Overview

Top financial planning for new entrepreneurs involves developing a strong business plan, maintaining separate personal and business finances, monitoring cash flow, keeping detailed financial records, and budgeting wisely. The article emphasizes that these practices are essential for navigating challenges and ensuring long-term success, as evidenced by statistics showing that businesses with effective financial management have significantly higher survival rates.

Introduction

In the dynamic landscape of entrepreneurship, the path to financial success is paved with strategic planning and disciplined financial management. For new entrepreneurs, establishing a strong business plan is not merely a checkbox on a to-do list; it is the foundation upon which their ventures will thrive.

This article delves into essential practices that can significantly enhance financial viability, including:

- The importance of separating personal and business finances

- The critical role of cash flow monitoring

With insights backed by statistics and expert opinions, aspiring business owners will discover practical strategies for:

- Maintaining detailed financial records

- Budgeting wisely

- Ultimately navigating the complexities of the entrepreneurial journey

As the business environment continues to evolve, adopting these financial best practices will not only safeguard against common pitfalls but also pave the way for sustainable growth and success.

Establishing a Strong Business Plan for Financial Success

Developing a strong strategy is essential for top financial planning for new entrepreneurs to ensure economic success. Your enterprise strategy should incorporate essential elements such as:

- An executive summary

- Thorough market analysis

- A clear organizational structure

- Detailed product or service offerings

- Effective marketing strategies

- A comprehensive budget

- Top financial planning for new entrepreneurs

In 2024, organizations that prioritize these elements are likely to experience improved success rates.

Significantly, 82% of enterprises that collapsed in 2023 did so due to cash flow issues, highlighting the importance of top financial planning for new entrepreneurs within your strategy. By clearly defining your objectives and the strategies to attain them, you can navigate challenges with greater confidence and implement top financial planning for new entrepreneurs to make informed financial decisions. As Sara Lynch aptly puts it, ‘There is no better way to encourage that entrepreneurial thinking than watching one of the classic films to inspire you.’

This highlights the value of gaining insights into strategic planning through various mediums. Furthermore, utilizing tools and templates can simplify the top financial planning for new entrepreneurs process, ensuring that your strategy is not only comprehensive but also realistic in its approach. Moreover, with the prevalence of unicorns increasing—1,000 active unicorns in the U.S. valued at $1.1 trillion in 2022—a well-organized strategy becomes crucial in navigating the complexities of the entrepreneurial landscape.

Remember, top financial planning for new entrepreneurs is not just a formality; it serves as a roadmap that guides your startup through these challenges.

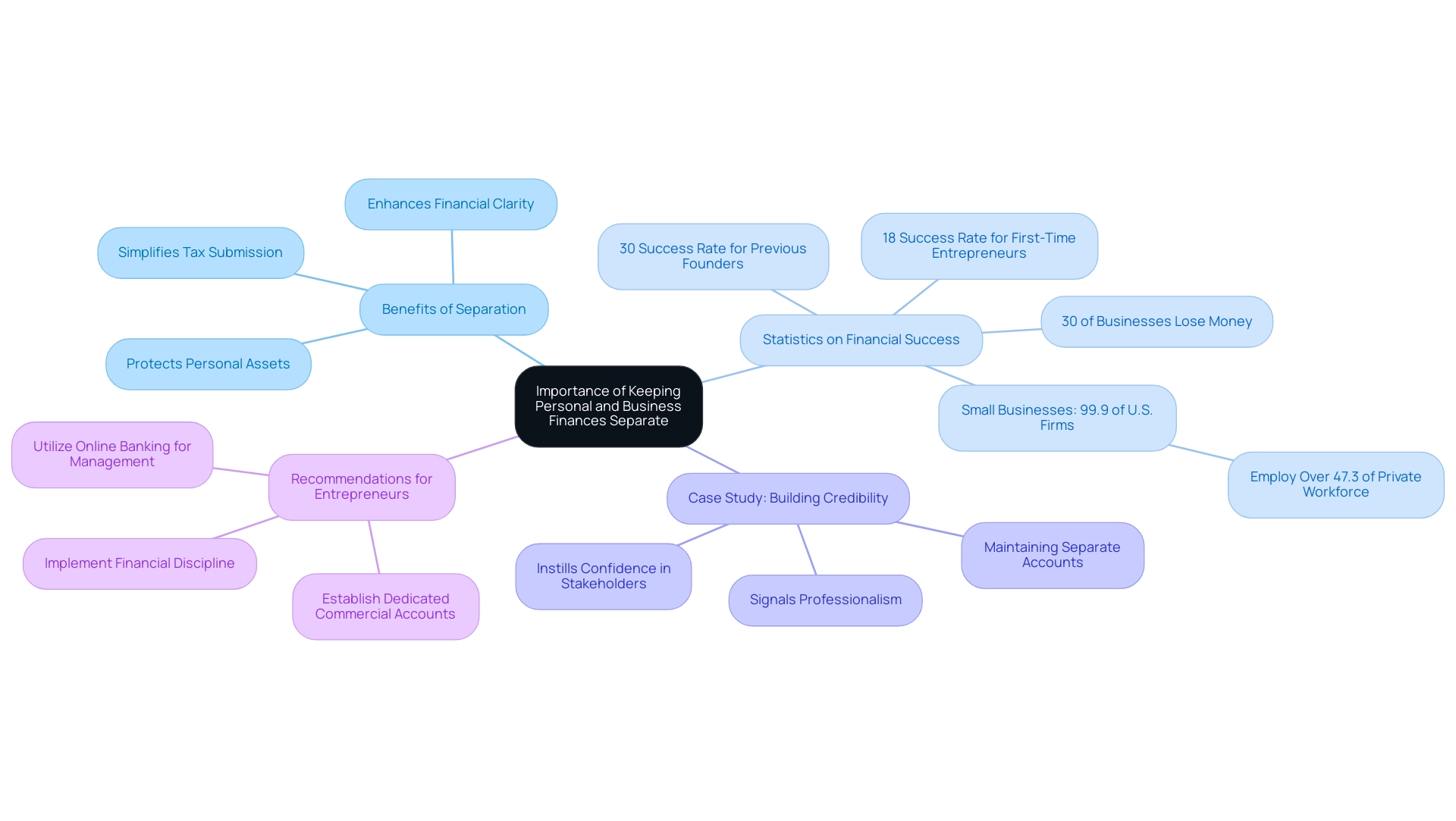

The Importance of Keeping Personal and Business Finances Separate

Maintaining a clear distinction between personal and professional finances is essential for top financial planning for new entrepreneurs. Establishing a dedicated commercial bank account is a fundamental step in this process. As Greynier Fuentes, vice president of sales and digital strategies at Veritran, points out,

Having more than one account at the same bank enables people to easily manage them through online or mobile banking.

This practice simplifies tax submission and offers a clearer perspective on your organization’s economic well-being. Moreover, it acts as a protective barrier for your personal assets against any liabilities, thereby ensuring you have both financial and legal safeguards in place.

Statistics reveal that about 30% of enterprises experience financial losses, underscoring the importance of sound financial management. Furthermore, creators of formerly successful enterprises have merely a 30 percent likelihood of achievement with their next endeavor, while novice founders encounter an even greater challenge with an 18 percent probability. By keeping financial resources separate, entrepreneurs can better navigate these risks.

To thrive, small enterprises, which represent 99.9% of all firms in the U.S. and employ over 47.3% of the private workforce, must implement top financial planning for new entrepreneurs. A case study titled ‘Building Credibility and Professionalism’ exemplifies this principle, showing that maintaining separate bank accounts and credit cards for transactions not only signals professionalism but also instills confidence in clients, suppliers, and lending institutions. This monetary discipline enables precise projections and ultimately boosts the credibility of the venture.

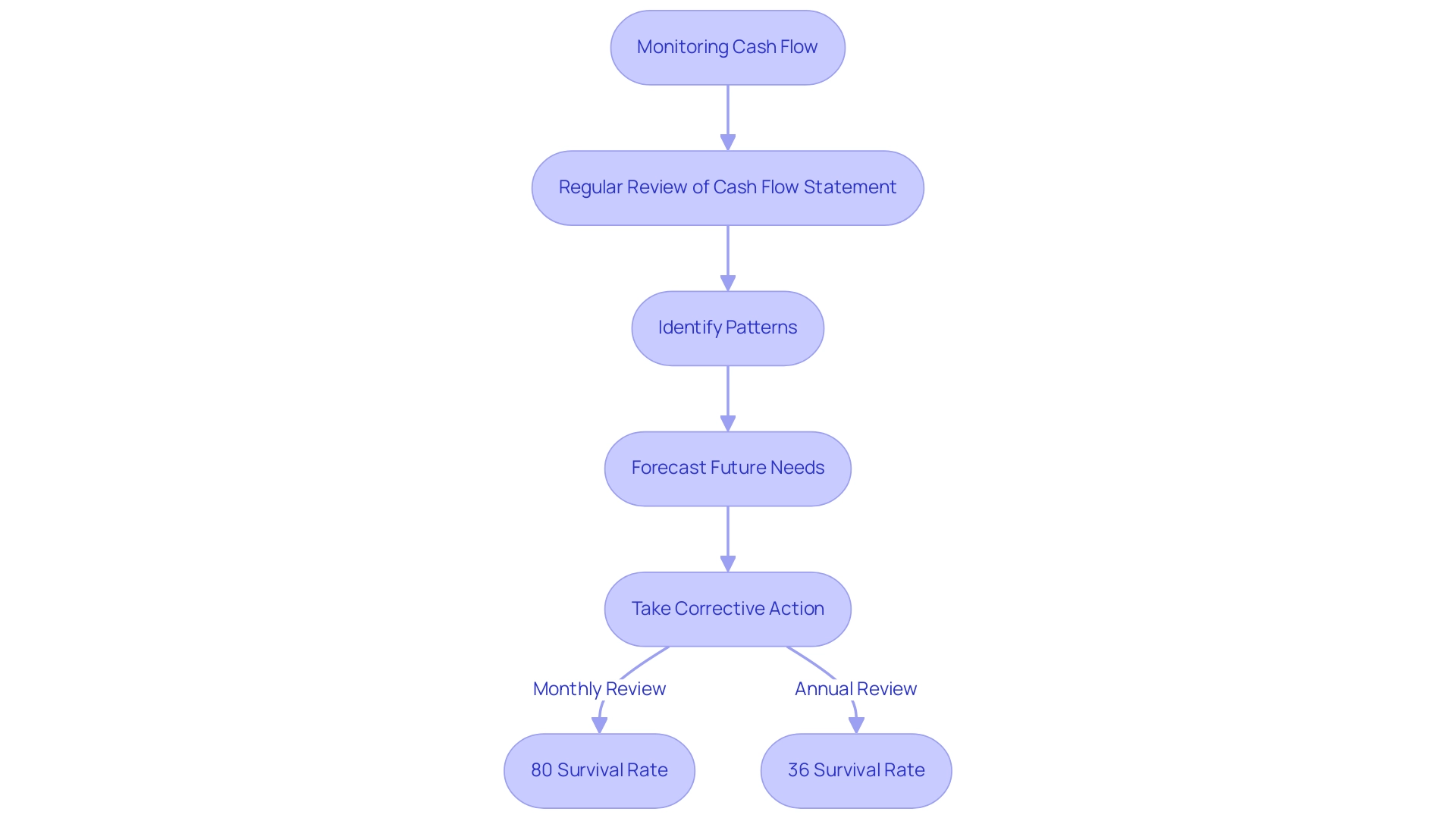

Monitoring Cash Flow: A Key to Business Viability

Monitoring cash flow is essential for maintaining the viability of your business, especially during a career transition. Regularly reviewing your cash flow statement allows you to track the inflow and outflow of cash, helping you identify patterns and forecast future cash needs. Such proactive measures prepare you for lean periods that may arise, ensuring that economic stability accompanies your transition.

Income growth is often a popular short-term objective for those changing careers, as it directly helps to alleviate stress related to obligations like bills and home maintenance. Businesses that diligently review their cash flow on a monthly basis enjoy an impressive 80% survival rate, in stark contrast to the mere 36% survival rate of those that do so annually. This statistic underscores the necessity of implementing a robust cash flow management system.

By staying on top of your finances, you can pinpoint potential shortfalls and take corrective action before they escalate into critical issues. Additionally, with substantial investments such as the $11 billion from AWS in Georgia focused on expanding AI infrastructure, there are ample opportunities for entrepreneurs to utilize technology in improving their management practices. As Jerry Vance wisely states, ‘As unsung heroes of resource management, outsourced controllers can bring significant benefits that go well beyond basic bookkeeping.’

Embracing digital and integrated solutions can transform vulnerabilities into strategic advantages for small and medium-sized businesses (SMBs). Utilizing such expertise and technology enhances your monetary strategy and offers top financial planning for new entrepreneurs, equipping you to navigate the complexities of entrepreneurship. Additionally, the emotional and transformative aspects of managing money are exemplified in the case study titled ‘The Art of Letting Go: A Guide to Selling a Business,’ which highlights the personal value attached to monetary decisions and can resonate deeply with those transitioning in their careers.

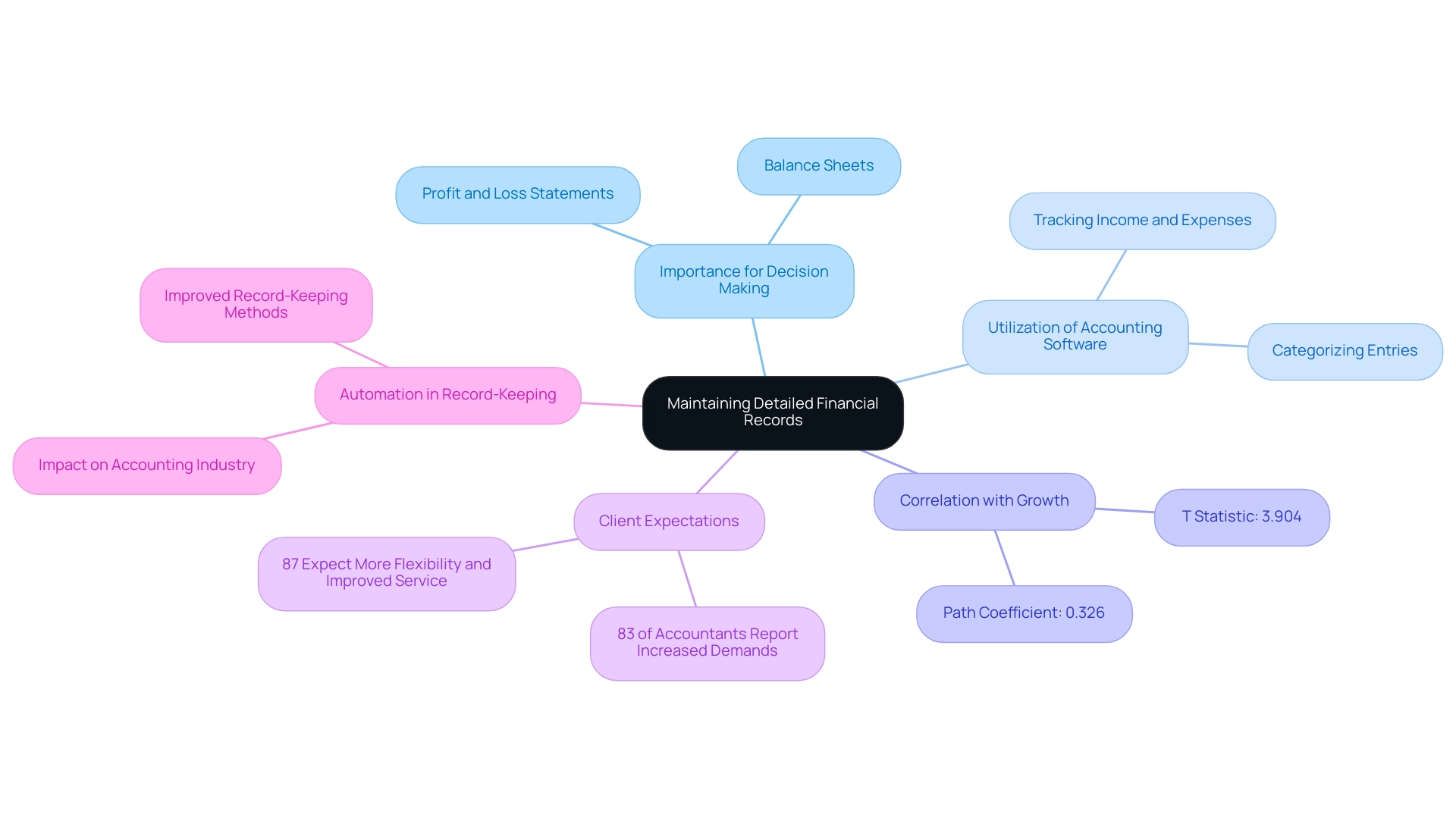

Maintaining Detailed Financial Records for Better Decision Making

Maintaining thorough monetary records is not just a best practice; it is essential for informed decision-making and represents top financial planning for new entrepreneurs. Utilizing accounting software effectively allows you to track all income and expenses meticulously, while categorizing these entries simplifies your analysis. Consistently examining monetary reports—such as profit and loss statements and balance sheets—allows you to precisely evaluate your company’s performance and fiscal health.

A recent study highlighted a positive correlation between structured records management and growth, with a path coefficient of 0.326 and a T statistic of 3.904, underscoring the importance of this practice. Additionally, 83% of accountants indicate that client demands have increased, suggesting a rising expectation for businesses to utilize monetary data for strategic decision-making. As Julie Watson from Application Hosting QuickBooks notes,

87% believe clients expect more flexibility and improved service levels from accountants without an increase in rates.

This sentiment reflects the increasing necessity of detailed record-keeping, as it not only aids in identifying trends but also empowers you to make data-driven decisions and is essential for top financial planning for new entrepreneurs. In a world where over 50% of accounting executives expect that automated systems will change the industry, the significance of maintaining precise records cannot be overstated. For instance, the accounting industry has seen a surge in job creation, with over 1 million jobs generated by the big four accounting firms in 2018, illustrating the growing demand for accountants who can meet these heightened client expectations.

Automation can greatly improve record-keeping methods, making it simpler for organizations to uphold precise and prompt documentation.

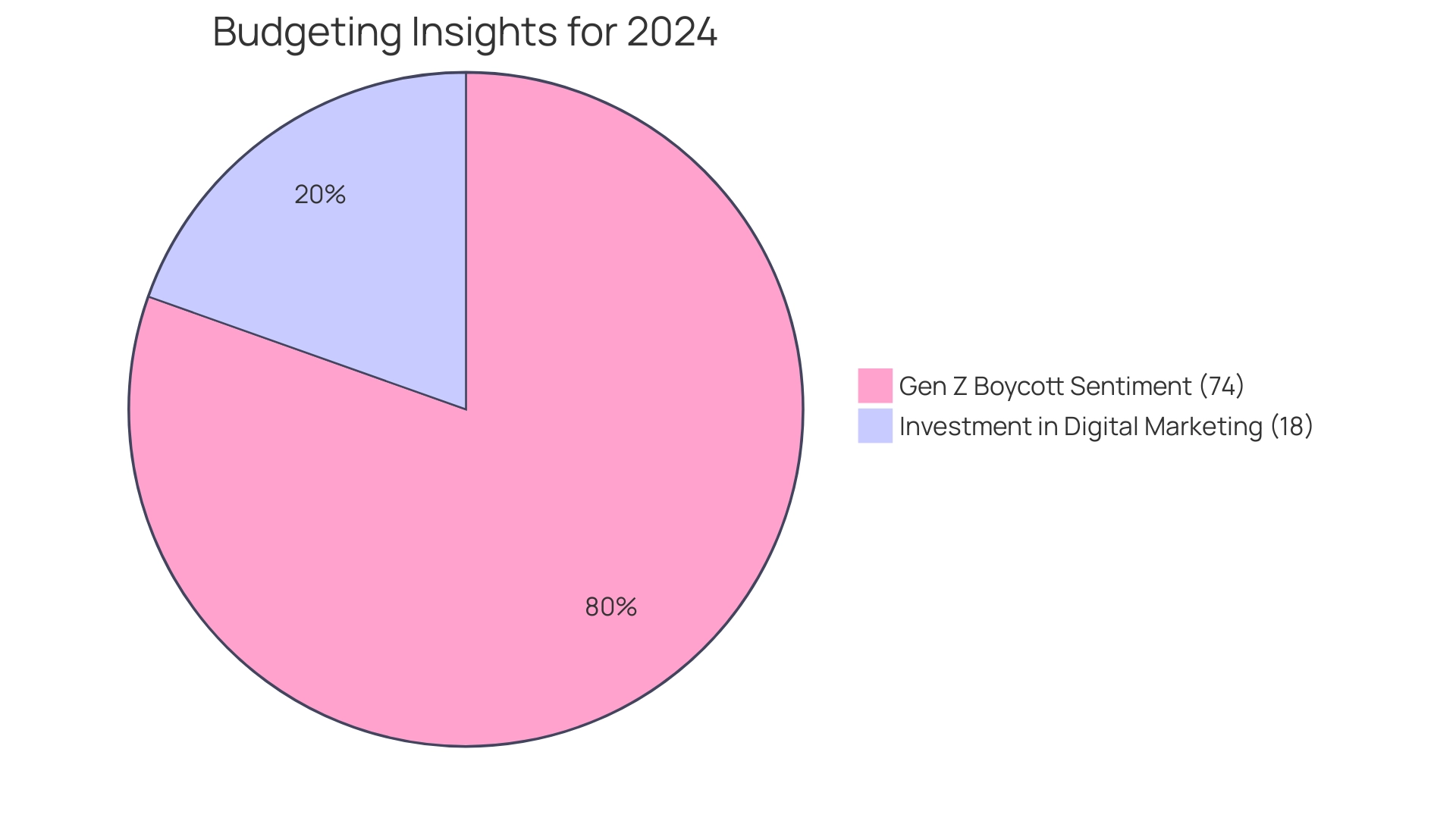

Budgeting Wisely: Strategies for Effective Resource Allocation

Effective budgeting is not just a financial necessity; it’s a cornerstone of top financial planning for new entrepreneurs to ensure successful resource allocation. Start by estimating both your fixed and variable costs to create a budget that accurately reflects your anticipated income and expenses. Regularly comparing your actual spending against your budget can reveal critical areas for adjustment, ensuring that you remain on track.

With 18% of small enterprises planning to invest in digital marketing in 2024, it’s crucial to allocate funds wisely in line with market trends. According to insights from the 2023 Firms in Focus series:

- ‘Firms in Focus is a series of chartbooks presenting Small Credit Survey data across various demographic characteristics of owners, as well as by state and metropolitan statistical area (MSA),’ highlighting the importance of data-driven decisions in enhancing operational efficiency and customer satisfaction.

Furthermore, understanding small enterprise statistics in 2024 can help entrepreneurs stay informed about trends, market demands, and emerging technologies, providing a competitive edge.

By adhering to a well-structured budget that reflects ethical practices—especially considering that 74% of Gen Z consumers would boycott brands that go against their values—you not only optimize resource allocation but also position your business for growth, even in challenging times. Remember, a disciplined approach to budgeting can lead to a competitive edge, helping you meet customer needs and adapt to emerging market demands.

Conclusion

Establishing a strong financial foundation is critical for new entrepreneurs navigating the complexities of business ownership. By developing a comprehensive business plan that includes:

- Detailed market analysis

- Effective marketing strategies

- A robust financial plan

entrepreneurs can significantly improve their chances of success. The staggering statistic that 82% of businesses failed in 2023 due to cash flow issues highlights the necessity of prioritizing financial management from the outset.

Separating personal and business finances is another essential practice that safeguards both personal assets and the financial health of the business. By maintaining distinct bank accounts and credit cards, entrepreneurs not only simplify tax filing but also enhance their credibility with clients and suppliers. With small businesses accounting for a substantial portion of the workforce, effective financial management becomes a key differentiator in a competitive landscape.

Monitoring cash flow is equally vital, as it allows entrepreneurs to anticipate financial needs and avoid potential pitfalls. Regular cash flow reviews lead to informed decision-making and contribute to an impressive survival rate for businesses that prioritize this practice. Furthermore, maintaining detailed financial records and employing effective budgeting strategies empower entrepreneurs to make data-driven decisions, ensuring resources are allocated wisely and strategically.

In conclusion, the journey of entrepreneurship can be fraught with challenges, but by implementing these financial best practices, aspiring business owners can lay the groundwork for sustainable growth and success. Embracing a disciplined approach to financial management not only mitigates risks but also positions businesses to thrive in an ever-evolving marketplace. Now is the time to take these insights and transform them into actionable strategies that will lead to enduring financial viability.

Frequently Asked Questions

Why is developing a strong strategy important for new entrepreneurs?

A strong strategy is essential for top financial planning and economic success. It helps entrepreneurs clearly define their objectives and the strategies to achieve them, enabling them to navigate challenges confidently.

What essential elements should be included in an enterprise strategy?

An effective enterprise strategy should incorporate an executive summary, thorough market analysis, a clear organizational structure, detailed product or service offerings, effective marketing strategies, a comprehensive budget, and top financial planning.

What statistics highlight the importance of financial planning for new entrepreneurs?

In 2023, 82% of enterprises that collapsed did so due to cash flow issues, emphasizing the necessity of top financial planning for new entrepreneurs.

How can entrepreneurs simplify the financial planning process?

Entrepreneurs can utilize tools and templates to streamline their financial planning process, ensuring that their strategy is both comprehensive and realistic.

What is the significance of maintaining a clear distinction between personal and professional finances?

Keeping personal and professional finances separate is crucial for sound financial management. It simplifies tax submissions, provides a clearer view of the organization’s financial health, and protects personal assets against liabilities.

What are the consequences of not implementing proper financial management?

About 30% of enterprises experience financial losses due to poor financial management. Additionally, former successful entrepreneurs have only a 30% chance of success with their next venture, while novice founders face an even lower probability of 18%.

How does maintaining separate bank accounts and credit cards benefit entrepreneurs?

Maintaining separate accounts signals professionalism, instills confidence in clients and suppliers, enables precise financial projections, and ultimately boosts the credibility of the venture.

What percentage of all firms in the U.S. are small enterprises, and why are they significant?

Small enterprises represent 99.9% of all firms in the U.S. and employ over 47.3% of the private workforce, making them crucial for economic stability and growth.