Overview

The article outlines the top seven steps for creating a business plan specifically aimed at first-time business owners, emphasizing the importance of a well-structured strategy in guiding their entrepreneurial journey. By detailing essential elements such as conducting market research, crafting a compelling executive summary, defining the business, and developing a robust financial plan, the article illustrates that these steps not only help articulate a clear vision and set goals but also enhance the chances of attracting investors and securing funding.

Introduction

In the dynamic landscape of entrepreneurship, a well-constructed business plan is not just a formality, but a critical blueprint for success. It serves as a guiding light, illuminating the path for aspiring business owners as they navigate the complexities of launching and sustaining a venture. From attracting investors to securing essential funding, the importance of a robust business plan cannot be overstated.

As the entrepreneurial environment continues to evolve, understanding the key components—from crafting a compelling executive summary to conducting thorough market research—can significantly enhance one’s chances of thriving.

This article delves into the essential elements of an effective business plan, providing insights and practical strategies that empower entrepreneurs to articulate their vision, manage their finances, and ultimately, achieve their business goals.

Understanding the Importance of a Business Plan

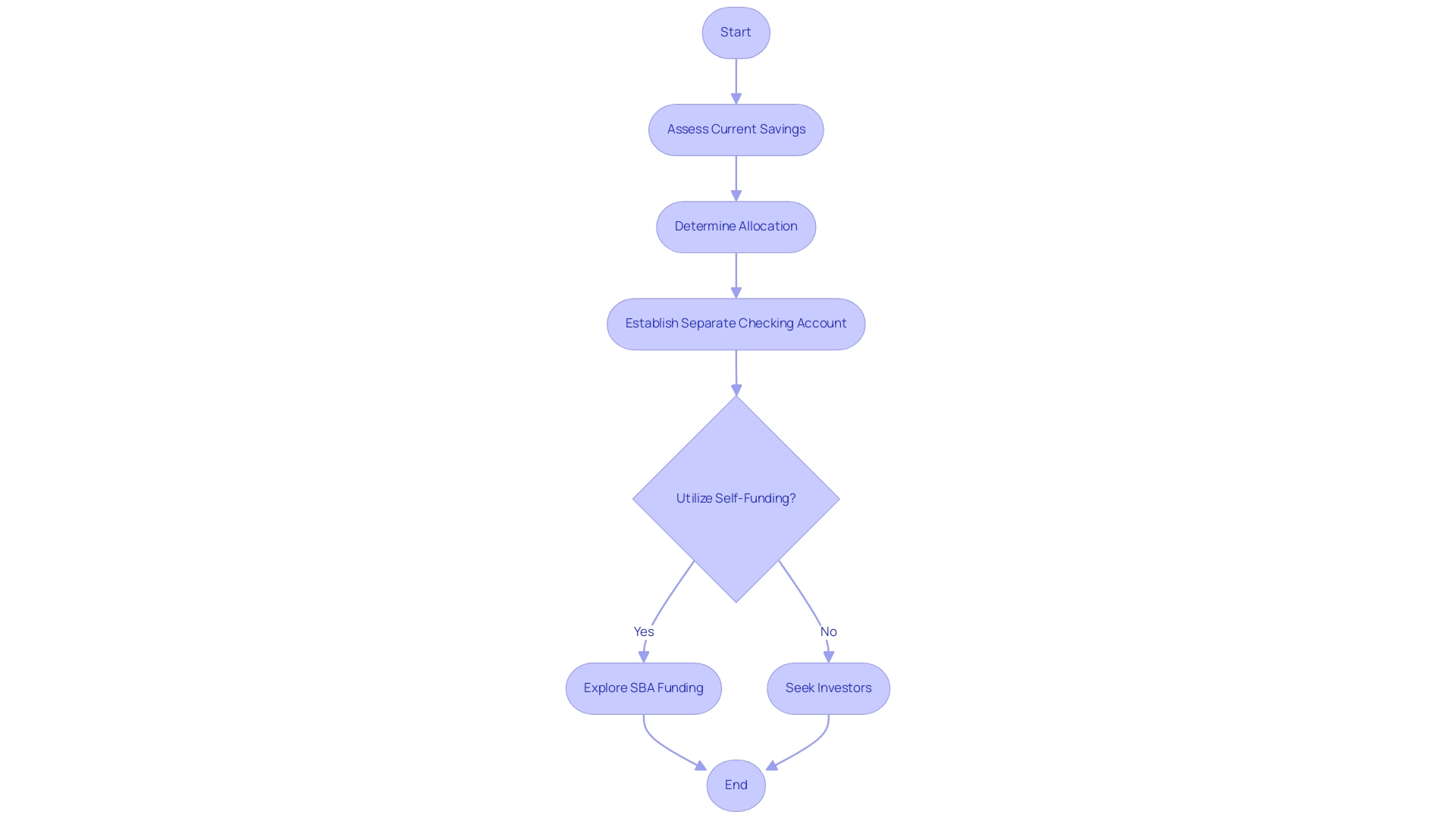

A strategy surpasses the function of a simple document; it acts as the crucial roadmap directing your entrepreneurial journey. This vital tool enables you to articulate your vision, set specific goals, and delineate the necessary steps for achieving them. Especially for first-time entrepreneurs, focusing on the top creating a business plan for first-time business owners is instrumental in attracting investors and securing funding, including self-funding options through checking and savings accounts.

To leverage these accounts effectively, entrepreneurs can start by:

- Assessing their current savings and determining how much they can allocate towards their ventures.

- Establishing a separate checking account to help manage funds more efficiently and track expenses.

Statistics indicate that 23% of small enterprise owners report having $250,000 or more on deposit, emphasizing the financial consequences of having a robust strategy that considers various funding methods.

Moreover, companies with a clear strategy achieve greater success rates, establishing it as a vital factor in today’s competitive environment. As we near 2024, the significance of development strategies continues to increase, with recent trends emphasizing their role in strategic organization and flexibility. Successful entrepreneurs frequently emphasize that a strong strategy not only aids in decision-making but also serves as a benchmark for measuring progress as your enterprise evolves.

As Randa Kriss aptly puts it, ‘Here’s a list of resources,’ which can be invaluable in developing your strategy. Additionally, effective time management is crucial for entrepreneurs to maximize productivity and achieve objectives; prioritizing tasks and delegating where possible are key strategies. By comprehending and executing the essential elements of an efficient strategy, including utilizing self-funding sources such as checking and savings accounts, you greatly improve your odds of succeeding in the entrepreneurial field.

Moreover, exploring funding options available from the U.S. Small Business Administration can provide additional support and resources, further strengthening your economic foundation.

Crafting a Compelling Executive Summary

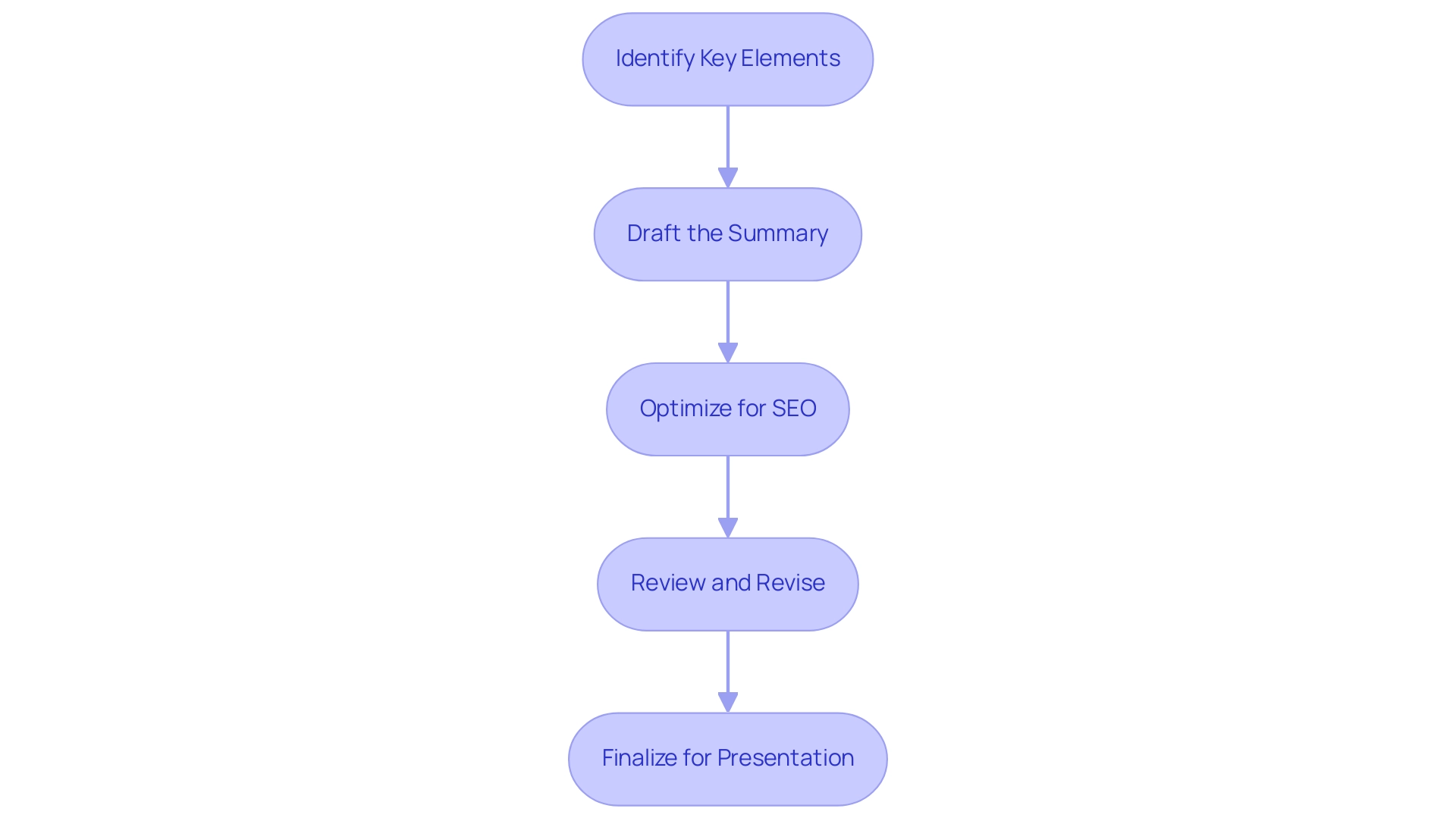

The executive summary serves as the crucial first impression for potential investors and stakeholders, making it essential that it is concise, compelling, and clear. This overview should encapsulate the key elements of your enterprise strategy, such as your concept, market opportunity, financial projections, and funding requirements. Aim for a one-page format that effectively captures the essence of your venture and entices the reader to explore further.

As Alexandra Sheehan aptly states,

The goal is to write an executive summary that draws the reader in and provides just enough context for the document that follows.

In 2024, understanding the statistics surrounding effective executive summaries is paramount; a well-crafted summary can significantly increase your chances of securing funding. It is also crucial to consider SEO techniques, as keyword optimization and user-friendly formatting can enhance the discoverability of your executive summary.

Additionally, it’s important to note that the main difference between an executive summary in project management and a traditional executive summary is that the former should be created at the beginning of your project, ensuring all relevant information is included from the outset. A real-world example is Cotopaxi’s annual impact report, which features an executive summary that is dense yet informative, providing essential insights into the company’s contributions toward social and sustainable goals. Remember, this document is your opportunity to make a lasting impression, so take the time to craft it thoughtfully.

By focusing on clarity and engagement, you not only inform but also inspire confidence in your vision.

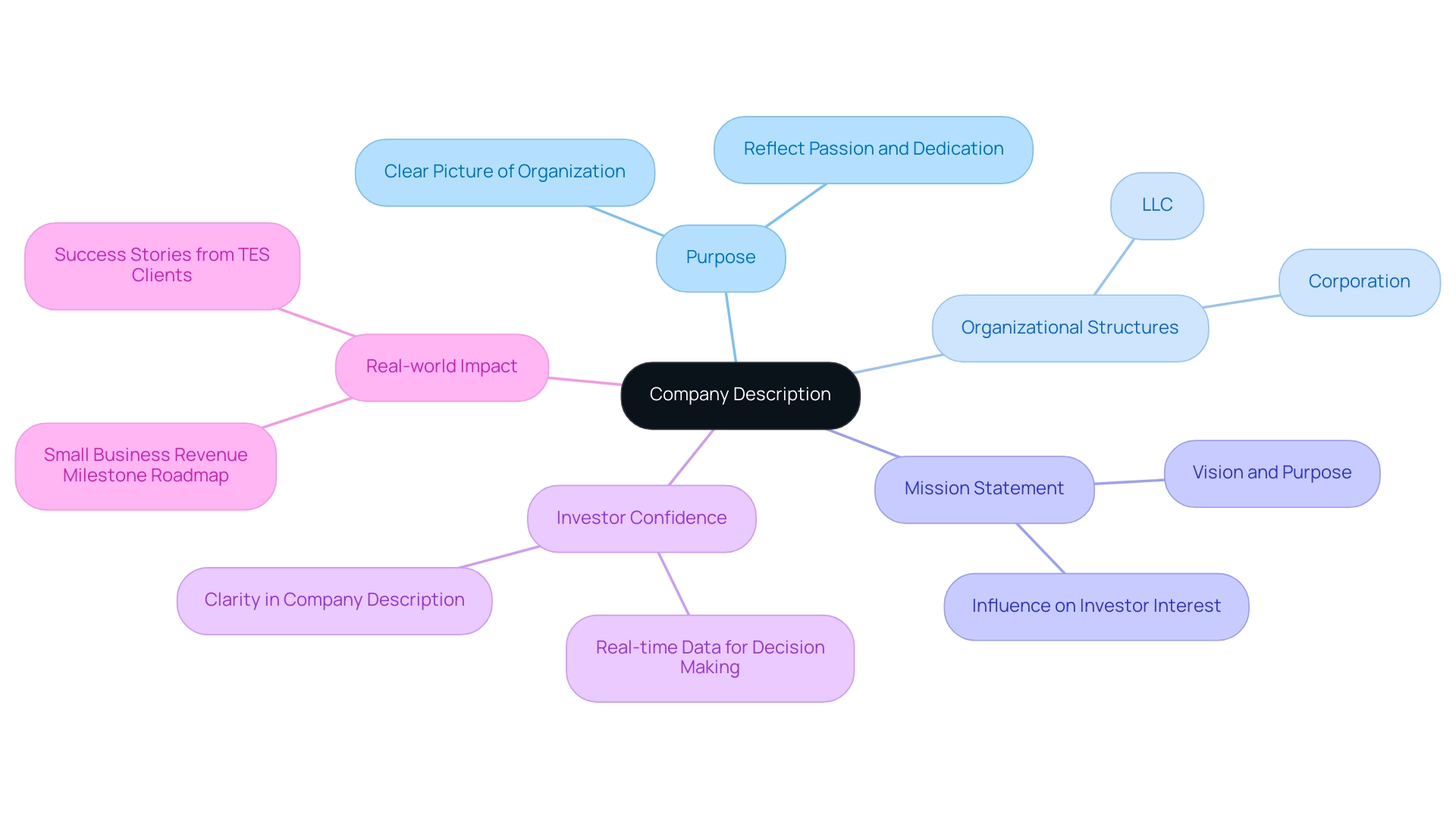

Defining Your Business: Company Description

A compelling company description is top Creating a business plan for first-time business owners, as it serves as the foundation of your plan by offering a clear picture of what your organization does, its mission, and its core values. In 2024, understanding the various types of organizational structures, such as LLCs and corporations, is crucial, especially considering that only 21% of small enterprises are established from scratch. This statistic emphasizes the importance of choosing the right structure to support your objectives.

With TES, North America’s premier organization in career transition coaching and consulting, you have access to expert guidance from coaches trained by TES, empowering you towards financial freedom and career fulfillment. This section should not only present factual information but also reflect your passion and dedication to your venture. By detailing the nature of your products or services and what sets you apart from competitors, you create a narrative that resonates with potential investors.

A well-defined mission statement is pivotal; it communicates your vision and purpose, which can significantly influence investor interest. As Julie Iriondo noted, survey results provide essential, real-time data for effective decision-making—this highlights the need for clarity in your company description, as it can guide not only your strategy but also investor confidence. By following best practices and drawing from successful examples highlighted in the Small Business Revenue Milestone Roadmap, which outlines top Creating a business plan for first-time business owners to achieve $1 million in revenue, you can craft a description that not only informs but also inspires confidence in your entrepreneurial journey.

For example, numerous clients who have employed TES’s coaching services have successfully transformed into profitable entrepreneurs, demonstrating the concrete effect of our training and assistance.

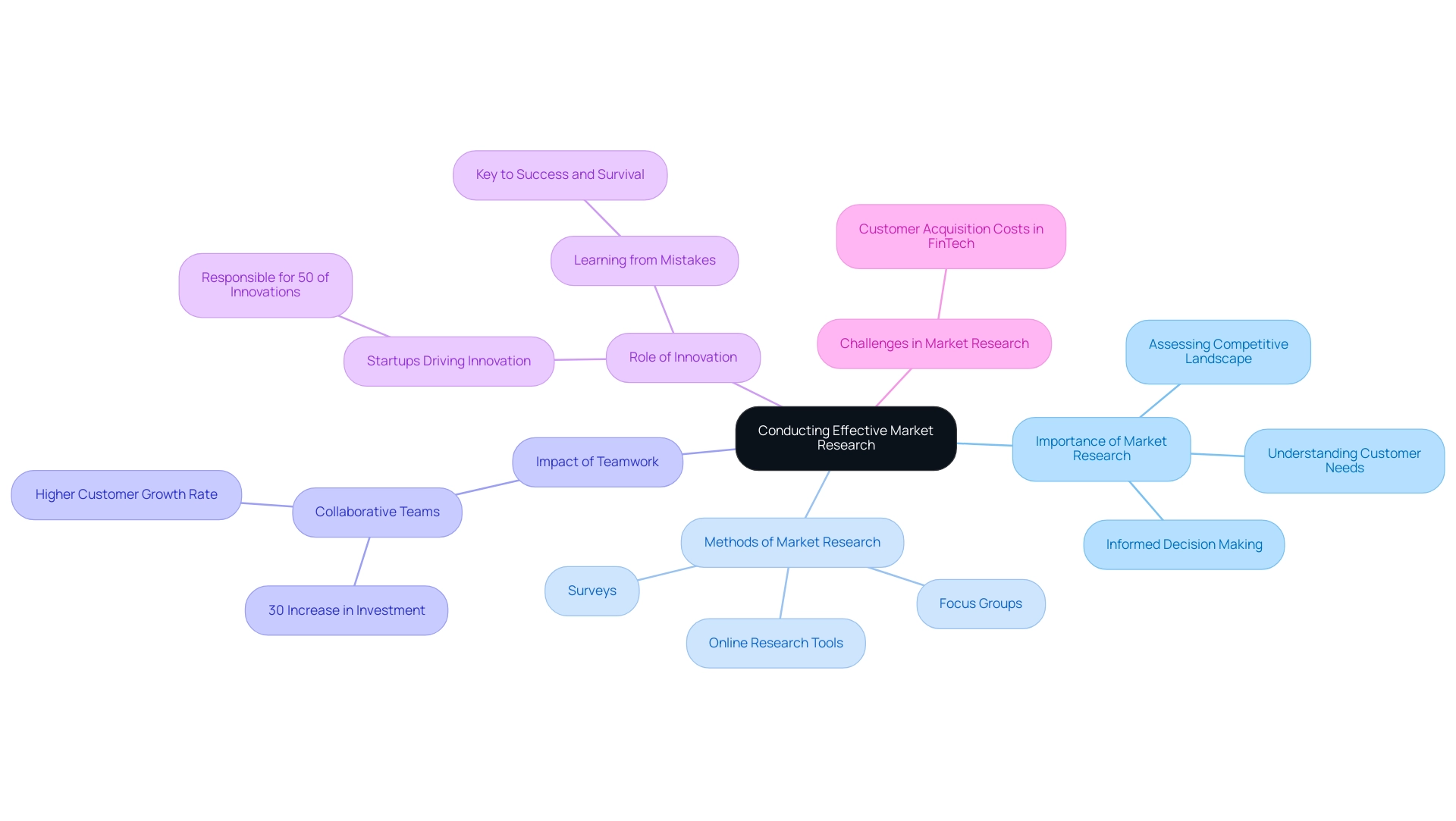

Conducting Effective Market Research

Market research serves as the backbone of any successful enterprise plan, acting as a critical tool for aspiring entrepreneurs. It encompasses the systematic gathering and analysis of data regarding your industry, competitors, and target audience. Understanding your ideal customer profile is essential; delve into their needs, preferences, and behaviors to tailor your offerings effectively.

Furthermore, assessing the competitive landscape helps you carve out your unique selling proposition. Employing a variety of methods—such as surveys, focus groups, and advanced online research tools—can yield valuable insights that will inform your business strategies and validate your ideas. As the landscape evolves, new ventures must be agile and informed in their decision-making.

Significantly, ventures with collaborative teams—especially those with two founders—experience a remarkable 30% increase in investment and customer growth. This highlights the power of teamwork in conducting market research and shaping successful business strategies. Additionally, FinTech companies face significant challenges with customer acquisition costs, making effective market research vital for developing strategies to overcome these hurdles.

The latest statistics indicate that new ventures are responsible for over 50% of all innovations, emphasizing that leveraging effective market research techniques not only helps in understanding market needs but also fosters innovation. As one expert aptly stated, ‘Despite the failure rate of new ventures, learning from your mistakes and the errors of others is the key to success and survival.’ Ultimately, informed decisions lead to superior outcomes, making market research an indispensable component of your entrepreneurial journey.

Developing a Robust Financial Plan

A strong monetary strategy is the backbone of any thriving new venture and is top in creating a business plan for first-time business owners, outlining your expected revenues, expenses, and funding needs. Begin by constructing a detailed budget that encompasses all operational costs, marketing expenditures, and projected sales. Financial projections should span at least three years, incorporating crucial documents such as profit and loss statements, cash flow forecasts, and balance sheets.

These projections not only assist in managing your resources effectively but also act as a compelling demonstration to investors of your thorough understanding of your business’s monetary health. As the financial landscape evolves, with early-stage companies raising a remarkable $201 billion in 2021, it’s essential to consider various funding sources, including:

- Loans

- Grants

- Equity investors

Notably, the average Series A funding in the U.S. increased from $15.5 million in 2020 to $26.3 million in 2022, highlighting the evolving funding opportunities for startups.

Strategically outlining how you intend to secure the necessary capital is vital for top creating a business plan for first-time business owners to successfully launch and scale your venture. Additionally, analysts emphasize the importance of budgeting, highlighting that top creating a business plan for first-time business owners with a well-structured monetary plan can significantly enhance your chances of success in a competitive market. For instance, the advisory sector, where 91.7% of firms employ fewer than 100 people and manage a staggering $114.1 trillion in assets, illustrates how small businesses can thrive with effective management.

Furthermore, the statistic that African-American and Latina female-founded startups raised $3.1 billion in 2020 underscores the growing support for underrepresented entrepreneurs. Remember, as highlighted by Kellogg Insights, older entrepreneurs are statistically more likely to succeed—specifically, a 50-year-old is twice as likely to reach success than a 30-year-old—making it imperative to leverage your experience in crafting a solid financial foundation for your venture.

Conclusion

A well-constructed business plan is undeniably a cornerstone of entrepreneurial success. It not only articulates your vision and goals but also serves as a strategic guide through the complexities of launching and sustaining a business. From understanding the importance of a compelling executive summary to defining a clear company description, each component of the business plan plays a vital role in attracting investors and securing funding. Thorough market research is essential, enabling entrepreneurs to grasp the needs of their audience and the competitive landscape, which in turn informs effective business strategies.

Moreover, developing a robust financial plan is crucial for demonstrating a deep understanding of your business’s financial health. With detailed budgets and projections, entrepreneurs can navigate the financial landscape more effectively, enhancing their appeal to potential investors. As the entrepreneurial environment continues to evolve, the emphasis on a solid business plan becomes increasingly significant, especially for those looking to adapt and thrive in a competitive market.

Ultimately, the insights presented highlight that a well-crafted business plan is not just a document but a powerful tool that can propel entrepreneurs toward their business goals. By investing the time and effort into developing each section thoughtfully, aspiring business owners can significantly improve their chances of achieving long-term success and making a lasting impact in their chosen industries. Now is the time to harness the power of a strategic business plan and set the foundation for a prosperous entrepreneurial journey.