Overview

This article addresses the authenticity of subsidy programs, reassuring you that they are indeed real and vital for supporting individuals and businesses across various sectors, especially during challenging career transitions. Have you ever felt overwhelmed by financial pressures? You’re not alone. These programs, such as the Low-Income Subsidy (LIS) and direct subsidies, provide crucial financial assistance that can significantly alleviate these burdens. They empower individuals like you to enhance employability and pursue economic independence.

By demonstrating the effectiveness of these programs through real-life examples, we can see how they serve as a lifeline during tough times. Imagine the relief of knowing there’s support available to help you navigate your career path. The journey to achieving your aspirations can be daunting, but with the right resources, it becomes much more manageable. Let’s explore how these subsidies can help you take ownership of your career and create a brighter future.

Introduction

In an ever-evolving economic landscape, we understand that navigating career transitions and financial challenges can feel overwhelming. Subsidies have emerged as a vital lifeline for individuals and businesses, providing essential government-backed financial aids—ranging from direct cash payments to tax breaks—designed to foster economic stability and empower those in need. As we explore the multifaceted world of subsidies in 2025, it’s crucial to grasp their definitions, purposes, and eligibility criteria. This knowledge is key for anyone looking to enhance their employability or embark on a new career path.

Imagine the relief that comes with educational funding or healthcare assistance; these programs not only alleviate financial burdens but also open doors to opportunities that can transform lives. You are not alone in seeking to leverage these resources. The insights and guidance provided throughout this article will illuminate the path to informed decision-making and financial independence, helping you feel supported as you take steps toward a brighter future.

Understanding Subsidies: Definitions and Purposes

Subsidies represent a vital form of assistance provided by the government, prompting us to consider whether these subsidy programs are genuinely designed to support individuals and businesses across various sectors, especially in a changing job market. These financial aids can take the form of cash payments, tax breaks, or grants, all aimed at fostering economic stability, encouraging specific behaviors, or assisting those in need. Understanding the diverse functions of these supports is essential, as they can significantly influence financial decisions and create opportunities for individuals navigating career changes.

As we look ahead to 2025, government assistance remains crucial in shaping economic landscapes, particularly for those in career transitions seeking to enhance their employability and achieve economic independence. For example, funding for K-12 education in Michigan reaches an impressive $24.0 billion, equating to approximately $16,766 per pupil. This substantial investment underscores the government’s commitment to improving educational opportunities, which can indirectly support those exploring new career paths.

Such funding can provide essential resources for training initiatives that align with the services offered by The Entrepreneur’s Source, empowering individuals to develop the transferable skills necessary for business ownership.

Real-world examples illustrate how grants have positively impacted people’s economic situations, raising questions about the authenticity of subsidy programs. Many individuals leverage government support to pursue educational or training opportunities that facilitate their transition from traditional employment to career ownership. For instance, a case study from ‘Your Career Revolution’ highlights a person who utilized state-funded training to acquire skills in digital marketing, resulting in a successful shift into entrepreneurship. With over 40 years of experience in Career Ownership Coaching™, The Entrepreneur’s Source exemplifies this impact by assisting clients in navigating their career transitions through personalized coaching and educational resources.

By helping clients understand and utilize available aids, The Entrepreneur’s Source enhances their ability to invest in their futures.

Experts emphasize that the primary goal of government assistance is to ascertain whether the subsidy program is authentic, as it aims to alleviate economic pressures and promote equitable access to resources. Phillip L. Swagel, Director, points out that feedback is vital for optimizing support programs. By addressing common career uncertainties, financial assistance can profoundly influence individuals’ financial decisions, empowering them to invest in their futures with greater confidence.

As we evaluate the landscape of financial support in 2025, it becomes evident that these aids are not merely handouts; they are strategic investments in human potential, nurturing a more resilient and adaptable workforce. For instance, Rhode Island’s community colleges allocate only 17.8% of what its four-year public colleges invest annually, highlighting the varying impacts of financial support across educational institutions. Understanding these implications enables individuals to make informed choices that align with their career aspirations, as expressed in ‘Your Career 2.0: A Survival Guide for The Battered Career Syndrome and Investor Syndrome.’

Moreover, the urgency of career progression is paramount; individuals are encouraged to act swiftly to seize these subsidies and resources, securing their economic independence and personal growth.

Exploring Different Types of Subsidies

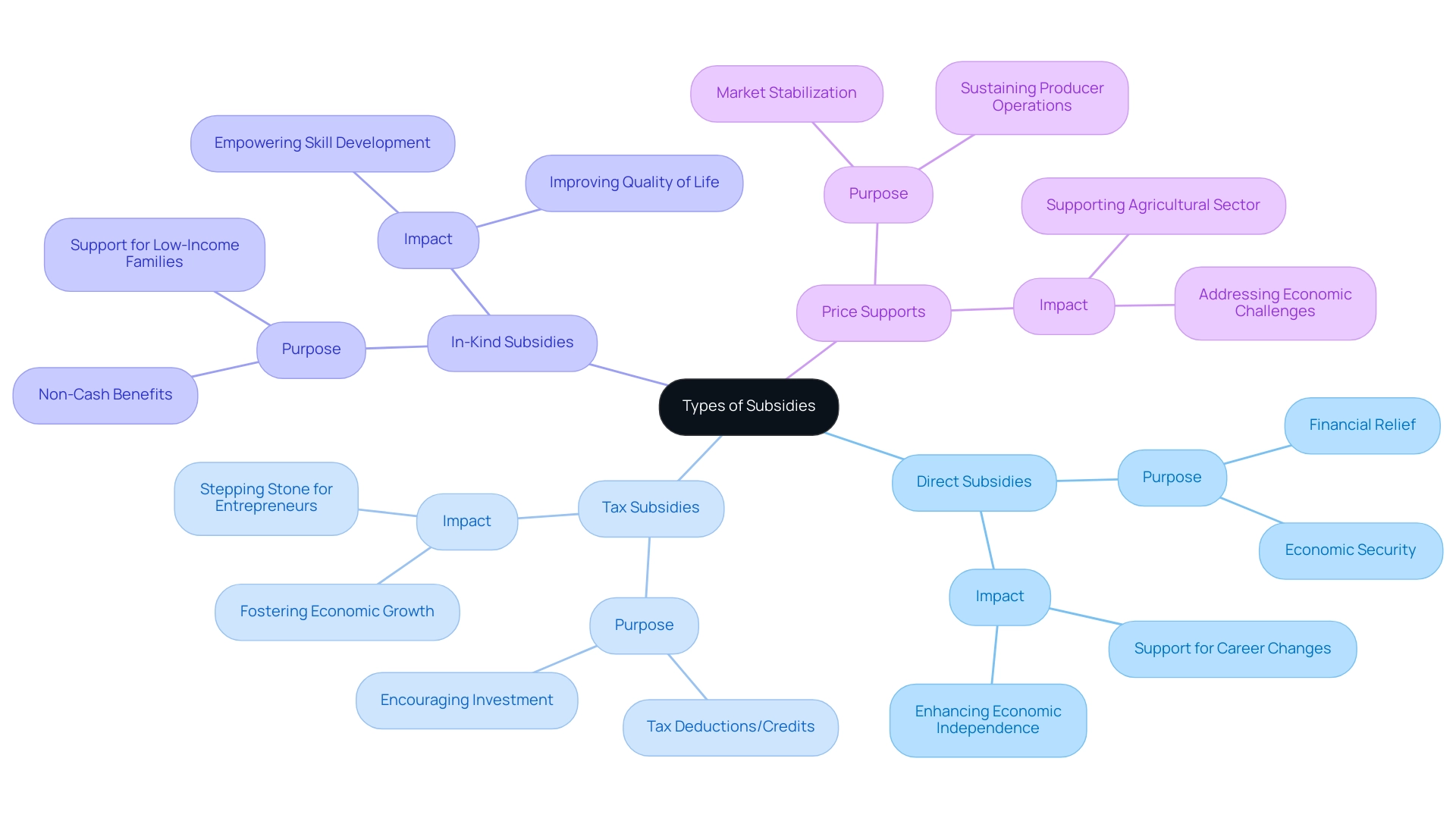

In 2025, subsidies can be categorized into several distinct types, each designed to assist individuals and businesses in meaningful ways, fundamentally influencing career transitions and economic stability.

- Direct Subsidies: These cash payments or grants aim to relieve financial burdens, promoting a sense of economic security. If you are considering a career change, you are not alone. Many individuals will benefit from this direct financial assistance, reflecting a compassionate commitment to support those in need. The Entrepreneur’s Source has empowered hundreds of thousands in evaluating their career options, illustrating how these aids can enhance economic independence, especially for individuals facing unjust or unequal salaries.

- Tax Subsidies: This category includes tax deductions or credits that effectively lighten the tax burden for eligible recipients. Experts highlight the importance of these incentives in fostering economic growth, encouraging spending and investment. For those dreaming of launching their own enterprises or investing in franchises, tax subsidies can be a vital stepping stone toward achieving economic independence.

- In-Kind Subsidies: Non-cash benefits such as food aid, housing vouchers, and healthcare services are crucial for low-income families, offering essential support that directly improves their quality of life. This stability can empower you to focus on developing transferable skills and engaging with your community, moving toward your goal of building wealth and equity.

- Price Supports: Government interventions that maintain the price of certain goods or services help stabilize markets, ensuring that producers can sustain their operations even in challenging economic conditions. For example, anticipated reductions in feed costs and unprecedented labor expenses highlight the economic environment shaping these subsidies.

Understanding these categories is essential for anyone navigating career obstacles. It’s important to discern the reality of subsidy programs as you pursue economic independence. The regulatory framework surrounding financial assistance, including the Agreement on Financial Assistance and Countervailing Measures (SCM Agreement), provides vital guidelines for addressing trade distortions caused by such support. As the landscape of subsidies evolves, staying informed about available types and their implications enables you to make knowledgeable choices regarding your economic future.

The unique value proposition of The Entrepreneur’s Source, with its extensive experience, no-cost coaching services, and structured decision-making processes, supports you in effectively navigating these financial assistance options. Together, we can facilitate a transformative career revolution, enabling you to take control of your destiny.

The Low-Income Subsidy (LIS): What You Need to Know

The Low-Income Subsidy (LIS), often referred to as Extra Help, raises an important question: Is this subsidy program real? It is a vital federal initiative designed to assist individuals with limited income in managing their Medicare prescription drug costs. As we look to 2025, this program continues to evolve, featuring updated income and asset limits that applicants must meet to qualify. For instance, individuals with an annual income below $20,385 and couples earning less than $27,465 may find themselves eligible for this essential support.

The LIS can significantly reduce out-of-pocket expenses for medications, making crucial healthcare services more accessible to those who need them most. Recent statistics reveal that over 9 million individuals are projected to qualify for the LIS in 2025, underscoring the program’s importance in alleviating the economic burdens associated with healthcare. Real-world examples vividly illustrate the impact of the LIS.

Consider the story of a retiree who faced a substantial drop in income and subsequently qualified for the subsidy. This assistance not only lowered their monthly prescription costs but also provided peace of mind, enabling them to focus on their health rather than financial worries. To qualify for the LIS, applicants must submit documentation of their income and assets, ensuring that the program effectively targets those in genuine need.

Healthcare professionals often highlight the significance of the LIS in reducing Medicare costs, frequently discussing whether this subsidy program is real. They note its crucial role in enhancing the quality of life for beneficiaries. Expert opinions on the LIS initiative emphasize its necessity in today’s healthcare landscape, with many advocating for continued support and awareness of the program. They question if the subsidy program is real, recognizing how it empowers individuals to take control of their healthcare expenses and access the medications they require.

By understanding the qualifications and benefits of the Low-Income Subsidy, individuals can navigate their healthcare options more effectively, ensuring they receive the support they deserve. At Find Your Career 2.0, we recognize the importance of such support systems in the broader context of career transitions. With over 40 years of experience, we have assisted hundreds of thousands in evaluating their career options and enhancing their lives.

As Parnell Woodard, a dedicated Career Ownership Coach, states, ‘I am committed to helping clients transition from traditional employment to career ownership, empowering them to achieve their career goals.’ This commitment to empowerment aligns with the need for accessible resources, whether in healthcare or career ownership. Moreover, Find Your Career 2.0 is recognized as a trusted partner for those seeking to reinvent their professional lives.

Our services, including personalized coaching and franchise matching, ensure that individuals can navigate their career transitions effectively. Just as the LIS provides essential support in healthcare, our coaching services offer guidance and clarity for those looking to take charge of their professional futures. Furthermore, our website’s compatibility with various browsers and assistive technologies demonstrates our dedication to accessibility, ensuring that everyone can access the resources they need to succeed.

For further insights on navigating your career transition, download the ‘Why work with Parnell’ PDF available on our website. This resource provides actionable strategies to help you address challenges such as age factor limitations and the need for transferable skills, empowering you to take charge of your career journey.

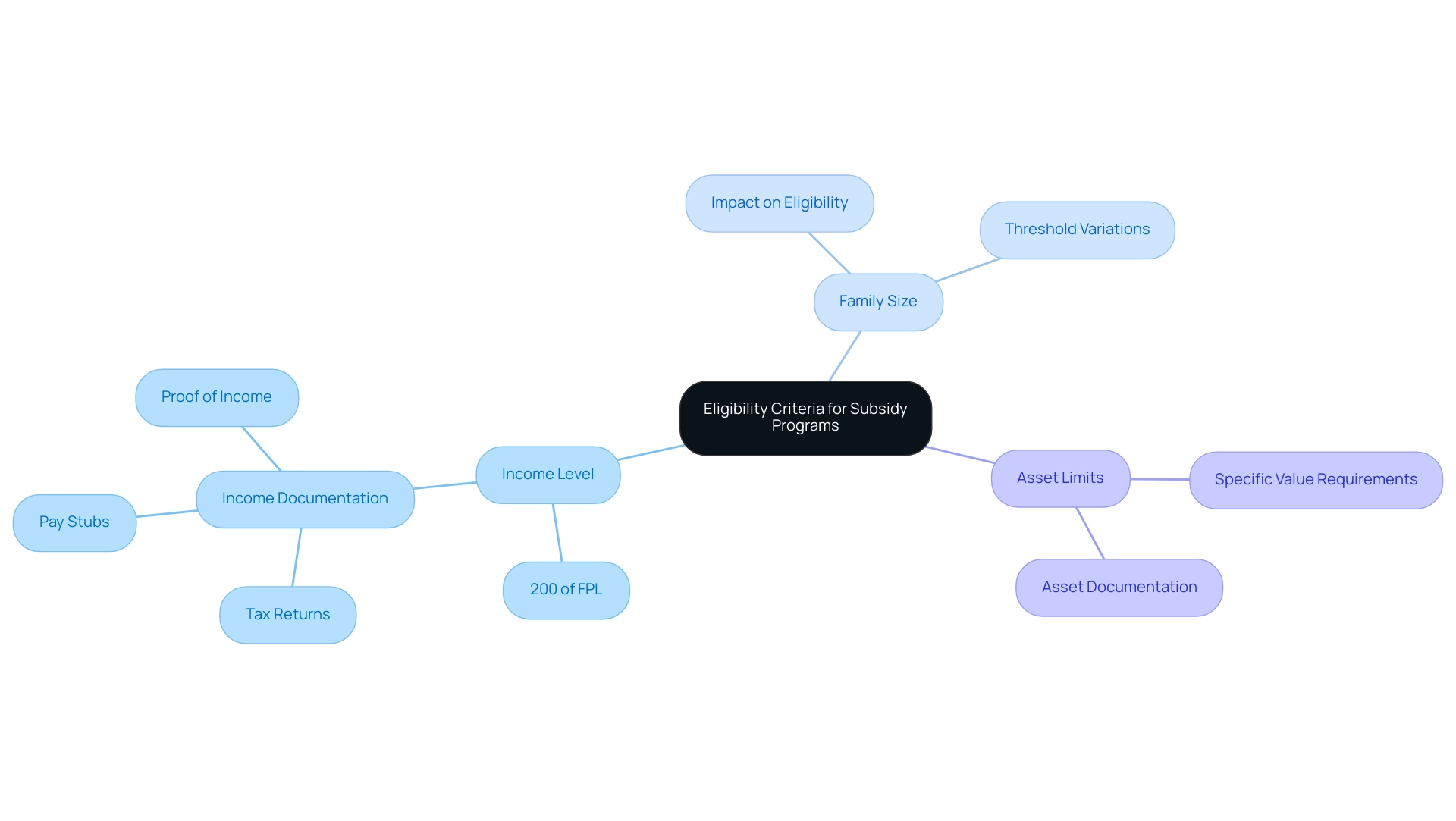

Eligibility Criteria for Subsidy Programs

Navigating financial assistance initiatives can feel overwhelming, especially when eligibility hinges on factors like income level, family size, and individual needs. In 2025, many programs require applicants to show that their income is below a certain percentage of the Federal Poverty Level (FPL). For example, a common threshold is set at 200% of the FPL, which varies depending on family size.

Moreover, some financial aids have asset limits, meaning that applicants must have resources below a specific value to qualify. This can add another layer of complexity for those seeking help.

To successfully navigate the application process, it’s essential for applicants to gather important documentation, such as:

- Tax returns

- Pay stubs

- Proof of income

This documentation is vital in substantiating their claims of eligibility. Recent statistics reveal that about 65% of applicants meet the income requirements for financial assistance in 2025, which underscores the importance of understanding these criteria.

Consider the challenges faced by individuals pursuing financial assistance. A single parent with two children may find that their modest income exceeds the threshold due to recent wage increases, complicating their eligibility. Social workers often highlight how crucial income limits can be, noting that “many families are just above the threshold, which can leave them without necessary support.”

Expert insights suggest that while eligibility requirements aim to assist those most in need, they can inadvertently exclude individuals who are on the brink of qualifying. As Parnell Woodard, a Career Ownership Coach, shares, “The structured process in navigating these eligibility criteria is crucial for people to gain clarity and confidence in their decisions.”

Additionally, the Annual Report on Individuals with Disabilities sheds light on significant social and economic indicators that may influence eligibility for financial assistance, providing a broader context for understanding these challenges. By gathering the right information and documentation, individuals can empower themselves to access the support they need. Remember, you are not alone in this journey; we understand the complexities involved and are here to help you find your way.

How to Apply for Subsidy Programs: A Step-by-Step Guide

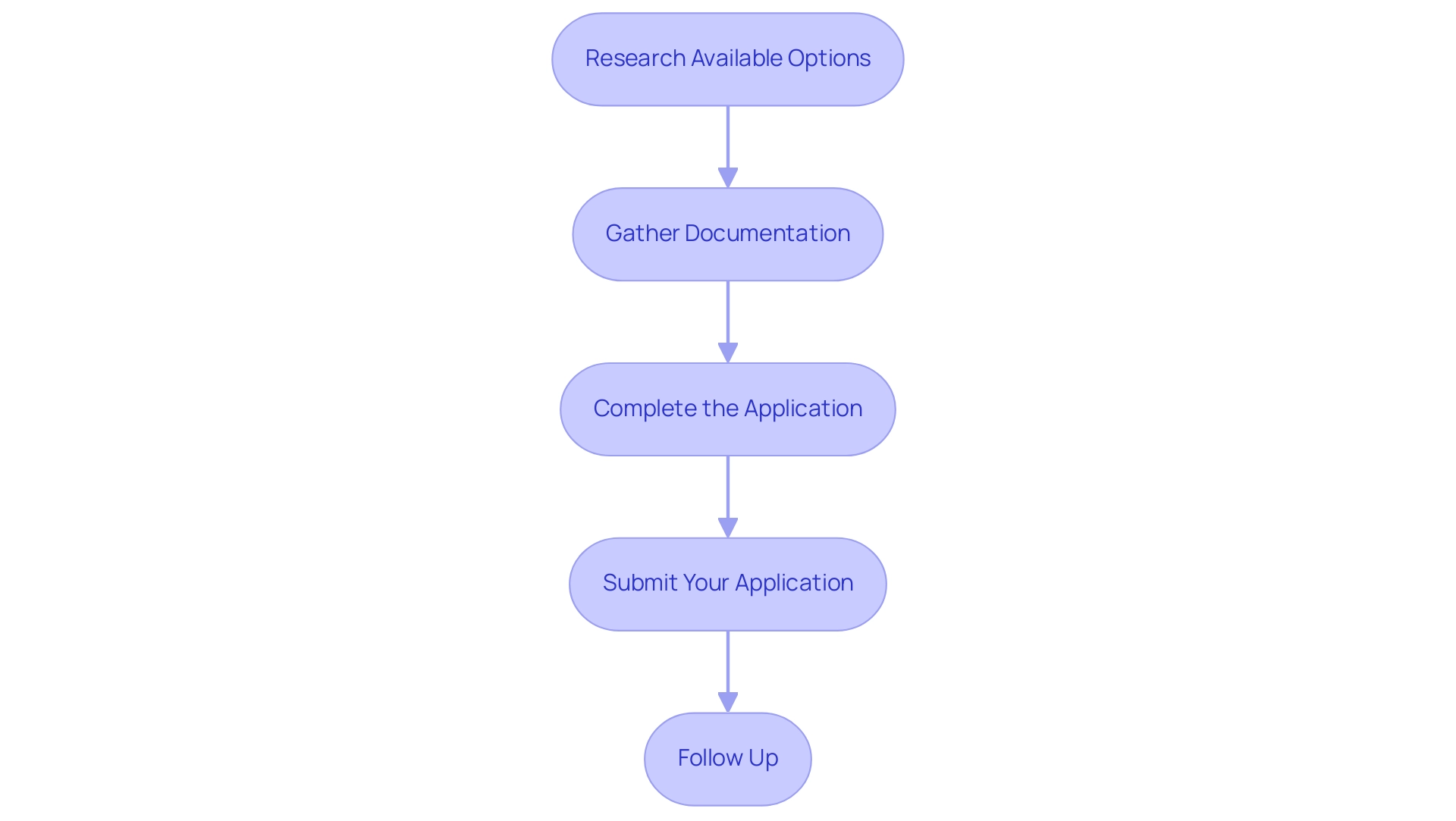

Applying for financial assistance initiatives can feel overwhelming, but it can be a straightforward process if you follow these essential steps:

- Research Available Options: Start by identifying the subsidy initiatives that align with your specific needs and circumstances. You may want to explore local, state, and federal options to find the best fit for your situation. Remember, you are not alone in this journey; many have walked this path before you.

- Gather Documentation: Collect all necessary documents to support your application. This typically includes proof of income, tax returns, identification, and any other relevant financial information. Proper documentation is crucial, as it can significantly impact your application’s success rate. Financial advisors emphasize that well-prepared applications are more likely to succeed, and we understand how important this is for you.

- Complete the Application: Take your time to carefully fill out the application form, ensuring that all required information is accurate and complete. Attention to detail is vital; errors or omissions can lead to delays or denials. You deserve a chance to succeed, so make sure your application reflects your situation accurately.

- Submit Your Application: Once your application is complete, submit it to the appropriate agency. This can often be accomplished online, but some may require you to send your application by mail. Be sure to check the submission guidelines for each program, as following these can make a difference in your experience.

- Follow Up: After submitting your application, it’s important to monitor its status. Regularly check for updates and be prepared to respond promptly to any requests for additional information. This proactive approach can help expedite the processing of your application, ensuring that you stay informed throughout the process.

In 2025, the average time taken to process financial assistance applications has improved, with many agencies aiming to provide decisions within a few weeks. However, this can vary depending on the system and the volume of applications received.

Real-world examples illustrate the effectiveness of following these steps. For instance, individuals who carefully compiled their documentation and followed the application instructions reported greater success rates in obtaining funding. Statistics indicate that the success rate for financial aid applications has improved, reflecting a growing awareness and accessibility of these programs.

Significantly, the average federal loan borrower in Ohio has an outstanding balance of $35,056.28, highlighting the burdens that may lead individuals to seek subsidies. You are not alone in facing these challenges.

Moreover, a case study on Puerto Rico college students shows that for the 2023-24 academic year, they received an average federal loan of $15,300.74, with many benefiting from federal grants. This emphasizes the importance of understanding the available funding aid options.

Recent changes in subsidy application processes have also streamlined requirements, leading to discussions about the accessibility of these programs, making it easier for applicants to navigate the system. In 2020, the success rate for federal grant applications was 21%, providing historical context for applicants regarding the likelihood of success. By following this step-by-step guide, you can enhance your chances of obtaining the assistance you need.

As Parnell Woodard, a Career Ownership Coach, emphasizes, transitioning to career ownership often requires navigating financial support systems effectively. Remember, you have the strength to pursue your goals, and support is available to help you along the way.

Avoiding Scams: Recognizing Real Subsidy Programs

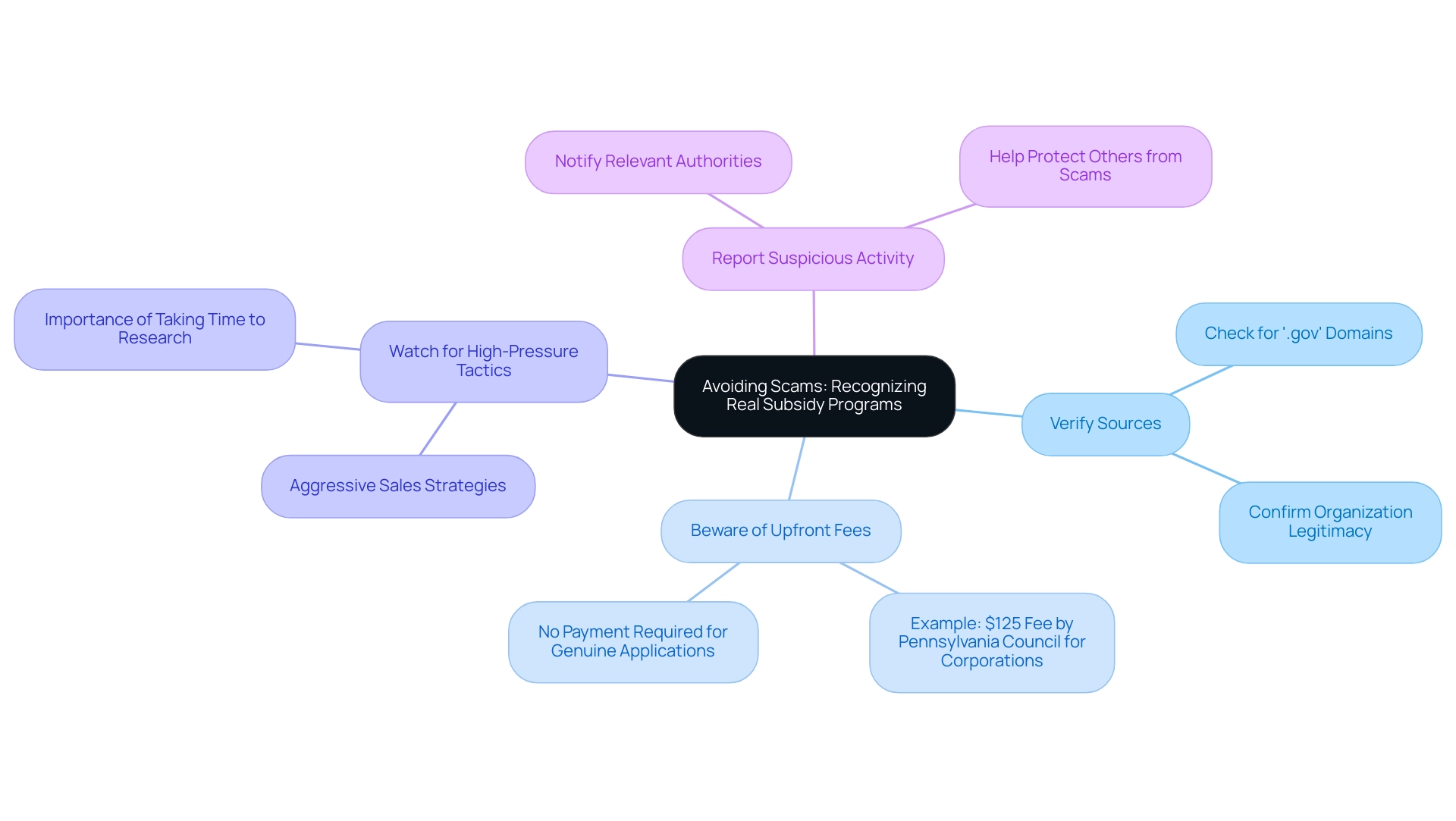

To effectively steer clear of scams associated with subsidy programs, we understand that navigating this landscape can feel overwhelming. Here are some essential tips to help you stay safe:

- Verify Sources: Always confirm the legitimacy of the organization providing the financial assistance. Trustworthy applications will have official government websites, typically ending in ‘.gov’. This ensures you are accessing accurate information directly from the source.

- Beware of Upfront Fees: Genuine subsidy initiatives do not require any payment to apply. It’s important to be particularly cautious of any requests for fees, as this is a common tactic used by scammers. For instance, a fraudulent entity known as the ‘Pennsylvania Council for Corporations’ has been reported soliciting $125 for record maintenance, highlighting the need for vigilance.

- Watch for High-Pressure Tactics: Scammers often employ aggressive strategies to rush people into making hasty decisions. Remember, it’s crucial to take your time, conduct thorough research, and verify the legitimacy of any program before proceeding.

- Report Suspicious Activity: If you suspect a scam, please report it to the relevant authorities. This not only helps protect yourself but also safeguards others from falling victim to similar schemes.

In 2025, the prevalence of financial aid scams remains a significant concern, with many individuals unfortunately falling victim to these fraudulent activities. According to recent statistics, a substantial number of people have reported being targeted by such scams. Consumer protection agencies, including the USDA, warn that “this is known as a phishing scam and is a type of fraud,” emphasizing the importance of awareness and education in combating these scams.

Furthermore, the Inflation Reduction Act influences financial assistance initiatives, impacting how individuals engage with these options. By staying informed and cautious, you can determine if the subsidy program is real while navigating its complexities more safely and effectively. Additionally, Certificates of Subsistence can be obtained directly from the Department of State for $40, typically available within two hours, serving as a legitimate example of a subsidy-related process.

Conclusion

Understanding the landscape of subsidies in 2025 reveals their essential role in providing financial support to individuals and businesses facing career transitions and economic challenges. You may find yourself overwhelmed by direct cash payments, tax breaks, and in-kind benefits designed to alleviate financial burdens and promote equitable access to resources. These insights underscore the multifaceted nature of subsidies, highlighting their potential to empower you to invest in your future and enhance your employability.

The Low-Income Subsidy (LIS) exemplifies how targeted financial assistance can significantly impact lives, particularly in managing healthcare costs. With millions projected to qualify for this vital support, it is clear that such programs are more than mere handouts; they represent strategic investments in human potential. We understand that navigating eligibility criteria and the application process can feel daunting, but this knowledge is crucial for maximizing access to resources. You are not alone in facing barriers that may prevent you from securing the assistance you need.

As the economic landscape continues to evolve, staying informed about available subsidies and their implications is critical for anyone seeking financial independence. By leveraging the various types of subsidies and being aware of potential scams, you can confidently approach your career transitions, equipped with the knowledge necessary to make informed decisions. Ultimately, the path to financial stability and career ownership is illuminated by the strategic use of government-backed support, empowering you to take charge of your future and achieve your personal and professional goals.

Frequently Asked Questions

What are subsidies and why are they important?

Subsidies are forms of assistance provided by the government, such as cash payments, tax breaks, or grants, designed to support individuals and businesses. They foster economic stability, encourage specific behaviors, and assist those in need, especially in a changing job market.

How do subsidies influence individuals facing career transitions?

Subsidies can significantly impact financial decisions and create opportunities for individuals navigating career changes by providing essential resources for training and education, ultimately enhancing employability and economic independence.

What is the significance of government funding for education in Michigan?

In Michigan, government funding for K-12 education amounts to approximately $24.0 billion, or about $16,766 per pupil, reflecting the government’s commitment to improving educational opportunities that can support individuals exploring new career paths.

How do grants assist individuals in transitioning to entrepreneurship?

Grants can facilitate access to educational and training opportunities, enabling individuals to develop skills for business ownership. For example, a case study highlighted someone who used state-funded training to successfully transition into digital marketing and entrepreneurship.

What role does The Entrepreneur’s Source play in assisting clients?

The Entrepreneur’s Source provides personalized coaching and educational resources to help clients understand and utilize available financial aids, enhancing their ability to invest in their futures and navigate career transitions.

What are the different types of subsidies available in 2025?

The main types of subsidies include: Direct Subsidies: Cash payments or grants that relieve financial burdens. Tax Subsidies: Tax deductions or credits that lighten the tax burden for eligible recipients. In-Kind Subsidies: Non-cash benefits like food aid and housing vouchers that improve quality of life for low-income families. Price Supports: Government interventions that stabilize the prices of certain goods or services.

Why is it important to understand subsidy programs?

Understanding the various types of subsidy programs is crucial for individuals navigating career obstacles, as it helps discern the reality of available assistance and make informed choices regarding their economic future.

How does feedback influence government assistance programs?

Feedback is vital for optimizing support programs, as it helps ensure that subsidy programs effectively alleviate economic pressures and promote equitable access to resources, ultimately empowering individuals to invest in their futures with confidence.

What is the urgency regarding career progression and subsidies?

Individuals are encouraged to act swiftly to seize available subsidies and resources, as doing so can secure their economic independence and facilitate personal growth.