Overview

The article outlines seven essential strategies for financial planning that are crucial for new entrepreneurs to achieve economic stability and growth. It emphasizes the importance of budgeting, cash flow management, setting monetary objectives, and leveraging technology, supported by statistics indicating that effective financial planning significantly increases the survival rates of new businesses.

Introduction

In the dynamic world of entrepreneurship, financial planning emerges as a critical pillar for success. New entrepreneurs often face a myriad of challenges, from managing cash flow to navigating tax obligations, all while striving for growth in an unpredictable marketplace. A well-structured financial plan not only provides a roadmap for achieving stability but also empowers business owners to make informed decisions that align with their long-term goals.

With statistics revealing that nearly 70% of businesses with a strategic plan survive beyond their first five years, the importance of meticulous financial management cannot be overstated. This article delves into the essential components of effective financial planning, offering insights into:

- Budgeting

- Cash flow management

- Tax compliance

- Risk mitigation

- The transformative role of technology

By understanding these elements, entrepreneurs can better equip themselves to thrive in their ventures and secure a prosperous future.

Understanding Financial Planning for New Entrepreneurs

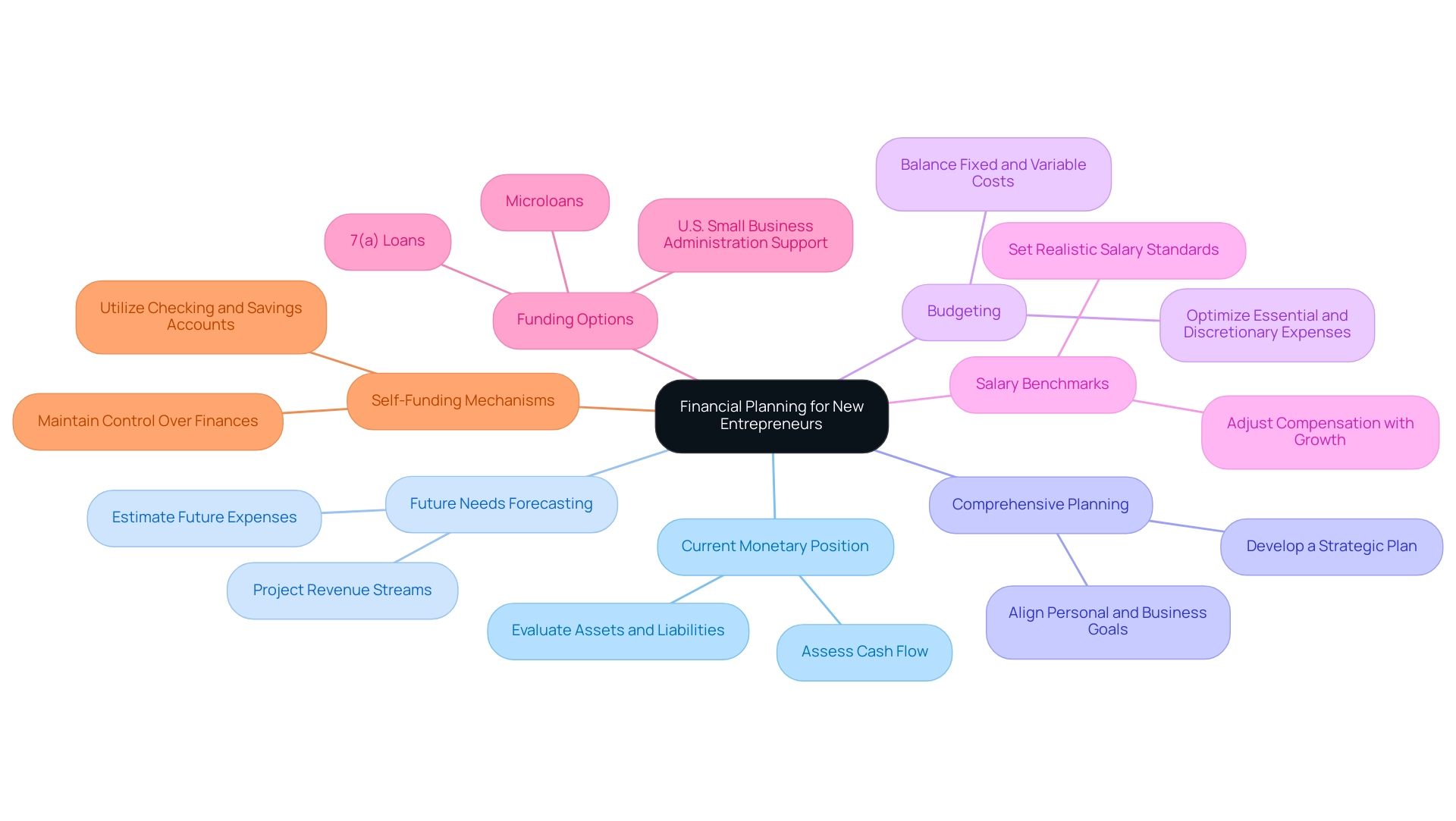

Strategies for financial planning for new entrepreneurs offer a systematic approach that enables new business owners to manage their finances with precision and foresight. It includes evaluating one’s current monetary position, forecasting future monetary needs, and creating a comprehensive plan aimed at attaining both economic stability and growth. For entrepreneurs, employing strategies for financial planning for new entrepreneurs is not merely a useful resource; it is a fundamental requirement for effectively managing the inherent uncertainties of starting a new venture.

This strategic plan serves as a blueprint, guiding critical decision-making processes and providing strategies for financial planning for new entrepreneurs, while also assisting in securing essential funding and establishing the groundwork for sustainable practices. Furthermore, it’s noteworthy that approximately 70% of enterprises that implement strategies for financial planning for new entrepreneurs endure beyond the crucial first five years, underscoring the importance of having a robust financial strategy in place. The clarity that comes with coaching can significantly enhance this process, as a coach not only helps in identifying blind spots but also fosters a deeper understanding of personal compensation expectations that can evolve with organizational growth.

Entrepreneurs should consider strategies for financial planning for new entrepreneurs, such as:

- Setting realistic salary benchmarks based on industry standards and adjusting their compensation as the business scales.

- Recognizing that comprehensive budgeting is vital; it involves balancing fixed and variable costs while optimizing essential and discretionary expenses.

- Exploring funding options available from the U.S. Small Business Administration, such as microloans and 7(a) loans, which can provide essential monetary support for startups.

Self-funding mechanisms through checking and savings accounts are also important, allowing business owners to maintain control over their finances while minimizing debt. Business planning plays a vital role in improving delegation and communication within an organization, clarifying roles and enhancing teamwork, which is essential for startups. As Tim Gerend, Chief Distribution Officer at Northwestern Mutual, aptly states,

For someone to feel comfortable sharing their dreams and worries with an advisor, there needs to be a human connection rooted in trust and understanding.

This sentiment emphasizes the necessity for business owners to develop connections founded on trust as they begin their economic journeys. It’s also important to acknowledge that aligning the owner’s economic well-being with commercial success is essential for implementing strategies for financial planning for new entrepreneurs, as it ensures that personal and organizational monetary planning operate in harmony. Significantly, the average age of new clients at Northwestern Mutual is 32, indicating that younger individuals are increasingly acknowledging the importance of monetary planning in their ventures.

Key Components of an Effective Financial Plan

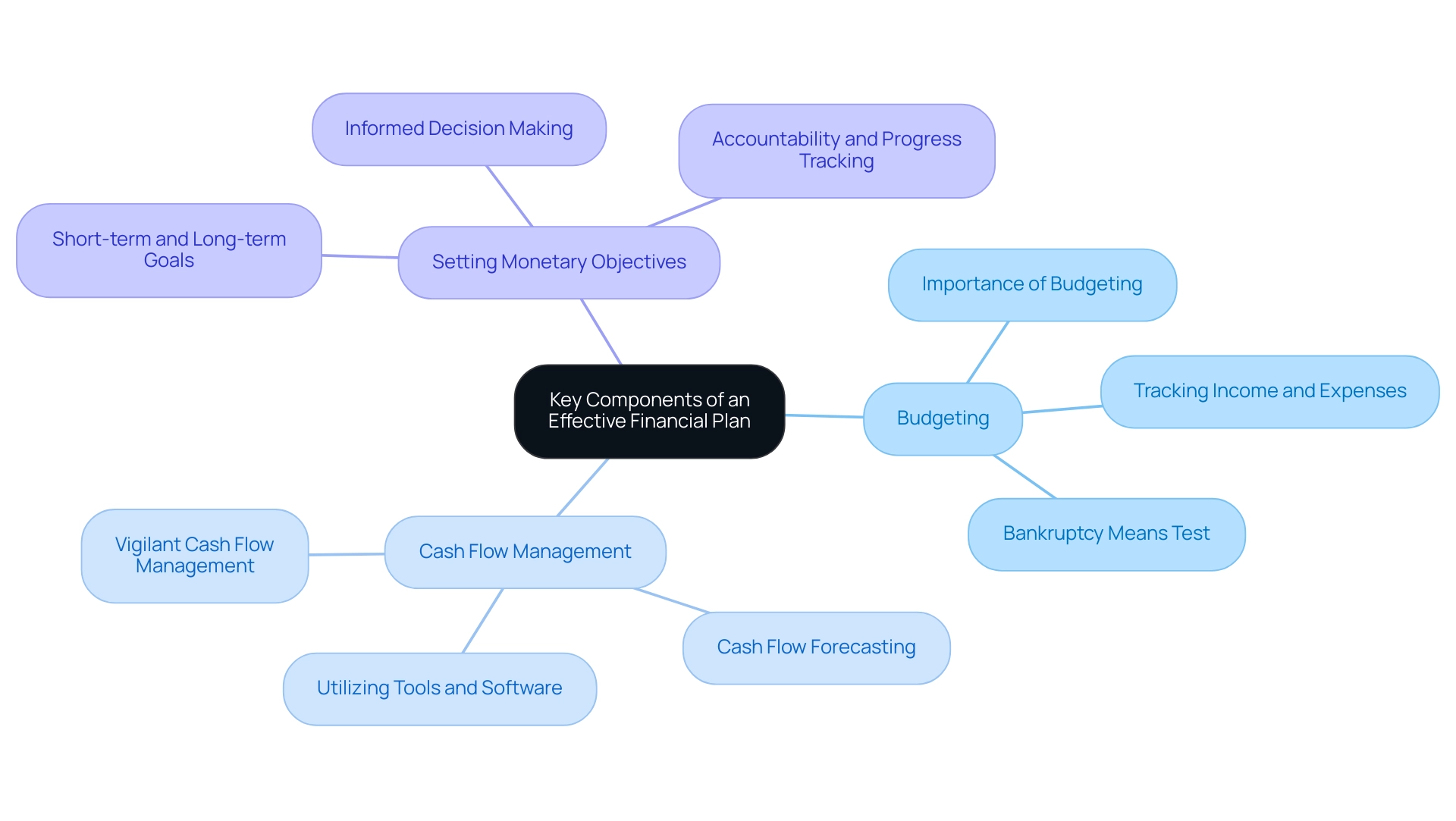

A successful monetary strategy, incorporating strategies for financial planning for new entrepreneurs, is essential for new venture creators and consists of various key elements that lead to sustainable growth.

-

Budgeting: Establishing a comprehensive budget is vital for tracking income and expenses. This practice not only ensures that entrepreneurs live within their means but also facilitates strategic investments in their business.

As a stark reminder, nearly 78% of Americans find themselves living paycheck-to-paycheck, underscoring the necessity of disciplined budgeting. Economic specialists stress that utilizing a bankruptcy means test can assist individuals requiring extra support, further underscoring the significance of planning and literacy.

-

Cash Flow Management: Vigilant cash flow management is essential to avert liquidity crises that can jeopardize a startup’s operations.

Entrepreneurs should diligently forecast both cash inflows and outflows, allowing them to maintain a strong economic position. Current best practices highlight the significance of utilizing tools and software to optimize this process, ensuring that business owners can respond quickly to changes in their cash flow.

-

Setting Monetary Objectives: Establishing clear and measurable monetary goals serves as a roadmap for business owners, providing the direction and motivation necessary to navigate their economic journey.

By outlining short-term and long-term objectives, business owners can make informed decisions that align with their overall business strategy. This structured approach fosters accountability and aids in tracking progress towards economic stability and growth.

These fundamental elements are increasingly critical as consumer spending accounts for approximately 70% of the U.S. economy, with the average American spending nearly $73,000 annually. Comprehending these dynamics will enable business owners to develop strong strategies for financial planning for new entrepreneurs that can endure economic fluctuations and foster enduring success. Furthermore, the absence of monetary knowledge leads to poor economic habits and choices, as demonstrated in the case study titled ‘The Role of Financial Literacy,’ which advocates for a renewed emphasis on enhancing economic education to improve personal finance oversight.

Navigating Tax Planning and Compliance

Tax planning is a crucial component of the strategies for financial planning for new entrepreneurs. A solid understanding of tax obligations—across local, state, and federal levels—can lead to substantial savings. Reports indicate that the share of Adjusted Gross Income (AGI) reported by the bottom 50 percent has decreased from 14.4 percent in 2001 to just 10.4 percent in 2021, reflecting a shifting landscape that underscores the importance of strategic tax compliance for startups.

Engaging a tax professional can be invaluable; experts emphasize that identifying strategies for financial planning for new entrepreneurs, including deductions and credits tailored to your business, can significantly minimize tax liabilities. Moreover, organizing monetary records and receipts not only simplifies the tax filing process but also mitigates the risk of costly penalties. As the 2024 SOI Bulletin emphasizes, understanding strategies for financial planning for new entrepreneurs, including tax compliance data and tactics, can enable business owners to manage their obligations with assurance and precision.

Additionally, with B2B payments in the US projected to reach $23 trillion, as noted by Tradeshift, understanding strategies for financial planning for new entrepreneurs is crucial in navigating the financial landscape. The 2023 IRS Data Book illustrates the operational efficiency of the IRS, which is vital for ensuring compliance and understanding the tax landscape. Entrepreneurs can benefit significantly from these insights as they formulate their tax strategies.

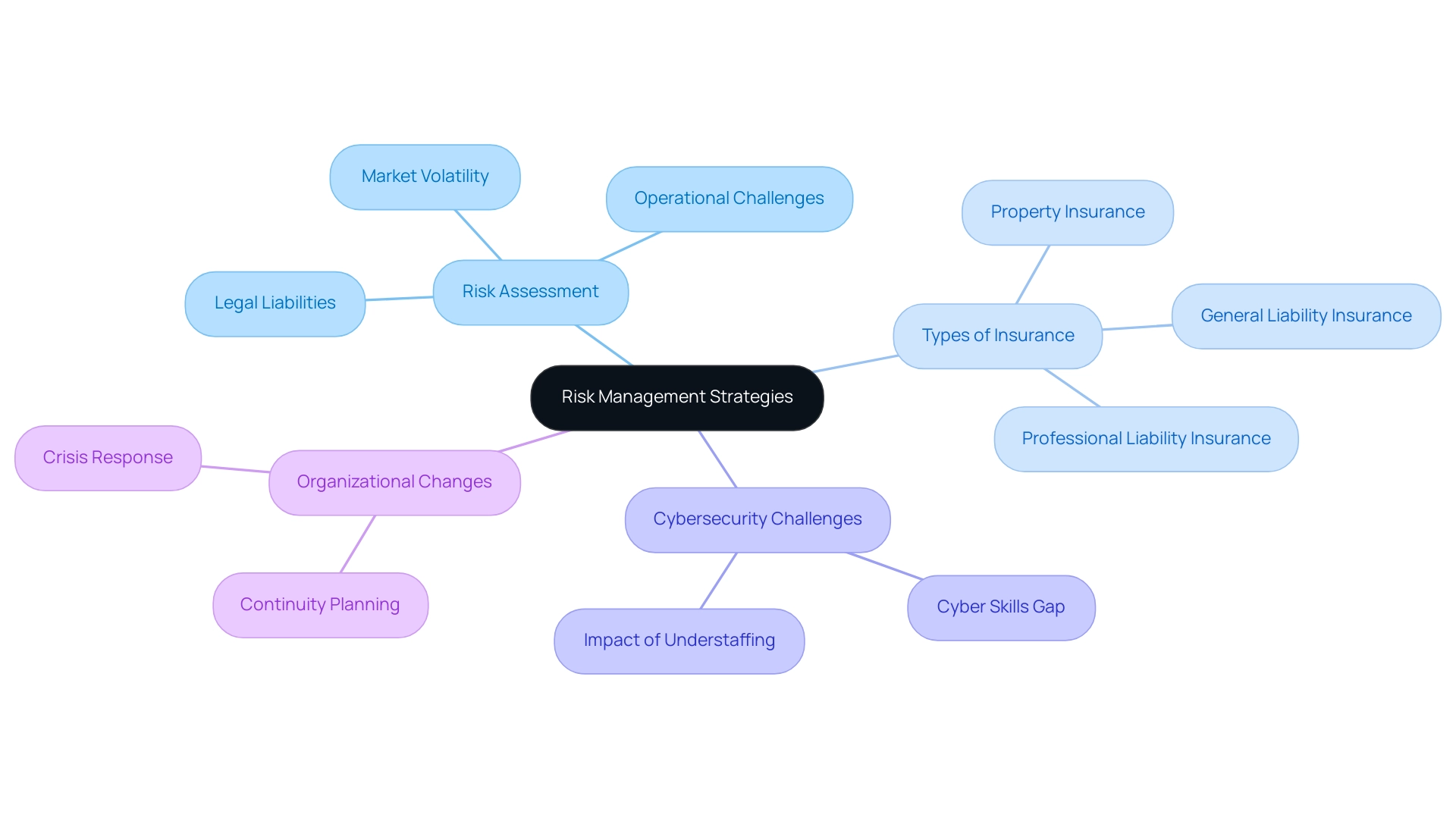

Implementing Risk Management and Insurance Strategies

Effective risk oversight is crucial for entrepreneurs, as it involves identifying potential dangers to their enterprise and developing strategies to alleviate them. Conducting a thorough risk assessment is a crucial first step, allowing business owners to evaluate risks related to market volatility, operational challenges, and legal liabilities. Notably, a staggering 98.3% of organizations maintain relationships with third parties that have experienced data breaches, and 50% of organizations have indirect relationships with at least 200 fourth parties that have breaches, highlighting the importance of vigilance in risk management.

This underscores the need for comprehensive approaches to address evolving threats. Insurance serves as a cornerstone of these strategies, offering a safety net against unforeseen events. Common types of insurance that every entrepreneur should consider include:

- General liability insurance

- Property insurance

- Professional liability insurance

These coverages are not just about compliance; they are vital for safeguarding against potentially devastating financial losses. Indeed, as we transition into 2024, the importance of insurance becomes even more evident, with 75% of executives expecting significant changes in how their organizations handle continuity planning and crisis response. Additionally, 62% of cybersecurity professionals report that their teams are understaffed, impacting the effectiveness of cyber defenses.

This suggests an urgent requirement for business owners to invest in tackling the cyber skills gap as part of their risk handling strategies. By securing the appropriate insurance coverage and understanding the real-world challenges in cybersecurity, business owners can not only protect their investments but also ensure smoother operations in times of crisis, thereby enhancing their business resilience.

Leveraging Technology for Financial Management

In the modern digital environment, technology has become essential for entrepreneurs to develop strategies for financial planning for new entrepreneurs. Leveraging advanced financial software and applications can significantly enhance strategies for financial planning for new entrepreneurs. Tools such as QuickBooks, FreshBooks, and Xero are leading the way, offering robust features for budgeting, invoicing, and expense tracking, which simplify the management of finances.

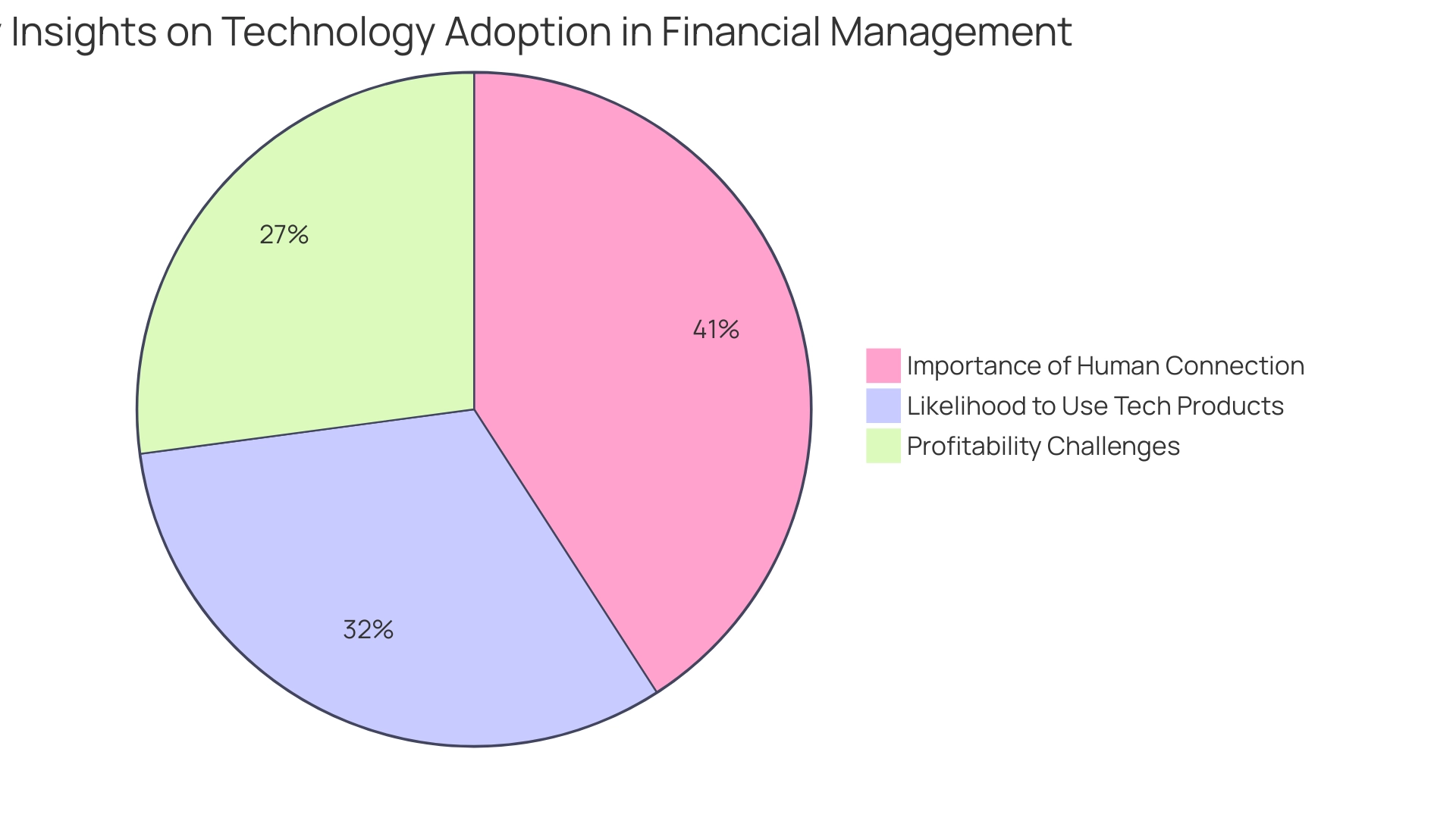

Notably, a recent survey revealed that:

- 95% of respondents believe that prioritizing human connection with clients and staff is a competitive advantage, underscoring the importance of integrating technology without losing the personal touch.

- Additionally, a significant challenge faced by firms today is reduced profitability due to increased costs of doing business, with 63% of respondents identifying this as a major obstacle.

Furthermore, cloud-based solutions facilitate real-time collaboration and ensure easy access to monetary data, which in turn enhances decision-making capabilities.

A report on leading banks in AI adoption in the Americas and Europe highlights how these institutions have successfully integrated technology into their operations, setting benchmarks for the industry. By adopting these technologies, business leaders not only save valuable time and reduce errors but also position themselves to concentrate on growth initiatives. As we enter 2024, the influence of software on small business efficiency will only become more pronounced, making it crucial for new entrepreneurs to implement strategies for financial planning for new entrepreneurs in order to thrive in an increasingly competitive market.

Moreover, with 74.4% of respondents indicating a likelihood to use financial products offered by prominent tech figures, it is clear that the trend towards technology adoption in financial management is accelerating.

Conclusion

Establishing a solid financial plan is fundamental for new entrepreneurs aiming to navigate the complexities of business ownership successfully. The key components—budgeting, cash flow management, tax compliance, risk mitigation, and leveraging technology—serve as the building blocks for a sustainable business strategy.

By implementing disciplined budgeting practices, entrepreneurs can maintain control over their finances while strategically investing in growth opportunities. Vigilant cash flow management further ensures that businesses remain solvent, allowing for timely responses to market fluctuations.

Understanding tax obligations and engaging professionals for compliance can lead to substantial savings, reinforcing the importance of proactive financial management. Moreover, risk management strategies, including appropriate insurance coverage, safeguard against unforeseen challenges, ensuring business resilience. As technology continues to evolve, embracing financial software not only streamlines processes but also enhances decision-making capabilities, allowing entrepreneurs to focus on growth.

In conclusion, a well-structured financial plan is not merely a roadmap; it is an essential aspect of entrepreneurial success. As nearly 70% of businesses with strategic plans thrive beyond their initial years, the message is clear: meticulous financial management is imperative. By prioritizing these practices, entrepreneurs can position themselves for long-term stability and prosperity in a competitive landscape.