Introduction

Navigating the transition from traditional employment to entrepreneurship can be both exhilarating and daunting. As individuals seek greater autonomy and fulfillment, the entrepreneurial landscape is becoming increasingly enticing. However, this shift requires more than just a desire for independence; it demands a profound change in mindset, strategic planning, and financial preparedness.

From understanding the nuances of startup costs to building a supportive network and committing to lifelong learning, each step plays a crucial role in laying the foundation for success. This article delves into essential strategies and insights that empower aspiring entrepreneurs to embrace their journey, tackle challenges head-on, and ultimately thrive in the competitive business world.

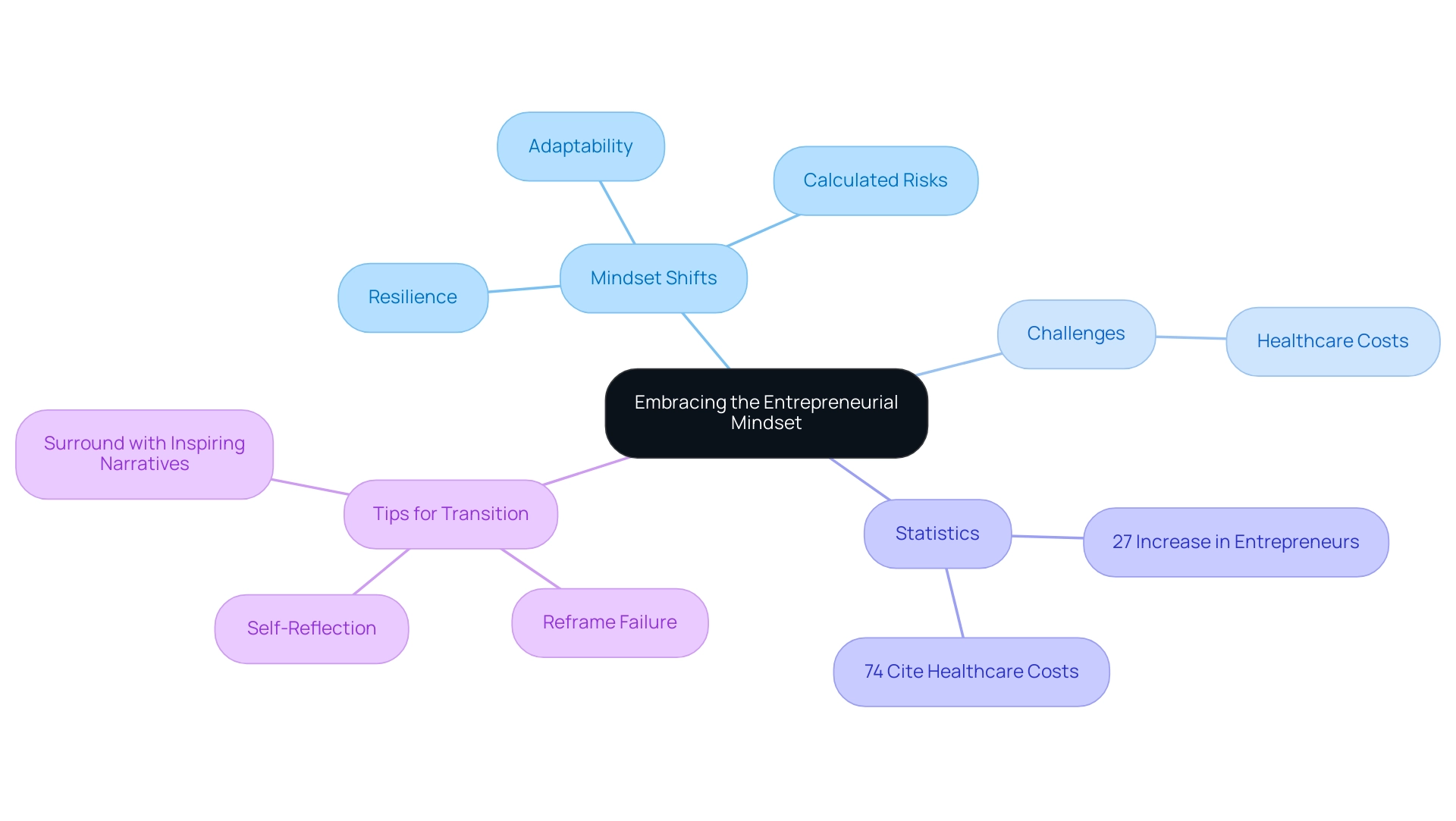

Embracing the Entrepreneurial Mindset

Transitioning to business ownership requires a fundamental shift in mindset, and there are valuable tips for how to transition from career to business ownership that can help in today’s evolving job market. Embracing a business-oriented mindset requires cultivating resilience, adaptability, and a readiness to take calculated risks. Notably, a statistic reveals that from 2019 to 2020, 27% more individuals embarked on entrepreneurial ventures fueled by dissatisfaction with corporate America, illustrating a growing desire for autonomy and fulfillment.

Additionally, 74% of small enterprises cite healthcare costs as their top challenge, underscoring the importance of preparedness for the hurdles ahead. Begin by reframing your perspective on failure; see it as a valuable learning opportunity rather than an insurmountable setback. Engage in self-reflection to identify your motivations for starting an enterprise, as one of the tips for how to transition from career to business ownership is ensuring they resonate with your core values.

Surrounding yourself with inspiring narratives of successful entrepreneurs can cultivate a positive outlook and reinforce your commitment to this transformative journey. For instance, the ‘Empire Builder’ case study highlights ambitious entrepreneurs whose ventures generate at least $1 million annually, driven by the desire to scale their income and impact. As Brandi Marcene aptly states, ‘Entrepreneurs are the backbone of commerce in the United States due to their ability to create new companies, drive innovation, take calculated risks, shape corporate culture, and bring diverse perspectives to the table.’

To assist you on this journey, ‘Your Career 2.0: A Survival Guide for The Battered Career Syndrome and Investor Syndrome’ serves as an invaluable resource, providing tips for how to transition from career to business ownership, along with strategies and insights tailored for aspiring entrepreneurs. Such insights serve as a powerful reminder of the potential impact you can achieve through your entrepreneurial endeavors.

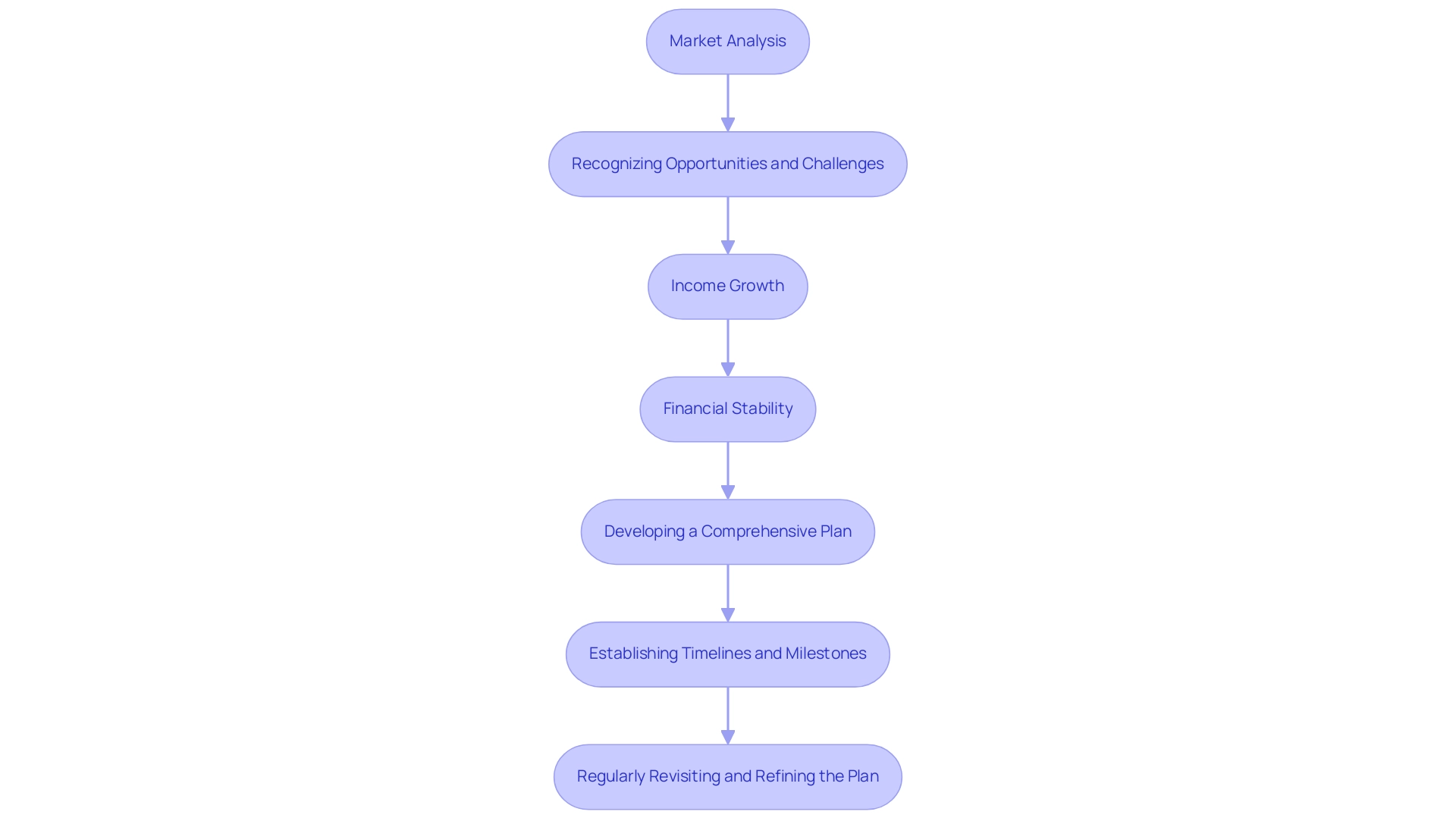

Strategic Planning for Your Business Transition

A robust strategic plan serves as the cornerstone for a successful business transition, especially for those seeking tips for how to transition from career to business ownership, whether they are moving from a stable corporate environment to entrepreneurship or franchising. Begin with a thorough market analysis to gain insights into your target audience and competitors. This foundational step enables you to recognize opportunities and challenges in your market landscape, which is crucial as you strive for income growth—a prevalent short-term objective that can reduce monetary stress, especially for those encountering unfair or disproportionate salaries.

When your income increases, your financial stability improves, enabling you to better manage obligations such as bills and maintenance costs, thus reducing the stress associated with these responsibilities. Next, develop a comprehensive plan that articulates your vision, mission, and objectives, while integrating tips for how to transition from career to business ownership. Ensure this plan encompasses essential elements such as:

- Product offerings

- Pricing strategies

- Marketing approaches

As you develop your strategy, it’s vital to establish realistic timelines and milestones to monitor your progress effectively. Regularly revisit and refine your strategic plan, as these are tips for how to transition from career to business ownership, to ensure it remains aligned with your evolving objectives. In today’s fast-paced environment, where the average blog post length has increased to 1,427 words, the depth and clarity of your planning can significantly impact your communication and strategic effectiveness.

Remember, the average click through rate for emails is 1.40%, highlighting the need for effective communication in your strategic planning. Additionally, the Federal Deposit Insurance Corporation’s guarantee of up to $250,000 per account emphasizes the critical importance of planning as part of your overall strategy. By integrating these elements, you position your enterprise for sustainable growth and resilience amidst change, ultimately enhancing your career pathway and economic outlook.

Financial Preparedness: Understanding Your Business Costs

Before embarking on the journey of ownership, a comprehensive assessment of your financial standing is paramount. Start by assessing your startup expenses, which generally include essential components like:

- Equipment

- Inventory

- Marketing

- Operational expenditures

Crafting a detailed budget that outlines anticipated income and expenditures for at least your first year is crucial, especially considering that 20% of small businesses fail within the first year.

Recent reports suggest that new entrepreneurs frequently neglect the various expenses related to starting their ventures, with some startups encountering an average of 10.5% of their first-year budget on offline expenditures alone, especially when merging online and in-person sales. This highlights the significance of comprehending both online and offline expenses in your budgeting process. Additionally, FinTech startups face significant challenges with customer acquisition costs, making it even more critical to have a solid monetary plan in place.

Establishing an emergency fund can provide a safety net to cover personal expenses during the initial months when cash flow may be tight. It is also wise to explore diverse funding options, including:

- Loans

- Grants

- Potential investors

Ensuring you have the capital necessary to sustain and grow your venture is essential. As the Office of Advocacy at the SBA observes,

Small enterprises are a family matter, at least they are for 31% of those in America; hence, nurturing your financial foundation is not merely a matter of numbers but also a commitment to your personal and familial aspirations.

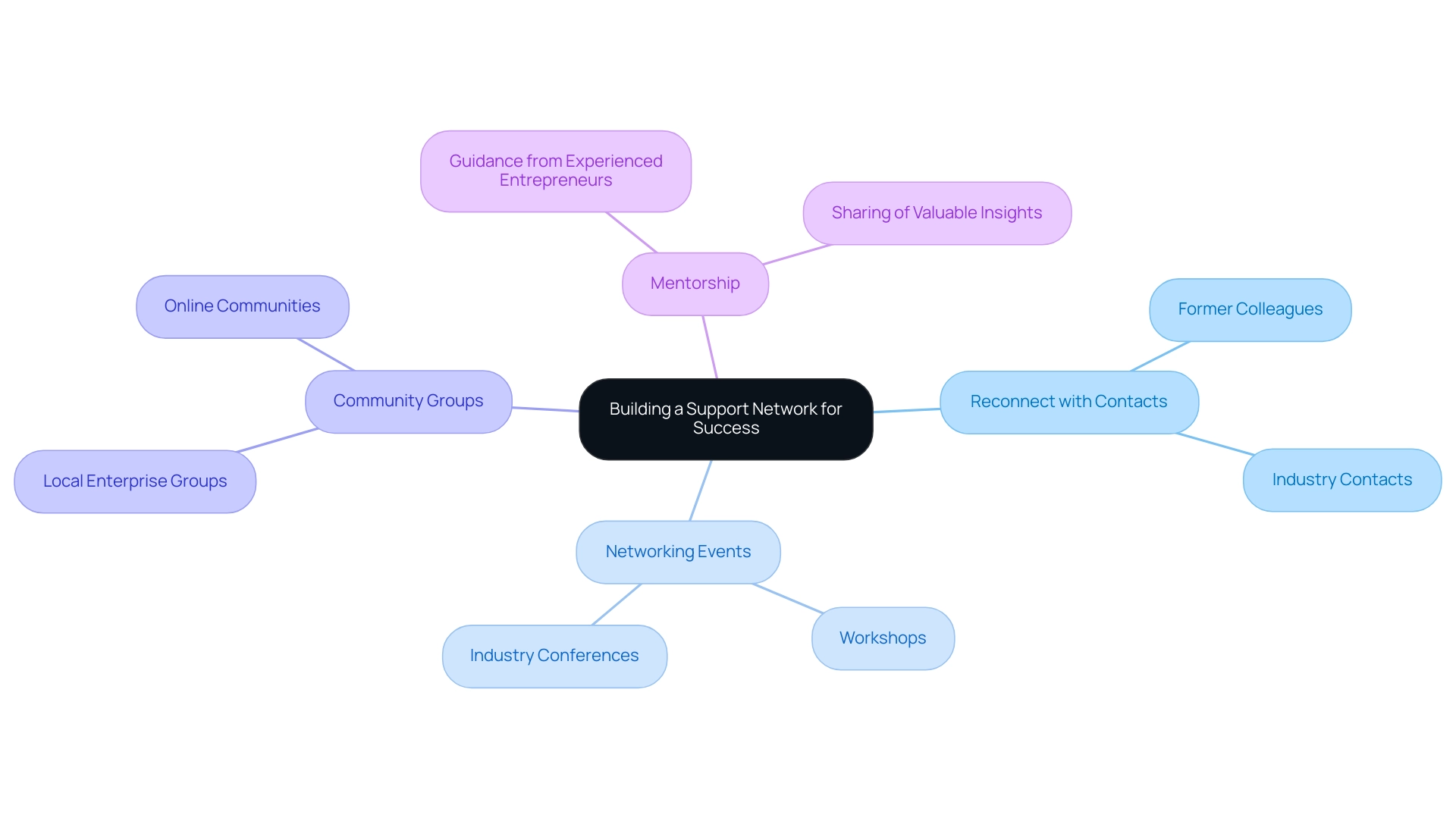

Building a Support Network for Success

Establishing a strong support network is crucial for your business journey, particularly when applying tips for how to transition from career to business ownership. Begin by reconnecting with former colleagues, friends, and industry contacts who can provide valuable insights or mentorship. Engaging in networking events, workshops, and industry conferences will connect you with like-minded individuals and potential collaborators.

Joining local enterprise groups or online communities can facilitate sharing experiences and resources, enhancing your entrepreneurial skill set. It’s crucial to recognize that your existing skills are transferable; leveraging these can significantly aid your transition into entrepreneurship. The importance of mentorship cannot be overstated; guidance from mentors who have successfully navigated similar transitions can provide invaluable tips for how to transition from career to business ownership as you embark on this new path.

Remember the words of Elia John from the University of Dodoma: ‘Show me your networks and I’ll tell you your future.’ This powerful reminder illustrates how the strength of your connections can significantly influence your success. A recent case study, ‘Influence of Entrepreneurial Networks on Internal Operations,’ utilized a linear regression model to assess the impact of both commercial and support networks on firms’ internal processes.

The findings revealed a statistically significant positive association with internal process scores, highlighting that these networks enhance overall performance. Furthermore, data collected from 311 Pakistani SMEs underscores the positive impact of networking activities, which can lead to increased profitability and innovation. So, don’t shy away from seeking out and cultivating these crucial relationships; they may very well provide you with tips for how to transition from career to business ownership while also addressing your employability concerns.

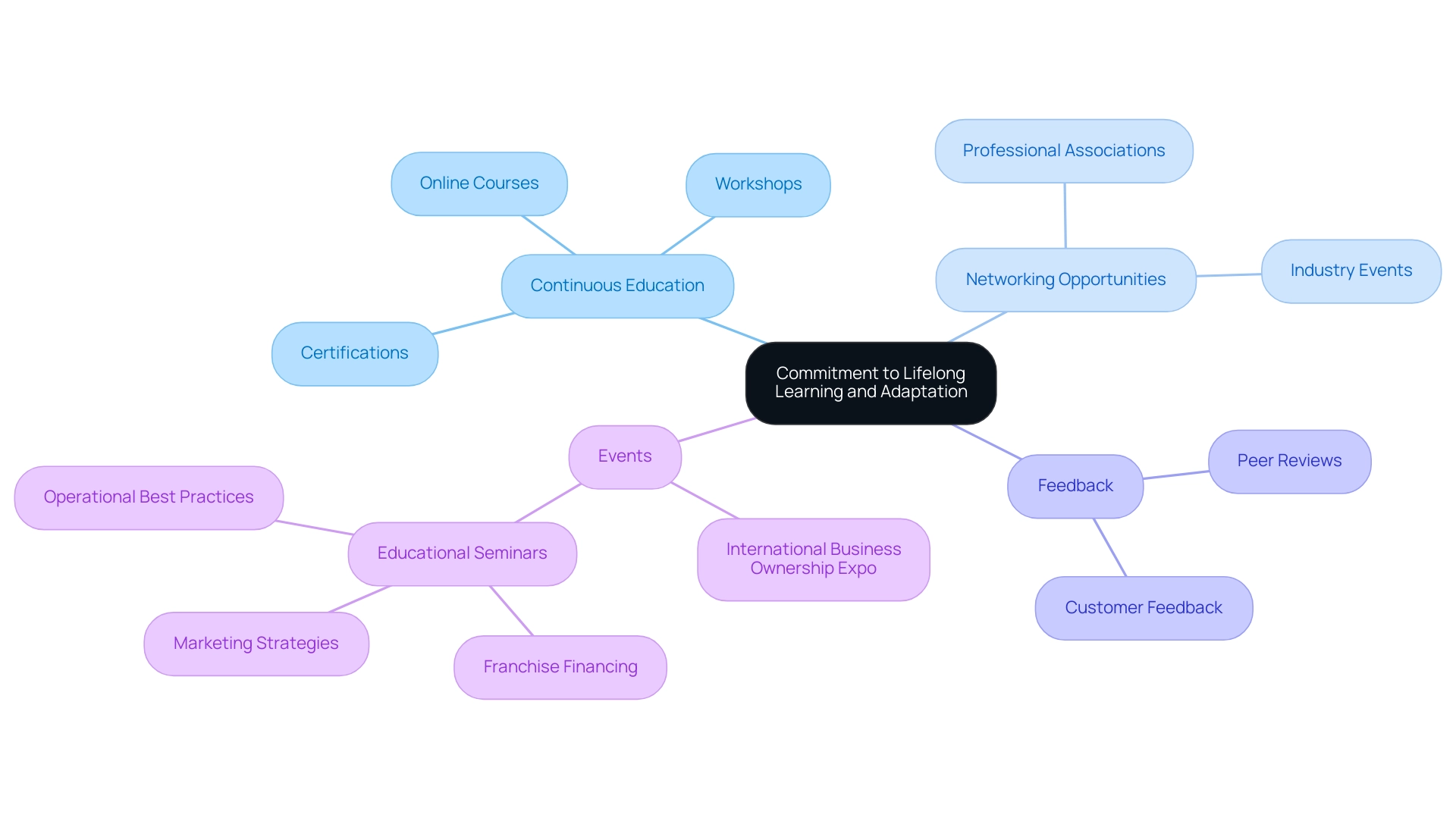

Commitment to Lifelong Learning and Adaptation

In today’s fast-paced commercial environment, lifelong learning is paramount for aspiring entrepreneurs who are looking for tips for how to transition from career to business ownership. Engaging in continuous education not only helps maintain a competitive edge but also contributes to a robust and engaged workforce—boosting profitability by an impressive 21%. This statistic highlights the critical role that ongoing training plays in enhancing employee engagement and overall organizational success.

To stay informed about industry trends, emerging technologies, and best practices, consider enrolling in relevant workshops, online courses, or certifications that align with your objectives. Joining professional associations can further enhance your learning journey by providing valuable resources and networking opportunities. A practical illustration of this necessity can be seen in the ‘Career Transition Example,’ which offers tips for how to transition from career to business ownership, where an individual moves from accounting to team leadership, highlighting the importance of ongoing education to remain competitive in the workforce.

Additionally, feedback from customers and peers is crucial; embrace it to refine your offerings and adapt your strategies accordingly. By committing to ongoing education that aligns with strategic objectives, you can implement tips for how to transition from career to business ownership, positioning yourself for sustained growth and success while remaining competitive in an ever-evolving landscape. Furthermore, attending events like the International Business Ownership Expo, taking place in New York City from May 30th to June 1st, 2024, offers a unique opportunity to connect with over 300 exhibiting franchise brands and industry experts.

This expo serves as a vital resource for aspiring entrepreneurs by offering tips for how to transition from career to business ownership, alongside insights and networking opportunities essential for making informed investment decisions. Attendees can participate in a variety of educational seminars covering topics such as franchise financing, marketing strategies, and operational best practices. These seminars are designed to equip entrepreneurs with the knowledge needed to thrive in the franchise landscape.

Coupled with personalized coaching, which can illuminate your blind spots and help clarify your entrepreneurial goals, these elements empower individuals toward financial self-sufficiency and long-term success. The networking opportunities at the expo offer aspiring business owners valuable tips for how to transition from career to business ownership by allowing them to build meaningful connections with industry leaders and fellow entrepreneurs, further enhancing their journey toward successful business ownership.

Conclusion

Transitioning from traditional employment to entrepreneurship is a multifaceted journey that requires careful consideration and proactive strategies. Embracing an entrepreneurial mindset is vital, as it fosters resilience and adaptability, essential traits for navigating the challenges ahead. Understanding the importance of a strategic plan, entrepreneurs can effectively analyze their market, establish clear objectives, and continuously refine their approach to ensure alignment with their evolving goals.

Financial preparedness cannot be overlooked; a thorough assessment of startup costs and a solid budgeting strategy are crucial for sustaining business operations. Establishing an emergency fund and exploring diverse funding options can provide the necessary financial cushion during the initial phases of business ownership. Additionally, building a robust support network is instrumental in this journey. Engaging with mentors and industry peers can offer invaluable insights and guidance, reinforcing the notion that collaboration often leads to greater success.

Lastly, committing to lifelong learning is essential in today’s dynamic business landscape. Continuous education and adaptability not only enhance personal skills but also contribute to overall business growth and innovation. By attending relevant workshops and networking events, aspiring entrepreneurs can stay informed and connected, positioning themselves for long-term success.

The journey into entrepreneurship is undoubtedly challenging, yet it is also filled with opportunities for growth and fulfillment. By embracing these strategies, individuals can confidently navigate the complexities of business ownership, transforming their aspirations into reality and contributing meaningfully to the entrepreneurial ecosystem.

Frequently Asked Questions

What mindset shift is necessary for transitioning to business ownership?

Transitioning to business ownership requires a fundamental shift in mindset, embracing resilience, adaptability, and a readiness to take calculated risks.

What recent trend has been observed in entrepreneurial ventures?

From 2019 to 2020, there was a 27% increase in individuals starting entrepreneurial ventures, largely driven by dissatisfaction with corporate America and a desire for autonomy and fulfillment.

What is one of the top challenges faced by small enterprises?

Healthcare costs are cited as the top challenge by 74% of small enterprises, highlighting the need for preparedness for potential hurdles.

How should one view failure when transitioning to business ownership?

Failure should be reframed as a valuable learning opportunity rather than an insurmountable setback.

Why is self-reflection important in the transition to business ownership?

Engaging in self-reflection helps identify motivations for starting a business, ensuring they resonate with one’s core values.

How can surrounding oneself with inspiring narratives help in this transition?

Reading about successful entrepreneurs can cultivate a positive outlook and reinforce commitment to the entrepreneurial journey.

What role do strategic plans play in transitioning to business ownership?

A robust strategic plan serves as the cornerstone for a successful transition, helping to articulate vision, mission, and objectives.

What should be included in a comprehensive strategic plan?

A strategic plan should include product offerings, pricing strategies, marketing approaches, and realistic timelines and milestones to monitor progress.

Why is market analysis important in the transition process?

Conducting a thorough market analysis provides insights into the target audience and competitors, helping to recognize opportunities and challenges.

How can increasing income impact financial stability for aspiring entrepreneurs?

Increasing income improves financial stability, allowing better management of obligations and reducing stress related to bills and maintenance costs.

What is the significance of regularly revisiting and refining the strategic plan?

Regularly revisiting and refining the strategic plan ensures it remains aligned with evolving objectives in a fast-paced environment.