Introduction

Navigating the world of franchising can be both exciting and overwhelming, particularly for those looking to make a significant career shift. One of the first hurdles aspiring franchisees face is understanding the net worth requirements set by franchisors. These financial thresholds are not merely bureaucratic obstacles; they serve as essential indicators of a candidate’s ability to sustain a franchise through its critical early phases.

By grasping the intricacies of net worth calculations and recognizing the importance of financial stability, potential franchisees can better position themselves for success. Moreover, as they explore various opportunities, understanding additional qualifications and strategies for overcoming financial barriers will empower them to make informed decisions.

This guide will delve into the essential aspects of franchise net worth requirements, offering valuable insights and practical advice for anyone ready to embark on their franchising journey.

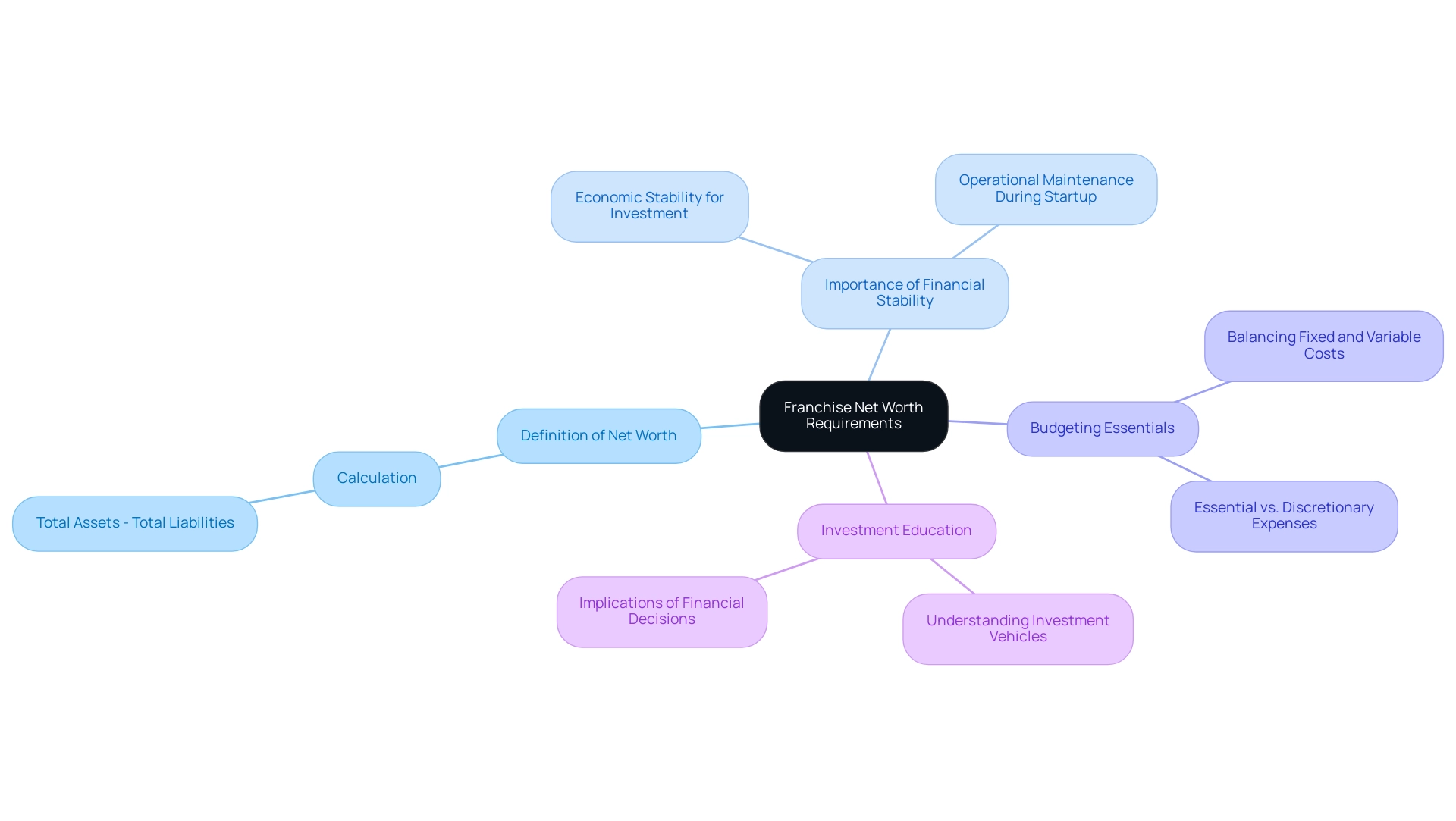

Understanding Franchise Net Worth Requirements

The criteria for franchises include what is net worth requirement for franchise, which refers to the minimum monetary threshold that potential business owners must meet to qualify for a business opportunity. Franchisors establish what is net worth requirement for franchise to ensure that franchisees possess the economic stability needed to invest in the venture and maintain operations during initial startup stages. Typically, net worth is determined by subtracting total liabilities from total assets, providing a clear picture of an individual’s monetary health.

Grasping these requirements is essential for anyone thinking about entering the business market, as they directly affect eligibility and potential success. Moreover, the budget serves as the backbone of economic planning, making it crucial to craft a comprehensive budget that effectively balances fixed and variable costs while delineating between essential and discretionary expenses. Empowering oneself through education about various investment vehicles and their implications can transform potential financial concerns into informed decisions, paving the way for a successful business journey.

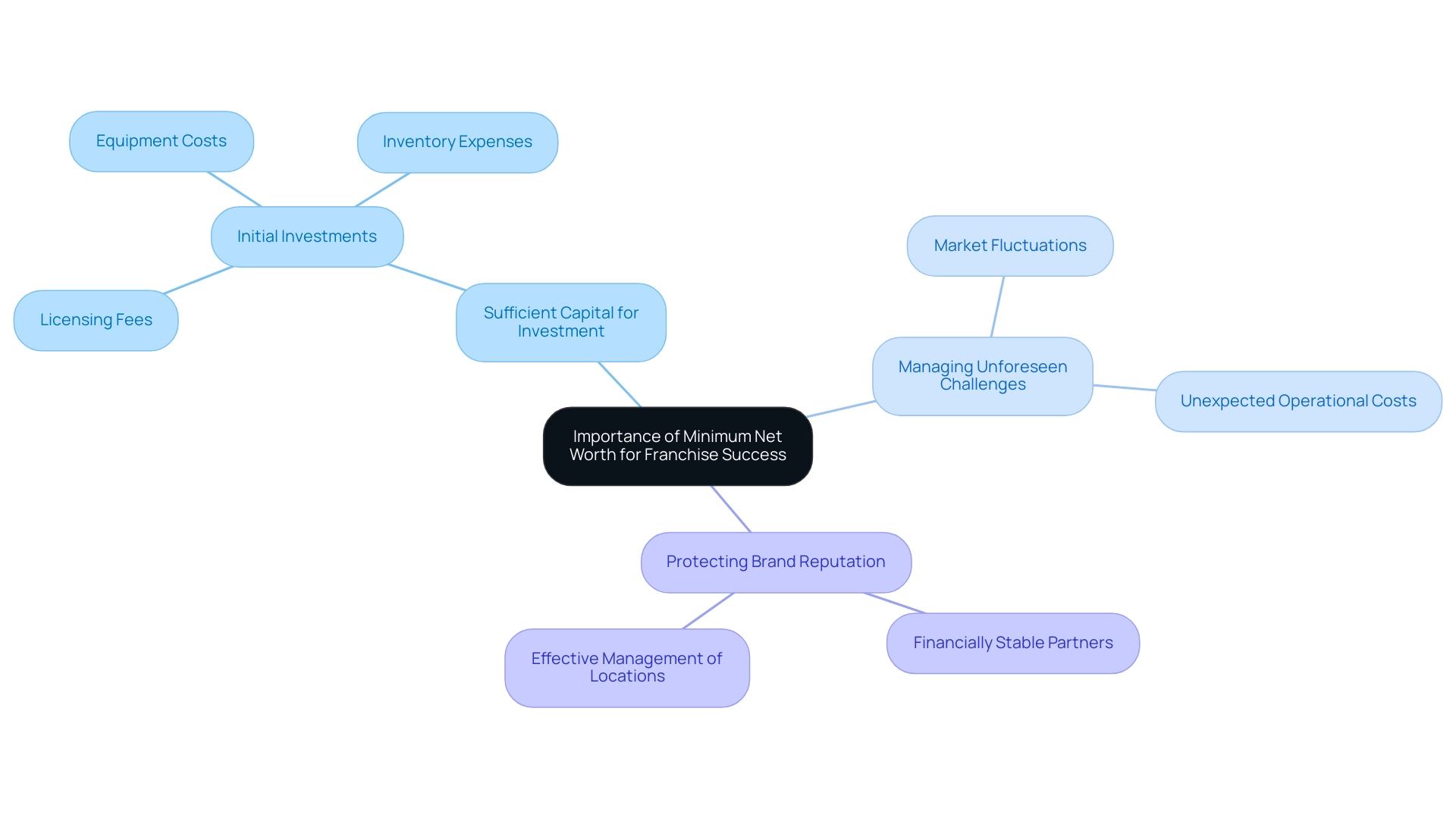

Why Minimum Net Worth is Essential for Franchise Success

Understanding what is net worth requirement for franchise is essential for business success for several reasons.

Firstly, they ensure that business operators possess sufficient capital to cover initial investments, including licensing fees, equipment, and inventory.

Secondly, having a solid monetary foundation allows franchisees to manage unforeseen challenges, such as fluctuating market conditions or unexpected operational costs.

Moreover, franchisors seek financially stable partners to protect their brand reputation and ensure that business locations are managed effectively. This monetary benchmark acts as a filter, assisting franchisors in recognizing candidates who understand what is net worth requirement for franchise and are likely to thrive in their business model.

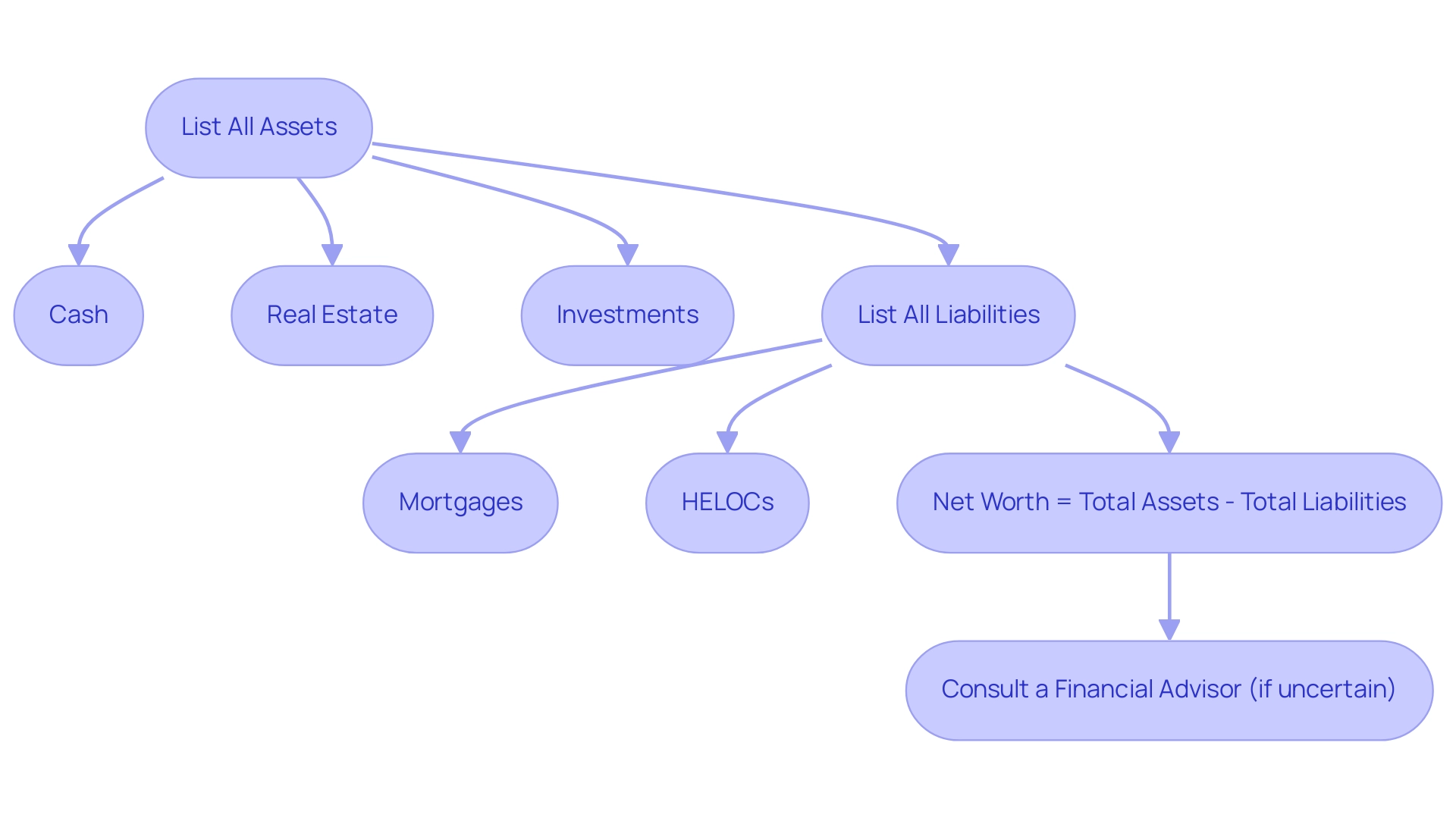

How to Calculate Your Net Worth for Franchise Opportunities

Comprehending your economic environment is essential when contemplating business ownership, especially in the context of assessing your net worth. Begin by listing all your assets, such as:

- Cash

- Real estate

- Investments

alongside your liabilities, including debts like:

- Mortgages

- Home equity lines of credit (HELOCs)

Mortgages can provide the necessary funding for property purchases, while HELOCs offer a flexible borrowing option against your home equity.

The formula is straightforward:

Net Worth = Total Assets - Total Liabilities

This calculation provides a clear snapshot of your monetary position, which is vital for understanding what is net worth requirement for franchise opportunities. Additionally, self-funding mechanisms through checking and savings accounts, as well as cash equivalents, can enhance your economic readiness.

If you’re uncertain about your financial assessment, consulting a financial advisor can provide valuable insights, ensuring your calculations are accurate and comprehensive.

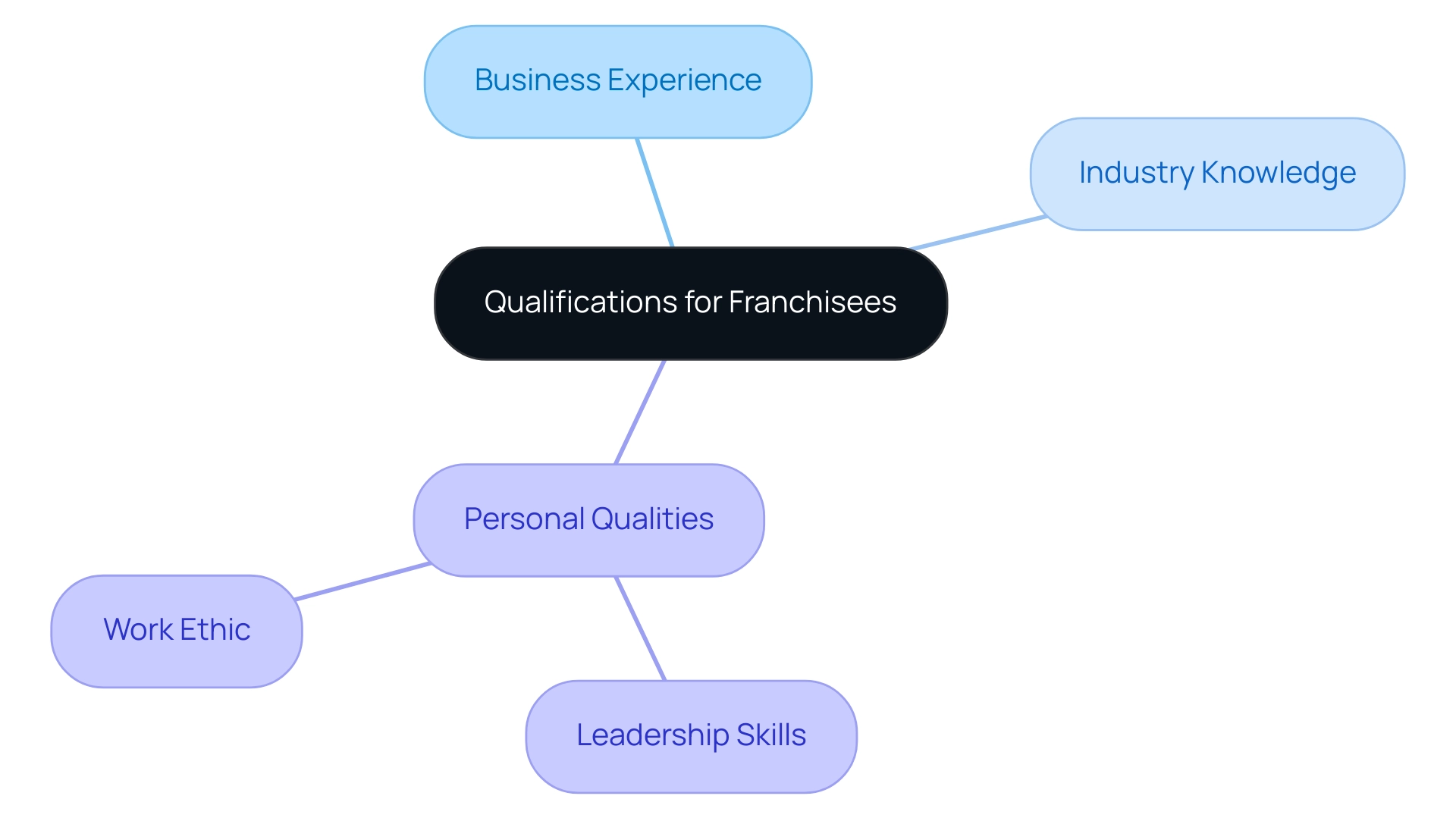

Beyond Net Worth: Other Qualifications for Franchisees

While what is net worth requirement for franchise is a critical factor, franchisors often consider additional qualifications when assessing potential business partners. These can include:

- Relevant business experience

- Industry knowledge

- Personal qualities such as:

- Leadership skills

- Work ethic

Many franchisors also seek candidates who exhibit a strong dedication to the brand’s values and customer service standards.

Comprehending these extra qualifications can assist aspiring business owners in better preparing themselves and enhancing their applications, ultimately increasing their chances of success in the system.

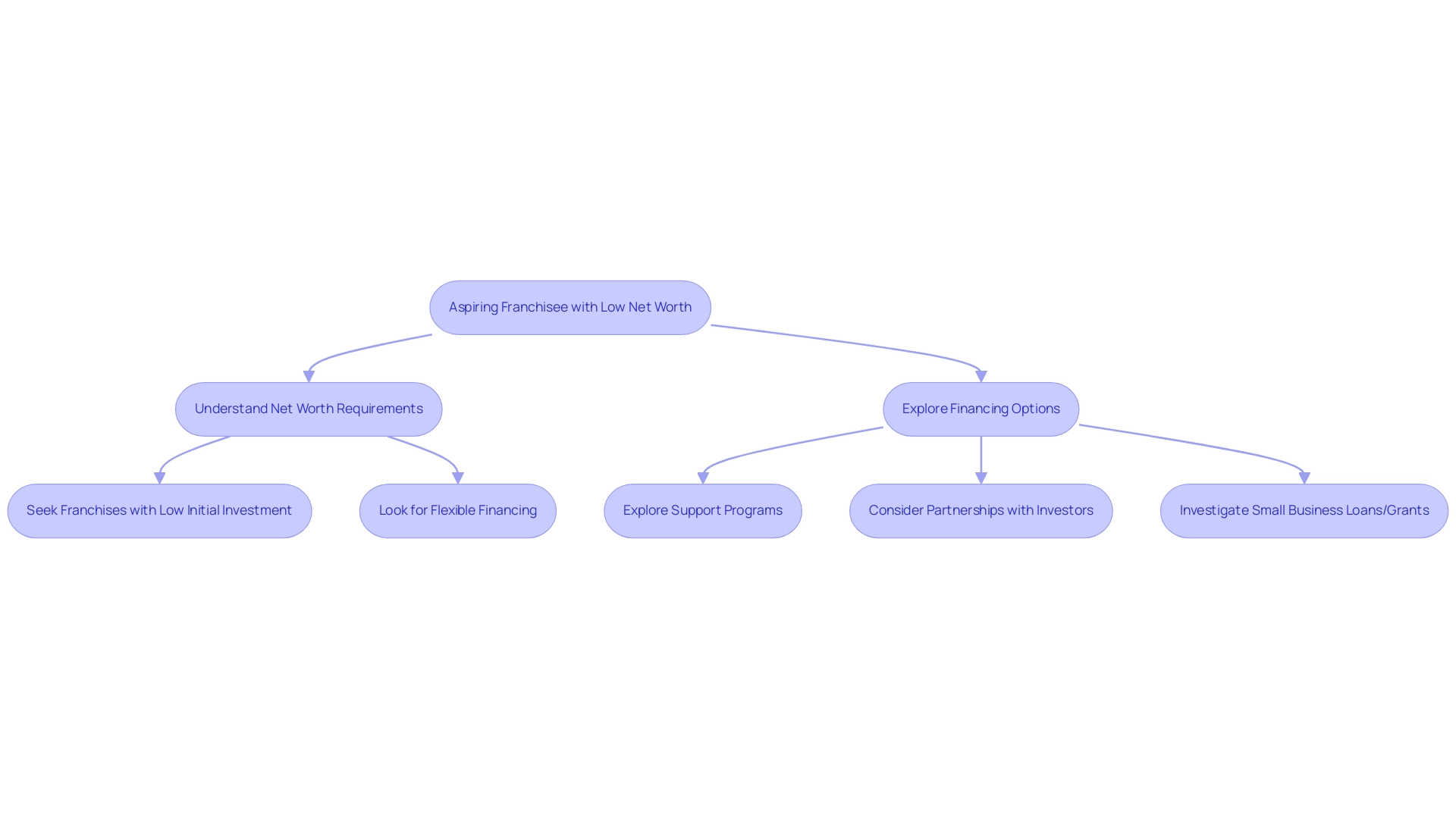

Navigating Franchise Opportunities with Low Net Worth

For individuals with low net worth, understanding what is net worth requirement for franchise can make entering the business market seem daunting, but there are effective strategies to navigate these challenges, particularly for those transitioning from traditional careers. TES Franchising is committed to accessibility initiatives that empower aspiring entrepreneurs to take control of their destinies. One viable option is to seek franchises by understanding what is net worth requirement for franchise that require lower initial investments or offer flexible financing options.

Many franchisors offer support programs aimed at assisting new business owners in obtaining funding or improving their skills through training. Additionally, aspiring franchisees can explore partnerships with investors or consider alternative financing avenues such as small business loans or grants. By being resourceful and proactive, individuals with low net worth can overcome barriers and find viable paths into franchising, ultimately achieving their career aspirations and financial freedom.

For any questions regarding accessibility, please contact TES Franchising directly. Also, consider reading ‘Your Career 2.0: A Survival Guide for The Battered Career Syndrome and Investor Syndrome’ for further insights on navigating career transitions.

Conclusion

Aspiring franchisees must prioritize understanding net worth requirements as a pivotal step in their franchising journey. These financial thresholds not only reflect a candidate’s ability to cover initial investments but also their capacity to navigate unforeseen challenges that may arise. By grasping the concept of net worth—calculated as total assets minus total liabilities—potential franchisees can better assess their financial readiness and make informed decisions about their future.

However, net worth is just one piece of the puzzle. Franchisors often seek candidates who bring additional qualifications such as:

- Relevant experience

- Industry knowledge

- Personal attributes that align with the brand’s values

This holistic approach to evaluating potential franchisees underscores the importance of preparation and self-assessment in enhancing one’s application.

For those facing financial constraints, the franchising landscape is not out of reach. Strategies such as:

- Seeking franchises with lower initial investments

- Exploring flexible financing options

- Partnering with investors

can open doors to opportunities that might seem unattainable. By adopting a proactive mindset and leveraging available resources, aspiring franchisees can navigate their way into successful franchise ownership.

In conclusion, understanding and addressing net worth requirements, alongside other qualifications, equips individuals with the tools needed to thrive in the franchising arena. With determination and the right strategies, anyone can turn their aspirations into reality, embarking on a rewarding career in franchising.