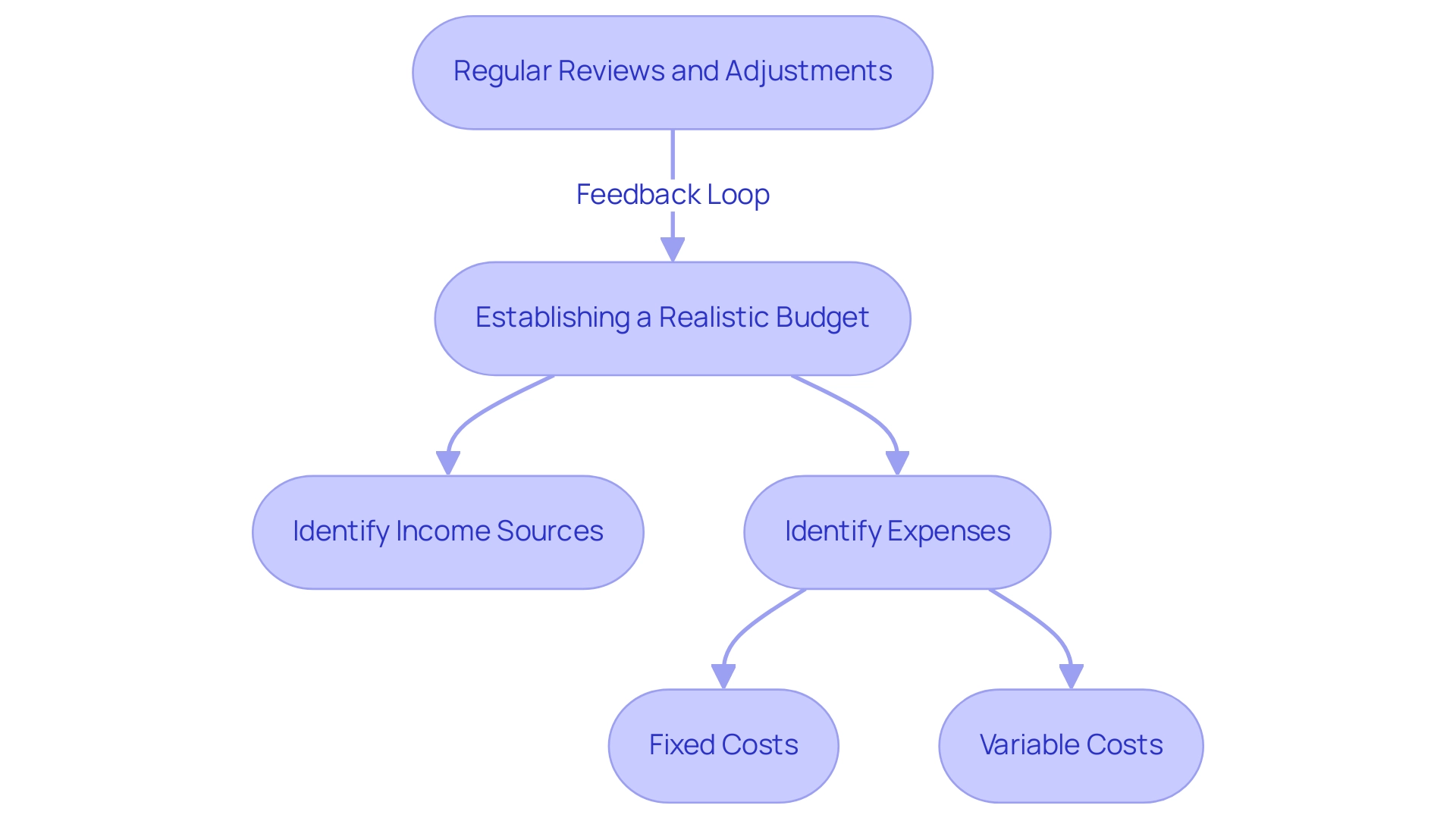

Establishing a realistic budget is crucial for any entrepreneur aiming to overcome the challenges in financial planning for new entrepreneurs while navigating the economic landscape of a startup effectively. Begin by identifying all potential income sources and expenses, ensuring that you categorize them into:

- Fixed costs—like rent and salaries

- Variable costs—such as materials and utilities

This categorization is essential as it enables more accurate planning and management of resources.

Regular reviews and adjustments to your budget are crucial, particularly when addressing the challenges in financial planning for new entrepreneurs in a dynamic market environment. In 2024, small enterprises will gain advantages from using innovative budgeting tools and applications created to offer real-time insights into spending habits and economic well-being. For instance, minorities received 30% of SBA 504 loans in 2023, reflecting the importance of understanding the economic landscape when budgeting.

Moreover, almost nine out of ten (89%) small enterprise owners convey assurance in their understanding of compliance and regulatory necessities, a feeling that highlights the significance of maintaining a robust economic strategy. The recent bank failures also serve as a reminder of budgeting’s critical role; only 13% of small-business owners opened new bank accounts, and 4% reported payroll delays, indicating operational disruptions that effective budgeting could help mitigate. Effective budgeting is essential to overcome the challenges in financial planning for new entrepreneurs, as it supports operational stability and fosters growth and resilience in your venture, helping you stay aligned with your monetary goals.

Explore the latest tools available to streamline your budgeting process, ensuring you are well-equipped to manage your startup’s finances adeptly.

Leveraging Financial Advisors

For new entrepreneurs, partnering with advisors who focus on small enterprises is essential. These experts offer customized guidance on budgeting, funding, and tax planning, which can significantly impact a startup’s trajectory. A statistic reveals that state-registered advisers have over 218,000 clients utilizing services beyond asset management, highlighting the prevalence and significance of advisory services.

Moreover, as noted by the Upmetrics Team, 91.7% of advisory private companies employ fewer than 100 people, collectively generating industry employment for 971,487 individuals in 2022. Such advisors are well-versed in the unique challenges faced by small business owners, making their insights invaluable. Building a solid rapport with an investment consultant not only offers continuous support and responsibility but also assists business owners in staying concentrated on their monetary goals.

Furthermore, networking with fellow entrepreneurs can lead to referrals for reputable advisors who understand the intricacies of the startup landscape. The SBA’s provision of $27.5 billion through over 57,300 7(a) loans in fiscal year 2023 underscores the crucial role of financial backing in supporting small businesses and fostering their growth, often facilitated through financial advisors. This combination of tailored advice and access to funding resources ultimately enhances the likelihood of startup success.

Conclusion

Building a successful startup requires a multifaceted approach that encompasses a variety of critical elements. A well-defined business model serves as the foundation, guiding entrepreneurs in understanding their target market and revenue streams, while effective cash flow management ensures sustainability and operational continuity. Securing adequate funding remains a challenge, yet exploring diverse funding avenues can provide the necessary resources for growth.

Moreover, separating personal and business finances is essential for maintaining clarity and protecting the integrity of the business. Entrepreneurs must also navigate complex tax obligations with proactive planning to minimize liabilities and ensure compliance. Establishing a realistic budget is vital for effective financial management, enabling entrepreneurs to adapt to changing market conditions. Finally, leveraging the expertise of financial advisors can provide tailored guidance, helping startups to make informed decisions and enhancing their chances of success.

In conclusion, by prioritizing these foundational aspects of entrepreneurship, new business owners can create a solid financial framework that not only supports their current operations but also positions them for long-term growth and resilience. Embracing these strategies equips entrepreneurs to thrive in a competitive landscape, transforming challenges into opportunities and fostering a sustainable future for their ventures.

Frequently Asked Questions

What is a functional business model?

A functional business model serves as a blueprint for how a company creates, delivers, and captures value. It is essential for new business owners to define their target market, understand customer needs, and identify potential revenue streams.

How does clarity in a business model benefit new entrepreneurs?

Clarity in a business model facilitates precise forecasting and empowers informed decision-making regarding pricing strategies, marketing initiatives, and operational expenditures.

What role does coaching play for new business owners?

Coaching assists business owners in clarifying their objectives, building confidence in decision-making, and overcoming challenges in financial planning, such as budget management and strategic planning.

What is the Business Model Canvas, and how is it useful?

The Business Model Canvas is a tool that enables individuals to visualize their business models effectively, ensuring alignment with financial goals and adapting to changing market demands.

What trends are emerging for startups as we approach 2024?

Startups are increasingly adopting collaborative approaches and advanced technologies to enhance their competitive edge, reflecting a growing emphasis on innovative model strategies.

Why is managing personal compensation expectations important for new founders?

New founders should anticipate a gradual increase in compensation linked to their company’s growth, which is crucial for maintaining financial stability.

What disparities exist in venture capital funding between male and female founders?

In 2022, male founders secured $156.2 billion in venture capital funding, while female founders received only $28.1 billion, highlighting significant disparities in funding opportunities.

What does the increase in unicorns indicate about startup dynamics?

A 1.2% increase in unicorns as of October 2022 signals a promising trend for startups that are willing to adapt and innovate.

What is the significance of cash flow management for new entrepreneurs?

Effective cash flow management is essential for overcoming financial planning challenges, requiring meticulous tracking of income and expenses to meet obligations.

How does cash flow forecasting help entrepreneurs?

Cash flow forecasting helps entrepreneurs anticipate potential shortfalls and plan for upcoming expenses, which is vital for financial planning.

What is the survival rate of companies that review their cash flow monthly?

Companies that review their cash flow monthly enjoy an 80% survival rate, compared to only 36% for those that conduct annual reviews.

What challenges do small business owners face regarding late payments?

Alarmingly, 37% of small business owners have considered terminating their operations due to late payment issues, highlighting the need for effective cash flow management.

How can accounting software assist entrepreneurs?

Accounting software can streamline cash flow management by providing real-time insights into the financial health of the organization.

Why is establishing a cash reserve important for entrepreneurs?

Establishing a cash reserve acts as a buffer against unexpected expenses, ensuring continuity during challenging times.

What recent trends have been observed regarding liquidity needs among small businesses?

There has been a reported increase in liquidity needs among small businesses, with 37% of SMEs indicating a significant need for better liquidity due to factors like poor cash management.