Overview

The article outlines seven essential strategies for financial planning tailored for new entrepreneurs, emphasizing the importance of budgeting, cash flow management, investment strategies, risk management, and setting financial goals. These strategies are crucial for navigating the financial challenges unique to entrepreneurship, such as managing variable incomes and tax complexities, as they provide a structured approach to resource allocation and long-term sustainability, ultimately enhancing the likelihood of business success.

Introduction

In the dynamic world of entrepreneurship, financial planning emerges as a cornerstone for success, guiding business owners through the intricate landscape of budgets, cash flow, and investment strategies. With the stakes high and the average business operating on a razor-thin margin of cash reserves, understanding the nuances of financial management is not just advantageous—it is essential.

Entrepreneurs face unique challenges, from fluctuating incomes to complex tax obligations, making strategic financial planning a necessity for sustainable growth. As interest in entrepreneurship surges among younger generations, the importance of equipping aspiring business owners with robust financial skills cannot be overstated.

This article delves into the critical components of effective financial planning, offering insights and practical strategies to help entrepreneurs navigate their financial journeys with confidence and clarity.

Understanding Financial Planning for Entrepreneurs

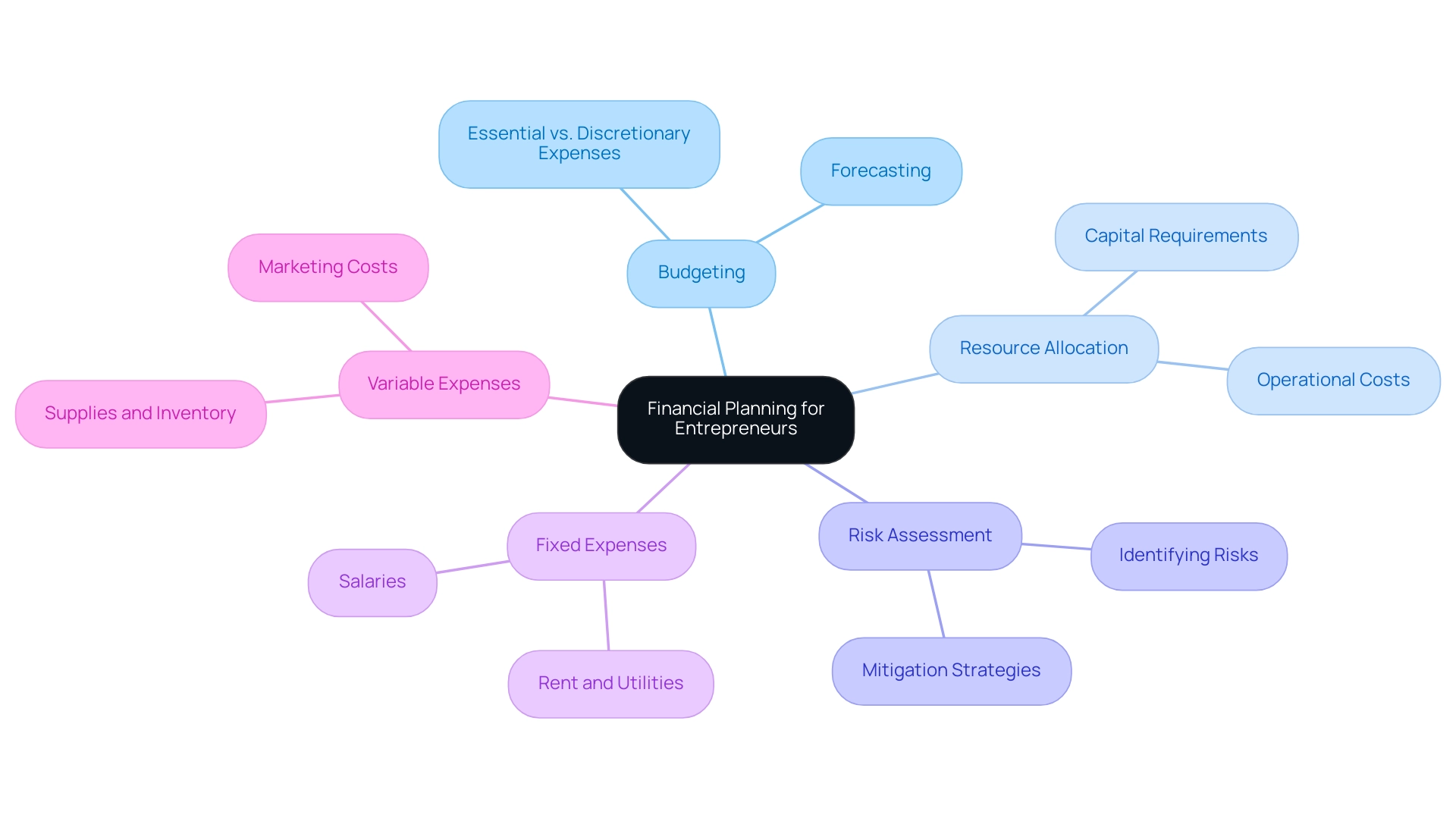

Financial planning for new entrepreneurs is a vital strategic process that involves creating a comprehensive budget to manage finances effectively and achieve organizational objectives. This process includes crucial elements like resource allocation, forecasting, and risk assessment, highlighting the significance of comprehending both fixed and variable expenses. Considering that the median company has less than one month of cash available, the stakes are high, making skilled fiscal planning essential for survival.

Industries like online retail, accounting, and landscaping require minimal capital to start, heightening the need for meticulous budgeting. By distinguishing between essential and discretionary expenses—such as prioritizing necessary operational costs over luxury items—entrepreneurs can optimize their resources and gradually align their compensation expectations with growth. This foundational knowledge equips new entrepreneurs with ways to financial planning for new entrepreneurs, enabling them to allocate resources effectively and prepare for unexpected challenges.

Significantly, a recent study from Oxford Economics shows that 74% of small and medium enterprise owners are ready to take considerable risks to ensure their success, emphasizing the necessity for strategic monetary management in a competitive environment. Furthermore, interest in entrepreneurship remains strong among younger generations—evidenced by a case study showing that two-thirds of teens would still consider starting a venture despite the challenges posed by COVID-19. This emphasizes the importance of providing aspiring business owners with strong budgeting abilities as they navigate their future projects, ensuring they manage their expenses without compromising their quality of life.

Key Components of a Successful Financial Plan

A successful economic strategy includes several vital elements that are crucial for individuals maneuvering through their professional environment:

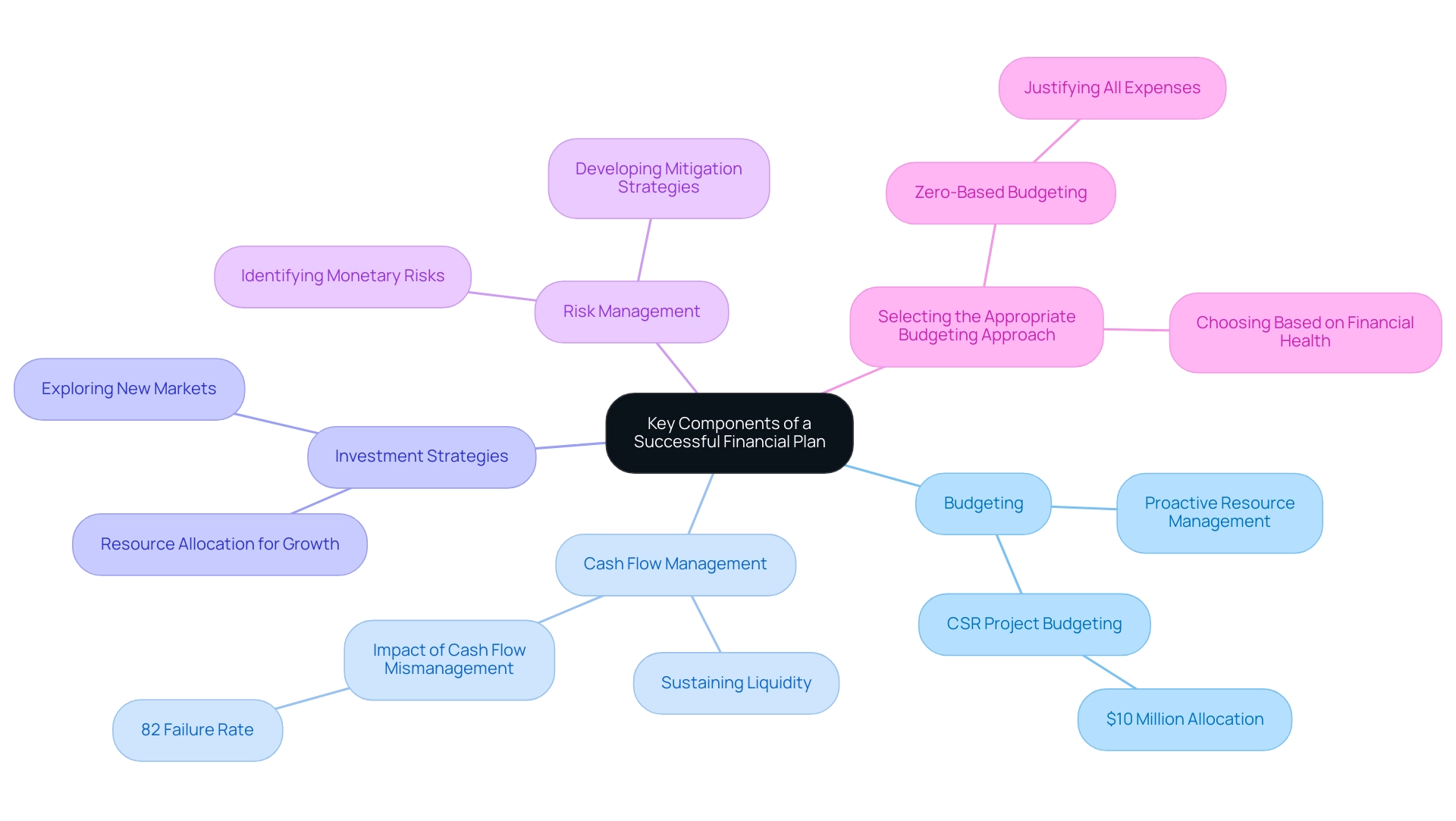

- Budgeting: A well-structured budget is foundational for tracking income and expenses. It guarantees that business owners function within their economic limitations, which is especially important for preserving stability during slower times. As highlighted by Oozle Media, Budgeting assists business owners in getting ready for slower times, underscoring the necessity for proactive resource management. Additionally, considering the statistic that $10 million was allocated for a company’s annual corporate social responsibility (CSR) project, business owners can see how effective budgeting supports larger monetary commitments and community impact.

- Cash Flow Management: Vigilantly monitoring cash flow is vital for sustaining liquidity. Effective cash flow management allows entrepreneurs to meet their financial obligations and seize growth opportunities as they arise. Recent statistics indicate that 82% of small enterprises fail due to cash flow mismanagement, underscoring its critical role in organizational health.

- Investment Strategies: Entrepreneurs must understand how to strategically allocate resources for growth—whether through reinvesting in their enterprise, exploring new markets, or utilizing investment vehicles. The appropriate investment strategy can significantly enhance long-term sustainability, enabling organizations to adapt and thrive.

- Risk Management: Identifying potential monetary risks and developing mitigation strategies is essential for shielding a business from unforeseen downturns. By proactively addressing economic vulnerabilities, business owners can protect their operations and ensure resilience in challenging times.

- Selecting the Appropriate Budgeting Approach: It is crucial for business owners to choose the method that best fits their monetary circumstances. For example, zero-based financial planning may be especially advantageous for financially troubled organizations, as it necessitates justifying all expenses from the ground up instead of relying on prior budgets. This approach can result in more effective distribution of resources and improved economic stability.

By focusing on these elements, including the diverse budgeting techniques shown in case studies, business owners can identify ways to financial planning for new entrepreneurs to create a strong monetary strategy that not only aids their present goals but also establishes a foundation for future achievements.

Setting and Prioritizing Financial Goals

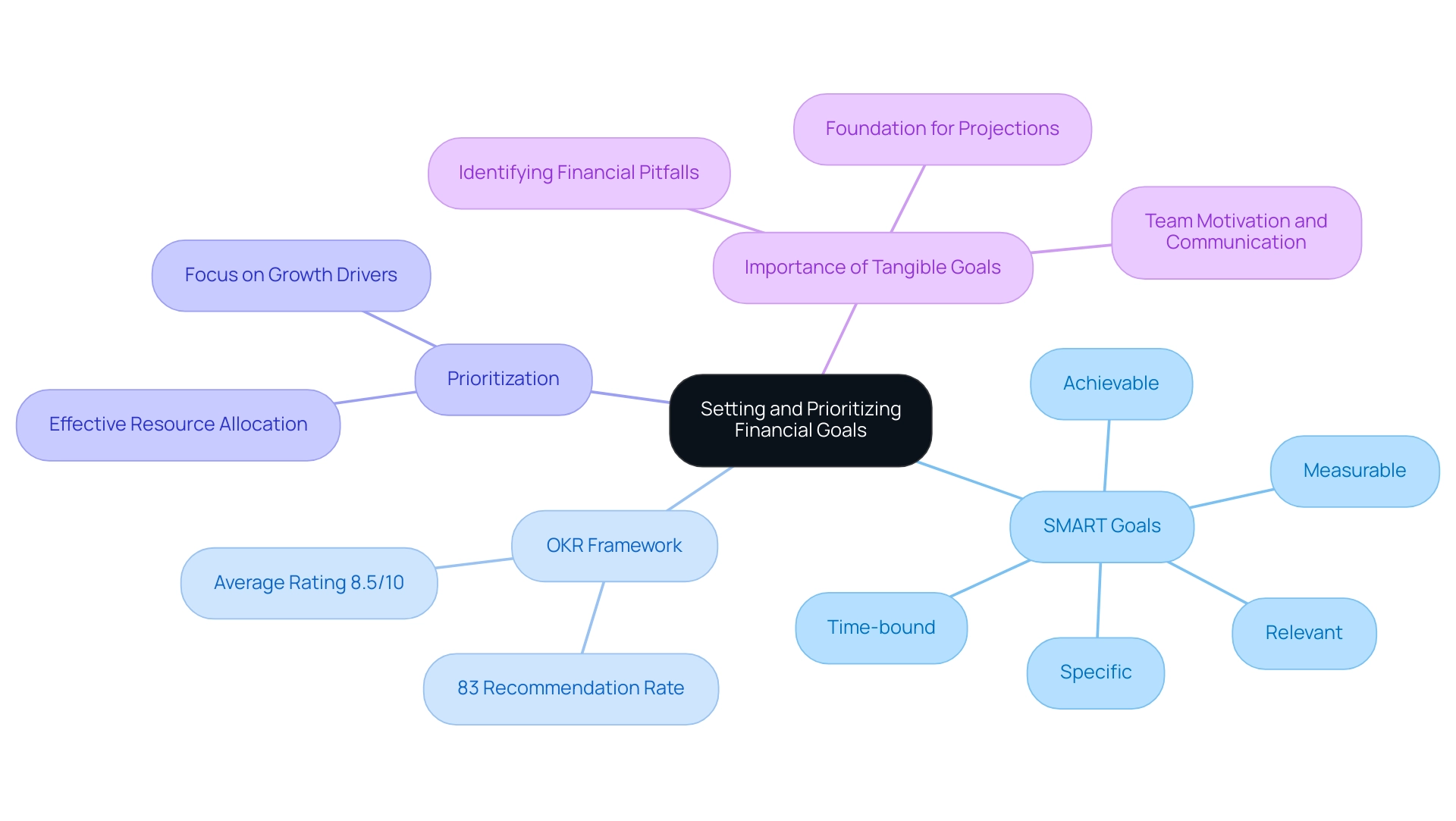

Establishing and prioritizing monetary objectives is essential for business owners as they explore ways to financial planning for new entrepreneurs. By defining specific, measurable, achievable, relevant, and time-bound (SMART) goals, business owners can identify ways to financial planning for new entrepreneurs, thus creating a clear roadmap for their financial success. For instance, a new business owner might aim to reach a revenue target within their first year or to decrease expenses by a certain percentage.

Prioritizing these goals is among the essential ways to financial planning for new entrepreneurs, enabling effective resource allocation and ensuring that focus remains on what genuinely drives growth. Notably, a survey indicated that 83% of companies recommend the OKR framework as an effective method for aligning goals and improving outcomes, with decision-makers rating it an average of 8.5/10 for recommendation, showcasing its relevance to entrepreneurs. Furthermore, the citation from HBR shows that only 11% of managers think their company’s strategic priorities are completely backed by the required monetary and human resources, highlighting the significance of establishing attainable economic goals in this context.

The case study titled ‘Importance of Tangible Goals’ emphasizes how setting specific monetary objectives creates a basis for forecasts and responsibility, which is particularly crucial for smaller enterprises with limited capital. This practice helps identify potential monetary pitfalls and fosters better team motivation and communication. By consistently reviewing and adjusting their monetary goals, business owners can stay aligned with the changing environment of their enterprises and their personal aspirations.

Navigating Unique Financial Challenges for Entrepreneurs

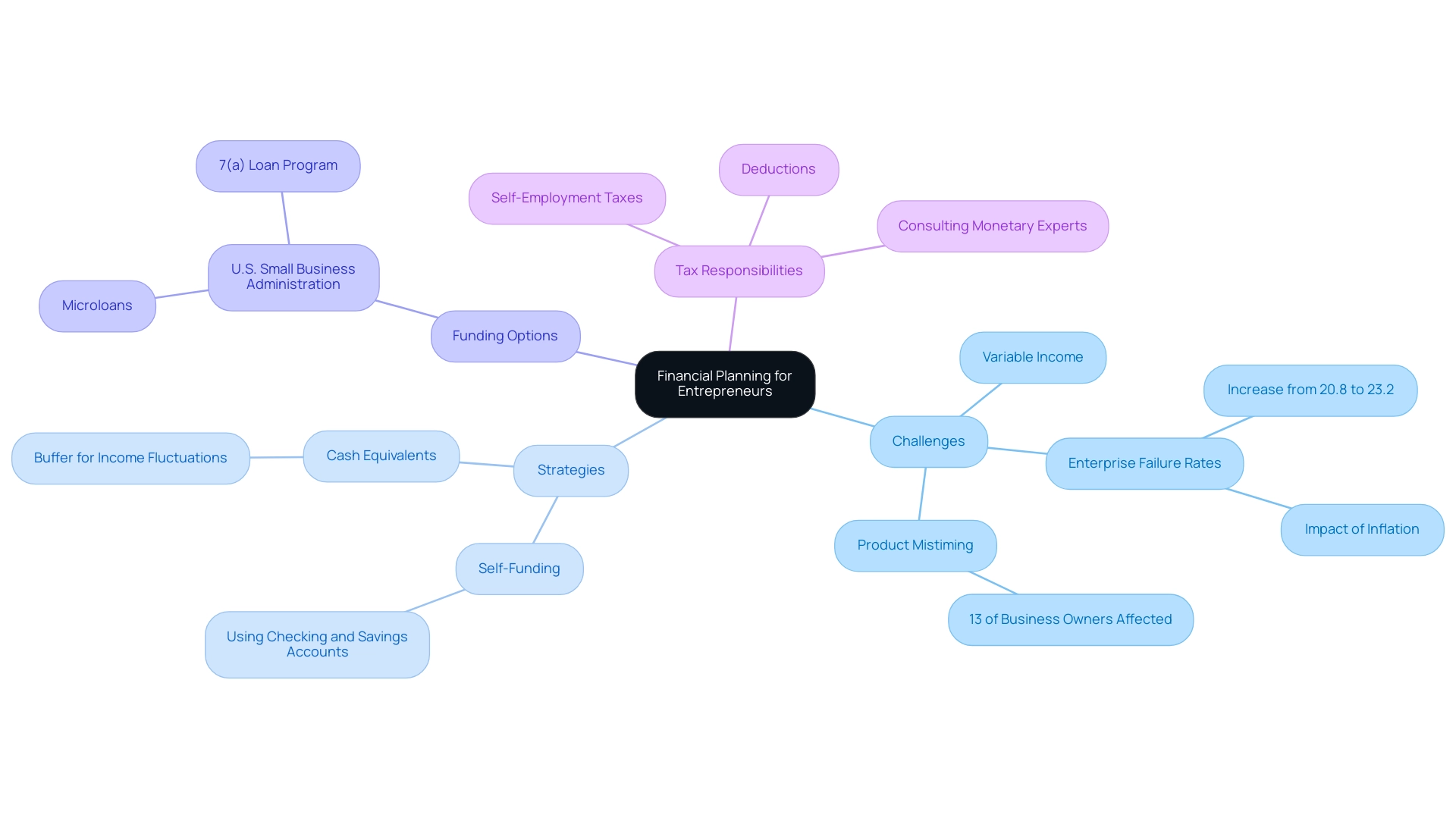

Entrepreneurs frequently grapple with distinct financial challenges, especially the ways to financial planning for new entrepreneurs, which include managing variable incomes and understanding the complexities of tax obligations. Unlike traditional employment, where income tends to be stable, business owners often experience significant fluctuations in earnings. This unpredictability necessitates the development of robust ways to financial planning for new entrepreneurs to maintain cash flow, especially during lean periods.

Recent analyses reveal that enterprise failure rates have surged, with inflation contributing to these difficulties; the failure rate rose from 20.8% to 23.2% within a single year, as highlighted in the case study titled “Impact of Inflation on Enterprise Failure Rates.” Such economic pressures are likely affecting consumer spending, which in turn impacts the survival rates of new ventures. A comprehensive business plan is essential not only for obtaining loans but also as one of the important ways to financial planning for new entrepreneurs, assisting individuals in navigating these turbulent waters.

Furthermore, 13 percent of business owners have reported encountering product mistiming, further complicating their economic situation. To enhance financial stability, business owners should consider various ways to financial planning for new entrepreneurs, including:

- Self-funding options available through checking and savings accounts

- Cash equivalents, which can be strategically utilized to smooth out income fluctuations and provide a buffer during uncertain times

Furthermore, business owners can explore funding opportunities from the U.S. Small Business Administration, such as microloans and the 7(a) loan program, which are designed to support small businesses in their growth endeavors.

Navigating tax responsibilities can be intricate for business owners, highlighting the importance of exploring ways to financial planning for new entrepreneurs, as they must account for self-employment taxes and various deductions. Interacting with monetary experts can offer crucial advice, providing ways to financial planning for new entrepreneurs, assisting business owners in understanding their tax responsibilities and enhancing economic results. As Jane Smith, CFO, notes,

We expect significant growth next quarter

—a reminder that proactive management of resources is vital.

By tackling these challenges directly, business owners can create a more robust economic base, paving the way for sustainable growth and achievement.

Leveraging Professional Advice and Financial Tools

Utilizing expert monetary guidance and advanced fiscal tools is essential for business owners exploring ways to financial planning for new entrepreneurs. Working together with monetary consultants offers customized perspectives that illustrate various ways to financial planning for new entrepreneurs, enabling them to make informed choices about investments, budgeting, and tax approaches. As Michael Urch, a Senior Wealth Manager, succinctly states,

It’s important to ensure that every monetary decision is aligned with your organization’s objectives.

Moreover, the current landscape shows that 71% of small business owners believe that entrepreneurship has positively influenced their economic security. However, it’s important to note that monetary literacy does not significantly influence self-confidence or the likelihood of seeking advice; only around 28 percent of older respondents indicated that they ever sought such guidance. This highlights the varying attitudes toward monetary guidance across demographics.

The case study titled ‘Complementary Relationship Between Financial Literacy and Financial Advice’ emphasizes that enhancing money management knowledge can improve the effectiveness of the guidance received, illustrating several ways to financial planning for new entrepreneurs by reinforcing the need for business owners to seek professional assistance. Using contemporary money management software can further streamline the budgeting and cash flow oversight process, allowing business owners to focus on expanding their ventures. By embracing these vital resources, entrepreneurs can navigate the complexities of financial management with greater confidence and clarity, ultimately setting their businesses up for sustained growth.

Conclusion

Effective financial planning is an indispensable aspect of entrepreneurship, serving as a guiding framework for navigating the complexities of budgets, cash flow, and investment strategies. By understanding the critical components of financial planning—including budgeting, cash flow management, investment strategies, and risk management—entrepreneurs can build a solid foundation for their businesses. This knowledge not only aids in maintaining stability during challenging times but also empowers entrepreneurs to seize growth opportunities as they arise.

Setting and prioritizing financial goals is equally vital, as it enables entrepreneurs to create a clear roadmap for success. By employing frameworks like SMART goals and OKRs, they can align their financial objectives with their broader business strategies. This alignment fosters accountability and motivates teams, ensuring that resources are allocated effectively to drive growth. Additionally, recognizing and addressing the unique financial challenges entrepreneurs face, such as variable incomes and tax complexities, is crucial for establishing a resilient financial foundation.

Lastly, leveraging professional advice and modern financial tools enhances the financial planning process, allowing entrepreneurs to make informed decisions tailored to their specific needs. By collaborating with financial advisors and utilizing advanced management software, entrepreneurs can navigate the intricacies of financial management with greater confidence. Embracing these strategies not only prepares entrepreneurs for immediate challenges but also positions them for sustained success in an ever-evolving business landscape.