Overview

Land is often seen as a non-current asset, a classification that resonates with many individuals navigating the complexities of financial management. This perspective arises from the long-term nature of land, which typically isn’t converted into cash within a year—unless, of course, there’s an intention for immediate sale.

Have you ever felt the weight of such decisions? The article highlights essential criteria for this classification, such as the asset’s intended use and marketability. It emphasizes that land is generally held for long-term investment rather than short-term liquidity, a choice that reflects a deeper commitment to stability and growth.

You are not alone in this journey; many find comfort in understanding that such decisions are part of a larger narrative of financial security and aspiration.

Introduction

Navigating the world of asset classification can feel overwhelming, especially in today’s rapidly changing economic landscape. We understand that for both businesses and individuals, grasping the differences between current and non-current assets is not just a technicality; it can deeply influence financial strategies, investment decisions, and even career trajectories.

Current assets, like cash and inventory, are essential for maintaining liquidity, while non-current assets such as land and machinery are vital for long-term growth. If you’re transitioning careers or seeking financial independence, understanding these concepts can empower you to make informed decisions and enhance your financial literacy.

This article explores the intricacies of asset classification, focusing on the unique characteristics of land, its implications for financial reporting, and the importance of accurate classification in achieving your professional and financial goals.

Remember, you are not alone in this journey; with the right knowledge, you can take charge of your financial future.

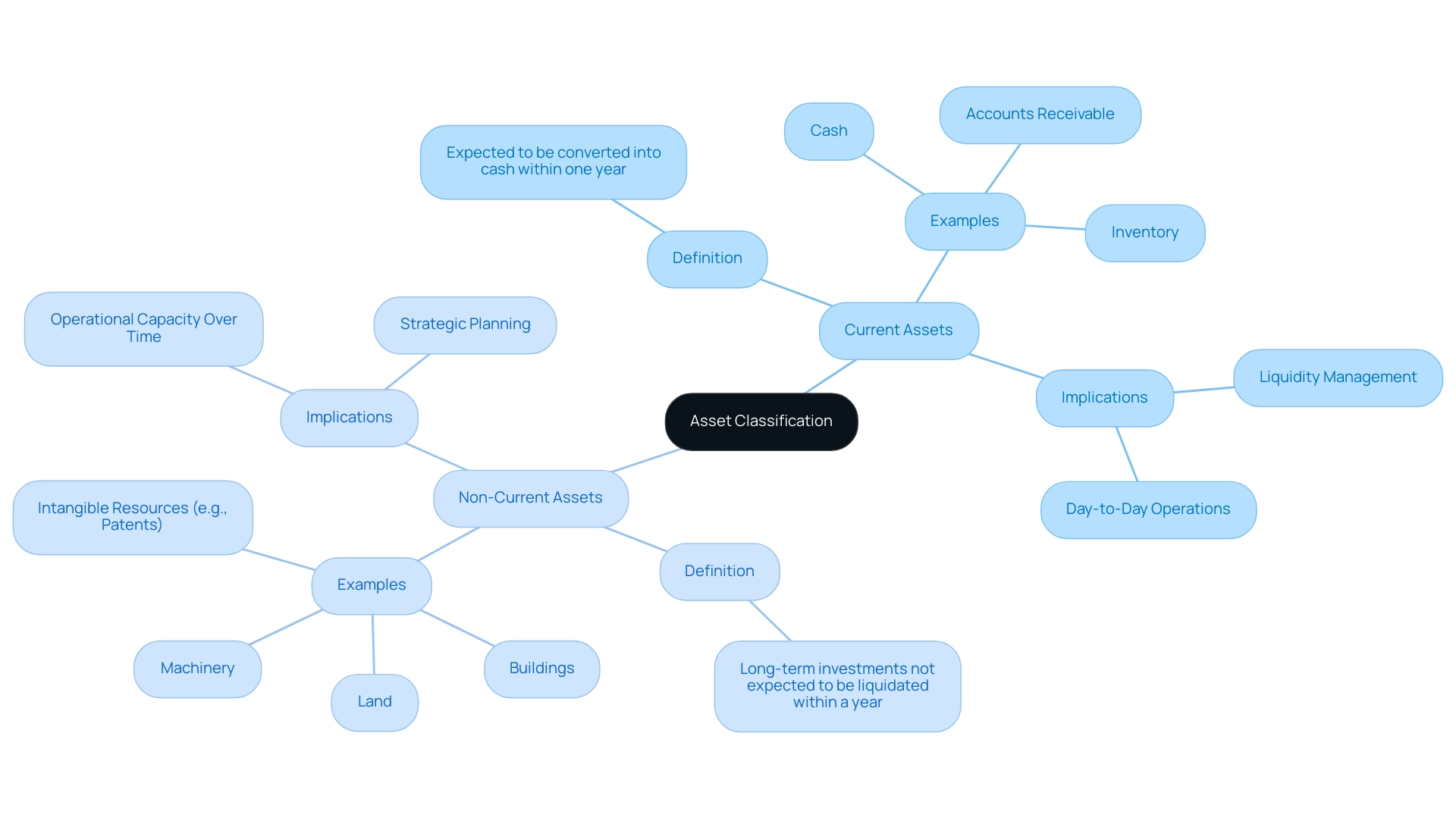

Understanding Asset Classification: Current vs. Non-Current Assets

Current resources are defined as those items expected to be converted into cash within one year. This category typically includes cash, accounts receivable, and inventory—essential components for day-to-day operations and liquidity management. In today’s evolving job market, understanding these financial concepts is crucial for career transitioners like you, seeking to navigate your path toward financial independence and empowerment.

On the other hand, non-current resources represent long-term investments that are not anticipated to be liquidated within a year. Examples include land, buildings, machinery, and intangible resources like patents, all of which contribute to a company’s operational capacity over time. For individuals moving from conventional jobs to career ownership, recognizing the importance of these resources can be vital in creating a sustainable future.

The significance of accurately classifying assets on accounting statements cannot be overstated. Proper classification impacts not only the balance sheet but also shapes business strategy, investment choices, and health assessments. Misclassification can lead to misleading ratios and hinder effective decision-making.

Understanding these concepts is particularly important for career transitioners, as financial literacy can significantly influence your career decisions and opportunities, especially in a declining job market where employability and financial security are paramount.

To assist you in determining whether an asset is current or non-current, consider the following checklist:

- Is the asset expected to be converted into cash within one year? If yes, then it is confirmed that land is a current asset.

- Is the resource intended for long-term use or investment? If yes, it is land a current asset.

- Evaluate the liquidity of the resource: Can it be easily sold or converted to cash? If so, it leans towards being a current resource.

- Assess the resource’s usage: Is it employed in daily operations or retained for future growth? Daily operational resources are typically current, while those held for long-term benefits are non-current.

For instance, Freeport-McMoRan reported $1.34 billion in non-current inventory, labeled as ‘Long-term mill and leach stockpiles.’ This illustrates that non-current inventory is not exclusive to the pharmaceutical sector but can also be found in other industries. This example highlights the importance of understanding the classification of resources in various contexts, particularly for those looking to mitigate risks and fast-track their new careers.

As Parnell Woodard, a Career Ownership Coach, emphasizes, “Transitioning from traditional employment to career ownership requires a solid understanding of economic concepts, which can empower individuals to make informed decisions about their professional futures.”

Understanding the distinctions between current and non-current assets is crucial for effective financial management and strategic planning. This knowledge is especially important as businesses and individuals navigate evolving economic landscapes in 2025.

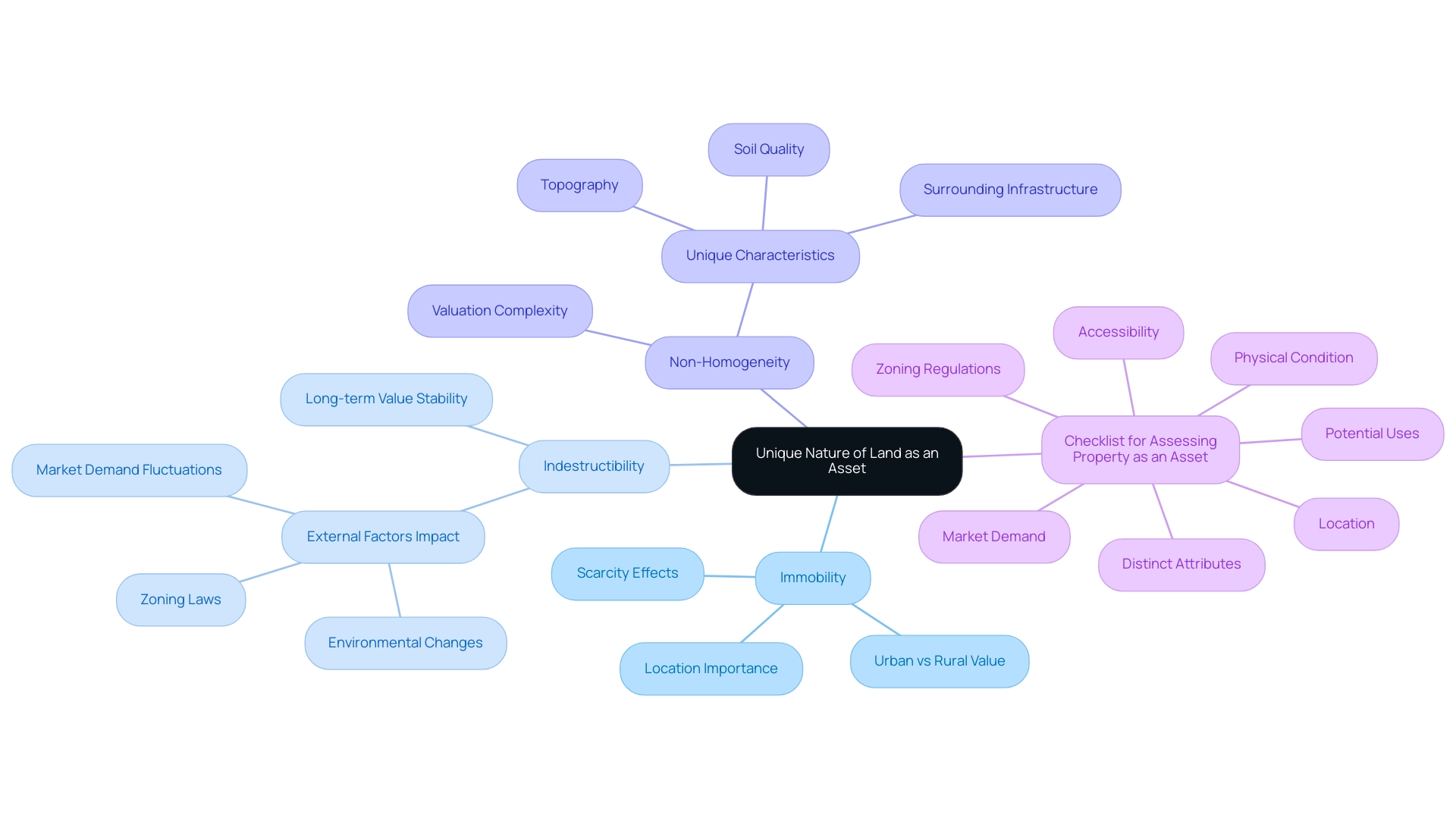

The Unique Nature of Land as an Asset

-

Immobility: Land is inherently immobile, meaning it cannot be moved from one location to another. This characteristic significantly influences its value, as the location of the property plays a crucial role in determining its desirability and potential uses. Urban areas, for instance, typically command higher prices due to their accessibility and proximity to resources compared to rural regions, which may have limited applications. Scarcity influences the worth of property depending on its location, highlighting the significance of grasping these dynamics for career transitioners pursuing economic stability and growth. Remember, you are not alone in navigating the emotional strain that can come with unjust or unequal salaries; understanding these factors can empower you on your journey.

-

Indestructibility: Unlike many other assets, real estate is indestructible; it does not deteriorate or wear out over time. This permanence contributes to its long-term value, making it a stable investment. However, while the area itself remains intact, its value can fluctuate based on external factors such as zoning laws, environmental changes, and market demand. As Parnell Woodard, a Career Ownership Coach, highlights, comprehending these factors is essential for individuals moving towards career ownership. This understanding enables informed choices regarding investments and helps manage the challenges of employability and economic independence. It can also ease some of the emotional weights linked to economic instability, reminding you that there are paths to stability and growth.

-

Non-Homogeneity: Each plot of ground is unique, defined by distinct characteristics such as topography, soil quality, and surrounding infrastructure. This non-homogeneity means that no two pieces of property are exactly alike, complicating valuation and necessitating a tailored approach to assessment. Factors such as usage potential and local market conditions must be considered when determining value, which is essential for career transitioners looking to leverage their assets effectively. The unique characteristics of property have significant implications for its valuation and classification in financial statements, especially regarding whether land is a current asset. For instance, the immobility of property means that its value is closely tied to its location, which can change over time due to urban development or shifts in market demand. Indestructibility ensures that property retains its value over the long term, but external factors can still impact its market price. Non-homogeneity requires a detailed analysis of each parcel to accurately assess its worth, making it essential for investors and accountants to understand these characteristics thoroughly. The 11th Edition of ‘Fundamentals of Engineering Economic Analysis’ provides 1,012 solutions that can aid in this understanding, further supporting career transitions in their journey towards financial freedom and personal agency. Additionally, ‘Your Career 2.0: A Survival Guide for The Battered Career Syndrome and Investor Syndrome’ serves as a valuable resource for those navigating these challenges.

Checklist for Assessing Property as an Asset

When classifying property as an asset, consider the following characteristics:

- Location: Assess the geographical position and its implications for value.

- Physical Condition: Evaluate the terrain’s topography and any environmental factors.

- Zoning Regulations: Understand local zoning laws that may influence the use of property.

- Market Demand: Examine current market trends and demand for property in the area.

- Potential Uses: Consider the various applications of the area and how they may impact its value.

- Accessibility: Assess the availability of the area and its closeness to essential services.

- Distinct Attributes: Recognize any distinctive traits that may improve or diminish the value of the property.

By methodically evaluating these traits, individuals and companies can make educated choices regarding whether land is a current asset in the categorization and appraisal of real estate as a resource. The Entrepreneur’s Source’s Career Ownership Coaching services can help individuals in grasping property valuation, as part of their career transition journey, ultimately empowering them to achieve financial independence and personal growth.

Key Criteria for Classifying Land as a Current Asset

-

Criteria for Classifying Land as a Current Asset: Understanding how to classify land can be challenging, but several key criteria can guide you:

- Intended Sale: If you plan to sell the land within one year, it qualifies as a current asset, providing you with immediate opportunities.

- Active Development Plans: Land that is actively being developed or improved for sale or operational purposes can also be classified as a current asset, reflecting your proactive approach.

- Marketability: The land must be readily marketable, indicating that it can be sold quickly without significant loss in value. Recent insights from the CA-Markov model predict conversions in land use, which can affect marketability and liquidity, reminding us of the ever-changing landscape.

- Liquidity: The asset should be convertible to cash within a short timeframe, typically within one year, ensuring you have the flexibility you need.

-

Examples of Scenarios for Current Asset Classification:

- Imagine a real estate developer who purchases a parcel of land with the intent to build residential units and sell them within the next year. This is a proactive step toward achieving their goals.

- Consider a company that acquires land for future expansion but plans to sell it within the next twelve months due to a change in strategic direction. This adaptability is crucial in today’s market.

- Think about agricultural land that is being prepared for sale after a successful harvest season, showcasing the importance of timing.

-

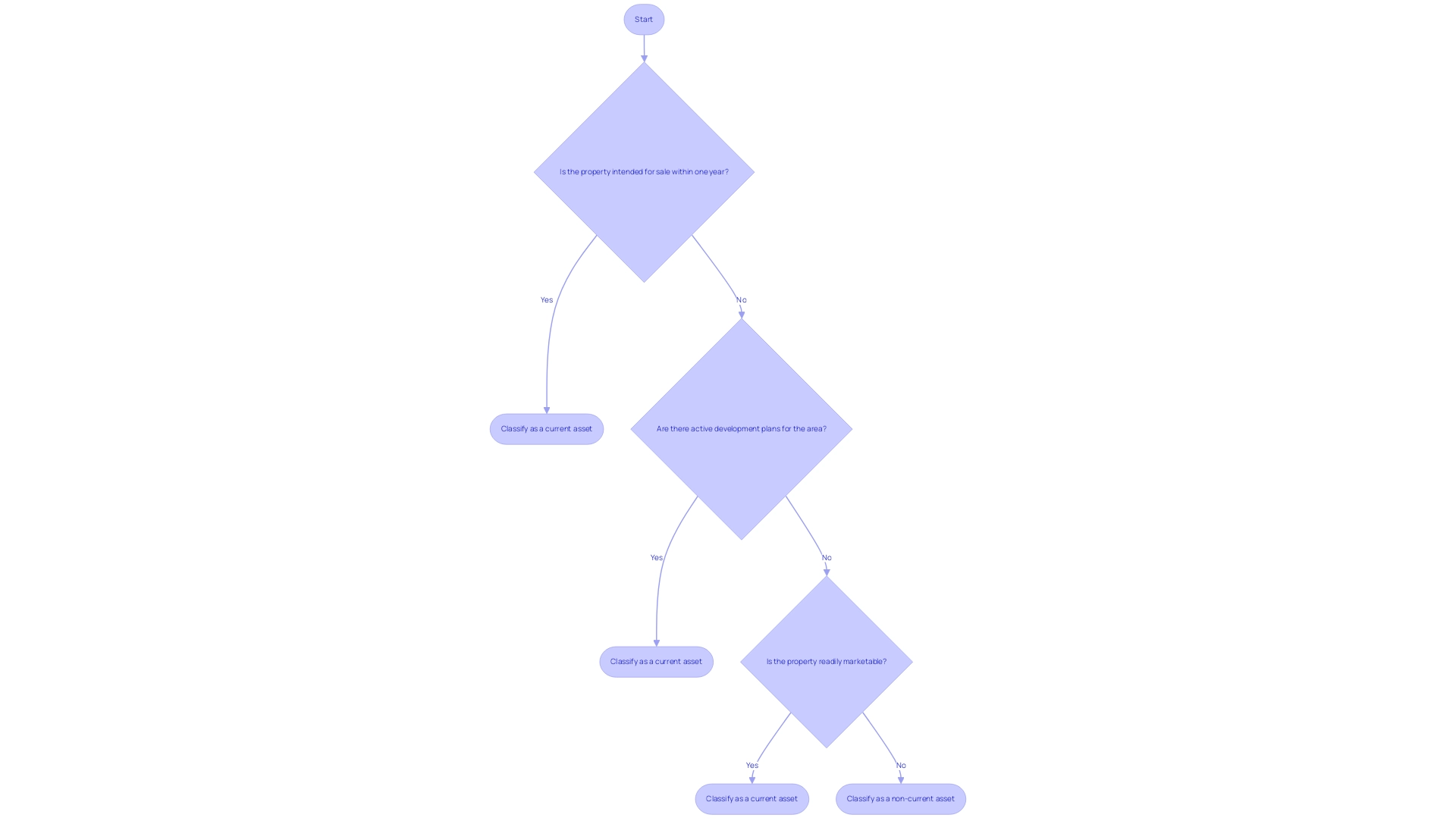

Decision-Making Flowchart: To assist you in determining the classification of land, consider the following flowchart:

- Is the property intended for sale within one year?

- Yes: Classify as a current asset, providing you with clarity.

- No: Proceed to the next question.

- Are there active development plans for the area?

- Yes: Classify as a current asset, reflecting your commitment to progress.

- No: Proceed to the next question.

- Is the property readily marketable?

- Yes: Classify as a current asset, ensuring you have options.

- No: Classify as a non-current asset, guiding your next steps.

- Is the property intended for sale within one year?

-

Importance of Documentation and Intent: Proper documentation is crucial in asset classification. Clear records of intent, such as sales agreements or development plans, support the idea that land is a current asset. Remember, understanding intent is vital not only in career transitions but also in monetary decision-making. This documentation aids in compliance with accounting standards and provides transparency for stakeholders. Furthermore, reflecting on the case study about the impact of the Great Recession on property values highlights the real-world implications of classification and its effects on reporting. Comprehending the purpose behind property acquisition and its intended use is essential for precise monetary reporting and strategic decision-making. You are not alone in navigating these complexities; support is available to help you through every step.

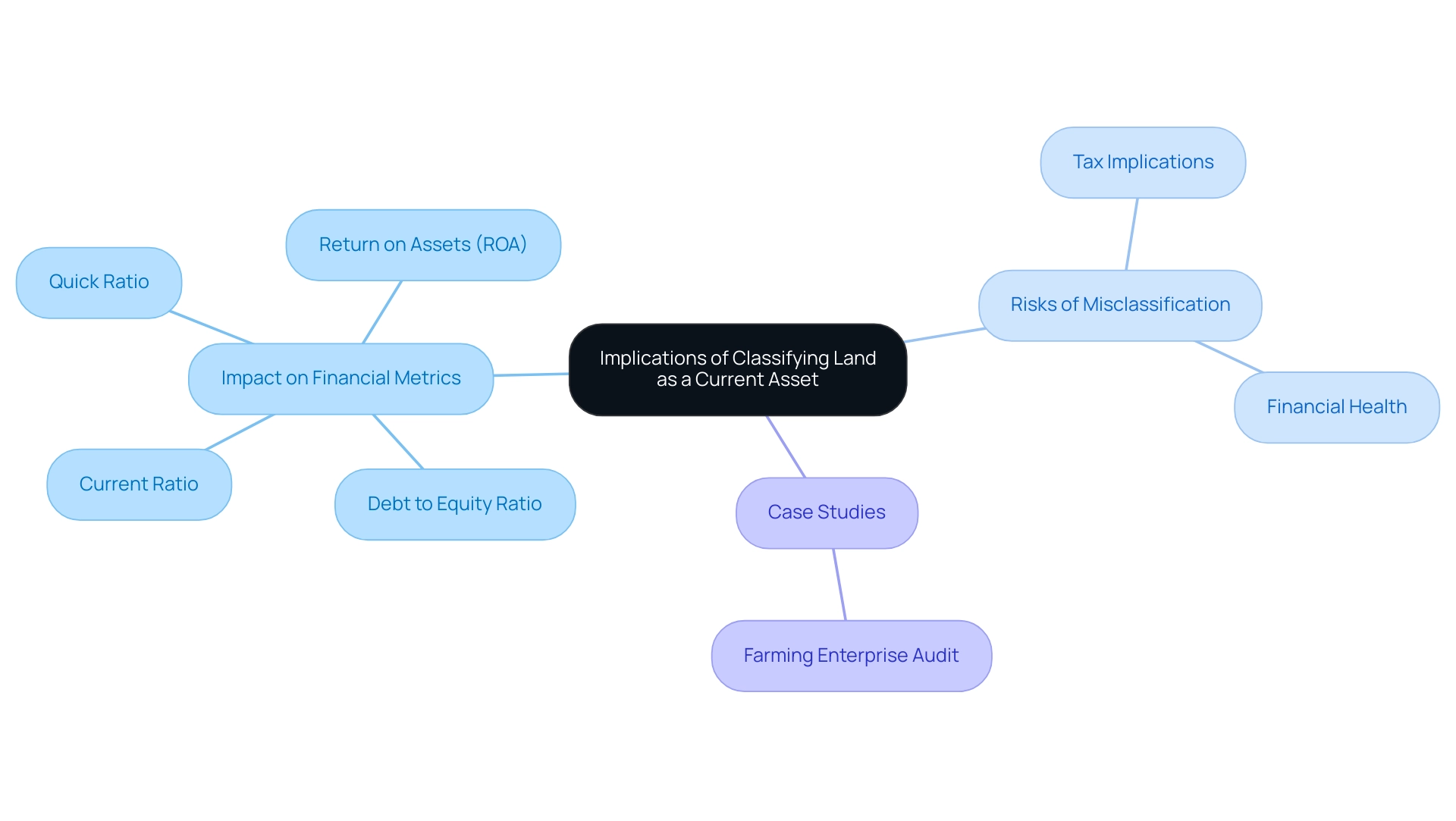

Implications of Classifying Land as a Current Asset

The classification of property as land a current asset can significantly impact a company’s balance sheet and financial ratios. If a company plans to sell the property within a year, it raises an important question: is land truly a current asset? This classification suggests that the company intends to sell the property soon, potentially increasing current resources and possibly misleading stakeholders about the company’s liquidity and operational efficiency.

Categorizing property as land a current asset can enhance short-term economic metrics, thereby improving the perception of the company’s financial health. However, this approach carries risks, especially if the area is not intended for immediate sale. Misclassification can lead to incorrect reporting of funds, which can affect tax obligations. Capitalized costs may delay tax expenses until the property is sold or developed, potentially resulting in penalties.

Businesses must carefully consider key financial metrics that may be influenced by the classification of land:

- Current Ratio: An inflated current asset figure can artificially boost this ratio, suggesting better liquidity than may actually exist.

- Quick Ratio: Similar to the current ratio, this metric may also be distorted, as it excludes inventory but includes current resources, raising the question of whether land is a current asset.

- Return on Assets (ROA): Misclassification can skew this ratio, impacting evaluations of whether land is a current asset and thus affecting assessments of resource efficiency.

- Debt to Equity Ratio: An inflated asset base can create confusion about whether land is a current asset.

As one expert insightfully noted, ‘such categorization helps you evaluate your business net capital and assess the company’s risk and solvency.’ This underscores the importance of precise classification in understanding whether land is a current asset in financial reporting.

Case studies reveal the challenges businesses face due to misclassification. For instance, a farming enterprise that designated its property to determine if land is a current asset encountered scrutiny during an audit, leading to adjustments that revealed a clearer economic position. This misstep not only affected their tax obligations but also their ability to secure funding, as lenders rely on accurate statements to assess risk.

As we look to 2025, the landscape of land categorization continues to evolve, with rising land prices creating potential discrepancies in property evaluations. Farmers and businesses must stay vigilant and seek guidance from financial experts to ensure proper classification, thereby protecting their financial integrity and operational success. The Entrepreneur’s Source highlights the importance of managing professional transitions, illustrating how supportive coaching can make a significant difference, even in the realm of management.

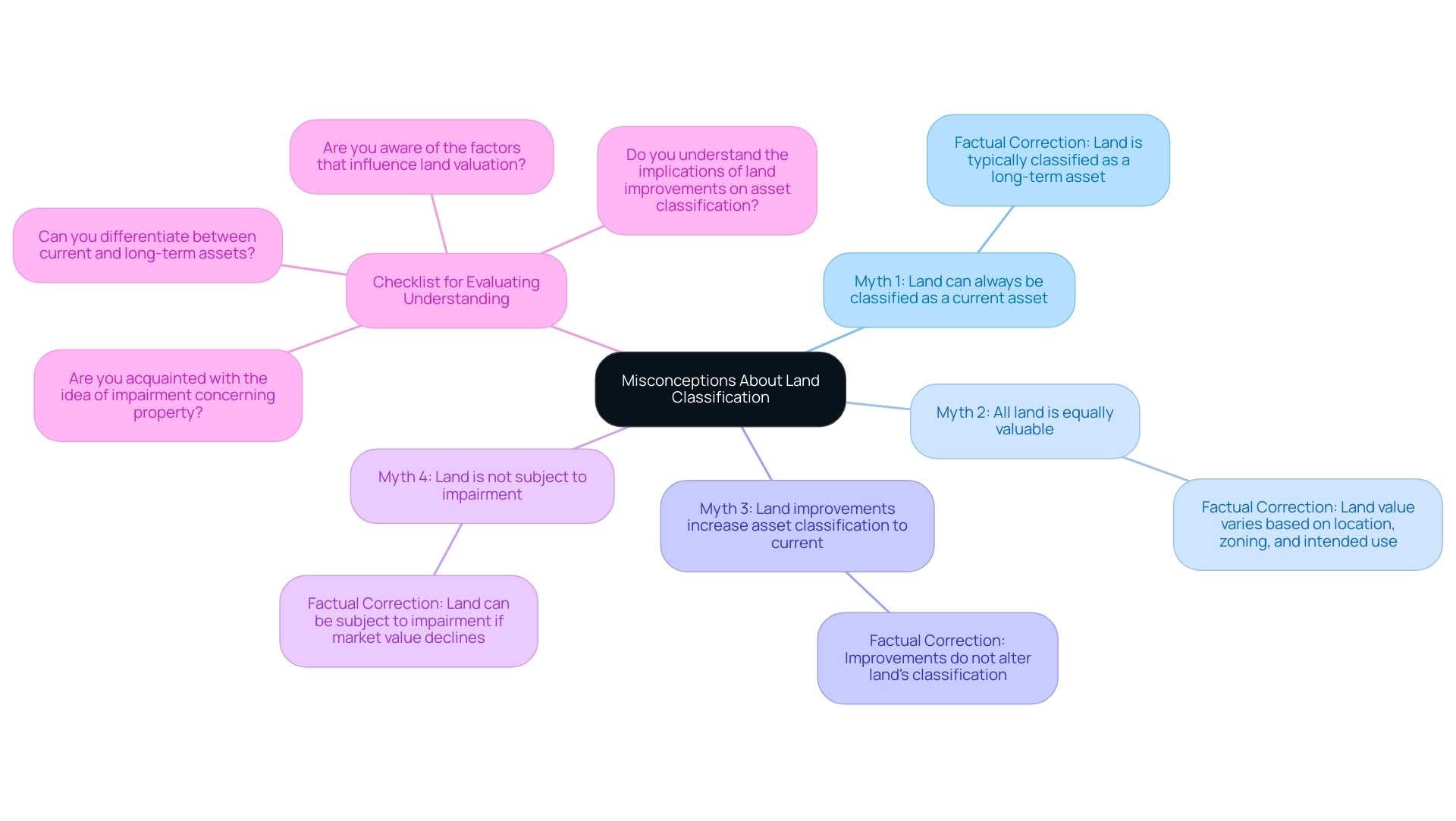

Debunking Myths: Misconceptions About Land Classification

-

Common Myths About Land Classification:

- Myth 1: Land can always be classified as a current asset.

- Factual Correction: We understand that it might seem logical, but land is typically classified as a long-term asset. This is due to its enduring nature and the fact that it is not intended for sale in the ordinary course of business. Current assets are expected to be converted into cash or consumed within one year, which simply does not apply to land.

- Myth 2: All land is equally valuable and can be treated the same in financial statements.

- Factual Correction: It’s easy to think all land holds the same value, but the reality is quite different. The value of land can vary significantly based on location, zoning regulations, and intended use. A nuanced understanding of these factors is essential to avoid misstatements in financial reporting. Recent statistics highlight that the impacts of ground data error can vary widely, emphasizing the importance of precision in classification.

- Myth 3: Land improvements automatically increase the asset’s classification to current.

- Factual Correction: While improvements can certainly enhance the value of land, they do not alter its classification. Improvements are typically capitalized and depreciated over time, while the land itself remains a long-term asset. We want to ensure you have clarity on this distinction.

- Myth 4: Land is not subject to impairment.

- Factual Correction: It’s a common misconception that land is immune to impairment. In fact, land can be subject to impairment if its market value declines significantly. Regular assessments are necessary to ensure that the carrying amount reflects its fair value. As noted by Giles M. Foody, addressing the issue of imperfect ground data will help realize the full potential of geomatics and the applications that depend on it.

- Myth 1: Land can always be classified as a current asset.

-

Checklist for Evaluating Understanding of Land Classification:

- Can you differentiate between current and long-term assets?

- Are you aware of the factors that influence land valuation?

- Do you understand the implications of land improvements on asset classification?

- Are you acquainted with the idea of impairment concerning property?

-

Significance of Precise Categorization: Understanding the precise categorization of terrain is essential. Misclassifying land can lead to monetary misstatements that may deceive stakeholders, affecting investment decisions and economic ratios. By tackling misunderstandings and ensuring transparency in resource categorization, organizations can enhance the reliability of their fiscal reports and sustain stakeholder confidence. Furthermore, grasping these classifications empowers career transitioners to make informed decisions about their financial literacy and career paths, reminding you that you are not alone in this journey.

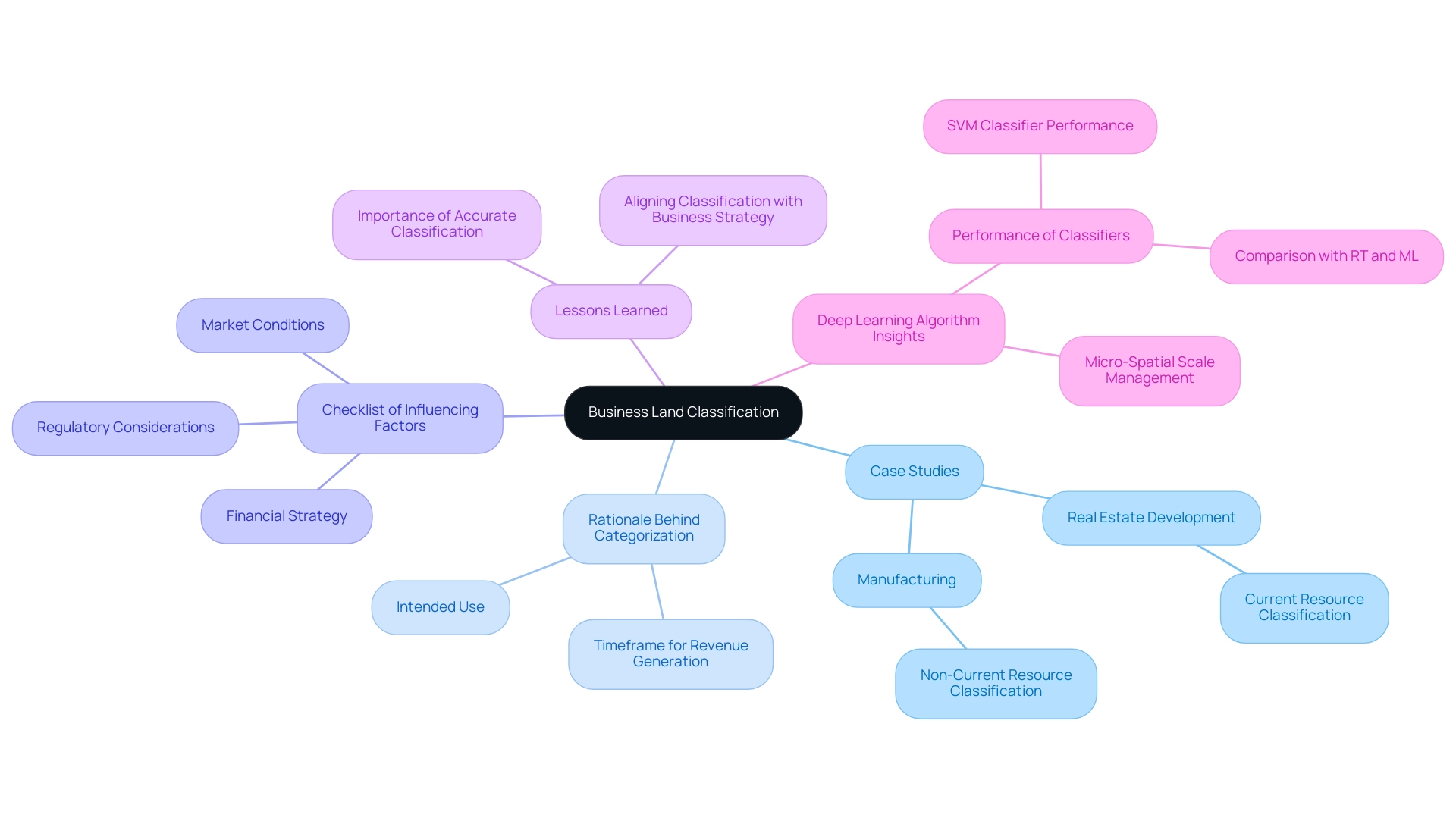

Real-World Examples: How Businesses Classify Land

-

Case Studies of Property Classification: Navigating the complexities of categorizing terrain can be challenging for many businesses, each facing unique circumstances and rationales. For instance, a real estate development company categorized a piece of property as a current resource, driven by its planned use for an upcoming project anticipated to generate income within the fiscal year. In contrast, a manufacturing firm viewed its property holdings as non-current resources, reflecting a long-term investment approach focused on future growth. Moreover, the overall area of NDWI calculated by the RF classifier is 78.79 km, highlighting the significant extent to which terrain categorization can be evaluated.

-

Rationale Behind Categorization Decisions: The reasoning behind these categorizations often hinges on the intended application of the terrain and the timeframe for anticipated returns. Companies aiming to use property for urgent operational needs typically categorize it as a current asset. Conversely, those retaining property for long-term value appreciation or future development lean towards a non-current designation. This distinction is crucial for economic reporting and strategic planning. Furthermore, assessing post-classification accuracy is vital for validating land use and land cover (LULC) maps produced by different models, ensuring classification decisions are grounded in reliable data.

-

Checklist of Influencing Factors:

- Intended Use: Is the land intended for immediate operational needs or long-term investment?

- Timeframe for Revenue Generation: Will the land generate revenue within the next fiscal year?

- Market Conditions: Are current market trends influencing the decision to hold or develop the land?

- Regulatory Considerations: Are there zoning laws or regulations that affect the classification?

- Financial Strategy: Does the classification align with the company’s overall financial strategy and reporting requirements?

-

Lessons Learned: These case studies illustrate the importance of aligning land classification with business strategy and operational needs. Businesses that clearly outline their objectives and understand the implications of their categorization decisions can better manage their assets and enhance financial transparency. By reflecting on the checklist of influencing factors, businesses can make informed decisions that resonate with their unique circumstances and goals. Furthermore, recent research utilizing a deep learning algorithm for terrain management on a micro-spatial scale suggests a sorting method expected to improve the swift and precise categorization of various lot shapes, further informing sorting strategies. The performance comparison of classifiers, including SVM, RT, and ML, has shown that the SVM classifier consistently outperforms others, achieving an average overall accuracy of 94% with Planet imagery in ArcGIS Pro, emphasizing the significance of selecting the appropriate method.

Key Takeaways on Land Classification

Understanding the classification of property as either a current or non-current resource is essential for effective resource management. It’s not just about the numbers; it’s about how these classifications impact your decisions and peace of mind.

-

Current Asset vs. Non-Current Asset: You might wonder if land qualifies as a current asset. Typically, it’s classified as a non-current asset due to its long-term nature and the fact that it isn’t expected to be converted into cash within a year. However, if the property is held for sale in the ordinary course of business, it may indeed be classified as a current asset. This distinction is crucial for your financial strategies.

-

Valuation Considerations: The value of real estate can change based on market conditions, location, and intended use. For example, the average productivity of timber in the Arapaho National Forest is about 40 per acre per year, which can significantly influence property valuation. Accurate evaluation is vital for your monetary reporting and investment choices, ensuring you make informed decisions.

-

Impact of Land Utilization: How you use the land can also affect its classification. Property used for operational purposes may be treated differently than land held for investment. Understanding GIS data structures, as highlighted by Pete Bettinger, can foster better communication among professionals and streamline your property classification processes.

-

Regulatory Framework: Being familiar with the accounting standards and regulations that govern asset classification is essential for compliance and accurate financial reporting. You deserve clarity in your financial practices, and knowing the rules helps you achieve that.

Final Checklist for Understanding Property Classification

- Identify the Purpose of the Property: Determine whether the property is held for operational use, investment, or sale.

- Assess Market Conditions: Evaluate current market trends that may influence the property’s value and classification.

- Review Accounting Standards: Familiarize yourself with relevant accounting principles that dictate asset classification.

- Consider Future Plans: Reflect on any potential changes in property use that could impact its classification.

- Consult Expert Opinions: Seek insights from professionals in resource management and accounting to ensure precise categorization.

Additionally, the case study on Mollisols in the South-West Pacific reveals the unexpected prevalence of certain soil types and their implications for usage management, emphasizing the importance of precise categorization. Moreover, remote sensing technology plays a vital role in contemporary terrain categorization techniques, utilizing satellite imagery and AI algorithms to enhance accuracy. Recent advancements indicate that machine learning with PCC achieved an overall accuracy of 88.8%, showcasing the effectiveness of modern classification methods.

By applying this knowledge to your asset management practices, you can deepen your understanding of land classification and make informed decisions that align with your business objectives. Remember, you are not alone in this journey; we are here to support you every step of the way.

Conclusion

Understanding the classification of assets, especially the distinction between current and non-current assets, is vital for both businesses and individuals navigating the complexities of financial management. Current assets, such as cash and inventory, are essential for maintaining liquidity and supporting day-to-day operations. In contrast, non-current assets like land and machinery serve as long-term investments that foster growth and stability.

The unique characteristics of land—its immobility, indestructibility, and non-homogeneity—add layers of complexity to its classification and valuation. Recognizing these factors is crucial for accurate financial reporting and strategic planning, particularly for those transitioning to career ownership or seeking financial independence. Misclassifying land can lead to misleading financial statements, impacting everything from a company’s liquidity ratios to its investment decisions.

Moreover, debunking common myths about land classification helps clarify misconceptions that could lead to financial missteps. Have you ever considered the intent behind land acquisition and its planned use? Understanding this is essential for accurate asset classification, ultimately safeguarding financial integrity and enhancing decision-making.

In conclusion, a solid grasp of asset classification not only empowers individuals and businesses to make informed financial decisions but also supports their journey toward achieving professional and financial goals. By utilizing the insights and frameworks discussed, you can navigate the evolving economic landscape with confidence, ensuring that your asset management strategies align with your broader objectives for growth and sustainability. Remember, you are not alone in this journey; we understand the challenges you face and are here to support you every step of the way.

Frequently Asked Questions

What are current resources?

Current resources are items expected to be converted into cash within one year, including cash, accounts receivable, and inventory, which are essential for day-to-day operations and liquidity management.

What are non-current resources?

Non-current resources are long-term investments that are not anticipated to be liquidated within a year, such as land, buildings, machinery, and intangible resources like patents, contributing to a company’s operational capacity over time.

Why is it important to classify assets accurately?

Accurate classification of assets on accounting statements impacts the balance sheet, business strategy, investment choices, and health assessments. Misclassification can lead to misleading ratios and hinder effective decision-making.

How can understanding current and non-current assets benefit career transitioners?

Understanding these financial concepts is crucial for career transitioners as financial literacy can significantly influence career decisions and opportunities, especially in a declining job market where employability and financial security are crucial.

What checklist can help determine if an asset is current or non-current?

To determine if an asset is current or non-current, consider: Is it expected to be converted into cash within one year? Is it intended for long-term use or investment? Can it be easily sold or converted to cash? Is it employed in daily operations or retained for future growth?

Can you provide an example of non-current inventory?

An example of non-current inventory is Freeport-McMoRan’s reported $1.34 billion in non-current inventory, labeled as ‘Long-term mill and leach stockpiles,’ illustrating that non-current inventory can be found across various industries.

What are the characteristics of land as an asset?

The characteristics of land as an asset include: Immobility: Land cannot be moved, influencing its value based on location. Indestructibility: Real estate does not deteriorate over time, contributing to its long-term value. Non-homogeneity: Each plot of land is unique, complicating valuation and requiring a tailored assessment approach.

What checklist should be used for assessing property as an asset?

When assessing property as an asset, consider: Location, Physical Condition, Zoning Regulations, Market Demand, Potential Uses, Accessibility, Distinct Attributes.

How can individuals navigate the emotional strain of career transitions?

Understanding economic factors related to assets can empower individuals in their career transitions, helping them manage challenges linked to employability and economic independence.