Overview

The article provides a comprehensive step-by-step guide on how to buy businesses for sale in Arizona, detailing essential processes from understanding the local economic landscape to navigating legal considerations and closing the deal. It emphasizes the importance of thorough research and planning, financial evaluation, and effective negotiation strategies, supported by insights into Arizona’s diverse economy and the potential challenges buyers may face.

Introduction

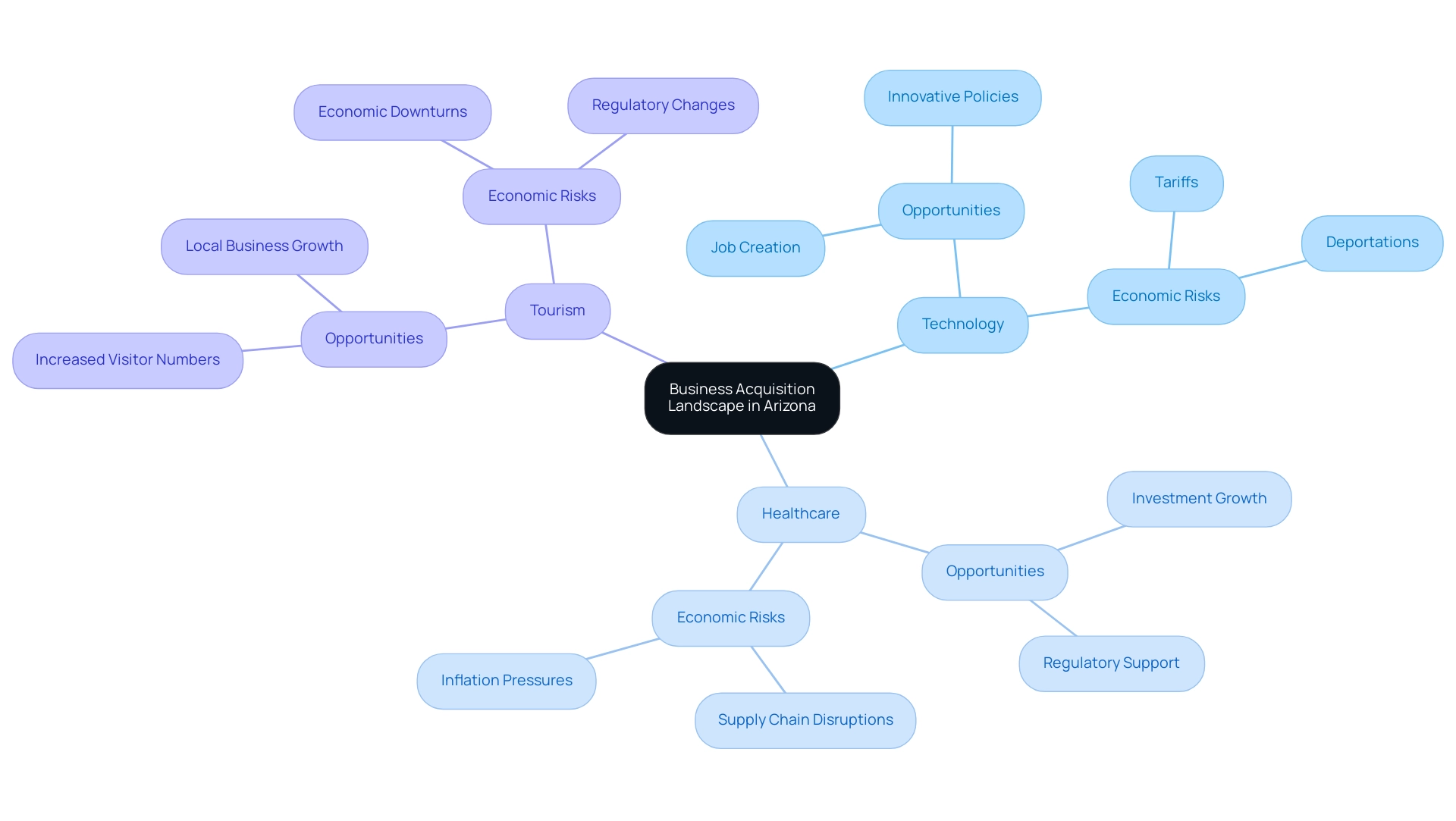

In the vibrant and ever-evolving landscape of Arizona’s economy, potential business acquirers are presented with both opportunities and challenges. With a diverse array of thriving sectors such as technology, healthcare, and tourism, the state has garnered attention as a prime investment location. However, looming economic risks, including rising tariffs and regulatory changes, necessitate a cautious approach for those looking to enter the market.

Understanding the intricacies of business acquisition in this unique environment is crucial, as it involves thorough research, strategic planning, and effective negotiation skills. This article delves into the essential steps for navigating the acquisition process, equipping prospective buyers with the knowledge to make informed decisions and successfully capitalize on Arizona’s promising business climate.

Understanding the Business Acquisition Landscape in Arizona

Before starting the acquisition process, it’s essential to understand the dynamic landscape of az businesses for sale in Arizona. The state boasts a diverse economy with flourishing sectors such as technology, healthcare, and tourism. However, potential economic risks loom, including significant increases in tariffs and mass deportations, which could disrupt supply chains and elevate inflation.

Recent forecasts indicate that nominal taxable retail sales growth is expected to decelerate from 3.4% in 2023 to just 1.0% in 2024, signaling a need for cautious optimism. President Joe Biden aptly noted, ‘Every time someone starts a new small venture, it’s an act of hope and confidence in our economy.’ This sentiment is especially pertinent as enterprises navigate these challenges.

Notably, Arizona’s economic development initiatives received national recognition in 2024, showcasing innovative policies and successful job-creating projects that enhance the state’s reputation as a favorable location for investment. To make informed investment decisions, consider engaging a coach who can provide clarity on your entrepreneurial goals and help you navigate these complexities. A coach can specifically assist in addressing challenges related to economic risks and regulatory environments, tailoring strategies that align with the opportunities in technology, healthcare, and tourism.

Investigating local market trends and industry growth potential is essential for recognizing feasible opportunities in az businesses for sale. Furthermore, understanding the regulatory environment, including state-specific laws that affect operations, is crucial. Interacting with local trade associations or chambers of commerce can offer invaluable insights and networking opportunities, assisting you in connecting with other entrepreneurs and industry specialists as you investigate purchasing options.

Preparing for Your Business Purchase: Research and Planning

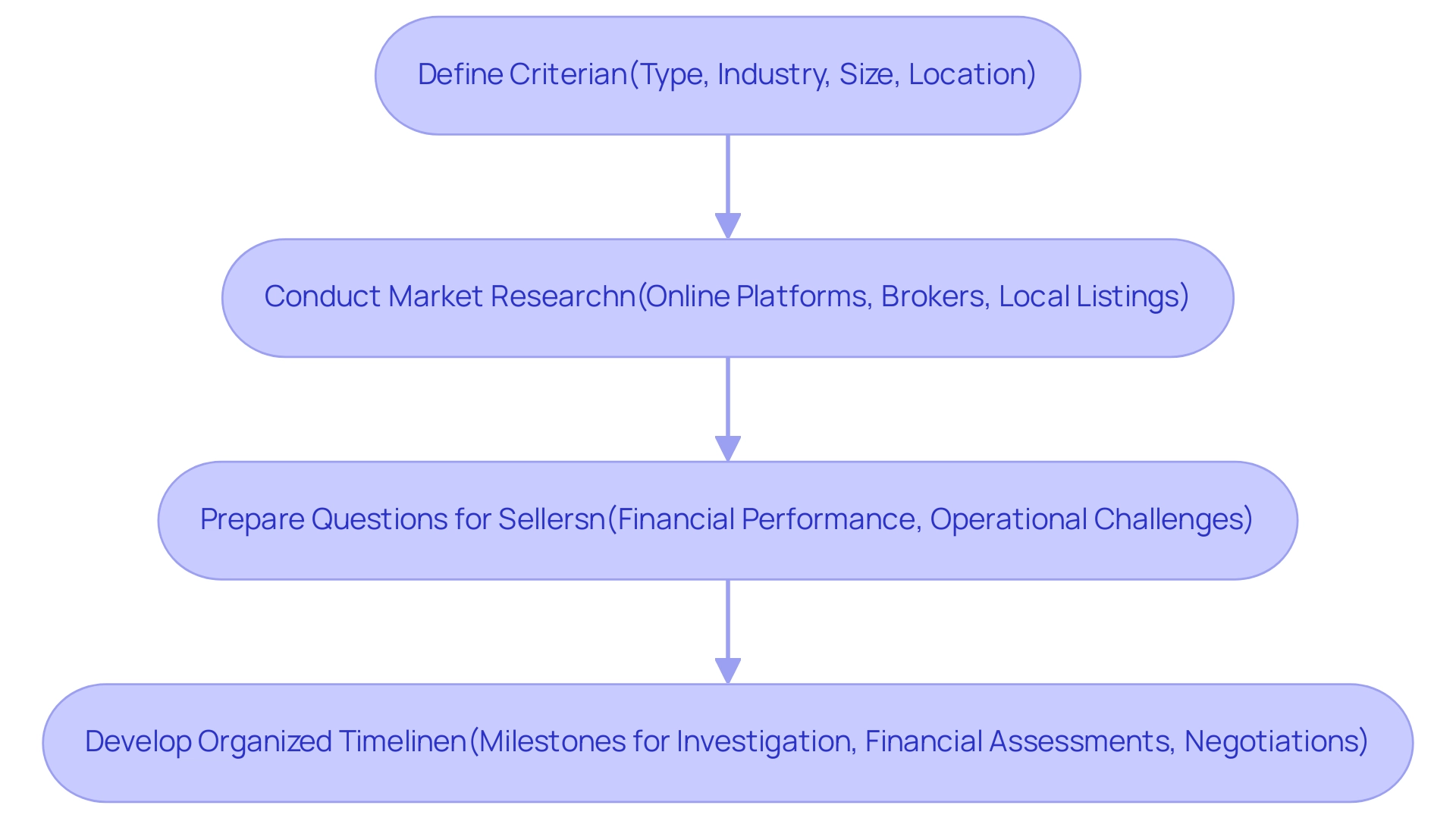

Start your acquisition journey by clearly defining your criteria, which should encompass the type of enterprise, industry, size, and geographical location you are targeting. Thorough market research is essential in identifying viable az businesses for sale in Arizona. Utilize various resources such as online platforms, brokers, and local listings to gather pertinent information.

As Khalid Saleh, CEO and co-founder of Invesp, notes, ‘Research and planning are fundamental to making informed decisions in business acquisitions.’ As you interact with sellers, prepare a list of insightful questions that explore their financial performance, operational challenges, and overall positioning. For example, the case study of Wood Mackenzie demonstrates how effective market analysis can influence key decisions in interconnected sectors, showcasing the importance of detailed insights.

Furthermore, develop an organized timeline for your procurement process, establishing specific milestones for investigation, financial assessments, and negotiations. This organized approach not only streamlines your efforts but also ensures that you remain focused and methodical throughout the acquisition journey. With just 15% of entrepreneurs having received a professional appraisal, being thorough in your investigation and planning will provide you with a competitive advantage in the field.

Furthermore, the recent success of Macromill Group highlights the relevance of leveraging digital marketing solutions and innovative data insights in understanding market trends, further emphasizing the need for thorough market research.

Navigating Financial Considerations: Funding Your Business Purchase

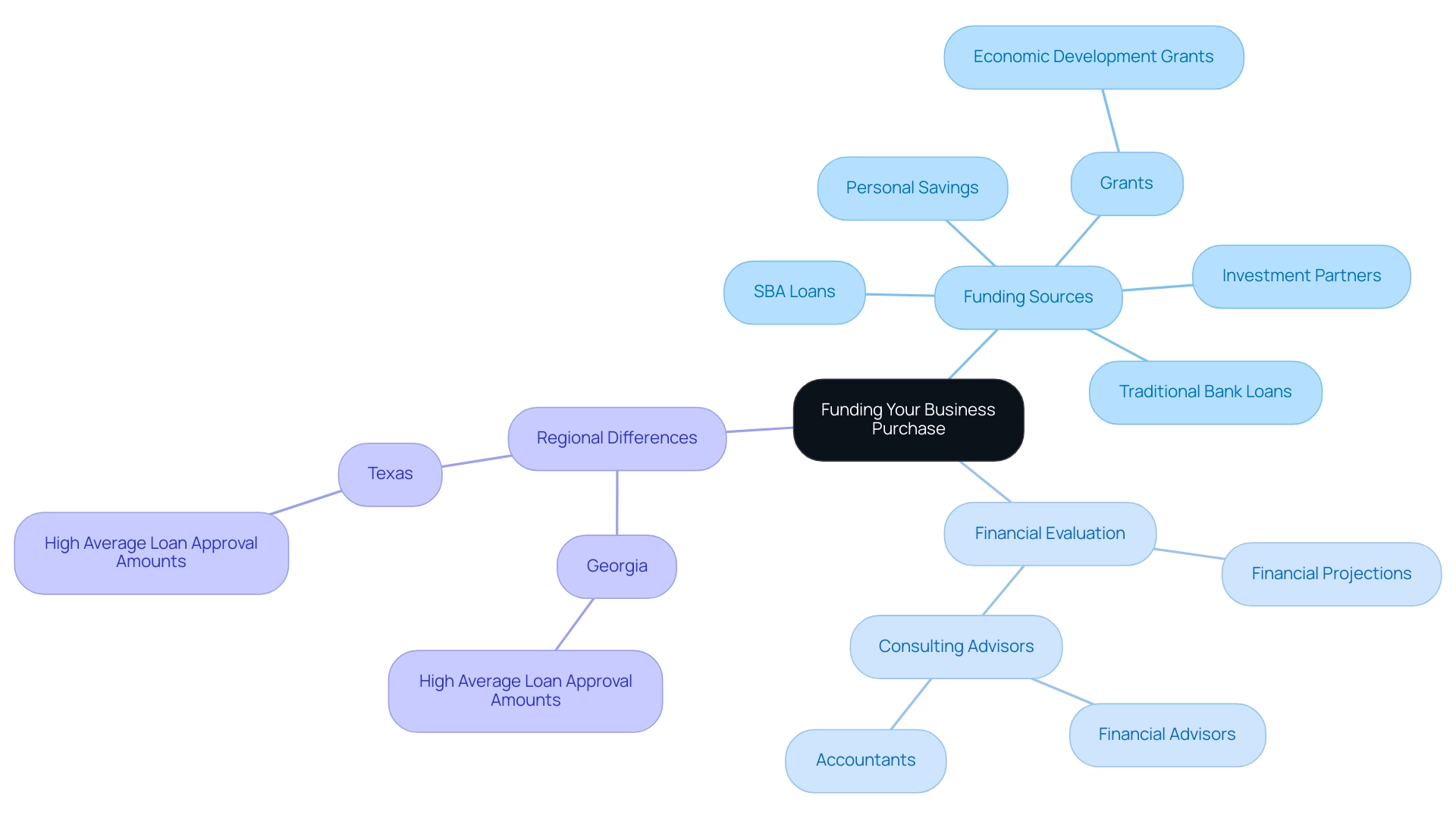

When considering a commercial purchase, a variety of funding options are available to support your investment. Personal savings, traditional bank loans, Small Business Administration (SBA) loans, and investment partners each play a crucial role in financing. It’s essential to conduct a thorough evaluation of your financial situation to determine how much you can realistically afford to invest.

A well-prepared plan becomes indispensable, detailing your financial projections and funding requirements, which will be pivotal in securing financing. Additionally, as of August 13, 2024, there are grants available for economic development that can further enhance your funding options. Consulting with a financial advisor or accountant can provide valuable insights into assessing the target company’s profitability, cash flow, and potential risks.

For instance, research shows that states like Georgia and Texas had the highest average loan approval amounts from 2018-2022, highlighting regional differences in lending practices that could affect your financing options. As one financial expert aptly put it, don’t give up and keep an open mind about acquiring new knowledge to maintain and expand your enterprise. Also, never be afraid to ask for help.

A great enterprise takes time; it’s not about winning the race but finishing and achieving your goals. Additionally, investigating and contrasting loan alternatives is crucial to discover competitive interest rates and advantageous terms, ensuring you make informed choices as you navigate the complexities of enterprise purchase.

Legal Essentials: Understanding Contracts and Due Diligence

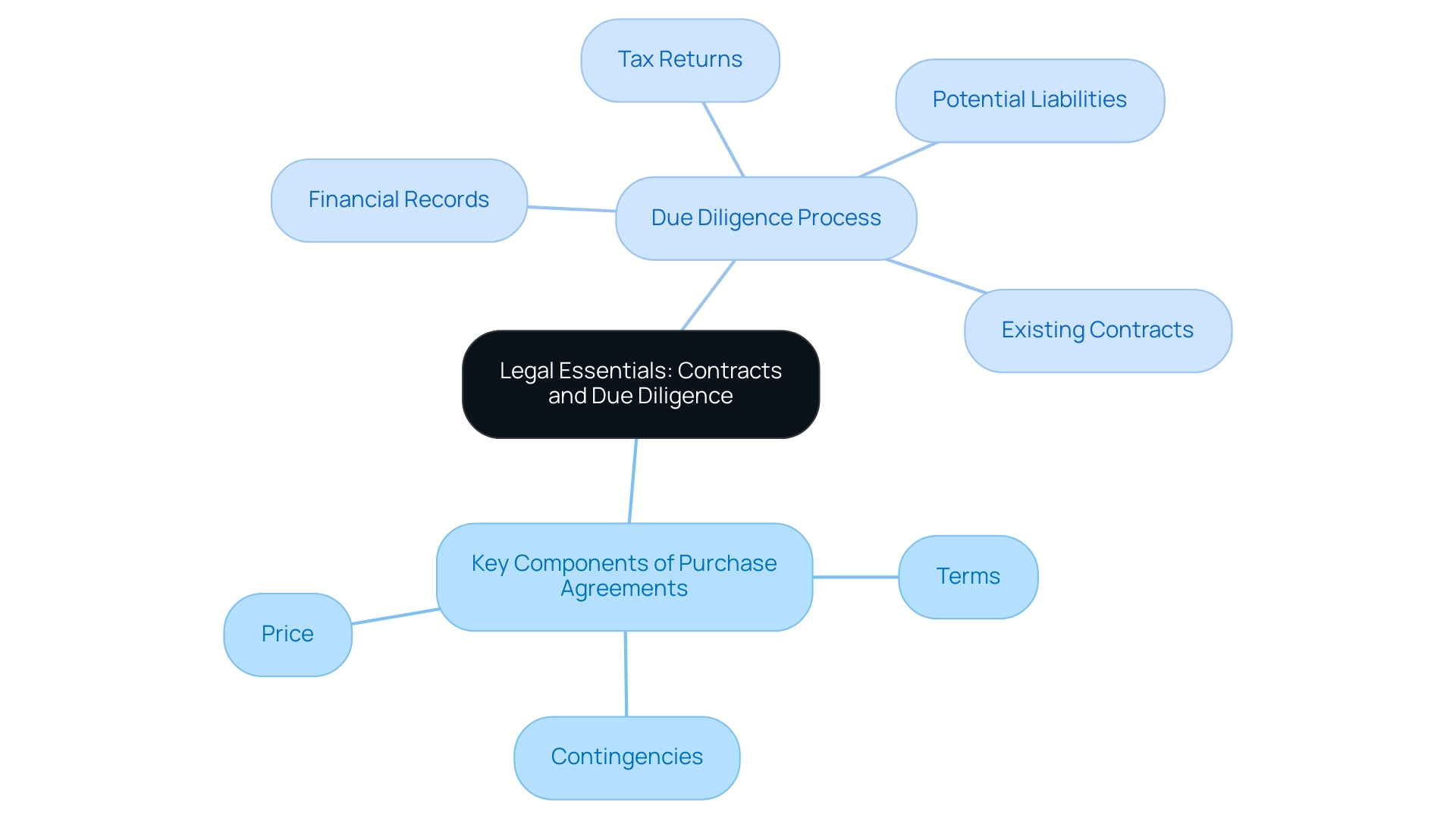

Engaging a qualified attorney with expertise in acquisitions is essential to successfully navigate the legal intricacies involved. Understanding the key components of purchase agreements is critical; these include:

- Price

- Terms

- Contingencies that dictate the transaction’s framework

Conducting thorough due diligence is a vital step in this process. This involves a meticulous review of:

- Financial records

- Tax returns

- Existing contracts

- Identifying any potential liabilities associated with the company

Such diligence is crucial for uncovering hidden issues that could significantly impact the organization’s value or operations. It has been observed that 95% of legal consumers prioritize online reviews when selecting legal representation, highlighting the importance of maintaining a robust online reputation.

In fact, websites with informative and high-quality content receive 434% more indexed pages, which can enhance visibility and credibility. Additionally, according to a case study on legal consumer statistics, 81% of consumers research online before contacting an attorney, further emphasizing the need for a strong online presence. Thus, ensuring that all agreements are documented in writing and fully comprehended before advancing to subsequent steps is paramount.

As noted by Li et al.,

Companies are increasingly adopting comprehensive strategies to integrate ESG principles into their organizational culture.

This trend also highlights the importance of due diligence in aligning practices with ethical standards and investor expectations. Furthermore, comprehending the 1992 Horizontal Merger Guidelines and its revisions can offer valuable context concerning legal factors in corporate purchases.

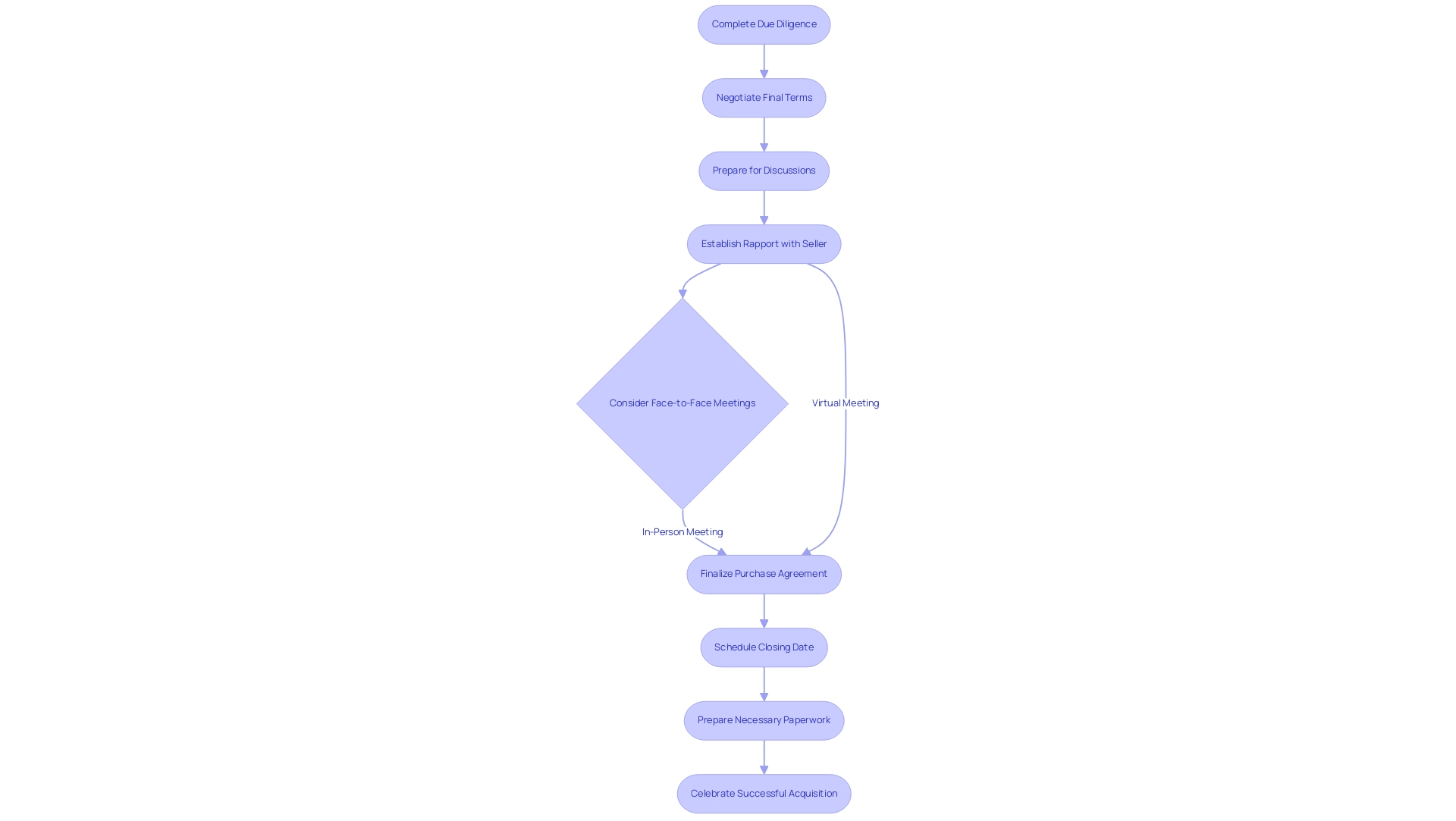

Closing the Deal: Negotiation Strategies and Final Steps

Following the completion of due diligence, the critical phase of negotiating the final terms begins. It’s essential to prepare for discussions on potential price adjustments derived from your findings. Successful negotiation strategies often hinge on establishing a rapport with the seller, which can significantly enhance the effectiveness of your discussions.

In fact, according to HubSpot, 51% of sales professionals affirm that in-person meetings are the most effective sales channel, emphasizing the importance of face-to-face interactions in negotiations. A study titled ‘Physical vs. Virtual Negotiation Practices’ revealed that participants engaged in face-to-face negotiations achieved superior outcomes compared to their virtual counterparts, with an average negotiation time exceeding 43 minutes.

To further bolster your negotiation skills, consider exploring Scotwork’s negotiation training programs, which boast an average ROI of 16.08 times the course fee within three months. Once an agreement is reached, collaborate closely with your attorney to finalize the purchase agreement, ensuring that all terms are clearly documented. Schedule a closing date and prepare for the necessary paperwork, including the transfer of licenses, permits, and assets.

Finally, take a moment to celebrate your successful acquisition and strategically plan for your transition into the role of a business owner, especially in the context of az businesses for sale within Arizona’s dynamic business landscape.

Conclusion

Navigating the business acquisition landscape in Arizona requires a comprehensive understanding of the state’s diverse economy and the potential risks involved. With sectors like technology, healthcare, and tourism flourishing, opportunities abound; however, prospective buyers must remain vigilant about economic fluctuations and regulatory changes that could impact their investments. Engaging a business coach and conducting thorough market research can provide valuable insights, helping to clarify goals and identify viable acquisition targets.

Preparation is key in this process. Defining clear criteria for the desired business, conducting diligent research, and creating a structured timeline can streamline the acquisition journey. Financial considerations also play a crucial role; exploring various funding options and developing a solid business plan are essential steps in securing the necessary financing. Collaborating with financial advisors can further enhance decision-making, ensuring that buyers are well-informed about profitability and potential risks.

Legal aspects cannot be overlooked either. Engaging an attorney with expertise in business acquisitions is vital for navigating contracts and conducting due diligence. This meticulous approach can uncover hidden liabilities and ensure that all agreements are well-documented and understood. As negotiations commence, effective strategies and strong interpersonal skills can facilitate successful discussions, ultimately leading to a favorable deal.

In conclusion, while the path to acquiring a business in Arizona is laden with complexities, a methodical approach that encompasses research, planning, financial evaluation, legal considerations, and negotiation can empower buyers to capitalize on the state’s promising business climate. By being well-prepared and informed, prospective acquirers can navigate challenges and seize opportunities, fostering a successful transition into business ownership.