Overview

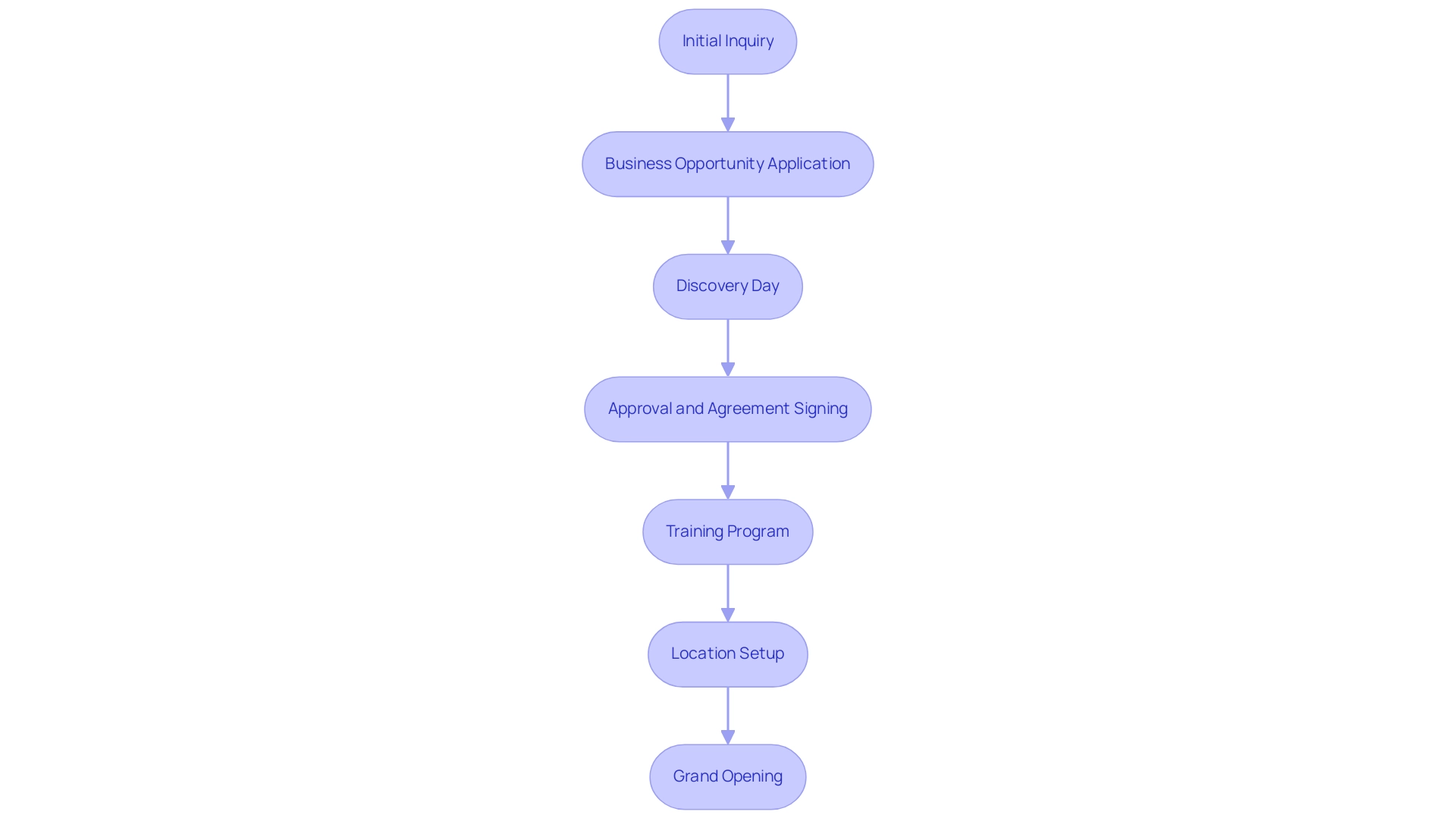

Opening a Fat Tuesday franchise can be an exciting yet daunting journey. Many aspiring entrepreneurs face challenges that can feel overwhelming at times. You are not alone in this; we understand the emotional weight that comes with such a significant decision. It’s important to follow a structured step-by-step process that includes:

- Initial inquiries

- Application

- Attending Discovery Day

- Signing agreements

- Training

- Securing a location

- Planning a grand opening

Understanding the financial landscape is crucial. Initial fees can range from $20,000 to over $1 million, which can be intimidating. However, by leveraging available resources such as coaching and funding options, you can navigate the complexities of franchise ownership successfully. Remember, there are supportive tools and people ready to help you every step of the way.

As you embark on this journey, reflect on what it means for you to take control of your career. Embrace the possibilities that lie ahead, and know that with the right guidance and support, your aspirations can become a reality. Taking action now is the first step toward your dream of career ownership.

Introduction

In the bustling world of entrepreneurship, franchising presents a unique opportunity for individuals yearning to own a business while benefiting from an established brand. Fat Tuesday, celebrated for its vibrant atmosphere and signature frozen cocktails, stands as a beacon for potential franchisees eager to embrace a flourishing market.

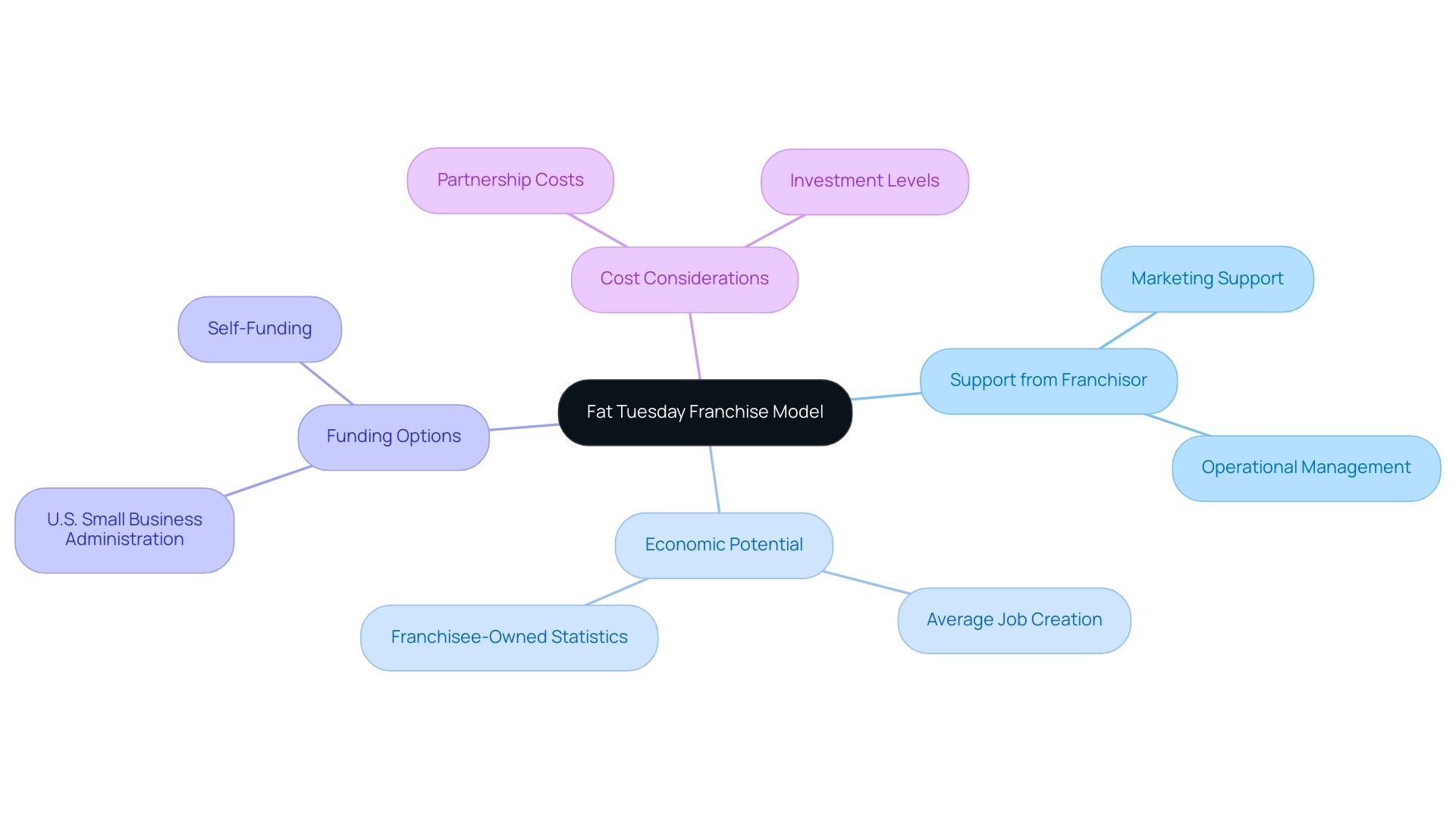

Understanding the franchise model is essential; it fosters a symbiotic relationship between franchisor and franchisee, where support, operational guidelines, and brand standards are instrumental. This journey not only creates jobs but also drives economic growth—franchising is more than a business venture; it’s a chance to embark on a fulfilling career path.

For those contemplating joining the Fat Tuesday family, exploring the steps, financial considerations, and available resources can illuminate the way toward successful franchise ownership. Remember, you are not alone in this journey; we understand the challenges and are here to guide you.

Understanding the Franchise Model: An Overview of Fat Tuesday

Fat Tuesday is not just a vibrant establishment; it’s a place where lively ambiance meets iconic frozen cocktails, making it an inviting option for those dreaming of business ownership. If you’re considering how to open a Fat Tuesday franchise, you’re not alone. Many aspiring entrepreneurs share this journey, and understanding the complexities of the business model can feel daunting. This model offers a strong connection between the franchisor and franchisees, providing essential support in areas like marketing and operational management. You can enjoy the benefits of a well-known brand while also having the freedom to make independent business decisions.

Imagine being part of a community that generates an average of 2.3 times more jobs than independently operated companies of similar size. This statistic highlights the incredible economic potential of franchising. However, navigating the financial aspects of starting a business is crucial. Funding options from the U.S. Small Business Administration can provide vital assistance, alongside self-funding through personal checking and savings accounts.

Consider the costs involved; for instance, a partnership with a Marriott Hotel can exceed 118 million dollars. This underscores the importance of understanding investment levels across different partnership models. Thankfully, resources like Find Your Career 2.0 offer invaluable Career Ownership Coaching™, equipping you with the knowledge and strategies to navigate the complexities of business ownership. Remember, you are not alone on this journey; support is available to help you realize your dream of opening a Fat Tuesday franchise.

Step-by-Step Process to Open Your Fat Tuesday Franchise

-

Initial Inquiry: Begin your journey by reaching out to Fat Tuesday’s business development team to express your interest. This crucial first step allows you to gather essential information about the business opportunity and what it entails. Remember, you are not alone in this process; 79% of people believe user-generated content significantly influences their purchasing decisions. It’s important to consider customer engagement strategies right from the start.

-

Business Opportunity Application: Next, complete the business opportunity application form. This step requires you to provide personal and financial details, which are vital for assessing your suitability as a franchisee. We understand that sharing such information can feel daunting, but it’s a necessary step toward your entrepreneurial dreams.

-

Discovery Day: Attend a Discovery Day event, an invaluable opportunity to meet the franchisor and gain deeper insights into the Fat Tuesday brand. This event is designed for you to ask questions and understand the business’s operational dynamics firsthand. Engaging with potential customers and gathering feedback during this event can be crucial, especially considering the influence of user-generated content on purchasing decisions. Remember, this is a chance to envision your future.

-

Approval and Agreement Signing: Upon receiving approval, it’s time to review and sign the business agreement. This document will outline your rights and responsibilities as a franchisee, marking a significant step in your business journey. Keep in mind that the typical business agreement lasts 10-20 years, allowing for growth and customer loyalty.

-

Training Program: Enroll in the comprehensive training program offered by Fat Tuesday, which covers essential operational procedures, marketing strategies, and customer service standards. This training is pivotal for ensuring your business operates smoothly and effectively.

-

Location Setup: Secure a suitable site for your business. Ensure that the site adheres to the brand’s specifications and complies with local regulations, as location plays a critical role in your business’s success. The hospitality sector, where Fat Tuesday operates, is among the most favored areas for business ownership, emphasizing the potential for achievement in this field.

-

Grand Opening: Finally, plan and execute a grand opening event. This is your opportunity to attract customers and establish your presence in the community. A successful launch can set the tone for your business’s growth. Remember, businesses contribute significantly to the economy, and a well-executed opening can help you tap into the robust business landscape.

As Seth Lederman, CEO of Frannexus, aptly puts it,

The only way to realize your own is through business ownership.

By following these steps, you are on the path to achieving your entrepreneurial dreams with a Fat Tuesday business.

Financial Considerations: Costs and Fees of a Fat Tuesday Franchise

When considering the opening of a Fat Tuesday franchise, it’s essential to navigate the financial landscape with care and understanding:

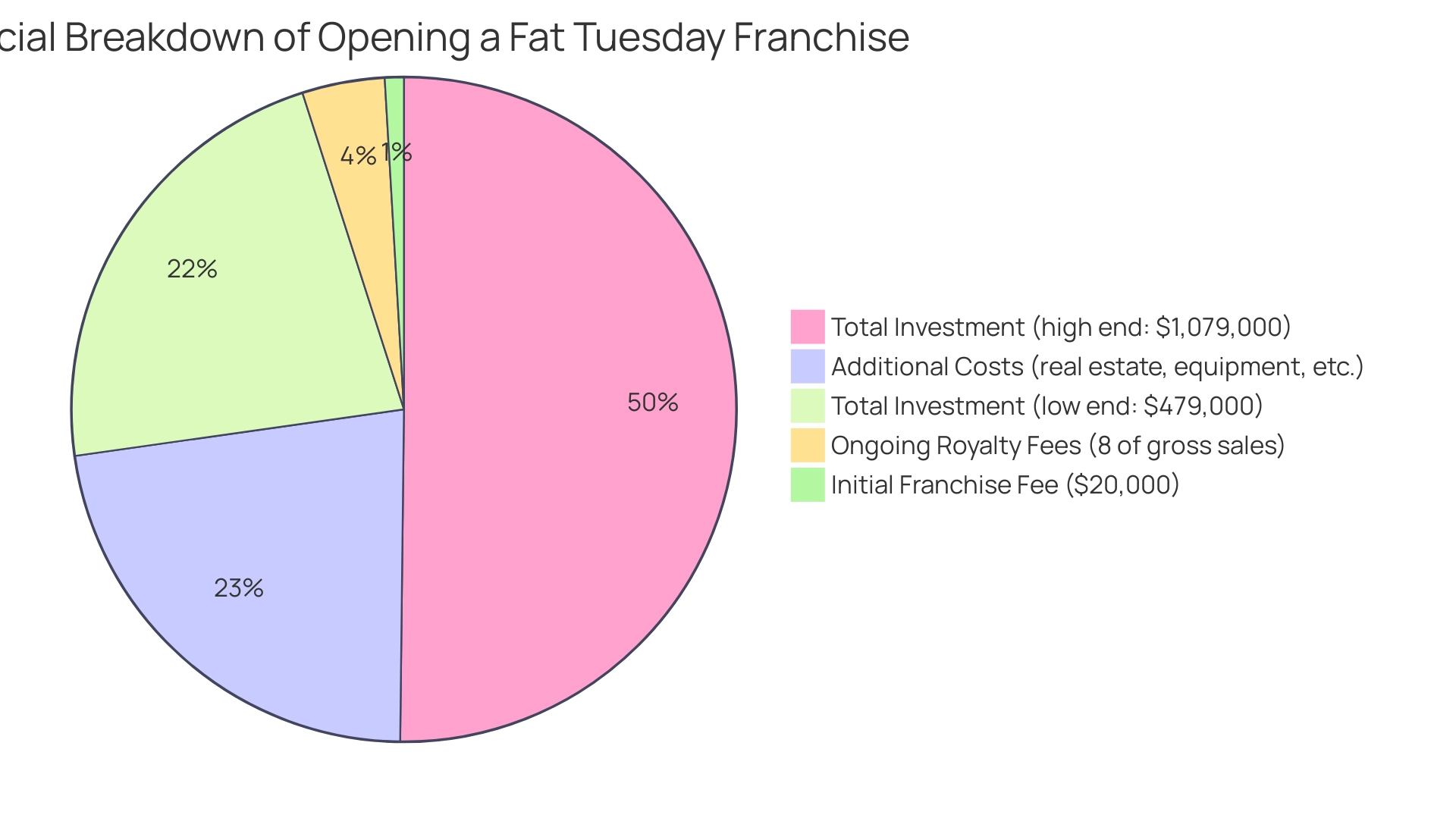

- Initial Franchise Fee: The franchise fee for Fat Tuesday is approximately $20,000, a competitive entry point in the food franchise market. In comparison, Sweetberry Bowls charges a higher initial franchise fee of $35,000, with ongoing royalty fees of only 6%. This highlights the varied financial commitments across food franchises, and we understand that making such an investment can feel daunting.

- Total Investment: Potential investors should anticipate a total upfront investment ranging from $479,000 to $1,079,000. This variation is influenced by factors such as location, establishment size, and regional market conditions. It’s important to consider how these factors may impact your journey.

- Ongoing Fees: In addition to the initial costs, individuals who operate a franchise must pay an ongoing royalty fee of 8% of gross sales, alongside a marketing fee that supports brand promotion and operational assistance. This financial structure is designed to enhance collective brand strength while providing individual franchisees with the necessary resources for success.

Significantly, McDonald’s generated approximately $65.6 billion in revenue from its franchised establishments in 2023, illustrating the potential profitability of such operations. This can be a source of inspiration as you contemplate your own business path.

- Additional Costs: Beyond the fee and royalties, it’s crucial to account for supplementary expenses, including real estate acquisition, equipment purchases, inventory stocking, and initial marketing initiatives. Creating a comprehensive budget is vital to ensure financial stability and to manage the challenges of successfully launching a new business. Remember, you are not alone in this process; many have walked this path before you.

- Franchise Models: It’s also important to consider different franchise models. For instance, Chick-fil-A operates under a unique model where the company owns all locations, which may lead to different investment and operational dynamics for its partners. Understanding these expenses not only assists in budget planning but also guides prospective business owners on how to open a Fat Tuesday franchise while making informed choices during their career transition.

Leveraging Support: Resources for Franchisees from The Entrepreneur’s Source

The Entrepreneur’s Source offers a nurturing suite of resources specifically designed to support aspiring franchisees on their journey toward financial independence and career fulfillment. These resources include:

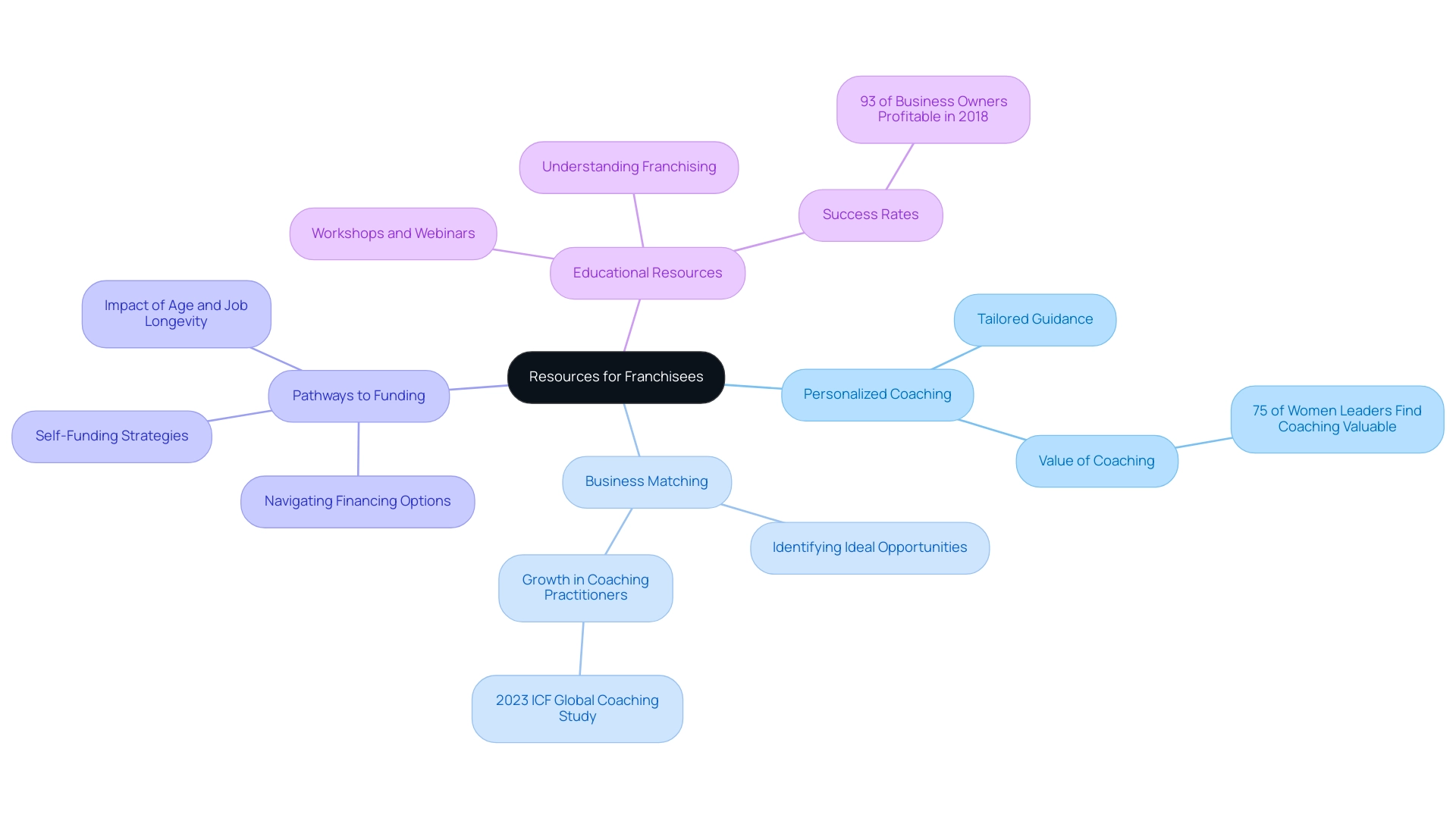

- Personalized Coaching: Our Career Ownership Coaches provide tailored guidance to help you navigate the complexities of the franchise landscape. We understand that making informed decisions aligned with your unique aspirations is crucial. Notably, 75% of women leaders find executive and leadership coaching to be a valuable investment, highlighting the importance of personalized support in achieving success.

This coaching not only helps tackle the challenges of traditional career paths but also assists in recognizing transferable skills that can be applied to your business venture.

- Business Matching: Our service helps identify the ideal business opportunity that resonates with your skills, interests, and financial goals. We emphasize personal alignment in your choices. The 2023 ICF Global Coaching Study reveals a significant increase in the number of coaching practitioners worldwide, underscoring the growing importance of coaching in achieving business success.

- Pathways to Funding: We provide guidance to navigate various financing options available from the U.S. Small Business Administration and other funding sources, equipping you with strategies to secure the necessary capital for your franchise investment. Understanding self-funding options through checking and savings accounts can enhance your financial preparedness as you embark on this journey. For instance, utilizing your savings can establish a solid foundation for your investment, allowing you to maintain greater control over your financial future.

Additionally, it’s essential to consider how age-related limitations and job longevity concerns may influence your career transition, as these factors can impact your decisions and opportunities in the business realm.

- Educational Resources: You will have access to workshops, webinars, and a wealth of materials designed to deepen your understanding of franchising and essential business management principles. This educational support fosters community engagement and encourages you to envision new possibilities beyond your current experiences.

By utilizing these resources, you not only solidify your foundation for understanding how to open a Fat Tuesday franchise but also enhance your chances of achieving long-term success in this dynamic environment. With a reported 93% of business owners being profitable in 2018, pursuing a business opportunity can be a viable path toward a successful and empowered career.

Navigating Challenges: Tips for Career Transitioners in Franchising

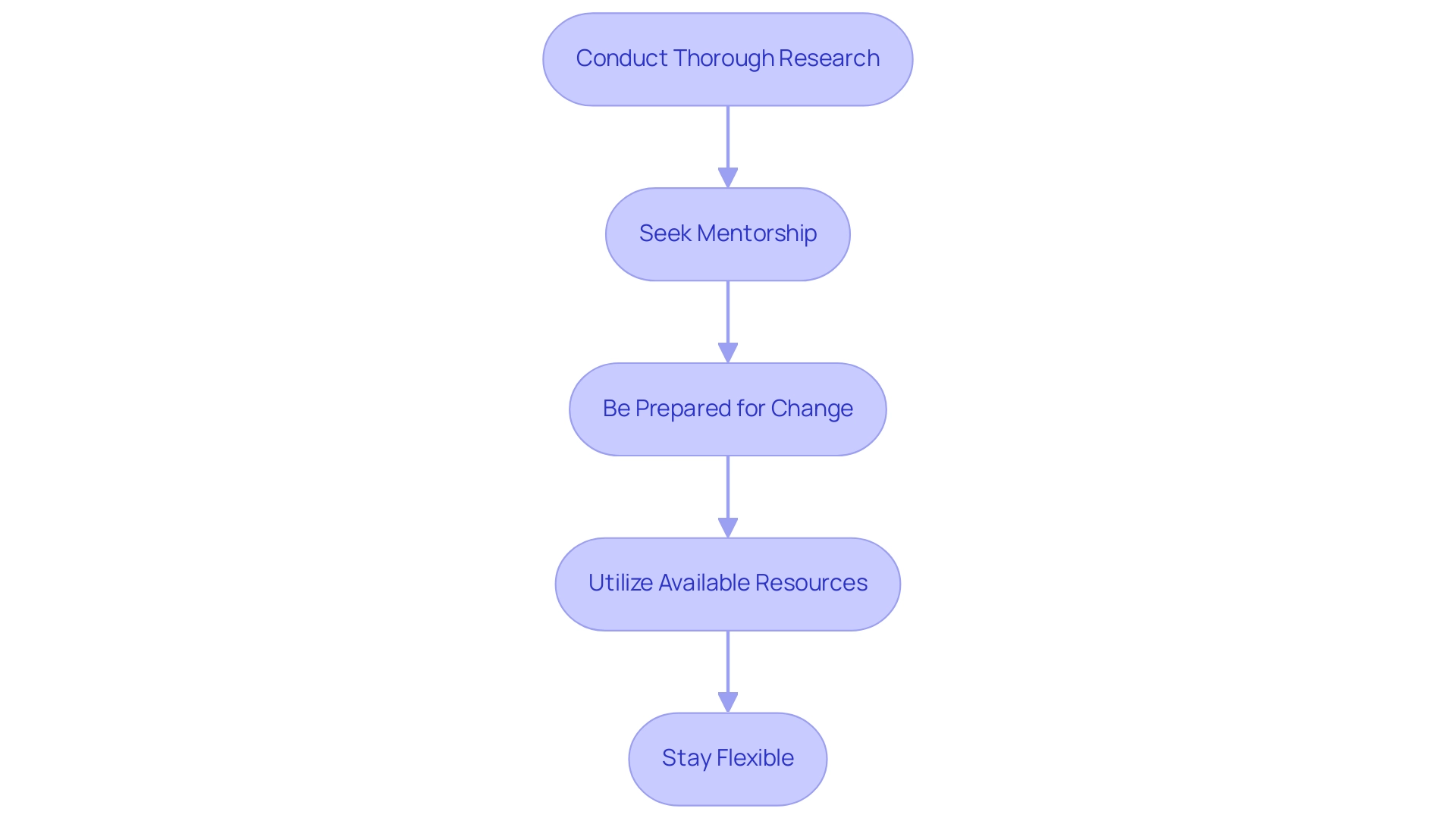

Transitioning to business ownership in 2025 presents unique challenges that many face. It’s completely normal to feel overwhelmed, but there are essential tips to help you navigate this journey and empower your career transition, as outlined in ‘Your Career 2.0: A Survival Guide for The Battered Career Syndrome and Investor Syndrome’.

- Conduct Thorough Research: We understand that a deep understanding of the franchise model, along with insights into market trends and customer demographics, is crucial for making informed decisions. This foundational knowledge will empower you to select a business that aligns with your goals. Did you know that the yearly value of the urgent care health business alone is $30 billion? This highlights the significant economic potential of ownership and the financial freedom it can provide.

- Seek Mentorship: Connecting with seasoned franchisees can offer invaluable insights and practical advice. As Brent Polachek, owner of Polacheck’s Jewelers, wisely states, “In an era of instant gratification, the art of generational relationship-building still drives retail success.” Their experiences can illuminate potential pitfalls and best practices in managing a business successfully, fostering your personal agency in this entrepreneurial journey.

- Be Prepared for Change: Transitioning from employee to business owner requires a significant shift in mindset and skill set. Embrace this change; recognize that developing entrepreneurial skills will be essential for your success and personal growth in a changing job market. This shift is particularly relevant for those experiencing Battered Career Syndrome and Investor Syndrome, as it encourages adaptability and resilience.

- Utilize Available Resources: We know that leveraging the comprehensive support offered by The Entrepreneur’s Source, which includes personalized coaching and educational resources, can be incredibly beneficial. These tools are designed to guide you through the complexities of ownership and enhance your decision-making process as you navigate through Battered Career Syndrome and Investor Syndrome.

- Stay Flexible: The ability to adapt your strategies in response to feedback and evolving market conditions is vital. Flexibility can be the key to overcoming challenges and seizing new opportunities as they arise. Various sectors within the industry, such as pack-and-ship and healthcare businesses, show significant economic potential, indicating a robust and expanding market that can lead to financial independence.

By implementing these strategies from ‘Your Career 2.0’ and embodying its principles, you can better position yourself for success in the vibrant landscape of franchise ownership. Remember, you have the power to take control of your destiny and pave the way for a rewarding career transition. You are not alone on this journey.

Conclusion

Embarking on the journey to become a Fat Tuesday franchisee is not just a business opportunity; it’s a vibrant chance to embrace entrepreneurship with the backing of a well-established brand known for its lively atmosphere and signature offerings. We understand that navigating the franchise model can feel daunting, but it’s essential to recognize that it sets the stage for a meaningful partnership between franchisor and franchisee. This relationship is built on robust support, clear guidelines, and shared goals, fostering not only your individual success but also contributing to job creation and economic growth.

As you navigate the steps to franchise ownership—from your initial inquiry to the exciting grand opening—know that you are not alone. Each phase, including thorough research, personalized coaching, and strategic financial planning, plays a pivotal role in achieving long-term profitability and career satisfaction. It’s important to consider the financial aspects, such as initial fees and ongoing costs, as they highlight the necessity of careful budgeting and informed decision-making. This preparation ensures that you are ready for your investment.

Moreover, by leveraging the wealth of resources available, including mentorship and educational materials, you can enhance your likelihood of success while gracefully navigating the challenges that come with transitioning to franchise ownership. Embracing a flexible mindset and welcoming change are crucial for overcoming obstacles and seizing opportunities in this dynamic business landscape.

Ultimately, joining the Fat Tuesday family is more than just a business venture; it represents a fulfilling career path filled with potential for personal and financial growth. By embracing the support and resources provided, you can confidently embark on your entrepreneurial journey, equipped to thrive in a competitive market. Remember, you are not alone in this journey, and together, we can achieve your dreams.