Overview

Creating a financial plan involves a step-by-step approach that includes evaluating your current economic situation, setting clear monetary objectives, developing a detailed budget, and managing cash flow effectively. The article emphasizes that a well-structured financial strategy is essential for new entrepreneurs to navigate startup challenges and achieve sustainable growth, supported by data showing that disciplined financial management significantly increases the likelihood of business success.

Introduction

Navigating the financial landscape can be one of the most daunting challenges for entrepreneurs, especially in an ever-evolving business environment. Developing a solid financial plan is not just a best practice; it is a necessity for those looking to launch and sustain their ventures successfully. From revenue forecasting to cash flow management, understanding the intricacies of financial planning is crucial for making informed decisions that can steer a business toward growth.

As the demand for forward-thinking finance strategies rises, it becomes increasingly clear that meticulous planning is the cornerstone of startup success in 2024. This article delves into the essential components of financial planning for entrepreneurs, offering a step-by-step guide, insights on setting realistic financial goals, and strategies to avoid common pitfalls, ensuring a robust foundation for any aspiring business owner.

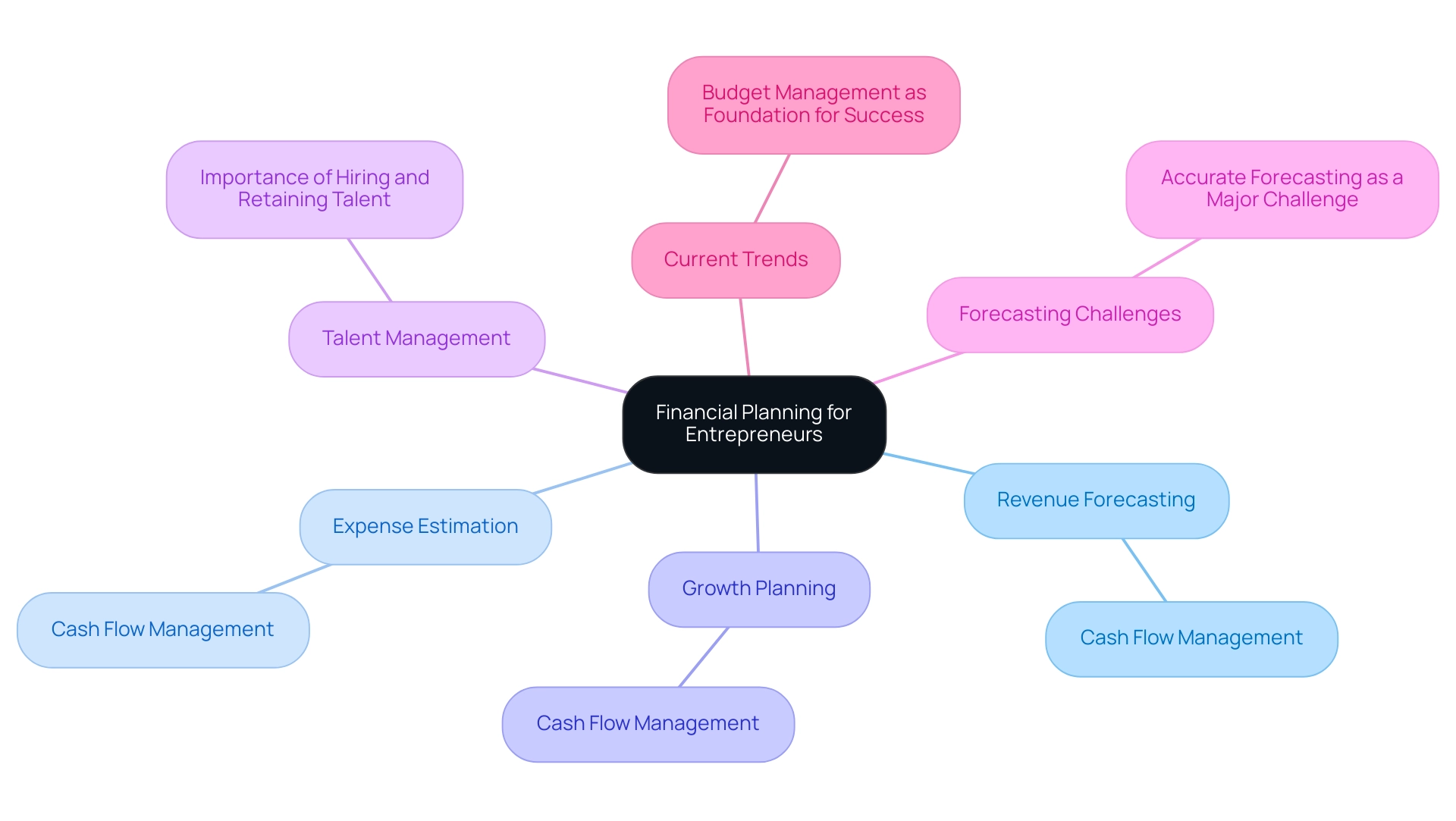

Understanding Financial Planning for Entrepreneurs

Creating a solid financial strategy serves as a guide to financial planning for new entrepreneurs who are seeking to navigate the complexities of launching and sustaining a business. This entails formulating a comprehensive strategy that encompasses:

- Revenue forecasting

- Expense estimation

- Growth planning

Cash flow management stands at the forefront of this process; it’s vital for ensuring that you have the liquidity to meet operational needs while also investing in future opportunities.

As 78% of UK finance leaders support a new type of CFO centered on future-oriented strategies, it highlights the changing landscape of finance leadership that business owners must adapt to. Furthermore, 83% of CFOs emphasize that hiring and retaining talent is very important to growth, indicating that talent management is a critical component of business strategy in today’s market. A staggering 36% of CFOs recognize precise forecasting as their most urgent challenge for the upcoming year, emphasizing the importance for business owners to prioritize careful budget management.

Current trends suggest that budget management is not just a formality but a foundation of startup success in 2024. A well-constructed fiscal plan acts as a guide to financial planning for new entrepreneurs, not only aiding in securing funding but also empowering them to make informed decisions and respond adeptly to shifting market dynamics. According to the case study titled “Common Challenges for Finance and FP&A,” finance teams face significant challenges, including staffing issues and data management, which can complicate forecasting and planning efforts.

By understanding your cash flow, investment requirements, and potential risks, you create a clear vision for your enterprise’s economic future, setting the stage for sustainable growth.

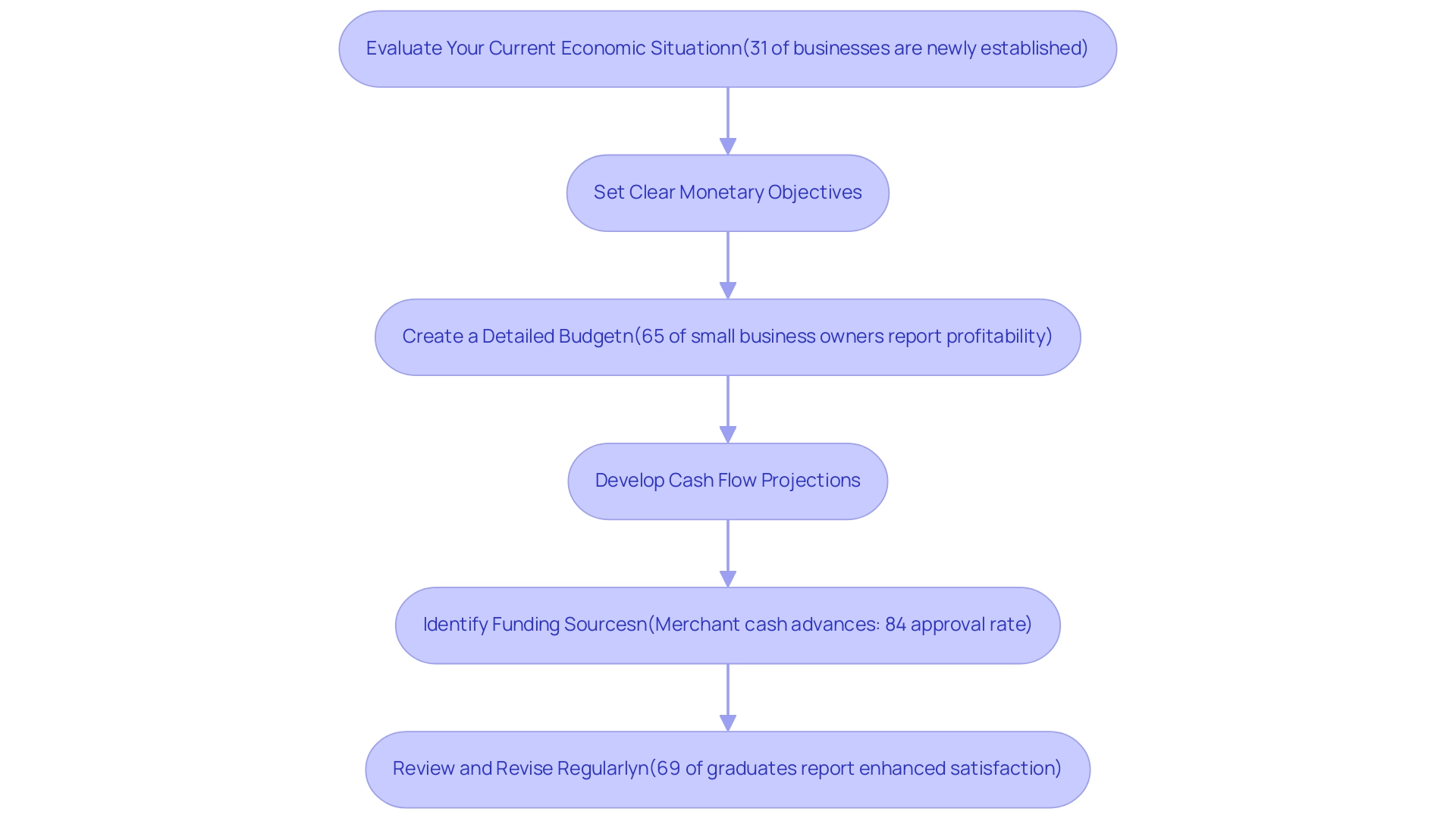

Step-by-Step Guide to Developing Your Financial Plan

- Evaluate Your Current Economic Situation: Begin by compiling all relevant economic documents, including bank statements, profit and loss statements, and tax returns. This thorough assessment is crucial as approximately 31% of businesses are newly established and typically take 2-3 years to achieve profitability. Comprehending your economic health is the foundation for informed decision-making, as outlined in the guide to Financial planning for new entrepreneurs, especially considering the challenges they face in their formative years.

- Set Clear Monetary Objectives: Clearly define your monetary aspirations for both the short and long term. Establishing specific revenue targets, profit margins, or savings goals acts as a guide to financial planning for new entrepreneurs, helping to provide direction and motivation to stay focused on your entrepreneurial journey.

- Create a Detailed Budget: Construct a comprehensive budget that outlines your anticipated income and expenses. This budget should encompass both fixed costs, such as rent and salaries, and variable costs, like marketing and supplies. A well-planned budget is essential, as emphasized in the guide to Financial planning for new entrepreneurs, especially considering that 65% of small enterprise owners report profitability. This statistic emphasizes the significance of disciplined monetary management in achieving success.

- Develop Cash Flow Projections: Project your cash inflows and outflows over the next 12 months. These projections serve as a guide to financial planning for new entrepreneurs, ensuring you can cover operational expenses and have funds to reinvest in your venture. A proactive strategy for cash flow management can prevent economic strain as your enterprise navigates its early stages.

- Identify Funding Sources: Investigate diverse funding options available to you, including loans, grants, and investments. For instance, merchant cash advances have an impressive 84% approval rate, while working with the Small Business Administration yields a 65% approval rate for small business loans. Understanding these pathways can greatly impact your guide to Financial planning for new entrepreneurs.

- Review and Revise Regularly: Acknowledge that budget management is not a one-time occurrence but a continuous procedure. Regularly revisit your budget plan and make necessary adjustments to ensure alignment with your evolving business goals. This is vital for achievement, as observed by the College for Financial Development, where 69% of graduates indicate enhanced satisfaction in their career paths, emphasizing the significance of ongoing education and adjustment in the economic sector.

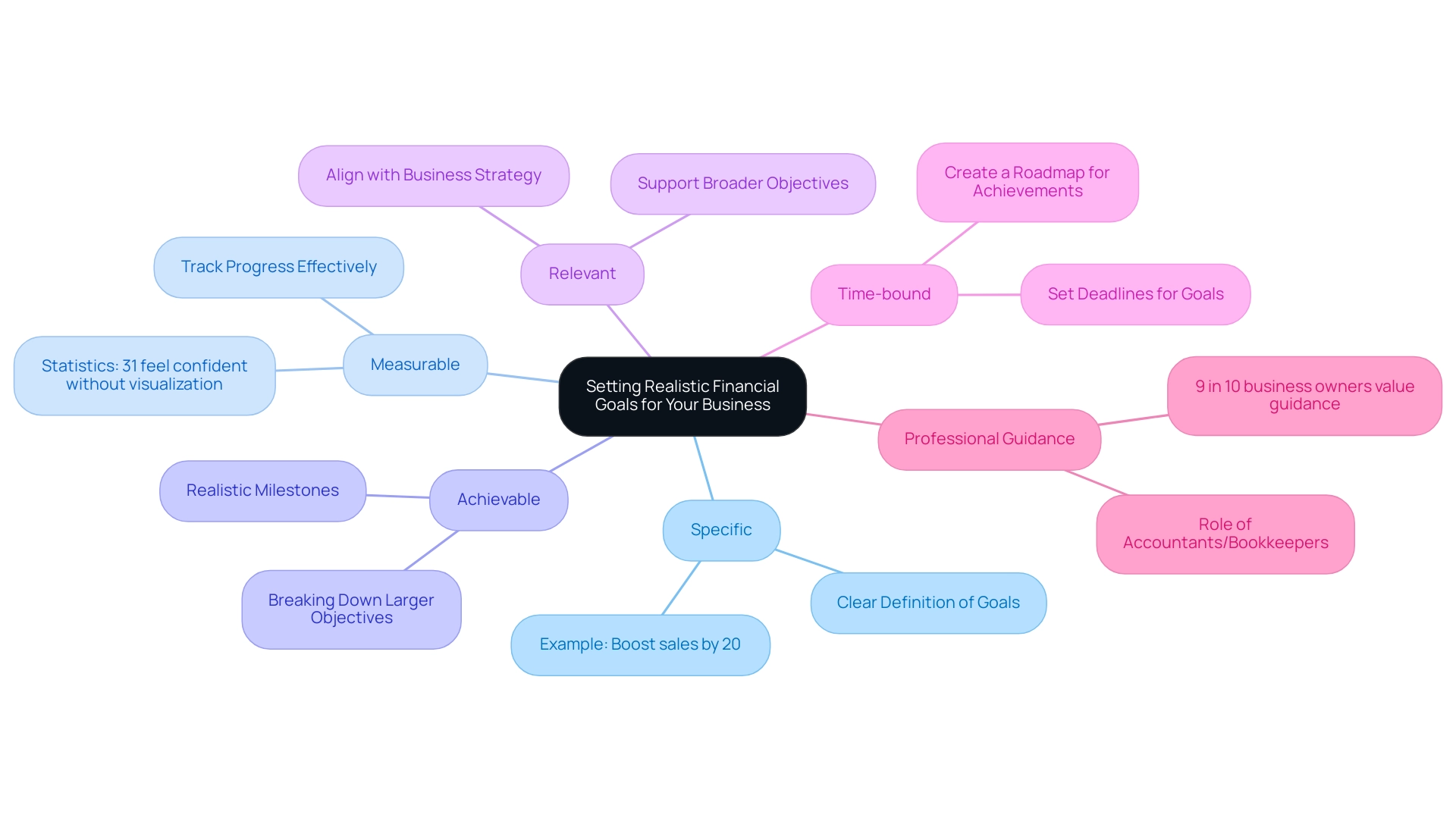

Setting Realistic Financial Goals for Your Business

When setting monetary goals, it’s essential to apply the SMART criteria: Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, rather than simply stating, ‘I want to increase sales,’ a SMART goal would articulate, ‘I want to boost sales by 20% over the next year.’ This level of specificity not only sharpens your focus but also enables you to effectively track your progress.

In fact, statistics indicate that 31% of individuals who do not visualize their objectives feel assured, emphasizing the significance of clear goal visualization in planning. It’s also advantageous to break down larger monetary objectives into smaller, manageable milestones. This approach provides a clear roadmap and allows for the celebration of achievements along the way, keeping your motivation high.

Companies that establish measurable economic objectives report, on average, a significant increase in sales, underscoring the importance of having clearly defined targets. Moreover, aligning your monetary objectives with your overall strategy—considering your values, mission, and long-term vision—will ensure that these targets contribute meaningfully to your broader goals, such as market expansion. As demonstrated in the case study titled ‘Align Them With Your Strategy,’ goals that support the broader organizational strategy ensure that monetary targets contribute to overall objectives.

Additionally, remember that another 9 in 10 business owners say their accountant or bookkeeper helps their business grow, reinforcing the value of professional guidance in achieving monetary goals.

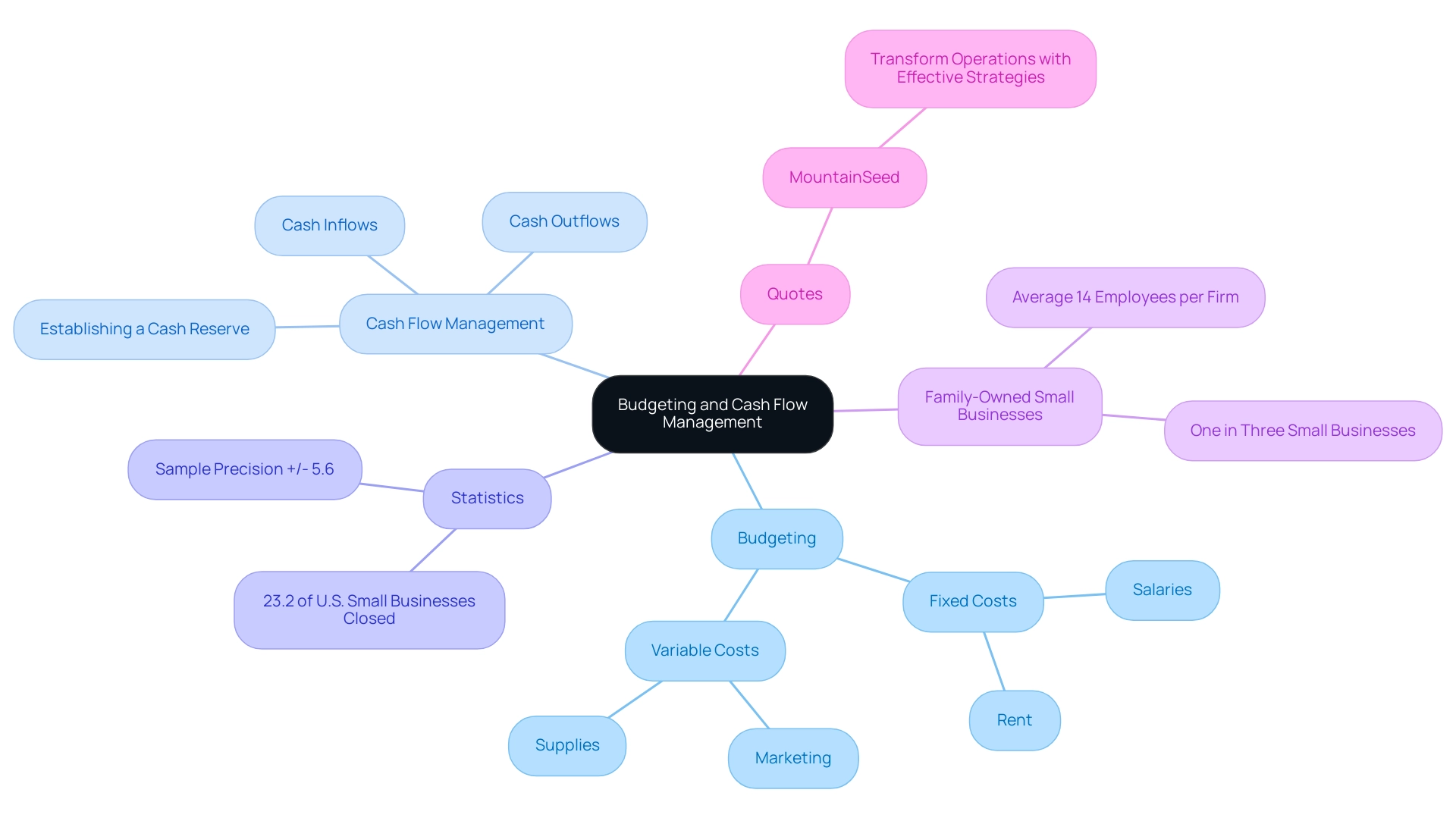

The Role of Budgeting and Cash Flow Management

Effective budgeting is essential for new entrepreneurs, as it serves as a guide to financial planning for new entrepreneurs, enabling you to develop a strategic plan for resource distribution aimed at achieving your economic goals. Begin by categorizing your expenses into:

- Fixed costs—such as rent and salaries

- Variable costs, including marketing and supplies

Consistently tracking these categories will assist you in remaining aligned with your economic objectives.

Furthermore, cash flow management is crucial for maintaining the liquidity necessary to meet your obligations. Keep a close eye on your cash inflows and outflows, and establish a cash reserve to safeguard against unexpected expenses. This proactive method not only aids in preventing economic pressure but also guarantees the seamless functioning of your enterprise.

Recent data shows that 23.2% of U.S. small enterprises started in March 2022 were shut down by March 2023, with a sample precision of +/- 5.6 percentage points at a 95% confidence level, highlighting the importance of strong management practices. For instance, family-owned small enterprises, which make up one in three small firms in the U.S. and average 14 employees per company, often illustrate the advantages of effective budgeting and cash flow strategies. Implementing best practices in these areas can set the foundation for long-term success and sustainability.

Moreover, the guide to financial planning for new entrepreneurs emphasizes the importance of creating a safety net and ensuring access to capital. As MountainSeed, a real estate consultancy firm, states, “By implementing effective budgeting and cash flow management strategies, businesses can transform their operations and secure their economic future.” This authoritative perspective reinforces the importance of these financial practices.

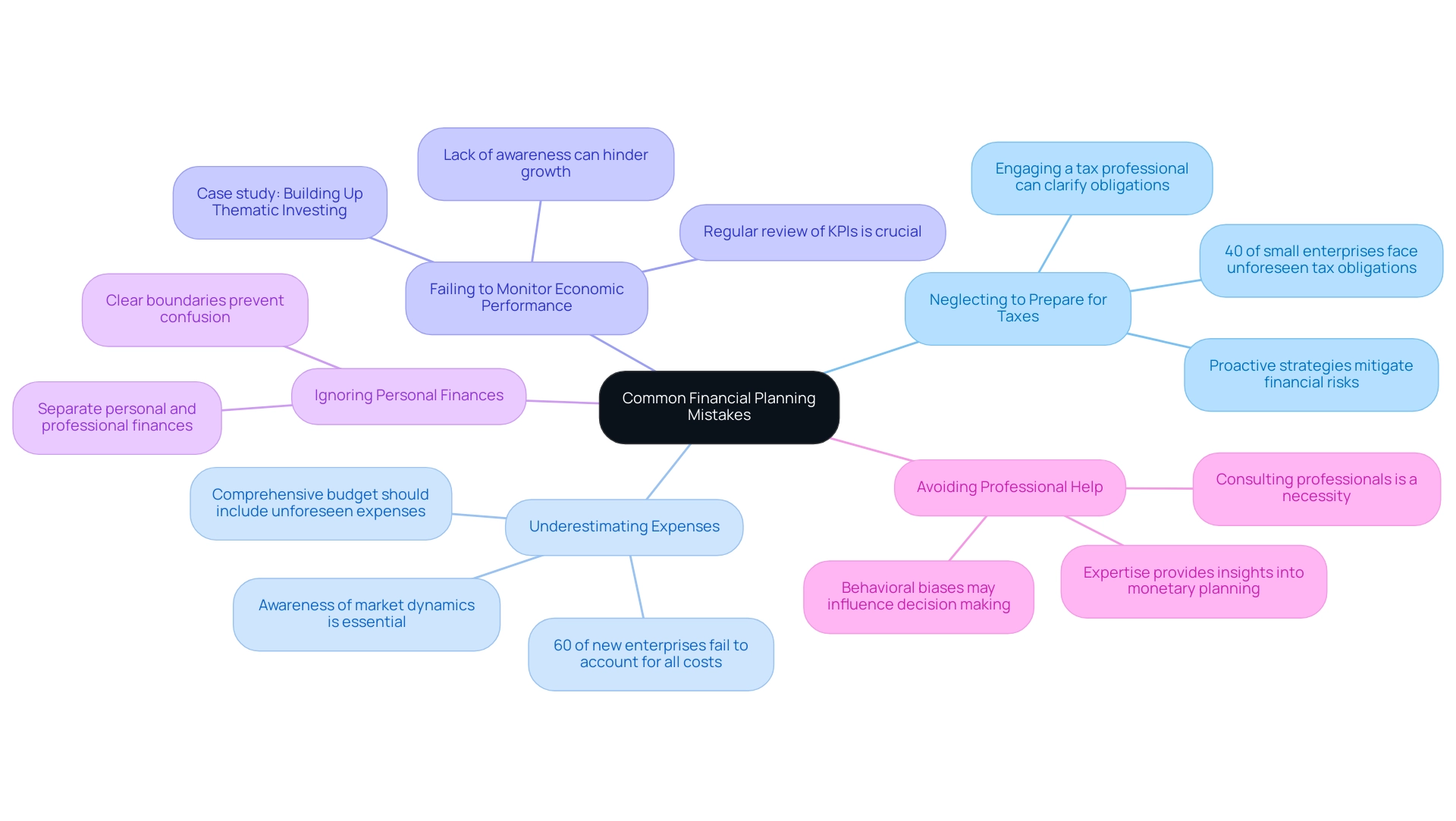

Avoiding Common Financial Planning Mistakes

-

Neglecting to Prepare for Taxes: A common pitfall for many new entrepreneurs is overlooking the importance of tax preparation. In 2024, statistics suggest that almost 40% of small enterprises encounter unforeseen tax obligations because of insufficient strategies. Engaging a tax professional can provide clarity on your obligations and serve as a crucial part of the guide to financial planning for new entrepreneurs by helping you structure your finances efficiently. Recent news on tax planning highlights its vital role in the success of small businesses, acting as a guide to financial planning for new entrepreneurs by demonstrating that proactive strategies can mitigate financial risks. Furthermore, with the U.S. fiscal deficit influencing economic growth, understanding tax implications becomes even more crucial for business owners navigating these challenging conditions.

-

Underestimating Expenses: Many entrepreneurs tend to be overly optimistic about their expenses. A realistic evaluation is essential; studies indicate that 60% of new enterprises fail to account for all costs they might incur, leading to significant cash flow challenges. According to the guide to financial planning for new entrepreneurs, a comprehensive budget should include not only operational costs but also unforeseen expenses that may arise during the initial stages of the venture. Thematic investing trends suggest that business owners should be aware of market dynamics that could influence their planning.

-

Failing to Monitor Economic Performance: Regularly reviewing your statements and key performance indicators (KPIs) is crucial for maintaining your organization’s health. Many entrepreneurs neglect this practice, which can lead to a lack of awareness about their monetary status and hinder growth. Establishing a routine to assess these metrics can act as a guide to financial planning for new entrepreneurs, enabling you to make informed decisions and adjust strategies as needed. The case study ‘Building Up Thematic Investing’ illustrates how companies have successfully adjusted their monetary strategies to respond to changing market conditions.

-

Ignoring Personal Finances: Keeping your personal and professional finances separate is vital for clarity and financial health. Combining the two can lead to confusion and may inadvertently affect your organization’s viability. Establish clear boundaries and maintain distinct accounts to ensure personal spending does not affect your business operations.

-

Avoiding Professional Help: Seeking advice from wealth consultants or accountants should not be regarded as a luxury but rather as a necessity. Their expertise can provide invaluable insights into your monetary planning and serve as a guide to financial planning for new entrepreneurs, helping you navigate complex challenges. As Amanda Lott wisely points out,

Do you have too much, or too little, in cash reserves? Behavioral biases may be influencing your decision making.

Consulting a professional can help you identify these biases and develop a more objective financial strategy.

Conclusion

Developing a comprehensive financial plan is paramount for entrepreneurs seeking to thrive in today’s competitive landscape. By understanding the core components of financial planning—such as:

- Assessing current financial conditions

- Setting clear objectives

- Budgeting effectively

- Managing cash flow

business owners can create a solid foundation that supports sustainable growth. The emphasis on realistic goal-setting through the SMART criteria further empowers entrepreneurs to track progress and make informed decisions that align with their long-term vision.

Moreover, avoiding common pitfalls in financial planning, such as:

- Neglecting tax obligations

- Underestimating expenses

- Failing to monitor financial performance

can significantly enhance a startup’s chances of success. The guidance to engage professionals for financial advice underscores the importance of having expert insight in navigating complex financial waters.

As the business environment continues to evolve, meticulous financial planning remains a critical factor in achieving entrepreneurial aspirations. By prioritizing these strategies and continuously refining their approach, entrepreneurs can not only safeguard their ventures but also position themselves for enduring success in 2024 and beyond. The journey may be challenging, but with the right financial framework in place, the possibilities for growth and innovation are boundless.