Overview

The article outlines seven essential steps for first-time business owners to create an effective business plan, emphasizing its importance in reducing the risks associated with entrepreneurship. It supports this by presenting key components of a business plan, such as market research and financial planning, which are critical for attracting investors and guiding strategic decisions, ultimately increasing the likelihood of success in a competitive landscape.

Introduction

Crafting a successful business plan is a fundamental step for any aspiring entrepreneur, serving as a critical roadmap that guides decisions and strategies. In a landscape where approximately 20% of new businesses fail within their first two years, understanding the elements of a robust business plan becomes essential for mitigating risks and enhancing the likelihood of success.

This article delves into the importance of a well-structured business plan, outlining its key components, and providing a step-by-step guide to writing one. Additionally, it emphasizes the necessity of thorough market research and financial planning, essential tools that empower entrepreneurs to navigate the complexities of starting and growing a business.

By equipping themselves with this knowledge, aspiring business owners can position themselves for sustainable growth and success in today’s competitive environment.

Understanding the Importance of a Business Plan

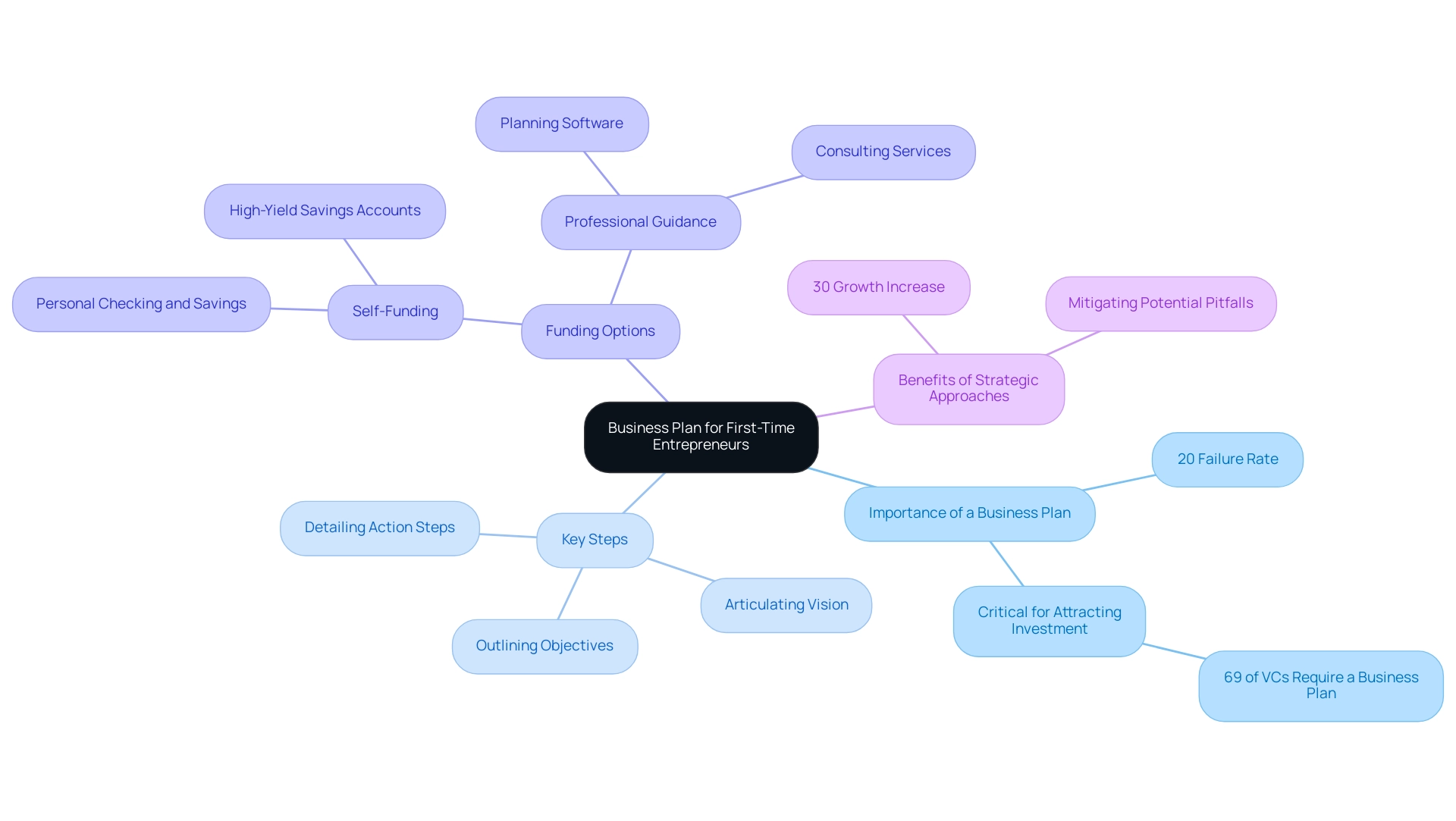

A strategy is not just a document; it outlines the essential steps to creating a business plan for first-time business owners on your entrepreneurial journey. It articulates your vision, outlines specific objectives, and details the steps to creating a business plan for first-time business owners necessary to achieve your goals. For aspiring entrepreneurs, understanding the steps to creating a business plan for first-time business owners is vital, especially considering that 20% of companies fail within the first two years.

This statistic emphasizes the dangers associated with entrepreneurship and highlights the significance of the steps to creating a business plan for first-time business owners in reducing those dangers. Research shows that 69% of venture capitalists will not consider investing in a new initiative without first reviewing a proposal, which underscores the steps to creating a business plan for first-time business owners as essential for obtaining funding and attracting potential partners. This statistic is supported by a recent survey, which is accurate to within +/- 5.6 percentage points using a 95% confidence level, enhancing its credibility.

Moreover, Olivia Chen, a seasoned Small Enterprise Writer at NerdWallet with over 5 years of experience in the CDFI lending realm, emphasizes that the steps to creating a business plan for first-time business owners are foundational for any startup, guiding operations and decision-making. Furthermore, aspiring entrepreneurs should also consider self-funding options through personal checking and savings accounts, as well as cash equivalents, which can provide a reliable financial foundation for their ventures. Services such as high-yield savings accounts and accessible cash management tools can enhance the effectiveness of self-funding.

Seeking professional guidance or utilizing planning software can lead to a remarkable 30% increase in growth, highlighting the tangible benefits of a strategic approach. Without a comprehensive strategy, navigating the complexities of entrepreneurship can be overwhelming, but the steps to creating a business plan for first-time business owners can help mitigate potential pitfalls. Grasping these dynamics, including available funding mechanisms and the steps to creating a business plan for first-time business owners, is crucial for anyone aiming to establish a successful venture in today’s competitive landscape.

Key Components of a Successful Business Plan

Developing a successful strategy is a crucial step for aspiring entrepreneurs and owners. A well-structured plan that includes the steps to creating a business plan for first-time business owners not only lays the foundation for your enterprise but also significantly increases your chances of success—research shows that having a plan can double your chances of organizational success. Here are the essential components that should be included:

- Executive Summary: This section provides a concise overview of your organization, encapsulating your mission statement and the key products or services you offer. A strong executive summary can capture the attention of potential investors and partners.

- Company Description: Here, delve into the specifics of your organization—detail your operational model, clarify your structure, and explain the problem your enterprise aims to solve. This provides insight into your unique value proposition.

- Industry Analysis: A thorough examination of your sector, target audience, and competitive landscape is essential. Understanding the market dynamics will help you position your venture effectively and identify growth opportunities.

- Organization and Management: Outline your enterprise structure and introduce the team that will drive your success. Highlighting the qualifications and roles of your team members builds credibility and showcases your organizational capacity.

- Products or Services: Provide a detailed description of what you offer, including the unique selling points that differentiate your products or services from competitors. This clarity is crucial for convincing stakeholders of your business’s viability.

- Marketing and Sales Strategy: Lay out your plan for attracting and retaining customers. Effective communication is vital here—according to recent insights, 25% of respondents cite good communication as a key factor in the success of strategic initiatives.

- Funding Request: If you are seeking funding, clearly outline your current and future funding requirements. This section should articulate how the funds will be used to advance your objectives.

These components are not just boxes to check; they are foundational elements in the steps to creating a business plan for first-time business owners that contribute to the strategic advantage of your enterprise. Significantly, firms with strategic outlines expand 30% quicker than those lacking them, and 71% of rapidly expanding companies usually possess strong strategic frameworks. By understanding and implementing these key components, you position yourself for accelerated growth and success in the competitive landscape of entrepreneurship.

Step-by-Step Guide to Writing Your Business Plan

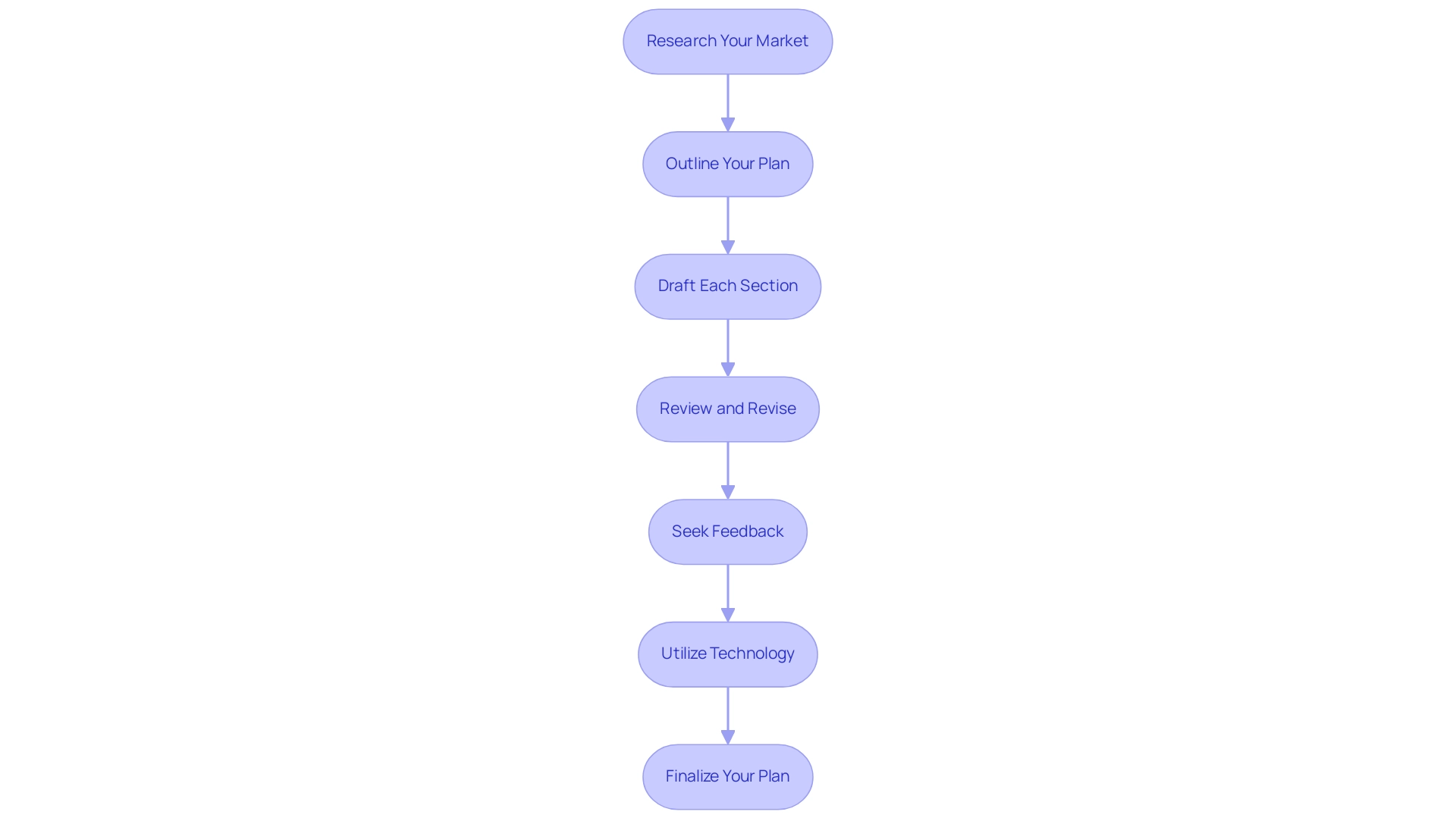

Creating a robust business strategy is one of the important steps to creating a business plan for first-time business owners. Follow these steps to creating a business plan for first-time business owners to ensure your plan is comprehensive and compelling.

-

Research Your Market: Gain a deep understanding of your industry, including trends and consumer behavior.

With the rise of remote work, which has increased by 44% over the last five years, recognizing the changing business landscape is essential. The Otter Assistant, used by over 500 million daily users, can help document your findings efficiently.

-

Outline Your Plan: Develop a clear structure by identifying key components such as your value proposition, target audience, and market analysis.

This foundational outline will serve as the first steps to creating a business plan for first-time business owners and guide your writing process.

-

Draft Each Section: Begin writing each section with a focus on clarity and conciseness.

This will help you communicate your ideas effectively. Remember, about half of small enterprises do not survive to their fifth anniversary, so understanding the steps to creating a business plan for first-time business owners is key in your planning. Additionally, consider incorporating future financial strategies, such as selling the business or paying off debts, to ensure long-term viability.

-

Review and Revise: Once you have a complete draft, take the time to review it thoroughly for coherence and accuracy.

This step is vital to ensure your strategy aligns with your vision.

-

Seek Feedback: Share your strategy with trusted mentors or advisors who can provide constructive feedback.

As Randa Kriss notes, accessing resources from federal and state agencies can offer additional insights.

-

Utilize Technology: Consider using tools like Otter.ai to transcribe meetings or brainstorming sessions.

This can help you capture important discussions and ideas that can be integrated into your plan.

-

Finalize Your Plan: After incorporating feedback and making necessary adjustments, prepare a polished version for presentation to potential investors or partners.

This final draft should showcase your dedication and preparedness for the entrepreneurial journey.

By following the steps to creating a business plan for first-time business owners, you can develop a strong strategy that not only acts as a guide for your endeavor but also enhances your likelihood of success in a competitive environment.

Conducting Market Research and Competitive Analysis

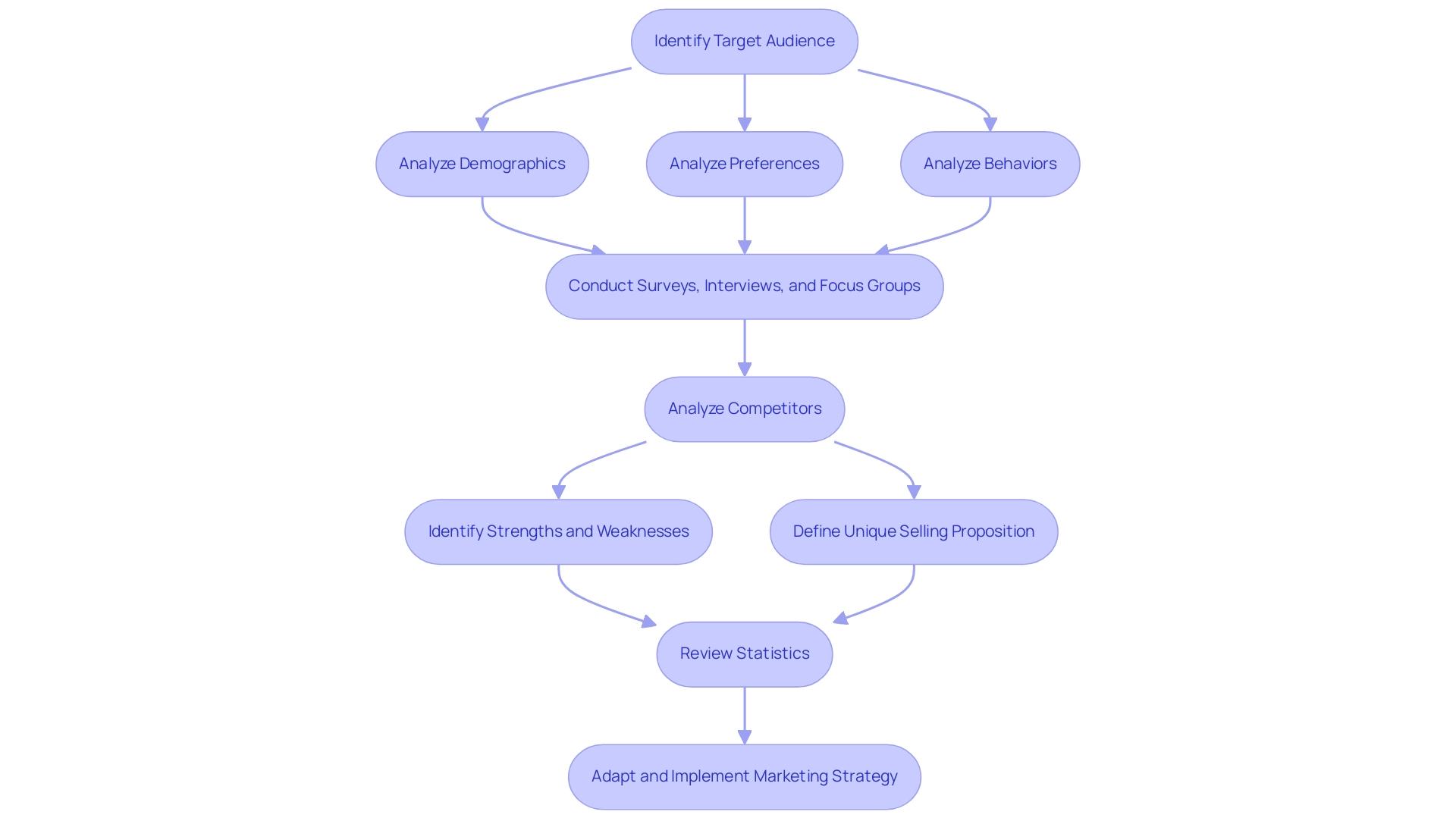

A comprehensive approach to industry research and competitive analysis is fundamental for any aspiring entrepreneur looking to understand the steps to creating a business plan for first-time business owners. Begin by pinpointing your target audience through an analysis of demographics, preferences, and behaviors. Tools such as surveys, interviews, and focus groups can provide invaluable insights, enabling you to understand your potential customers on a deeper level.

Following this, turn your attention to your competitors. Identify their strengths and weaknesses, in addition to their positioning in the industry. This analysis is crucial; it allows you to define your unique selling proposition and fine-tune your marketing strategy effectively.

In fact, recent statistics indicate that:

- 84% of brands and marketers report positive outcomes from their pay-per-click advertising campaigns, underscoring the significance of strategic positioning.

- Video ad expenditure is anticipated to surpass $240 billion by 2028, highlighting the increasing importance of digital marketing strategies in research efforts.

A real-world example of startup success can be seen in the case of Black Founders in Y Combinator, where the number of black-founded startups increased from 101 to 201, showcasing the potential for innovation and growth in diverse entrepreneurial landscapes.

By understanding the subtleties of the industry landscape and following the steps to creating a business plan for first-time business owners, you will not only improve your decision-making but also be better prepared to foresee challenges and capitalize on opportunities that emerge in the dynamic economic environment. As innovative techniques and current trends in competitive analysis emerge, staying adaptable and informed will prove essential for your entrepreneurial journey.

Financial Planning: Projections and Funding Requests

Financial planning is one of the essential steps to creating a business plan for first-time business owners. To begin, develop comprehensive financial projections that encompass:

- Sales forecasts

- Expense estimates

- Cash flow analyses

It’s crucial to base these projections on realistic assumptions derived from thorough market research.

In 2024, startups are expected to face an average funding request of around $1 million, making it imperative to clearly articulate your funding requirements to potential investors. Outline how the funds will be utilized and present a solid repayment strategy if applicable. Investors are especially keen on grasping the route to profitability, so ensure that your financial strategy is closely aligned with your overall objectives and growth aspirations.

Notably, the funding landscape is evolving, with digital health startups alone receiving $57 billion in global funding in 2021—a remarkable increase of 79% from the previous year. This trend signals a burgeoning interest in innovative sectors, which could influence funding opportunities. Moreover, it’s crucial to incorporate supporting data in your strategy, as financial specialists highlight the significance of thorough financial planning in obtaining funding.

For instance, African-American and Latina female-founded startups raised $3.1 billion in 2020, indicating a growing recognition of diverse entrepreneurial efforts. Significantly, comprehending startup achievement rates can offer valuable insights; new enterprises have a long-term achievement rate of only 10% to 20%, with first-time small enterprise owners experiencing an 18% achievement rate. By incorporating proper risk management strategies, startups can improve their chances of success despite these challenges.

Additionally, the average age of a financial advisor is 44.8 years, highlighting the importance of seeking experienced guidance in financial planning. By embracing these financial planning essentials, you establish a solid groundwork that aligns with the steps to creating a business plan for first-time business owners.

Conclusion

A well-crafted business plan is not just a document; it is the cornerstone of entrepreneurial success. Throughout the article, the significance of a comprehensive business plan has been emphasized, showcasing its role as a roadmap that articulates vision, objectives, and strategies. Key components such as the executive summary, market analysis, and financial projections provide essential insights that can substantially increase the chances of securing funding and achieving long-term growth.

Moreover, the importance of thorough market research and competitive analysis cannot be overstated. Understanding the nuances of the market landscape enables entrepreneurs to identify opportunities and position their businesses effectively. By leveraging tools and resources for research, aspiring business owners can make informed decisions that enhance their strategic advantage.

As the entrepreneurial landscape continues to evolve, embracing structured financial planning is vital. Clear projections, funding requests, and risk management strategies are crucial for attracting investors and ensuring sustainability. With the right approach, entrepreneurs can navigate challenges and seize opportunities, setting the stage for a prosperous business future.

In conclusion, a solid business plan is an invaluable asset that empowers aspiring entrepreneurs to transform their visions into reality. By investing the time and effort into crafting a comprehensive plan, individuals can significantly enhance their potential for success in a competitive marketplace.