Overview

Creating a financial plan for new entrepreneurs involves defining business goals, exploring funding options, and developing key financial documents like income statements and cash flow projections. The article emphasizes that a structured approach, including regular reviews and realistic projections, significantly enhances the chances of long-term success and sustainability for new ventures, as evidenced by research showing that strategic planning can lead to a higher survival rate for businesses.

Introduction

Crafting a financial plan is a pivotal step for aspiring entrepreneurs, serving as a strategic blueprint that guides their business endeavors. With a well-structured financial plan, entrepreneurs can not only articulate their financial goals but also outline actionable strategies to achieve them, thereby navigating the complex landscape of business ownership with confidence.

This article delves into the essential components of a successful financial plan, providing a comprehensive guide to help business owners establish a solid financial foundation. From understanding income statements and cash flow projections to setting SMART goals and avoiding common pitfalls, the insights shared here will empower entrepreneurs to make informed decisions that foster growth and sustainability.

By embracing these principles, business owners can enhance their financial literacy, attract potential investors, and ultimately realize their entrepreneurial dreams.

Understanding the Essentials of a Financial Plan for Entrepreneurs

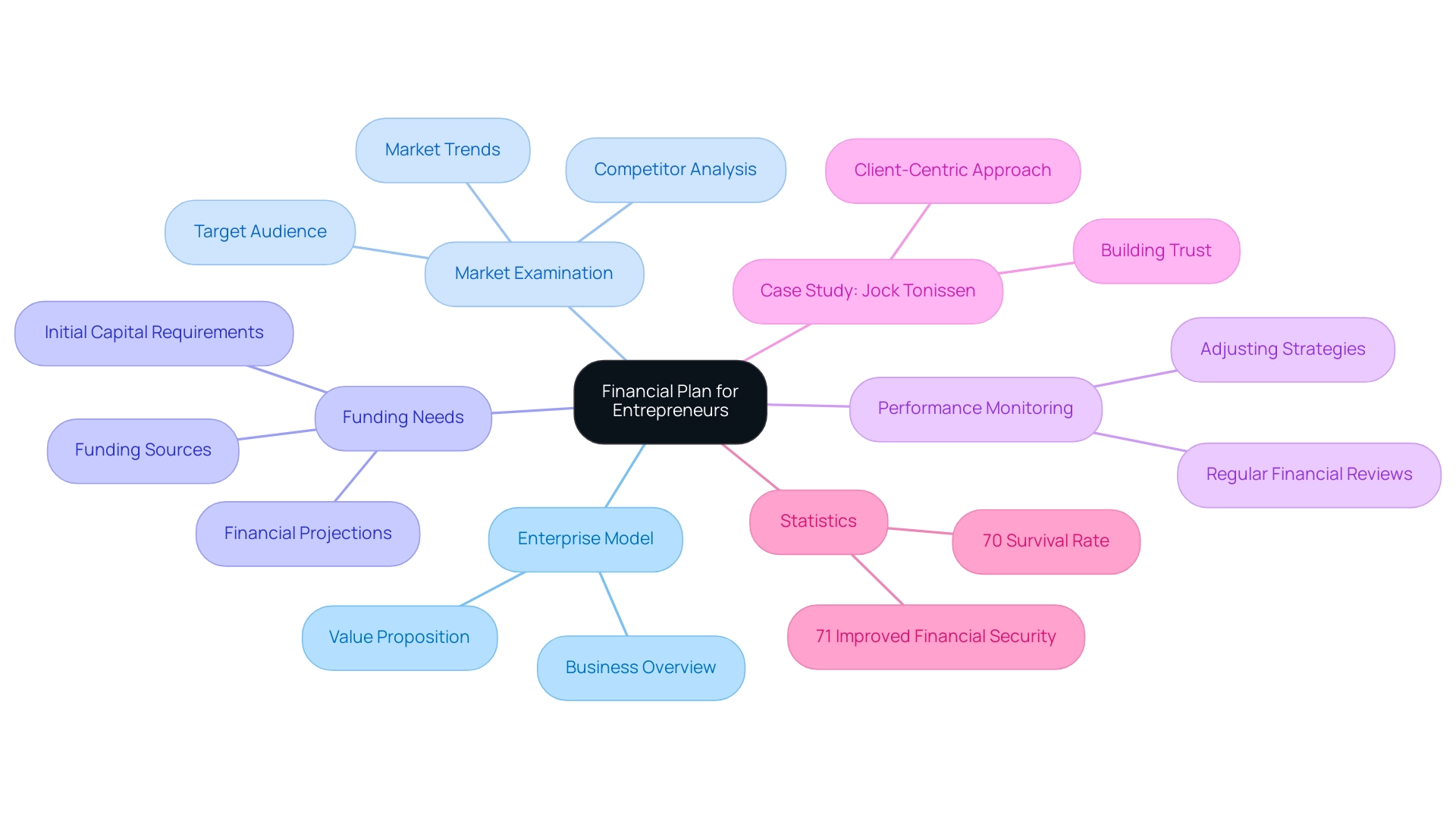

A well-designed monetary strategy is a vital resource for any aspiring entrepreneur, illustrating how to financial planning for new entrepreneurs while detailing the methods to achieve their economic objectives. It allows entrepreneurs to proactively navigate the challenges and opportunities that lie ahead. Key elements of a monetary strategy consist of:

- A detailed summary of your enterprise model

- Extensive market examination

- Distinct funding needs

Consistent oversight of economic performance is essential, as it enables prompt modifications in strategies to reach monetary goals. Recent data shows that around 70% of companies with a strategic approach endure beyond the initial five years, emphasizing how to financial planning for new entrepreneurs is essential. Moreover, a notable 71% of small business owners indicate that ownership has improved their economic security.

These insights emphasize the significance of understanding and executing how to financial planning for new entrepreneurs in relation to the key components of a budget plan. Jock Tonissen, a seasoned advisor with decades of experience, exemplifies this principle by emphasizing the value of personalized strategies tailored to meet the unique needs of clients. His method has cultivated trust-based connections that significantly aid in long-term economic success.

As Hobart Wealth mentions, ‘Through our established methods and tailored approach, we strive to help entrepreneurs in attaining prosperity and fulfilling their aspirations.’ By understanding these essentials, you can create a strategy that not only guides your decisions but also places you advantageously to draw in prospective investors and collaborators.

Key Components of a Successful Financial Plan

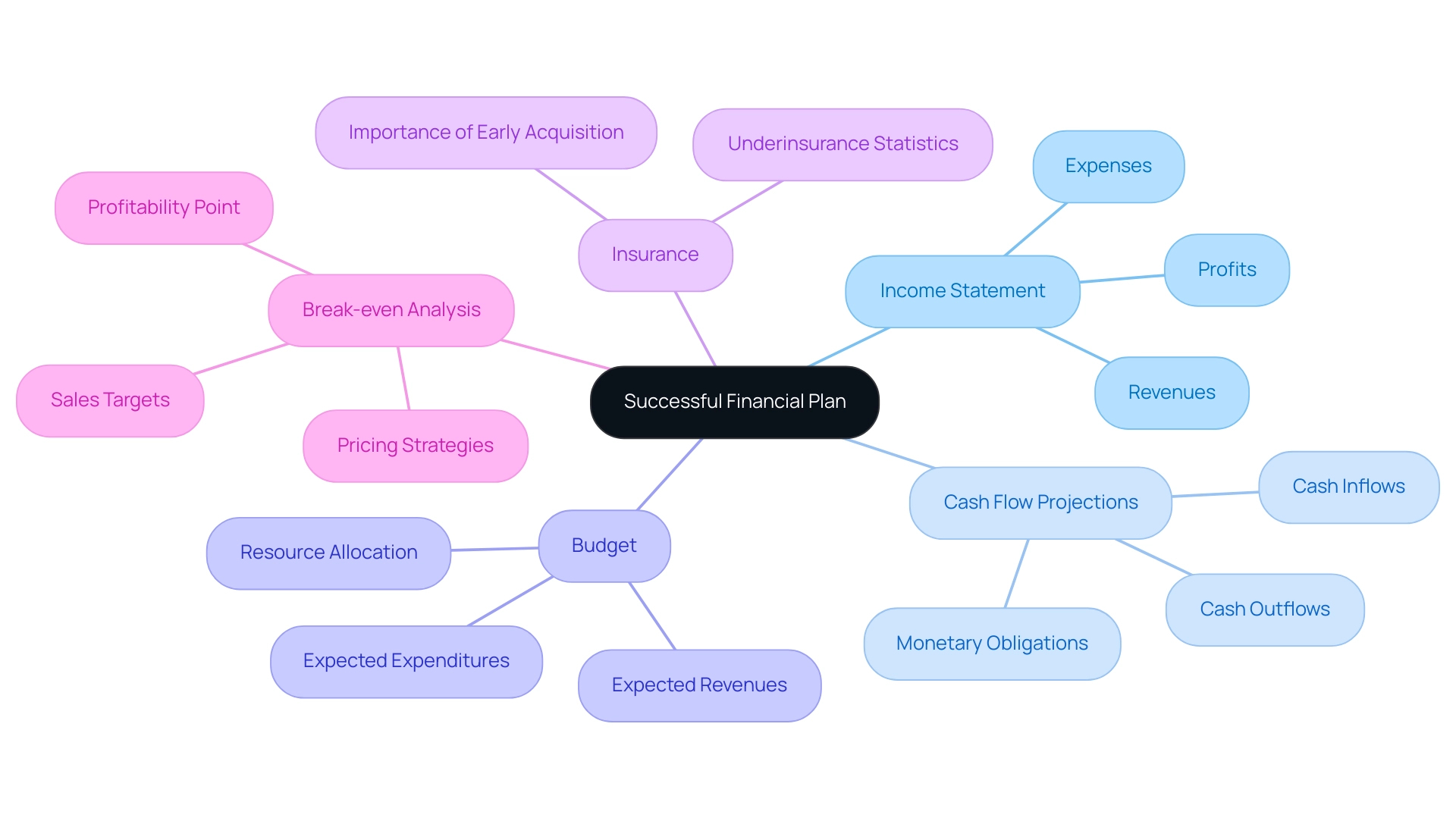

A strong monetary strategy is essential for understanding how to financial planning for new entrepreneurs, as it includes several vital elements that are crucial for guaranteeing sustainability and growth. Among these, the Income Statement serves as a foundational document, summarizing your revenues, expenses, and profits over a designated period. This statement offers insights into your business’s operational efficiency, enabling you to make informed decisions.

According to economic experts, a clear income statement is vital for understanding profitability and identifying areas for improvement.

Next, Cash Flow Projections are indispensable for effective management. These projections estimate your cash inflows and outflows, providing a roadmap to ensure that you can meet your monetary obligations. With the ever-changing landscapes of commerce, staying ahead in cash flow planning is essential, particularly as 2024 approaches with updated best practices.

As a guideline, saving 20% – 30% of your pre-retirement income aligns with the 80% income-replacement rule, which can be an important factor in your planning.

A well-structured Budget is also crucial, functioning as a detailed outline of expected revenues and expenditures. This tool aids in resource allocation, enabling you to prioritize spending and investment strategically. By adhering to sound budgeting principles, you can maintain control over your resources and align them with your business objectives.

Additionally, the significance of insurance cannot be overlooked. A recent study indicates that 84% of millennials are underinsured, with only 16% possessing sufficient insurance to safeguard their assets and family. This underscores the necessity of incorporating insurance as a critical component of your monetary plan to safeguard against unforeseen circumstances.

Lastly, conducting a Break-even Analysis is vital for any entrepreneur. This analysis helps identify the point at which your business will become profitable, equipping you with the knowledge needed to set realistic sales targets and pricing strategies. As Kris Borghesan, Chief Marketing Officer at FutureVault, emphasizes, understanding the economic landscape and utilizing digital vault solutions can enhance your management capabilities.

By understanding these key components—income statements, cash flow projections, budgets, break-even analysis, and the importance of insurance—you can learn how to financial planning for new entrepreneurs and establish a solid economic foundation that is essential for the longevity and success of your enterprise.

Step-by-Step Guide to Crafting Your Financial Plan

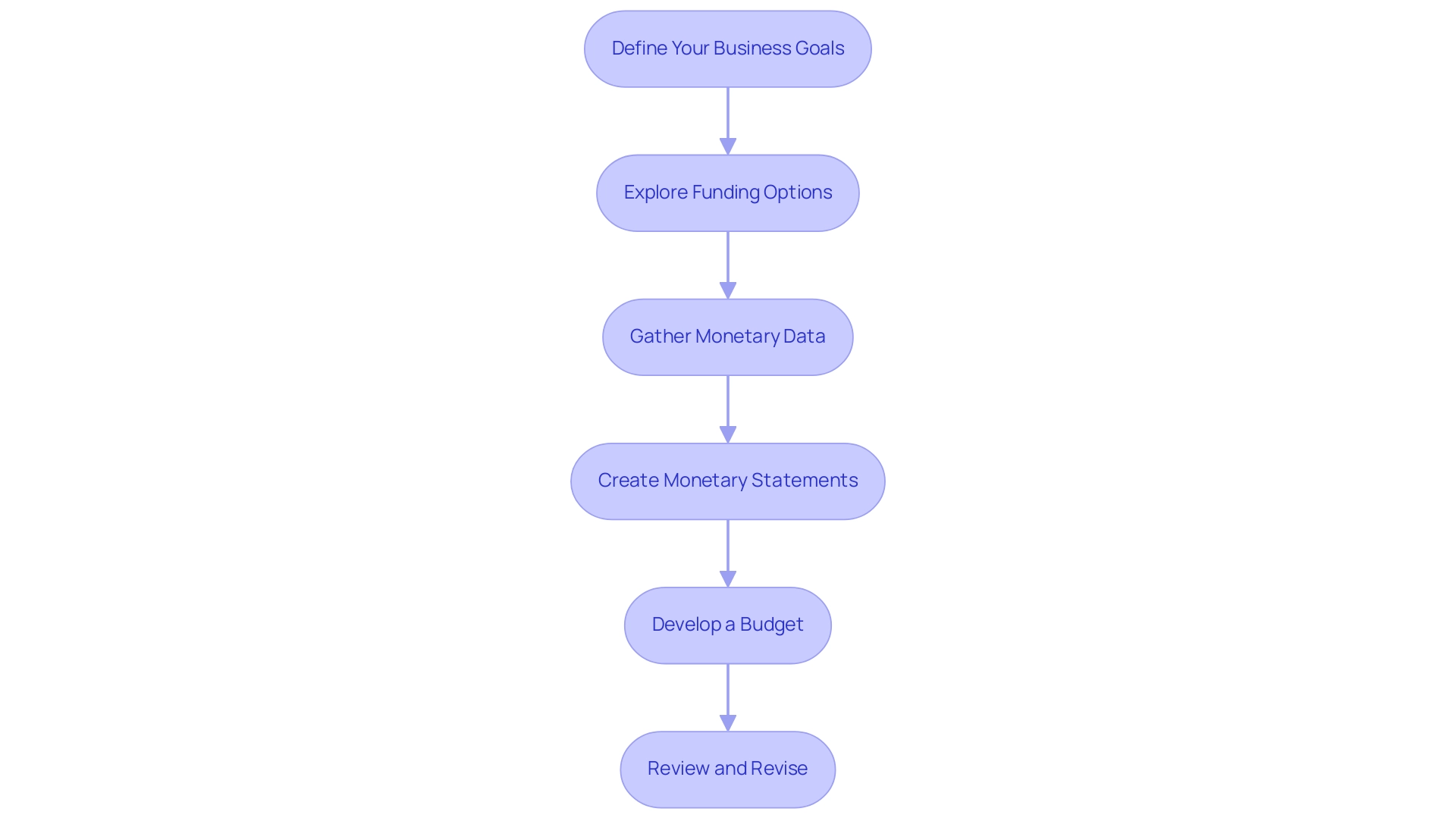

Developing a budget strategy is crucial for aspiring entrepreneurs, and understanding how to financial planning for new entrepreneurs will assist you in managing this process efficiently. Here’s a step-by-step guide to crafting your economic plan:

-

Define Your Business Goals: Start by identifying both your short-term and long-term objectives. Consider what you want to achieve financially and operationally, such as increasing revenue, expanding your market reach, or investing in new technology. For instance, Joe established a hierarchy of goals focusing on consumption in various areas, such as housing and education, which helps prioritize his monetary objectives.

-

Explore Funding Options: Understanding the various funding options available, including those from the U.S. Small Business Administration, can significantly influence your economic strategy. The SBA offers a range of funding programs tailored for small businesses, which can provide crucial support. Additionally, self-funding mechanisms through checking and savings accounts or cash equivalents can provide a valuable safety net. Using these accounts allows you to maintain control over your finances while also having immediate access to funds. This dual approach enables you to leverage external resources while ensuring you have a dependable monetary cushion.

-

Gather Monetary Data: Collecting precise monetary data is crucial. If you possess historical monetary records, analyze them for trends. If you’re just starting, conduct market research to create informed projections. Utilizing digital tools can streamline this process, allowing you to save time and enhance efficiency. As Don Whalen, Founder and President of PreciseFP, aptly states,

We like to say your client does the data entry for you.

This emphasizes the benefits of leveraging technology in data collection. For example, understanding Joe’s total expenditures of $25,300 can provide a benchmark for your own budgeting.

-

Create Monetary Statements: Develop key monetary documents, including your income statement, cash flow projections, and balance sheet. These statements will serve as the backbone of your monetary strategy, providing insights into your business’s economic health and operational efficiency.

-

Develop a Budget: Outline your expected revenues and expenses for the upcoming year. A well-organized budget not only assists you in allocating resources wisely but also readies you for possible economic challenges.

-

Review and Revise: The budgeting process is not static. Frequently review your plan to adjust to changes in the market or modifications in your operational model. This continuous assessment is essential for understanding how to financial planning for new entrepreneurs, ensuring that your investment strategy remains pertinent and efficient as your enterprise expands and develops.

Remember, understanding how to financial planning for new entrepreneurs can often feel overwhelming. Seeking assistance from a Certified Financial Planner™ Professional can provide invaluable guidance for both small and large monetary decisions, reinforcing the significance of professional support in developing a resilient fiscal strategy.

By following these steps, you can create a robust plan that not only supports your enterprise objectives but also adapts to the dynamic nature of the entrepreneurial landscape, effectively utilizing both self-funding through checking and savings accounts and external resources from the U.S. Small Business Administration.

Setting Financial Goals and Projections for Your Business

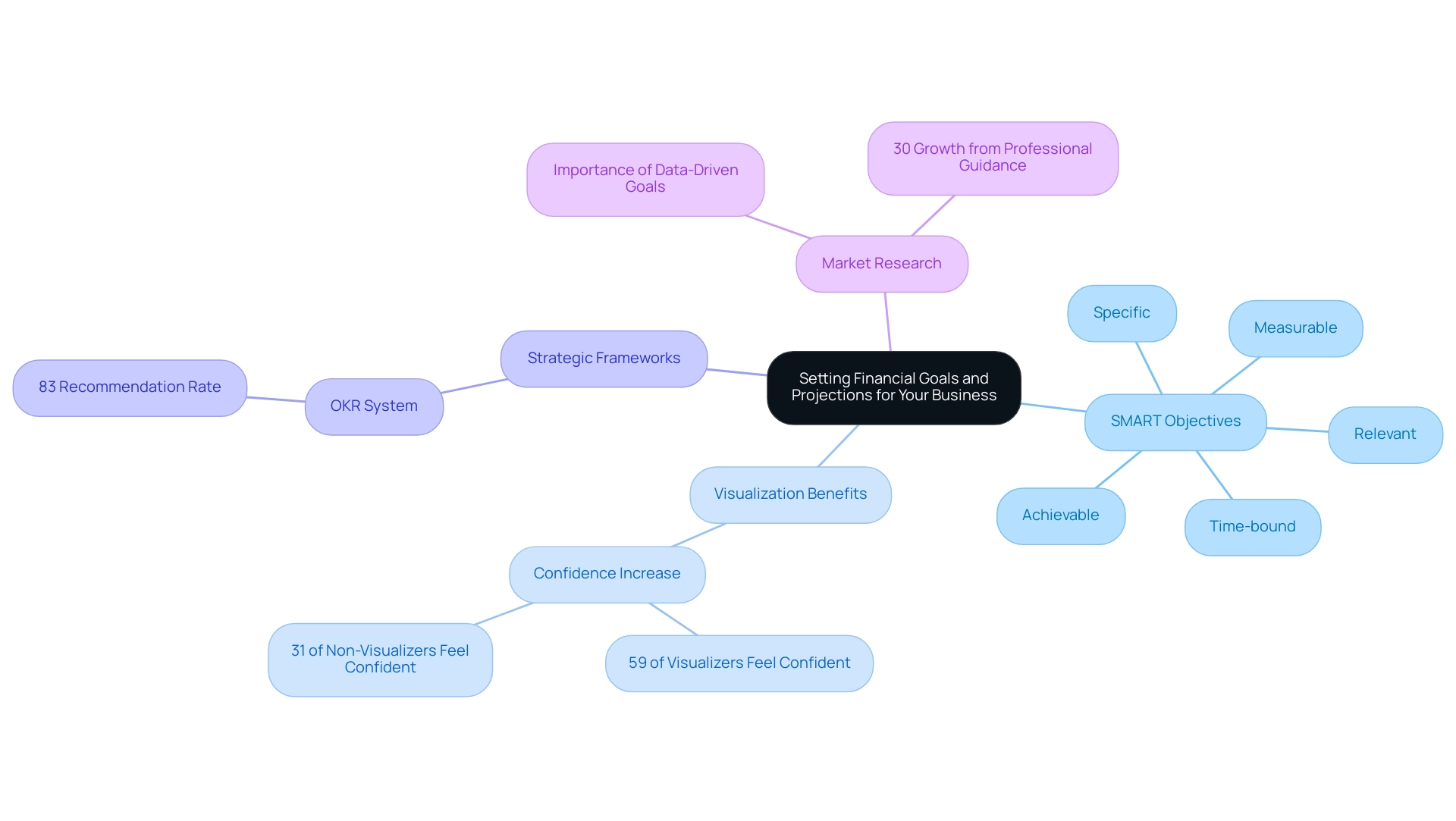

Establishing financial targets is a crucial step for any aspiring business owner and is essential for understanding how to financial planning for new entrepreneurs by creating objectives that are Specific, Measurable, Achievable, Relevant, and Time-bound (SMART). For instance, you might establish a target to increase revenue by 20% within the upcoming year or to cut operational costs by 10% over the next six months. These objectives should not be arbitrary; rather, they must be grounded in thorough market research, historical data, and industry benchmarks.

Research demonstrates that specific, challenging objectives can enhance performance 90% of the time, as evidenced by Locke and Latham’s Theory of Setting Objectives. Furthermore, it’s essential to consistently assess your objectives and forecasts to stay in tune with the constantly evolving market environment. Engaging in this practice not only helps you adjust to new market conditions but also reinforces your commitment to success.

As Simons wisely states,

When we establish objectives, we like to envision a bright future with our enterprise thriving, but to pinpoint your essential performance variables, you need to participate in an uncomfortable exercise and contemplate what can lead to your strategy’s failure.

A practical example of this is found in the case study titled ‘Benefits of Visualizing Objectives,’ which indicates that 59% of individuals who visualize their objectives report feeling more confident compared to only 31% who do not. Leveraging strategic frameworks like the OKR system can further enhance your ability to align organizational objectives, with 83% of companies recommending its effectiveness in improving outcomes.

Ultimately, keep in mind that understanding how to financial planning for new entrepreneurs, along with pursuing expert advice or using business planning software, can result in a 30% boost in business growth, making it crucial to invest in tools that aid in precise monetary projections and goal setting.

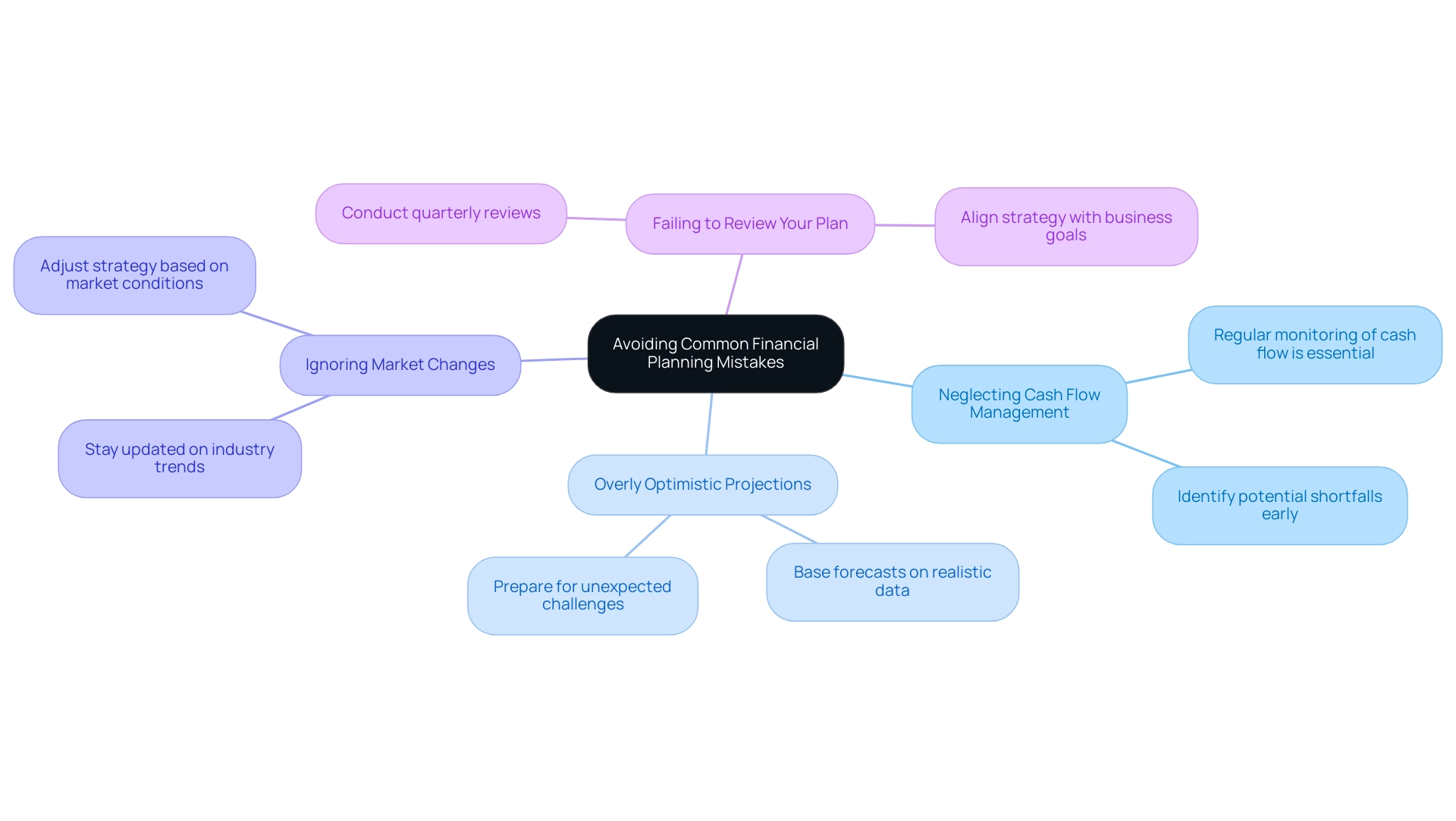

Avoiding Common Financial Planning Mistakes

To navigate the economic landscape successfully, aspiring entrepreneurs should understand how to financial planning for new entrepreneurs by being vigilant about avoiding typical planning mistakes, particularly the importance of comprehensive budgeting. Here are essential tips to maintain your economic health on track:

-

Neglecting Cash Flow Management: Always maintain a vigilant eye on your cash flow.

Insufficient cash flow is one of the primary reasons startups fail, so regular monitoring can help prevent potential shortfalls. -

Overly Optimistic Projections: While it’s inspiring to dream big, ensure that your revenue and expense forecasts are grounded in reality.

This realistic approach helps alleviate economic strain and prepares you for unexpected challenges. -

Ignoring Market Changes: The business environment is ever-evolving.

Staying updated on industry trends enables you to adjust your strategy and take advantage of opportunities or avoid pitfalls. -

Failing to Review Your Plan: A monetary plan is not static; it requires regular reassessment and adjustments to remain relevant.

Conduct quarterly reviews to ensure your strategy aligns with your business goals and market conditions.

Additionally, it’s crucial to understand how to financial planning for new entrepreneurs by crafting a comprehensive budget that encompasses both fixed and variable costs, clearly delineating between essential and discretionary expenses. Finding balance and strategically streamlining expenses without sacrificing quality of life can significantly enhance your venture’s economic health.

The significance of sound economic management is highlighted by the fact that while household savings increased during the pandemic, many have since depleted their savings. By acknowledging these pitfalls and taking proactive steps, you can learn how to financial planning for new entrepreneurs to create a more robust and resilient strategy that supports your entrepreneurial journey.

As Larry Richardson aptly puts it, ‘Trust. Integrity. Mutual respect. These are the operating principles I rely on when I work to develop an investment approach that is designed to meet my clients’ economic goals and objectives.’

Embracing these principles not only fosters trust but also enhances your resource management efforts, ultimately increasing your chances of success in budgeting and investment.

Furthermore, many adults feel unprepared to manage their resources due to a lack of basic knowledge about finances, as highlighted in a 2023 Ramsey Education report. This emphasizes the need for ongoing education in budgeting, investing, and credit scores to improve financial literacy among entrepreneurs.

Conclusion

A comprehensive financial plan is fundamental for aspiring entrepreneurs aiming to establish a successful business. By understanding essential components such as:

- Income statements

- Cash flow projections

- Budgets

- Break-even analysis

- The role of insurance

entrepreneurs can create a solid foundation that supports long-term growth and sustainability. The insights provided highlight the importance of regular monitoring and adaptability within the financial planning process, empowering business owners to navigate challenges effectively.

Setting SMART financial goals and making informed projections are critical steps in this journey. By grounding objectives in thorough market research and historical data, entrepreneurs can enhance their performance and align their strategies with the dynamic nature of the business landscape. The emphasis on avoiding common pitfalls, such as:

- Neglecting cash flow management

- Failing to review plans regularly

reinforces the necessity of a proactive approach to financial planning.

Ultimately, the journey of entrepreneurship is enriched by a well-crafted financial plan that not only articulates goals and strategies but also positions business owners favorably to attract investors and partners. By embracing these principles and continuously seeking knowledge, entrepreneurs can navigate their financial landscape with confidence, paving the way for success in their ventures.