Overview

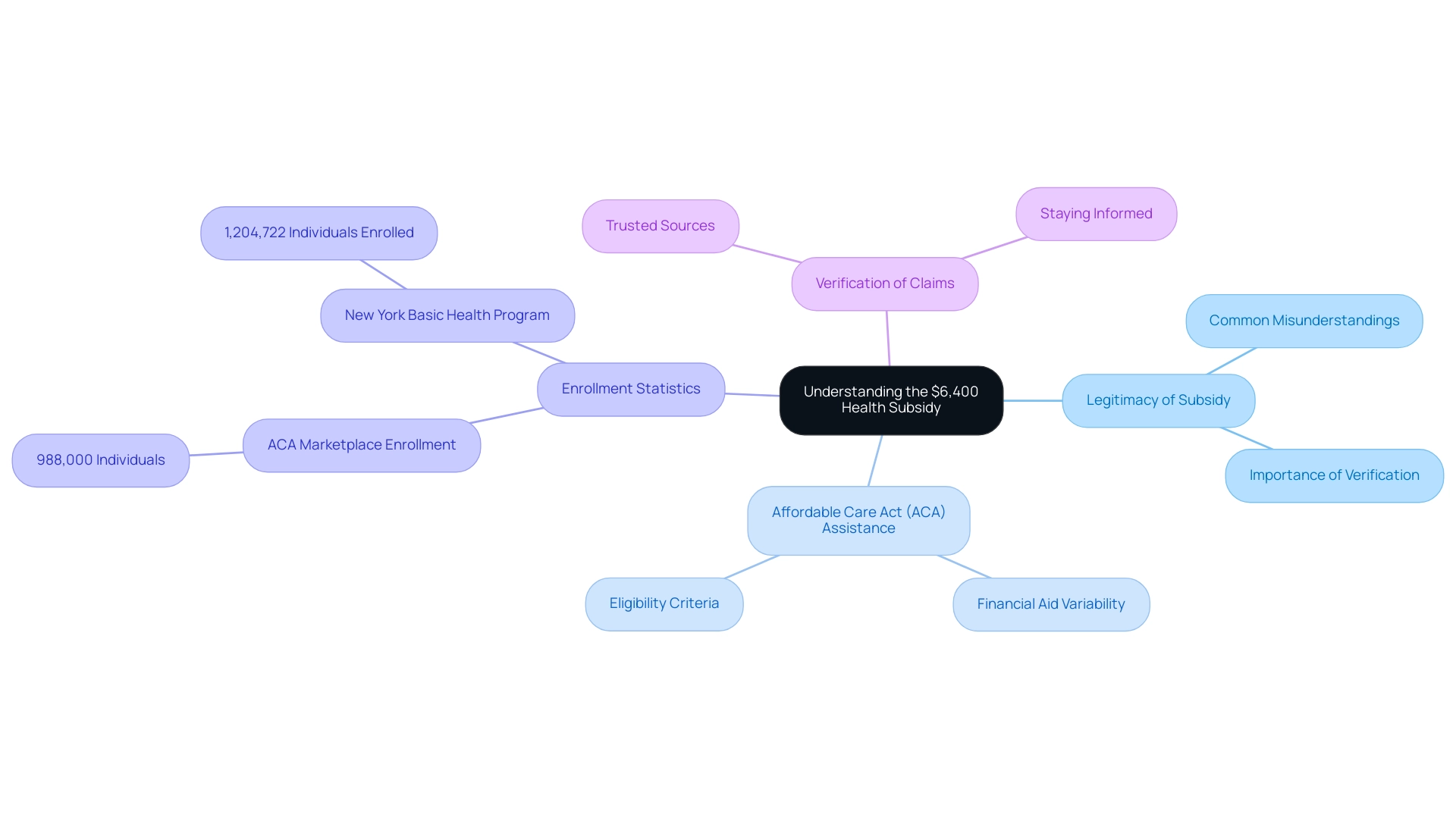

The legitimacy of the $6,400 subsidy may raise concerns for many individuals. It’s essential to understand that this amount is not universally available; instead, it is a form of financial assistance offered through the Affordable Care Act (ACA). This assistance can vary significantly based on personal circumstances, such as income and family size. We understand that navigating these complexities can be overwhelming, especially when seeking support. The article emphasizes the need to verify such claims through official sources, ensuring you are not misled by scams that prey on misinformation regarding health subsidies. Unfortunately, there has been a troubling rise in fraudulent activities targeting those who are vulnerable and in need of financial help. Remember, you are not alone in this journey; seeking accurate information is a vital step toward securing the assistance you deserve.

Introduction

In a landscape rife with misinformation, many individuals find themselves drawn to the notion of a flat $6,400 health subsidy, often believing it to be a straightforward solution to their healthcare costs. However, we understand that the reality is far more complex. The government does not provide a universal subsidy of this amount; rather, financial assistance is intricately tied to the Affordable Care Act (ACA) and varies significantly based on personal circumstances such as income and family size.

As nearly a million new consumers navigate the ACA Marketplace, it’s essential to grasp the true nature of these subsidies. This article delves into the myths surrounding the $6,400 health subsidy, explores the tactics employed by scammers who exploit this confusion, and provides critical insights on how you can protect yourself from falling victim to fraudulent schemes.

You are not alone in this journey; together, we can navigate these challenges and find the support you need.

Understanding the $6,400 Health Subsidy: Fact or Fiction?

The widespread assertion of a flat $6,400 financial assistance raises an important question: is the $6,400 subsidy legitimate? Many individuals may mistakenly believe they qualify for a straightforward monetary payout. However, it is crucial to understand that the legitimacy of the $6,400 subsidy relates to the government’s financial aid offerings. Assistance is actually provided through the Affordable Care Act (ACA), with financial aid differing based on personal circumstances, such as income and family size.

Currently, nearly 988,000 new consumers have opted for affordable medical coverage in the ACA Marketplace. This underscores the significance of these financial aids in supporting individuals. Bob Herman, a Business of Health Care Reporter, highlights the necessity of verifying financial aid claims, as misinformation can lead to confusion among potential beneficiaries. Moreover, the case study of New York’s Basic Health Program, which reported 1,204,722 individuals enrolled as of January 13, 2024, illustrates how state-level initiatives effectively broaden health coverage.

To ensure you have accurate information, it is essential to verify financial assistance claims through trusted sources, including official government websites and reputable news outlets. The ever-changing nature of these financial aids emphasizes the importance of staying informed and cautious while navigating assistance options. Remember, you are not alone in this journey, and seeking clarity can empower you to make informed decisions.

How the $6,400 Health Subsidy Scam Operates

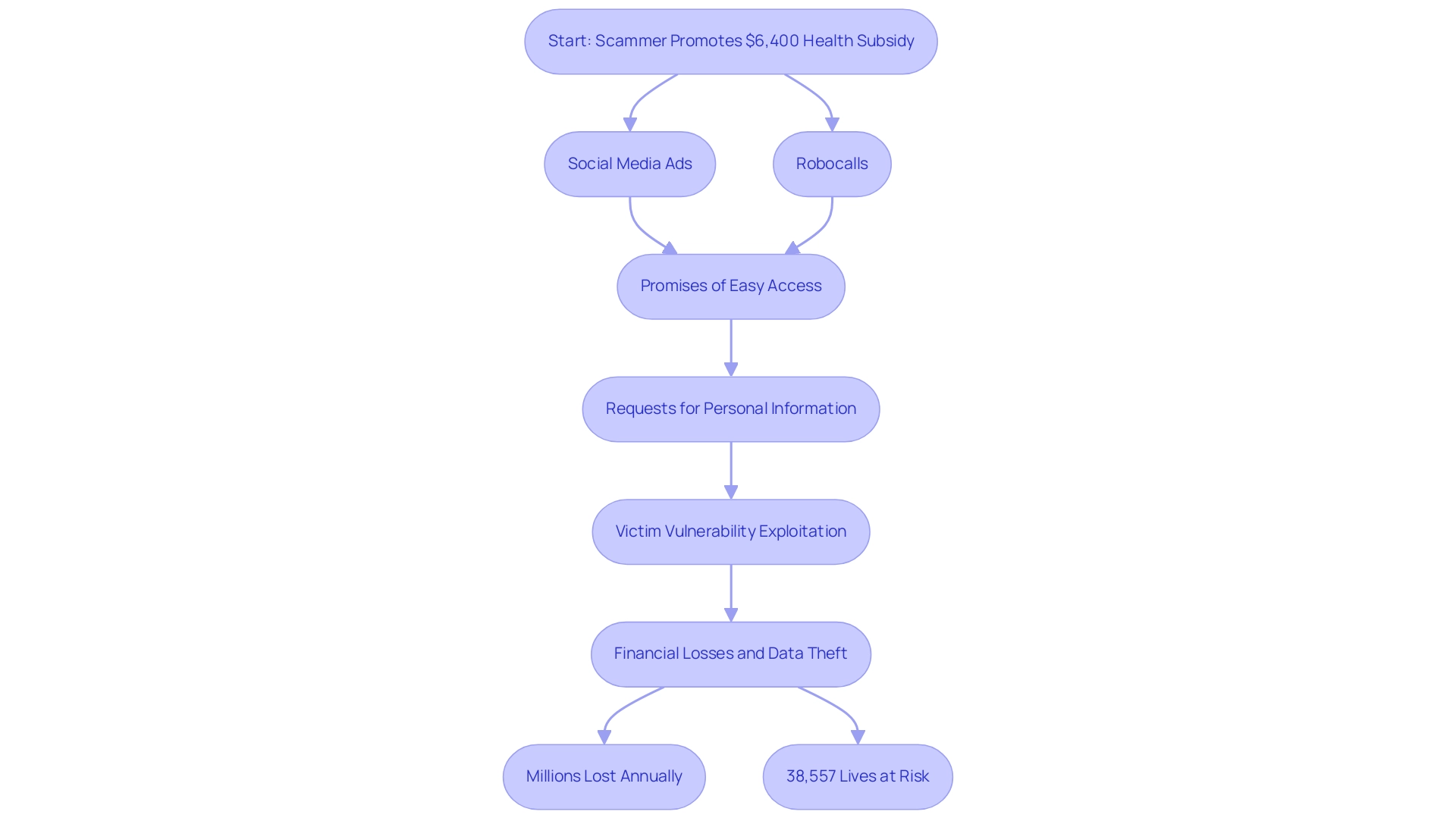

Fraudsters are increasingly leveraging social media advertisements and robocalls to promote the deceptive $6,400 financial assistance, raising concerns about the legitimacy of this subsidy. They attract individuals with promises of easy access to resources, but these misleading messages often request sensitive personal information, such as Social Security numbers and banking details, under the guise of managing the assistance. Such tactics exploit the vulnerabilities of those seeking financial help in healthcare, and we understand how distressing this can be.

Recent reports reveal a troubling surge in scams related to health subsidies, with estimates suggesting that millions of dollars are lost annually due to this type of fraud. Cybersecurity experts warn that scammers often employ sophisticated methods to access personal data, making it crucial for individuals to remain vigilant. If you ever reconsider receiving promotional information from us, you can easily opt-out by sending an email to Unsubscribe@FranchiseSource.com. Please allow up to 72 hours from receipt of your email for us to remove you from our system.

Alarmingly, the potential elimination of the ACA could lead to the loss of 38,557 lives and 980,103 life-years each year, underscoring the urgent need for healthcare reform and the challenges faced by the uninsured population. Additionally, if hospital fees were reimbursed at current Medicare rates, a reduction of 5.54% could occur, providing a financial context that highlights the importance of legitimate health subsidies.

By understanding these tactics and the broader implications of fraudulent activities, you can better recognize the signs of such schemes. This knowledge empowers you to avoid becoming a victim of these deceitful practices, especially when questioning the legitimacy of the $6,400 subsidy. Examining a single-payer healthcare system shows that significant savings across various healthcare sectors could meet the financial needs of currently uninsured and underinsured groups. This further emphasizes the importance of protection against fraud in this critical area. Remember, you are not alone in facing these challenges, and there are resources available to help you navigate this complex landscape.

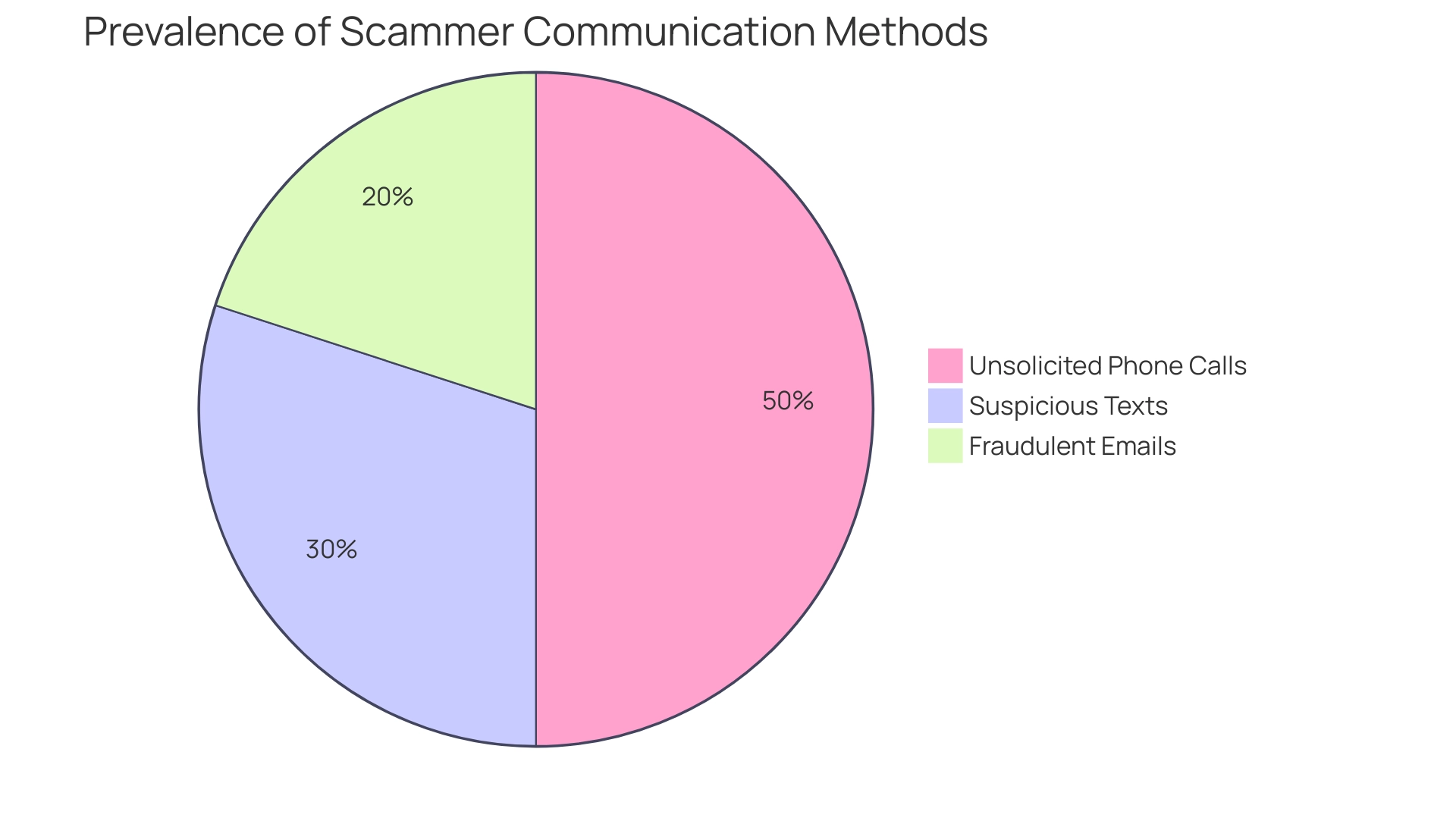

Recognizing Initial Contact: How Scammers Reach Out

Scammers often use unsolicited phone calls, texts, or emails, pretending to be legitimate communications from government agencies. It’s alarming to note that 49.85% of calls received from the same state are flagged as spam, which highlights the prevalence of these fraudulent activities. An estimated 43.7 to 45.5 million people in the UK have received suspicious calls or texts, illustrating just how widespread these deceptive practices are.

These impostors frequently employ official-sounding language and may even spoof caller IDs to enhance their credibility. As Josh Hodges, Chief Customer Officer at NCOA, emphasizes,

That’s why it’s so crucial to keep yourself informed about the latest schemes aimed at older adults.

Additionally, since January 2017, there has been an increase in W-2 phishing campaigns, underscoring the ongoing threat of government agency impersonation scams.

If you receive unexpected communication, we encourage you to take a moment to verify if the $6,400 subsidy is a legitimate source before proceeding. Remember, legitimate agencies will never ask for sensitive information through unsecured channels. Understanding the actions taken by U.S. adults after encountering financial cybercrime can also inform your responses, reinforcing the importance of caution. You are not alone in facing these challenges; staying informed is a powerful step toward protecting yourself.

Scam Tactics: What Information Do Scammers Seek?

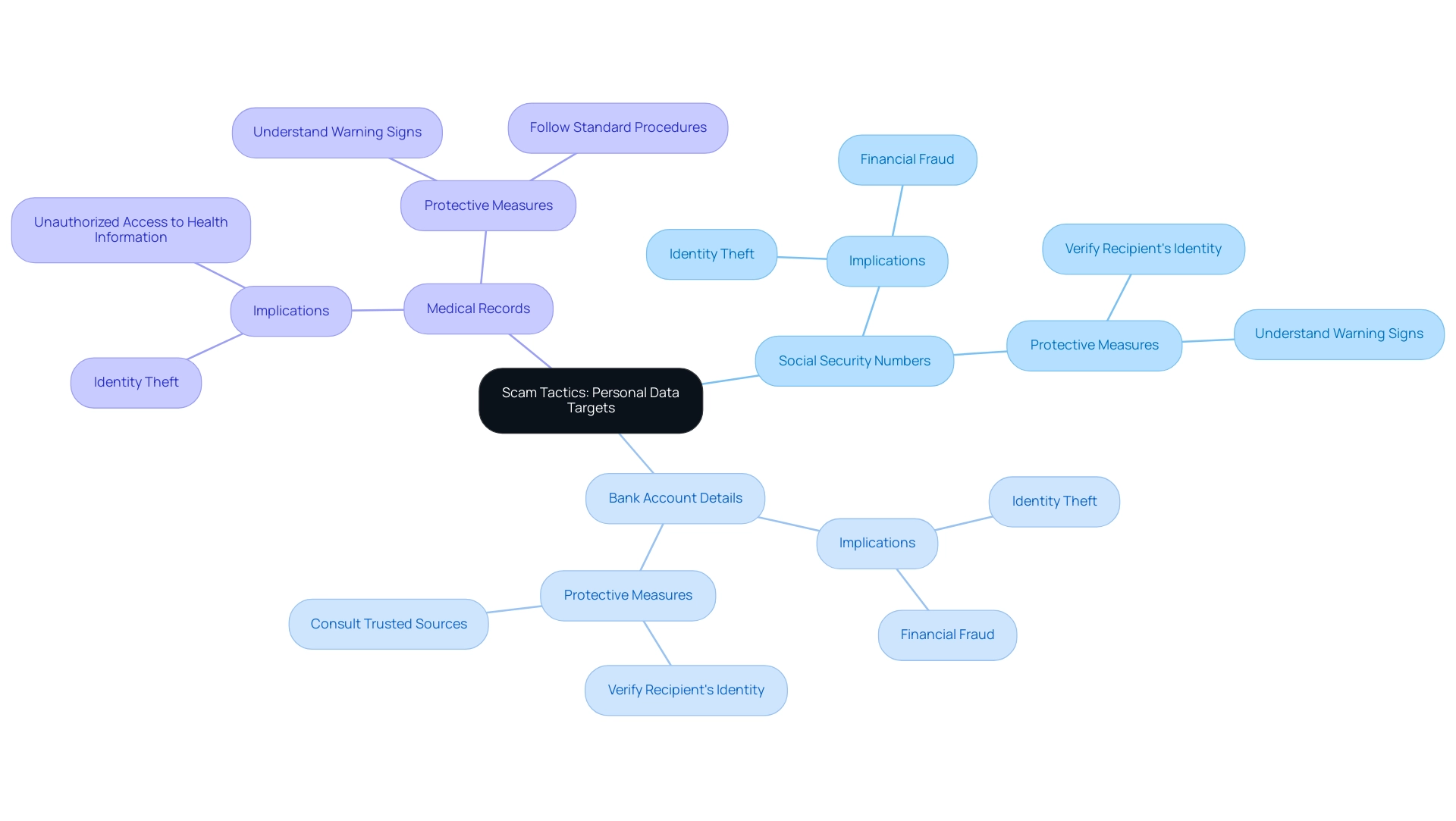

Fraudsters are increasingly focusing on personal data, including Social Security numbers, bank account details, and sensitive medical records. This alarming trend can lead to identity theft or financial fraud, which has become all too common. Recent reports indicate that identity theft associated with health data is a growing concern, with the Office for Civil Rights resolving 126 cases of HIPAA violations for over $133 million as of November 2022.

State attorneys general can impose penalties ranging from $100 to a maximum of $25,000 per violation category, per year. This highlights the serious consequences of such violations. To protect yourself, it’s vital to avoid sharing sensitive details unless you can confidently verify the recipient’s identity and legitimacy. If you need to review or update your personal details, please follow the standard procedure outlined by the service provider under the ‘Contacting Us’ section, which may include verifying your identity before any changes are processed.

As noted by an identity theft expert, ‘The best way to protect your medical identity is to understand the warning signs of theft: strange medical bills, Explanations of Benefits, and diagnoses you don’t recall receiving.’ Additionally, the FTC Health Breach Notification Rule mandates that vendors inform consumers of breaches involving unsecured data. This underscores the importance of vigilance in protecting personal data. Always prioritize caution and consult trusted sources if you find yourself uncertain about a request for personal details.

Remember, failing to safeguard your personal data can lead to severe penalties, so it’s essential to follow the correct procedures diligently. You are not alone in this; we understand the challenges you face, and taking proactive steps can make a significant difference in your safety.

Protecting Yourself: Tips to Avoid the $6,400 Scam

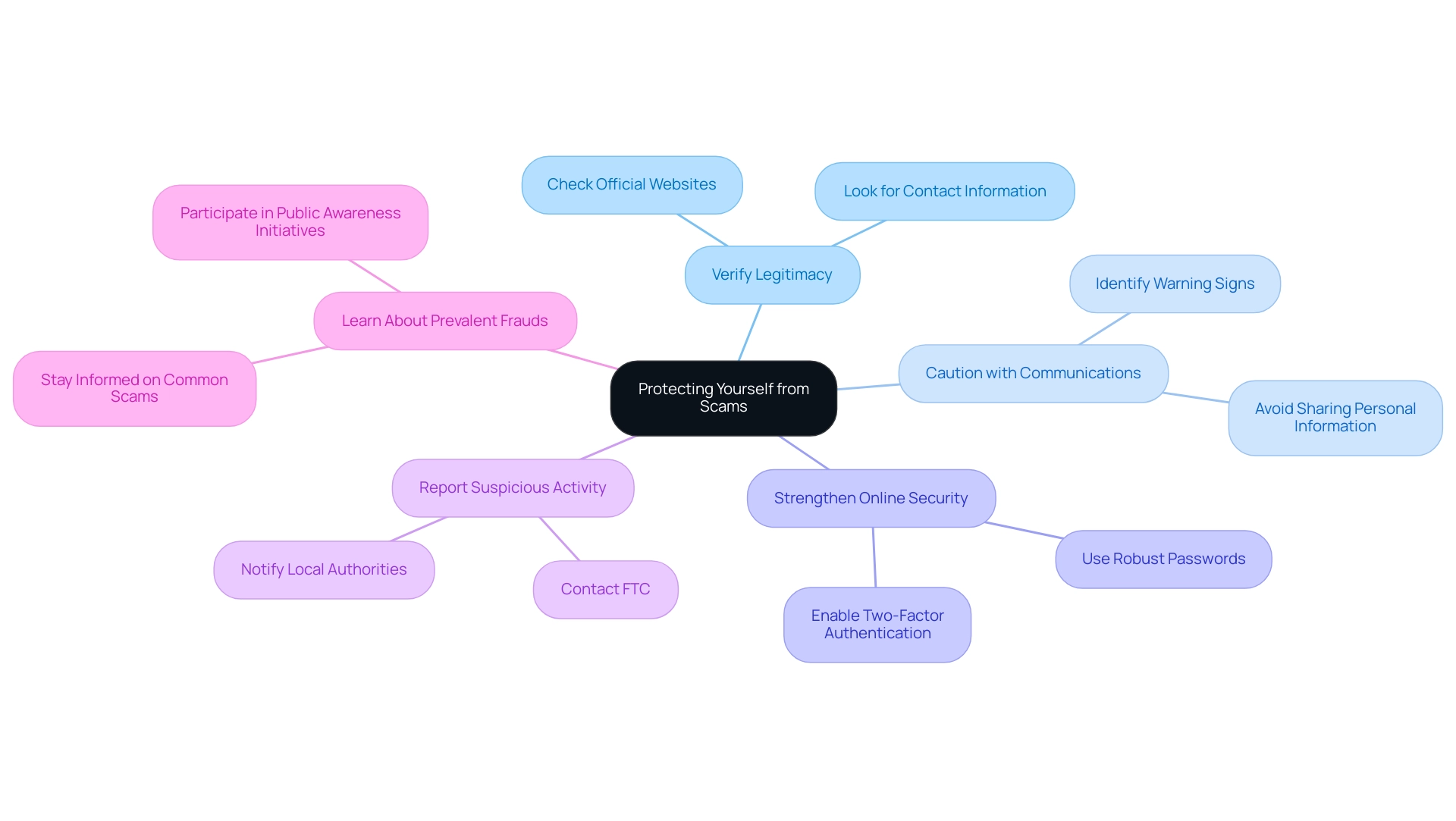

To protect yourself against the rising danger of fraudulent schemes, including those associated with health subsidies, we understand how concerning this can be. Here are some essential tips to help you navigate this challenging landscape:

- Always verify the legitimacy of any subsidy claims through official government websites. This step is crucial, especially given the alarming rise in fraudulent claims, with 95 datasets highlighting the scale of the issue.

- Exercise caution with unsolicited communications that request personal information; these are often warning signs of fraudulent activities. Remember, you are not alone in feeling uncertain about these situations.

- Strengthen your online security by using robust passwords and enabling two-factor authentication. This proven method can significantly help in preventing unauthorized access to your information.

- If you notice any suspicious activity, don’t hesitate to report it to the Federal Trade Commission (FTC) or your local authorities. The FTC has noted that nearly 1 in 5 individuals reported financial losses due to deceptive schemes, which accounted for 15% of all fraud reported. This underscores the importance of staying vigilant and aware.

- Finally, take the time to learn about prevalent frauds to better identify warning signs. This proactive measure is supported by effective public awareness initiatives that have successfully informed consumers about the methods employed by con artists. By applying these strategies, you can significantly lower your risk of becoming a target for fraudulent activities and safeguard your personal information. Together, we can navigate these challenges and protect what matters most.

What to Do If You’ve Been Scammed: Recovery Steps

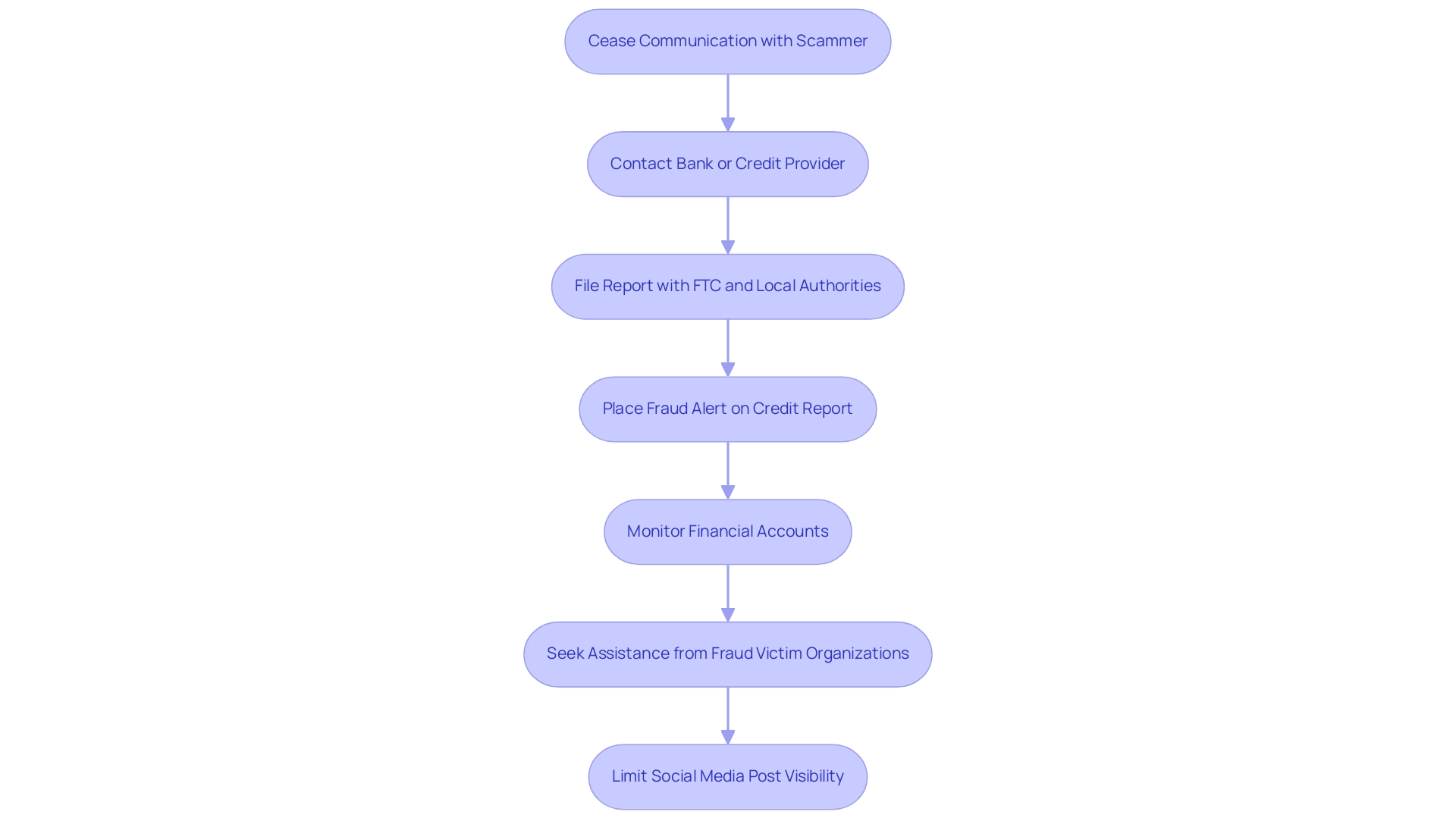

If you suspect that you have fallen victim to the fraud regarding whether the $6,400 subsidy is legitimate, it’s crucial to act swiftly. We understand how distressing this situation can be, and following these essential steps can help protect you and begin the recovery process:

- Cease all communication with the scammer immediately. This action is vital to prevent further manipulation and protect your well-being.

- Contact your bank or credit card provider right away. Reporting any unauthorized transactions is a critical step. Preventive measures are essential; in 2019 alone, banks successfully stopped £268.8 million in attempted remote banking fraud, highlighting the importance of prompt reporting.

- File a report with the Federal Trade Commission (FTC) and your local authorities. This action not only documents the crime but may also aid in larger investigations. Remember, whistleblowers have been crucial in DOJ recoveries, contributing to 76% of the total amount recovered, particularly in healthcare fraud cases. Reporting scams is vital.

- Consider placing a fraud alert on your credit report. This alert warns creditors of potential identity theft, allowing you to take further protective measures.

- Monitor your financial accounts closely for any unusual activity. Regular oversight is essential. As Polonius wisely stated,

Technology often is only as good as the expert resources and regular monitoring dedicated to it.

This reinforces the need for skilled personnel in managing fraud prevention efforts, as highlighted in the case study on governance and expertise in fraud management.

- Seek assistance from organizations that help fraud victims. These resources can provide valuable guidance on recovery steps and emotional support throughout the process.

- Additionally, to avoid future scams, limit post visibility on social media. Verify messages from friends, and research companies before making purchases.

Taking these steps can significantly improve your chances of mitigating losses and recovering from the impact of the scam. You are not alone in this journey, and there are resources available to support you.

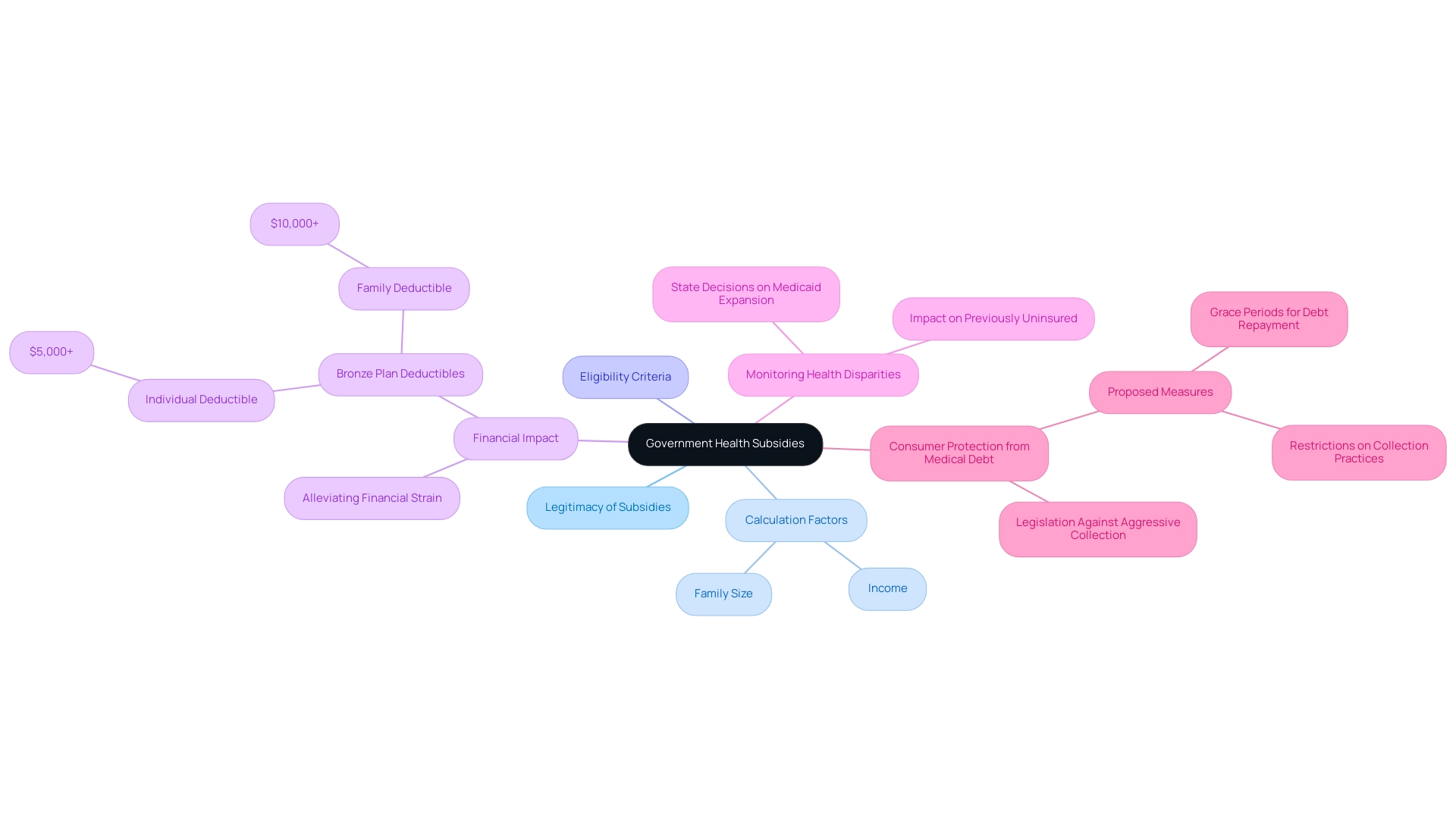

The Truth About Government Health Subsidies: What You Need to Know

Government health financial assistance, an essential component of the Affordable Care Act (ACA), is designed to support eligible individuals in managing health insurance premiums. This leads us to an important question: is the $6,400 subsidy legitimate? These financial aids are carefully calculated based on factors such as income and family size, and they have the potential to significantly reduce monthly premiums for many. For example, deductibles for Bronze plans often exceed $5,000 for an individual and $10,000 for a family, highlighting the financial strain that this assistance can help alleviate.

It is crucial to understand the specific eligibility criteria and the application process to access these benefits legitimately. Staying informed through official resources is vital to ensure the accuracy of information regarding financial assistance. As Andrea Sorensen emphasizes, ‘Monitoring disparities in well-being under the ACA is crucial, as extending coverage may enhance status among previously uninsured individuals.’

Initial evidence indicates a positive trend in expanding ACA coverage, and ongoing observation of health disparities remains essential. These disparities can greatly influence the effectiveness and reach of financial assistance in improving health outcomes for those who were previously uninsured. Furthermore, many states have enacted legislation to protect consumers from aggressive medical debt collection practices, further underscoring the importance of these subsidies in easing financial burdens. Remember, you are not alone in navigating these challenges, and support is available to help you through this process.

Conclusion

The widespread belief in a flat $6,400 health subsidy can be a source of confusion and potential exploitation. It’s important to understand that government health subsidies are not universal; they are intricately linked to the Affordable Care Act and depend on individual circumstances such as income and family size. This understanding is crucial, especially as nearly a million new consumers seek affordable health coverage. Verifying any claims regarding subsidies through trusted sources is essential to ensure you are making informed decisions.

Unfortunately, scammers are taking advantage of this confusion with deceptive tactics, ranging from unsolicited communications to requests for sensitive personal information. The rise of these scams highlights the importance of staying vigilant and educated about recognizing fraudulent schemes. We want you to feel secure, so it’s vital to remain cautious and informed. Use reliable resources to differentiate between legitimate assistance and scams.

To protect yourself against these threats, please:

- Verify subsidy claims

- Avoid sharing personal information through unsecured channels

- Report any suspicious activity to authorities

If you find yourself deceived, taking immediate action is vital to mitigate potential damage. By taking proactive steps and staying informed, you can safeguard your personal information and navigate the complexities of health subsidies effectively. Ultimately, understanding the reality of government health subsidies empowers you to seek legitimate assistance while avoiding the pitfalls of scams in an increasingly complex healthcare landscape. Remember, you are not alone in this journey, and there are resources available to help you every step of the way.