Introduction

Transitioning from a conventional career path to the realm of business ownership is a journey filled with both excitement and uncertainty. Aspiring entrepreneurs must navigate a landscape that demands not only strategic planning but also a deep understanding of their motivations and values.

This article delves into the essential steps required for a successful transition, including:

- Cultivating the right mindset

- Establishing a solid business structure

- Securing financial foundations

- Building a supportive network

By embracing continuous learning and surrounding themselves with experienced advisors, individuals can effectively tackle the challenges of entrepreneurship, positioning themselves for long-term success in a competitive environment.

As the landscape of small business ownership continues to evolve, the insights shared here will empower aspiring business owners to make informed decisions and thrive in their new ventures.

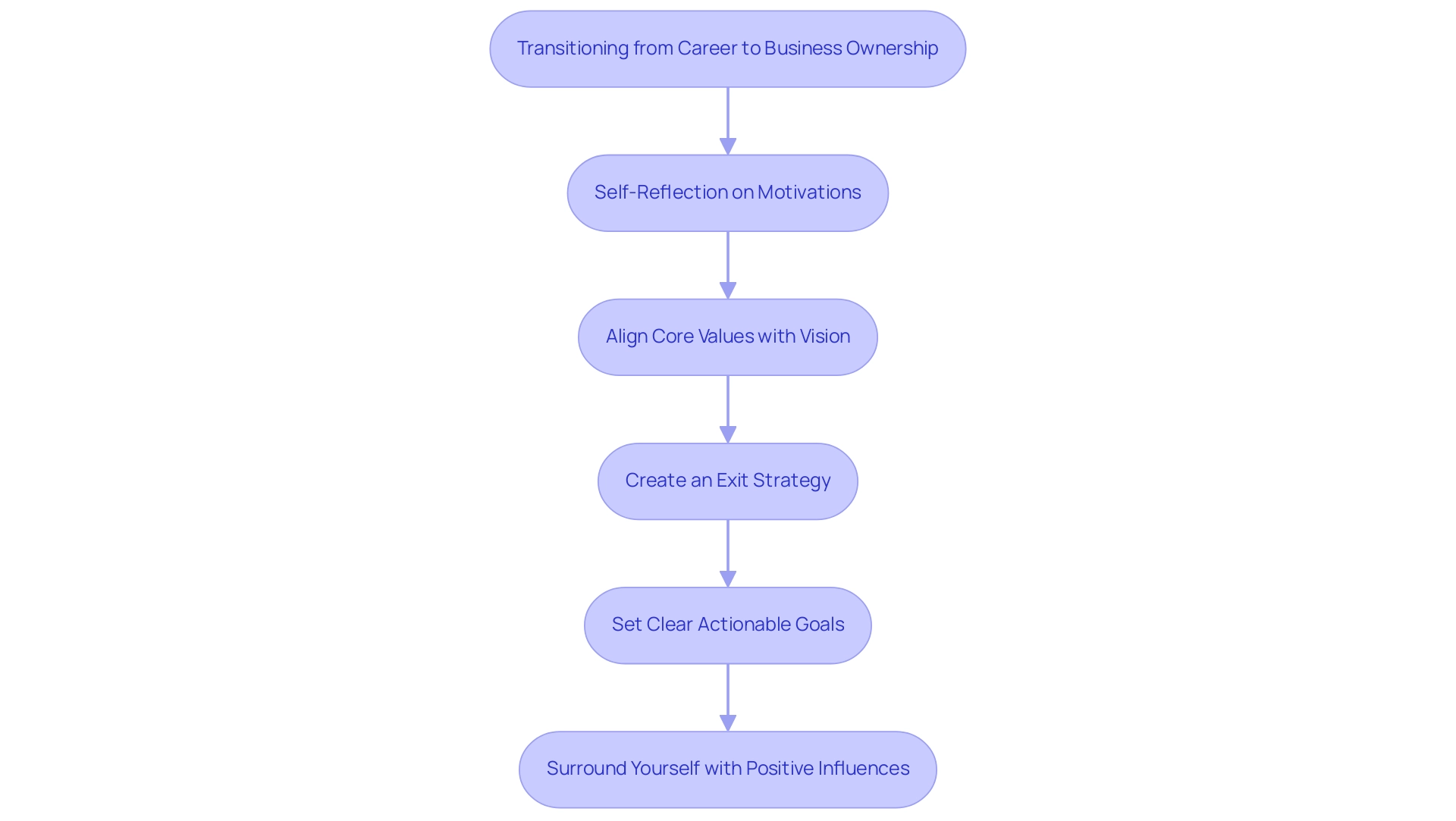

Shifting Mindsets: Preparing for the Transition to Business Ownership

A guide to How to transition from career to business ownership emphasizes that moving from a career to ownership requires deep self-reflection on your motivations. Start by asking yourself what specifically motivates your ambition to own a company. Grasping your core values and their alignment with your vision is vital, as negative exit motivations, or ‘push factors,’ can not only lessen your enthusiasm but also result in a decline in the worth of your enterprise if not addressed.

Bill Prinzivalli emphasizes this by stating,

I’ve written a book to help owners create the exit strategy and make the companies more valuable before transitioning to the next chapter. The Transition Handbook is full of practical advice, insights from experts and leaders, and actionable tools. This perspective underscores the importance of intentionality in your transition.

For additional guidance, consider ‘Your Career 2.0: A Survival Guide for The Battered Career Syndrome and Investor Syndrome,’ which acts as a guide to how to transition from career to business ownership, providing a comprehensive resource for navigating the challenges of career transitions. With around 33.2 million small enterprises in the United States, the importance of having a guide to How to transition from career to business ownership cannot be overstated for aspiring individuals. Cultivating an entrepreneurial mindset is vital; embrace uncertainty and view challenges as opportunities for growth.

The case study ‘Navigating the Soft Side of Exit’ illustrates that the exit process is nuanced and relational, requiring owners to consider both tangible and intangible factors. Setting clear, actionable goals and breaking them down into smaller, manageable steps can guide your journey effectively. Lastly, as you navigate this transition, surround yourself with positive influences, such as mentors or fellow business owners, to reinforce your new mindset and maintain motivation throughout the process.

Remember, success often hinges on both tangible strategies and the relational dynamics of your journey.

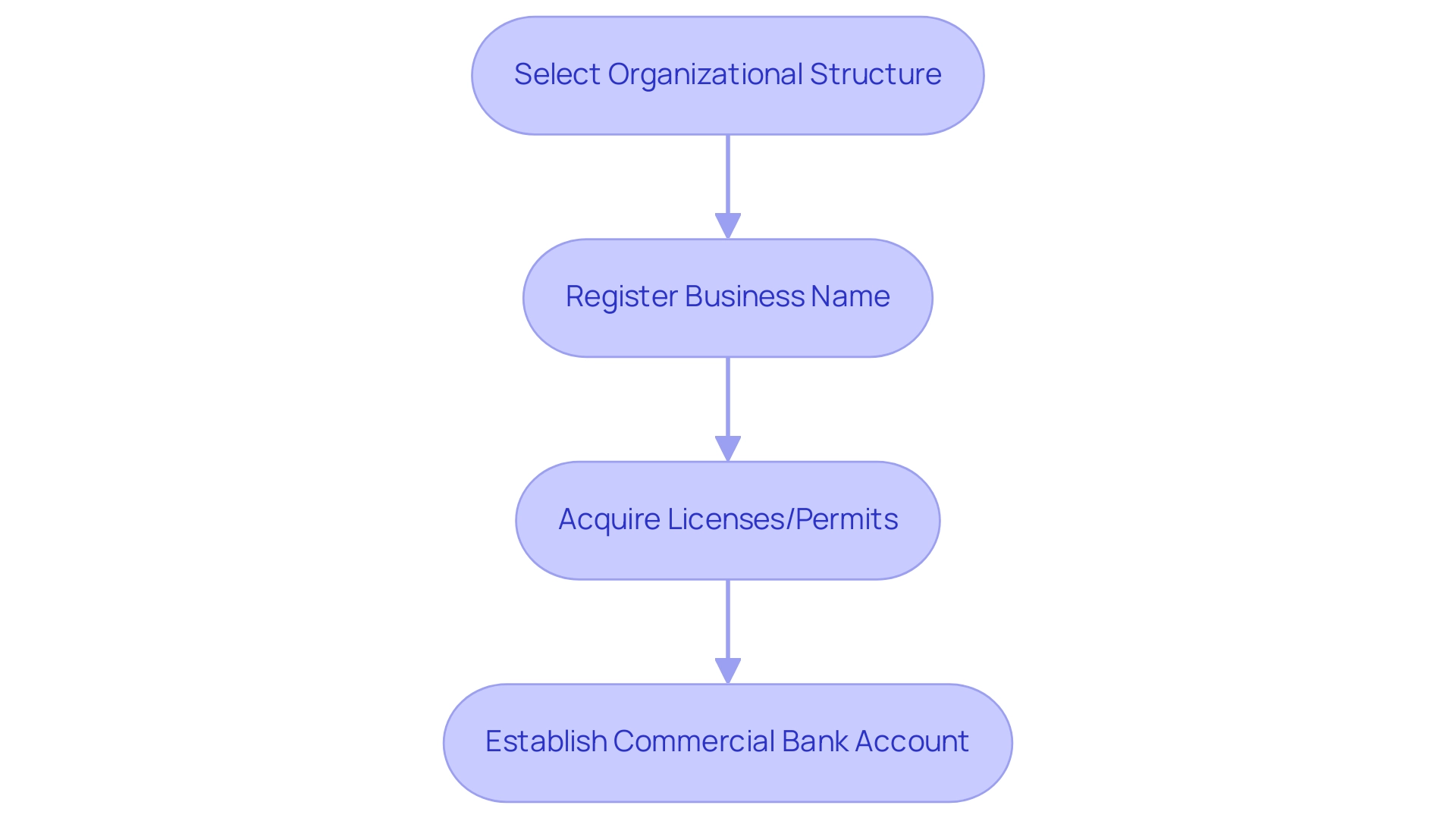

Essential Steps to Establish Your Business: From Structure to Registration

Selecting the appropriate organizational framework is a crucial initial move for aspiring individuals seeking a guide to how to transition from career to business ownership, as it directly influences your objectives and operations. Options such as sole proprietorships, limited liability companies (LLCs), and corporations each come with specific implications regarding liability, taxation, and management. For instance, LLCs offer personal liability protection, which can be crucial in safeguarding your assets.

According to recent statistics, small enterprise failure rates have seen a decline of over 30% since 1977, largely due to advancements in technology and resources that support new entrepreneurs in making informed decisions. In Missouri, there are projected to be 6,055 company formations within the next four quarters of 2023, highlighting a growing entrepreneurial environment. Furthermore, small enterprises are vital to the economy, representing 99.9% of all firms in the U.S. and employing over 47.3% of the private workforce.

This highlights the significance of making informed decisions, which can serve as a guide to how to transition from career to business ownership. Once you’ve determined the most suitable structure for your venture, the next step is to register your name and acquire any necessary licenses or permits. This ensures compliance with local government and industry regulations.

Additionally, establishing a separate commercial bank account is essential for maintaining financial clarity and integrity, allowing you to distinguish between personal and operational expenses. Recent news indicates an 8.2% shift in new applications submitted in Tennessee in December 2023 compared to the prior year, with a total of 96,903 new applications, suggesting a lively market for new ventures. Matthew Woodward observes that 25% of entrepreneurs embark on ventures when an opportunity presents itself, making it essential to have your foundational elements in place to seize such moments effectively.

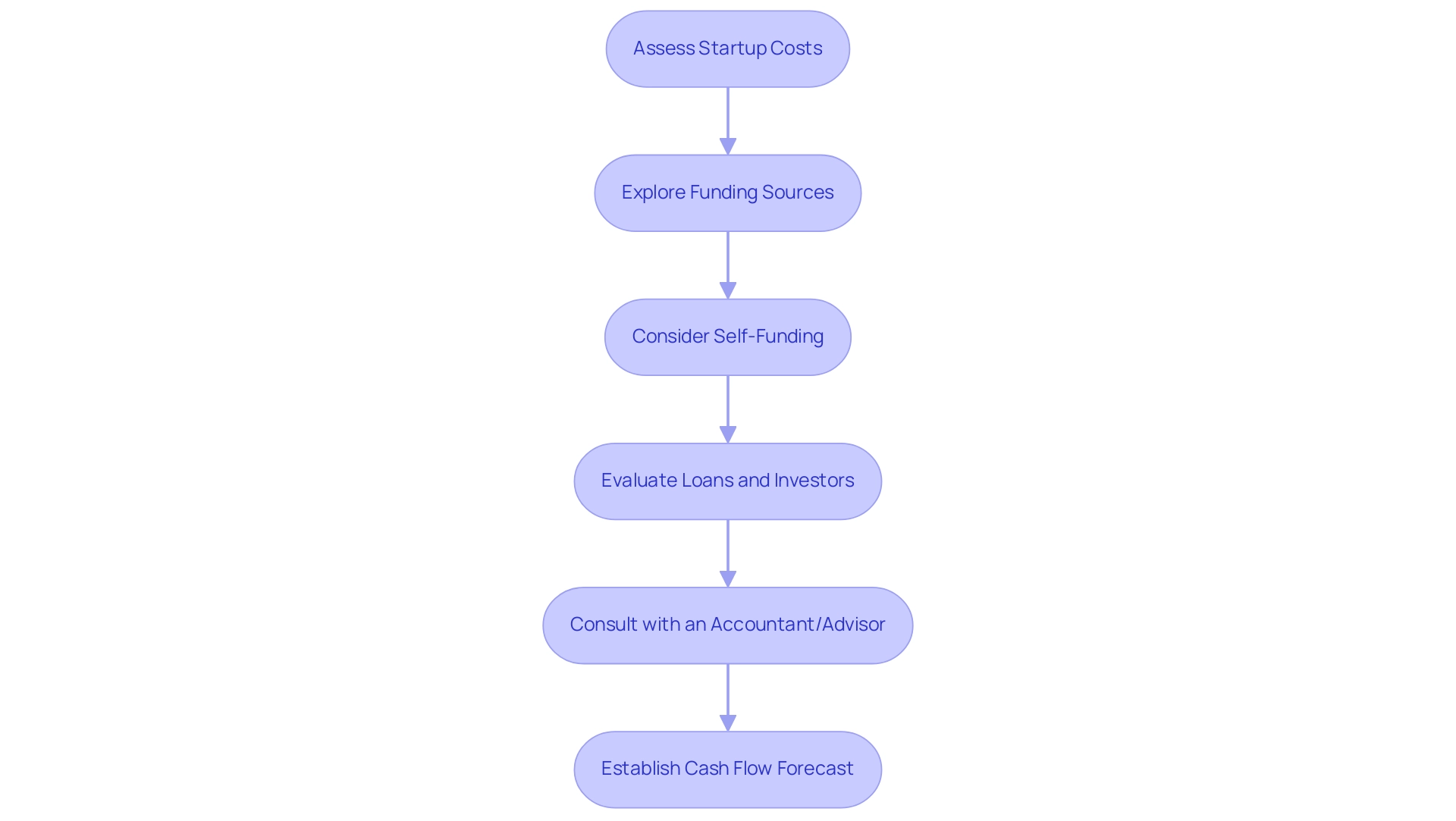

Financial Foundations: Planning for Your Business’s Economic Success

A thorough plan that details your monetary forecasts, budget, and funding sources is a crucial guide to how to transition from career to business ownership for any thriving enterprise. Start by meticulously assessing your startup costs, which should encompass equipment, inventory, and operational expenses. Recent findings indicate that the average startup costs for small enterprises in 2024 are expected to be more significant than in previous years, making it imperative to have a clear understanding of your financial landscape.

As you investigate different funding choices at your disposal, think about self-funding methods via your checking and savings accounts, as they can offer a strong base for your venture. Additionally, look into loans and potential investors, including angel investors, who can offer not only capital but also valuable mentorship and connections through personal networks. This diversification of funding sources is crucial for business sustainability.

Furthermore, funding options available from the U.S. Small Business Administration can provide additional support, including loans and grants tailored for small businesses, which serves as a guide to how to transition from career to business ownership, while a proactive approach to maintaining a cash flow forecast will help you anticipate income and expenses effectively. Interacting with an accountant or advisor can provide invaluable guidance as you refer to the guide to how to transition from career to business ownership while navigating the complexities of planning. Their expertise will ensure that you establish sound monetary practices while comprehensively understanding your tax obligations and possible deductions.

This strategic approach not only strengthens your business’s economic foundation but also serves as a guide to how to transition from career to business ownership in an evolving marketplace. As Roxanne Voidonicolas aptly states,

By proceeding, you agree to the Terms and Conditions and Privacy Policy

—it’s essential to understand the commitments you are making, particularly in the monetary realm. Understanding these commitments is crucial, especially when considering the potential impact of financial planning on profitability.

Furthermore, acknowledging the challenges consumers encounter in locating small enterprises—where 42% reported difficulty despite a preference for shopping small—emphasizes the necessity of effective planning to enhance visibility and accessibility for new ventures.

Building Your Support Network: The Role of Advisors in Your Transition

To embark on your journey as an entrepreneur, it’s essential to refer to the guide to How to transition from career to business ownership, which emphasizes identifying key advisors who can provide expertise in critical areas such as finance, marketing, and legal matters. Considering that the average age of a consultant is 44.8 years, with 61% exceeding the age of 40, their expertise is crucial for navigating the complexities of ownership. Anand Sekhar, vice president of Practice Management & Consulting at Fidelity Institutional, emphasizes this necessity, stating,

Younger investors are actively seeking guidance, and if you cannot meet their diverse and unique needs today, they will find someone who can — and take the transfer of wealth with them.

This underscores the importance of a guide to How to transition from career to business ownership, which can help aspiring innovators find informed advisors to assist them during the early phases of their ventures.

Alongside financial advisors, finding mentors with industry expertise can offer you essential insights and guidance customized to your particular operational context. Participating in local commerce associations or online networks enables you to connect with other innovators, enhancing your learning journey through shared narratives and assistance. Networking events, such as the upcoming International Business Ownership Expo in New York City from May 30th to June 1st, 2024, present excellent opportunities not only to expand your support network but also to cultivate relationships that can lead to fruitful collaborations.

This event is designed to connect aspiring entrepreneurs with over 300 exhibiting franchise brands, providing a variety of franchise opportunities at different investment levels, along with comprehensive educational seminars that cover essential topics for success.

Surrounding yourself with knowledgeable and supportive individuals is crucial as outlined in the guide to How to transition from career to business ownership, helping you overcome the inevitable challenges that come with ownership. The financial advisory sector, which commands 40% of the global market in North America and boasts assets under administration totaling $9.6 trillion at Fidelity alone, exemplifies the competitive landscape in which you’ll be operating. Major firms like Ameriprise Financial, BlackRock, Goldman Sachs, Citigroup, Morgan Stanley, and Wells Fargo Advisors underline the importance of having access to robust advisory services.

By actively building a strong support network and engaging in events like the International Business Ownership Expo, you position yourself for success as you navigate your entrepreneurial journey while also empowering yourself through resources like the global book launch of ‘Your Career Revolution™.’ Don’t miss out on this opportunity—register today and take the first step towards finding your perfect franchise match.

Embracing Continuous Learning: Adapting to Your New Role as a Business Owner

As a new entrepreneur, embracing a commitment to lifelong learning is vital for your growth and the success of your venture. Under the guidance of a career ownership coach like Parnell Woodard, who believes in a personalized and supportive approach, you can explore tailored resources such as:

- Workshops

- Online courses

- Industry conferences

These resources enhance your skill set and keep you aligned with market trends and best practices. Engaging with professional associations not only provides invaluable training and networking opportunities but also connects you with like-minded individuals who share your ambition for improvement.

Regularly assess your skills and knowledge, and be open to constructive feedback from peers and mentors, as this reflects your adaptability to change. Embracing challenges as unique learning experiences fosters a culture of continuous improvement within your business, better positioning you for long-term success. Recent findings indicate that 92% of survey respondents believe that training goals should reinforce a positive employee experience, highlighting the importance of building diverse teams and enhancing engagement.

Additionally, 75% of employees are eager to participate in manager-assigned courses, showcasing the value of structured learning opportunities. As noted by Devlin Peck, 70% of employee learning occurs informally on the job, reinforcing the need to integrate informal learning into your development strategy. By focusing on continuous learning and aligning your development goals with these broader organizational trends, you enhance your operational performance and contribute significantly to your overall employee experience.

For further resources, consider downloading the Funding Options and Education infographic to aid in your career development.

Conclusion

Transitioning into business ownership is a multifaceted journey that requires careful planning and introspection. By cultivating a strong entrepreneurial mindset, aspiring business owners can embrace uncertainty and view challenges as opportunities for growth. Understanding personal motivations and aligning them with business goals is crucial for fostering enthusiasm and ensuring long-term commitment.

Establishing a solid business structure and securing the appropriate registrations lays a critical foundation for any new venture. Choosing the right structure protects personal assets and positions the business for compliance and operational success. Furthermore, a comprehensive business plan that includes detailed financial projections and diverse funding strategies is essential for navigating the complexities of entrepreneurship. Engaging with financial advisors can enhance understanding of fiscal responsibilities and help ensure sustainability.

A robust support network is equally vital. Surrounding oneself with knowledgeable mentors and industry peers can provide invaluable guidance and encouragement throughout the entrepreneurial journey. Networking opportunities, such as industry expos, can facilitate connections that lead to fruitful collaborations.

Lastly, a commitment to continuous learning is necessary for adapting to the ever-evolving business landscape. Embracing education and seeking feedback fosters a culture of improvement, positioning business owners for long-term success. By integrating these strategies, aspiring entrepreneurs can not only navigate the complexities of their transition but also thrive in the competitive world of business ownership.