Overview

The essential steps to financial planning for new entrepreneurs include setting clear financial goals, managing cash flow, creating a budget, planning for contingencies, monitoring progress, and seeking professional financial advice. The article emphasizes that these structured practices not only enhance the likelihood of business success but also provide a solid foundation for navigating financial challenges, as evidenced by statistics showing that businesses with formal financial strategies grow significantly faster than those without.

Introduction

In the dynamic world of entrepreneurship, navigating the financial landscape can often feel overwhelming for new business owners. Establishing a solid financial foundation is crucial not only for survival but also for long-term success. From setting clear financial goals and managing cash flow to creating a comprehensive budget and planning for unexpected expenses, each aspect plays a pivotal role in shaping a sustainable business.

As entrepreneurs embark on this journey, understanding the importance of monitoring progress and seeking professional financial advice becomes essential. This article delves into the key strategies and best practices that can empower new entrepreneurs to take control of their financial health, ensuring they are well-equipped to thrive in a competitive market.

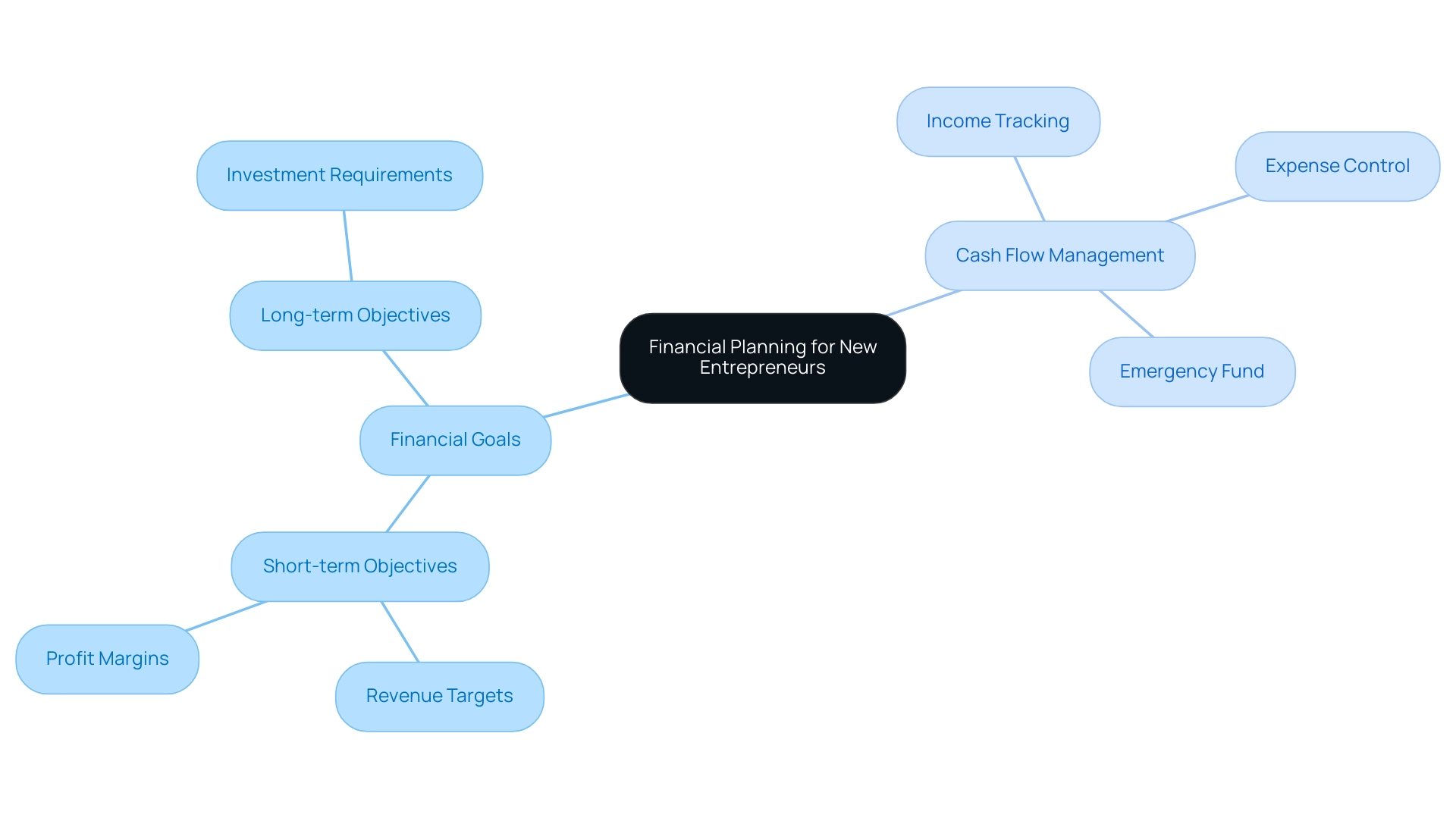

Establishing Financial Goals and Understanding Cash Flow

Setting clear monetary objectives is one of the crucial steps to financial planning for new entrepreneurs in effective budgeting. This process involves defining both short-term and long-term objectives, such as:

- Revenue targets

- Profit margins

- Investment requirements

Research indicates that the steps to financial planning for new entrepreneurs can lead to businesses growing 30% faster than those without a formalized financial strategy, underscoring the critical role of goal setting.

Furthermore, writing down and visualizing goals can increase the likelihood of achieving them by 42%, highlighting the importance of structured goal management practices. In fact, 83% of companies endorse the OKR framework for aligning organizational goals and enhancing outcomes, offering a practical method for individuals to apply in their planning.

Comprehending cash flow management is also vital; business owners must follow the steps to financial planning for new entrepreneurs by meticulously tracking their income and expenses to maintain adequate liquidity for day-to-day operations.

Effective cash flow management encompasses not only managing accounts receivable and controlling expenses but also maintaining an emergency fund for unexpected costs. To assist in this, creating a cash flow statement can be invaluable. This statement outlines essential steps to financial planning for new entrepreneurs, allowing business owners to visualize their inflows and outflows, making it easier to anticipate potential cash shortages and guiding informed financial decisions.

By utilizing these optimal strategies, new founders can significantly improve their likelihood of success in the competitive market environment.

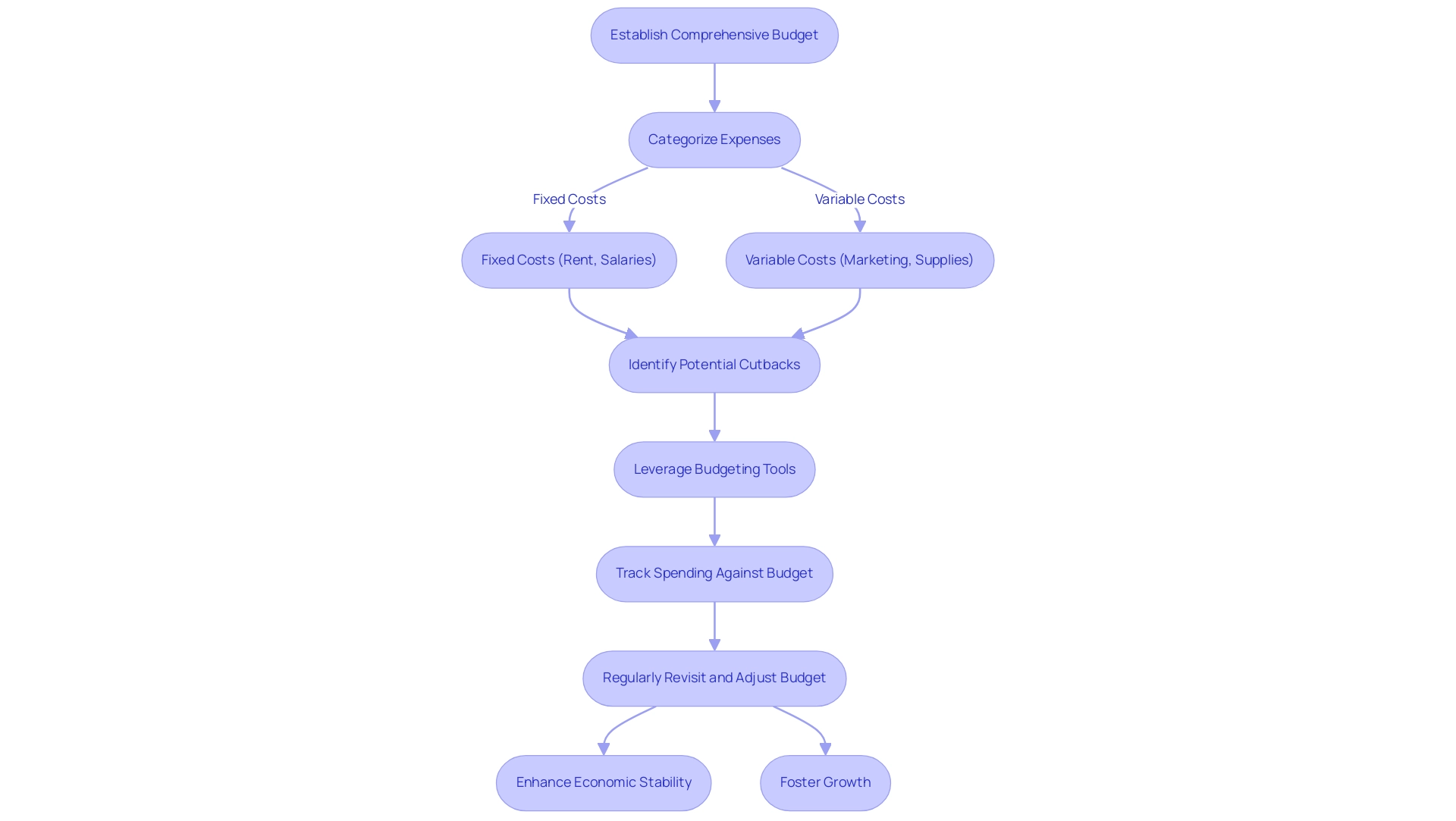

Creating a Budget and Managing Expenses Effectively

Establishing a comprehensive budget is one of the essential steps to financial planning for new entrepreneurs and effective expense management. By categorizing expenses into fixed and variable costs, business owners can pinpoint where adjustments may be necessary. For instance, fixed costs, such as rent and salaries, remain constant, while variable costs, like marketing and supplies, can fluctuate.

This clear distinction enables business owners to make informed decisions about potential cutbacks. Furthermore, leveraging the latest budgeting tools can significantly streamline the tracking process, allowing entrepreneurs to compare actual spending against their budget seamlessly. Regularly revisiting and adjusting the budget is crucial to ensure it aligns with evolving monetary goals and operational needs.

Discipline in managing expenses not only enhances economic stability but also fosters the growth necessary for a successful enterprise.

The significance of efficient budgeting is emphasized by the statistic that 23.2% of U.S. small enterprises that launched in March 2022 were shuttered by March 2023, highlighting the essential role of monetary planning in organizational survival. Moreover, the recent bank failures have had a tangible effect on small-business operations, with only 13% of owners opening new bank accounts and 4% reporting payroll delays, illustrating the consequences of insufficient money management. As Philip Freeman, Founder & CEO of Murphy’s Naturals, Inc., notes, the unpredictability in business can lead to difficult choices, such as canceling expansion projects due to rising costs and delays.

This highlights how the steps to financial planning for new entrepreneurs, including meticulous planning and budgeting methods, can aid in alleviating such challenges, making a well-organized budget crucial in managing the intricacies of entrepreneurship.

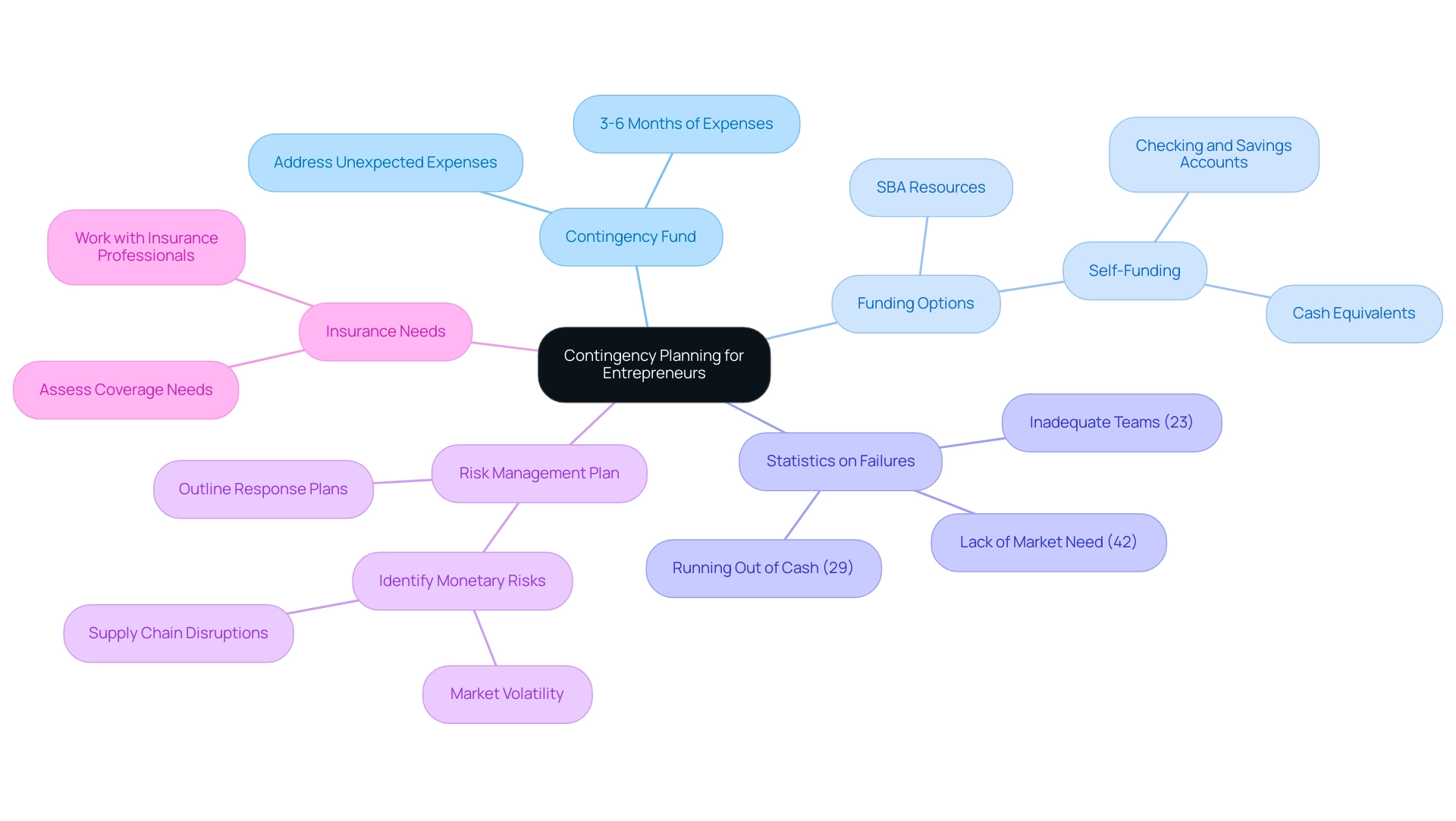

Planning for Contingencies and Unexpected Expenses

Contingency planning is an essential part of the steps to financial planning for new entrepreneurs. Establishing a contingency fund is essential to address unexpected expenses, such as equipment repairs or sudden revenue declines. One of the important steps to financial planning for new entrepreneurs is to aim for a fund that covers three to six months’ worth of operating expenses, providing a vital safety net during challenging times.

It’s also important to explore funding options available from the U.S. Small Business Administration, which can offer crucial resources for small enterprises. Additionally, self-funding through checking and savings accounts, as well as cash equivalents, can empower entrepreneurs to maintain financial flexibility and independence. Self-funding services, such as those outlined in our ‘Read More’ section, can provide essential insights into managing these accounts effectively.

Statistics reveal that:

- 42% of small business failures are attributed to a lack of market need

- 29% fail due to running out of cash

This underscores the necessity of having a robust contingency plan. Furthermore, developing a comprehensive risk management plan is one of the essential steps to financial planning for new entrepreneurs. This strategy should identify potential monetary risks—such as market volatility and supply chain disruptions—and outline clear response plans.

As Lawrence P. Spaulding, Jr., a seasoned professional, aptly stated, ‘These generalized practices are like having a boat with plenty of life preservers, but the vessel’s hull is full of holes.’ Additionally, small enterprises should work with insurance professionals to assess their needs and secure appropriate coverage. By proactively identifying and addressing these vulnerabilities, along with leveraging self-funding and available SBA resources, business owners can navigate uncertainties with greater confidence and resilience, significantly enhancing their chances of long-term success.

Monitoring Progress and Adjusting Financial Plans

For new business owners, the steps to financial planning for new entrepreneurs involve tracking monetary progress, which is not merely a task but an essential practice that guarantees alignment with company objectives. Consistently examining essential fiscal statements—such as profit and loss reports and cash flow documents—allows business owners to assess their performance against set standards. As highlighted by Accountancy Cloud,

Ignoring your monetary metrics is like driving blindfolded,

which underscores the necessity of staying informed.

Should discrepancies arise, entrepreneurs must be prepared to modify their economic plans. This could involve:

- reallocating resources

- revising budgets

- adjusting pricing strategies

Embracing a flexible approach is essential, particularly as new trends in monitoring emerge for 2024, such as the increasing use of AI-driven analytics and real-time dashboards that allow for quicker decision-making.

By being proactive and willing to pivot when necessary, business founders significantly enhance their chances of long-term success, especially in a landscape where startups face a notable 53% failure rate in construction but still hold a 36.4% chance of enduring beyond five years. Moreover, startups are key drivers of economic growth, making the monitoring of economic progress crucial not only for individual success but also for broader economic impact. Furthermore, the gender gap in startup funding underscores the difficulties many business founders encounter; female-led startups secured 25% less than their male equivalents in 2021, emphasizing the significance of strategic funding planning to manage such disparities.

Such insights demonstrate the significance of not only monitoring but also adjusting plans based on performance, thereby providing essential steps to financial planning for new entrepreneurs in a competitive environment.

![]()

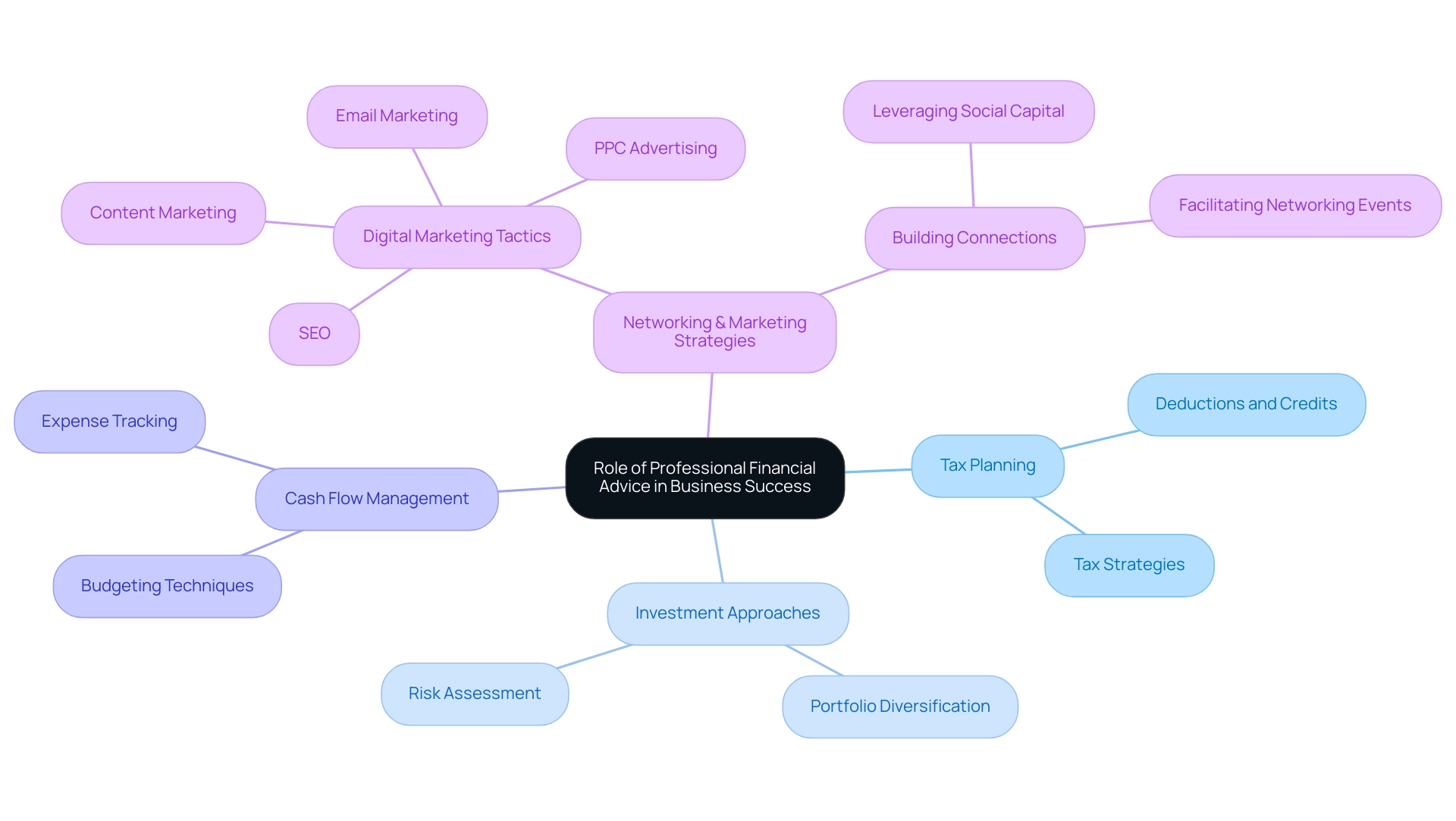

The Role of Professional Financial Advice in Business Success

Utilizing the knowledge of professional advisors can be a game-changer for new business owners, significantly influencing their steps to financial planning for new entrepreneurs. These consultants provide customized insights into crucial areas such as:

- Tax planning

- Investment approaches

- Cash flow management

These are important steps to financial planning for new entrepreneurs, ensuring that the monetary practices align with the unique context of the business. Furthermore, they play an essential role in assisting business owners by outlining the steps to financial planning for new entrepreneurs, helping them identify possible monetary risks and develop effective mitigation strategies.

By leveraging this professional guidance, business owners can make informed decisions that not only meet their immediate needs but also incorporate the steps to financial planning for new entrepreneurs to support their long-term objectives. As a result, this collaboration enhances the overall economic health and sustainability of their ventures, providing essential steps to financial planning for new entrepreneurs and setting a solid foundation for growth in a competitive landscape. According to recent statistics, the median deal size for startups that secured a seed round from 2020 to 2023 was $3.9 million, highlighting the economic environment that founders are navigating.

An increasing number of entrepreneurs are acknowledging the importance of advisors, which play a crucial role in the steps to financial planning for new entrepreneurs as they navigate the complexities of launching and sustaining a successful startup in 2024. As Sramana Mitra wisely states, ‘I tell my founders I’ve spent three decades building my social capital and am happy to invest in making connections,’ emphasizing the importance of networking that advisors can facilitate. Additionally, financial advisors can assist in implementing effective marketing strategies, as highlighted in case studies showcasing the success of startups that utilized digital marketing tactics alongside the steps to financial planning for new entrepreneurs.

Conclusion

Establishing a robust financial foundation is essential for new entrepreneurs aiming for long-term success in a competitive market. By setting clear financial goals and understanding cash flow, business owners can create a roadmap that aligns with their aspirations. Implementing structured goal management practices, such as the OKR framework, and maintaining a cash flow statement empowers entrepreneurs to make informed decisions and anticipate challenges.

Effective budgeting and expense management are equally critical. Entrepreneurs must categorize their costs and leverage budgeting tools to track spending meticulously. Regularly revisiting the budget ensures it remains relevant in the face of changing financial goals and operational needs. The importance of disciplined financial planning cannot be overstated, especially in light of recent statistics highlighting the high failure rates among new businesses.

Moreover, planning for contingencies and unexpected expenses is vital. Establishing a contingency fund and developing a comprehensive risk management strategy equips entrepreneurs to navigate uncertainties confidently. By proactively addressing potential financial risks and exploring available resources, businesses can enhance their resilience against unforeseen challenges.

Finally, monitoring financial progress and seeking professional financial advice can significantly improve business outcomes. Regularly reviewing key financial metrics allows for timely adjustments to strategies, while the expertise of financial advisors provides invaluable insights into tax planning and investment strategies. In a landscape where startups face numerous challenges, leveraging these best practices and resources can empower entrepreneurs to thrive and contribute positively to the economy. Embracing these principles will not only enhance individual business success but also foster a more sustainable entrepreneurial ecosystem.