Overview

The article identifies Florida, Arizona, and North Carolina as some of the top retirement states for 2024 due to their favorable climates, tax benefits, and vibrant community life, which are essential for a fulfilling retirement experience. This conclusion is supported by detailed evaluations of each state’s living conditions, healthcare quality, and recreational opportunities that cater to retirees’ preferences, ensuring they can enjoy their golden years comfortably and actively.

Introduction

As retirement nears, the decision of where to settle becomes pivotal for achieving a fulfilling and enjoyable lifestyle in one’s later years. In 2024, various states emerge as prime locations, each offering unique advantages such as favorable climates, tax incentives, and access to quality healthcare. From the serene landscapes of Alaska to the vibrant communities of Florida, retirees have a wealth of options to consider.

However, the subjective nature of retirement preferences means that factors like community engagement and personal interests can significantly influence the ideal choice. This comprehensive guide delves into the best and worst states for retirement, examining key elements that shape the experience of retirees and offering insights into making an informed decision for a rewarding retirement journey.

Overview of the Best Retirement States for 2024

As the end of one’s career nears, the selection of location among the best retirement states becomes vital for ensuring a satisfying lifestyle during one’s golden years. In 2024, several regions are recognized as the best retirement states because of their attractive climates, tax advantages, quality healthcare facilities, and vibrant recreational opportunities. For example, Alaska and New Hampshire are ranked among the best retirement states, with Alaska boasting the lowest tax burden at just 5.06% while also achieving commendable rankings in average savings account balance and overall net worth.

This is especially significant, as Brent Polacheck, owner of Polacheck’s Jewelers, remarks, ‘In an era of instant gratification, the art of generational relationship-building still drives retail success,’ emphasizing the importance of connections in financial planning. Meanwhile, a recent report by Seniorly identified Washington D.C. as the top destination for older adults in 2025, thanks to its abundance of healthcare providers and diverse leisure activities. However, it’s essential to acknowledge that the best retirement states are subjective and greatly influenced by individual preferences, such as urban versus rural living, climate, and community.

As demonstrated in the case study titled ‘Subjectivity of Lifestyle Choices,’ individual preferences play a crucial role in decision-making when selecting a location for later life. This overview acts as an extensive guide, assisting individuals in navigating the multitude of factors that make some regions the best retirement states, ultimately ensuring a fulfilling retirement experience.

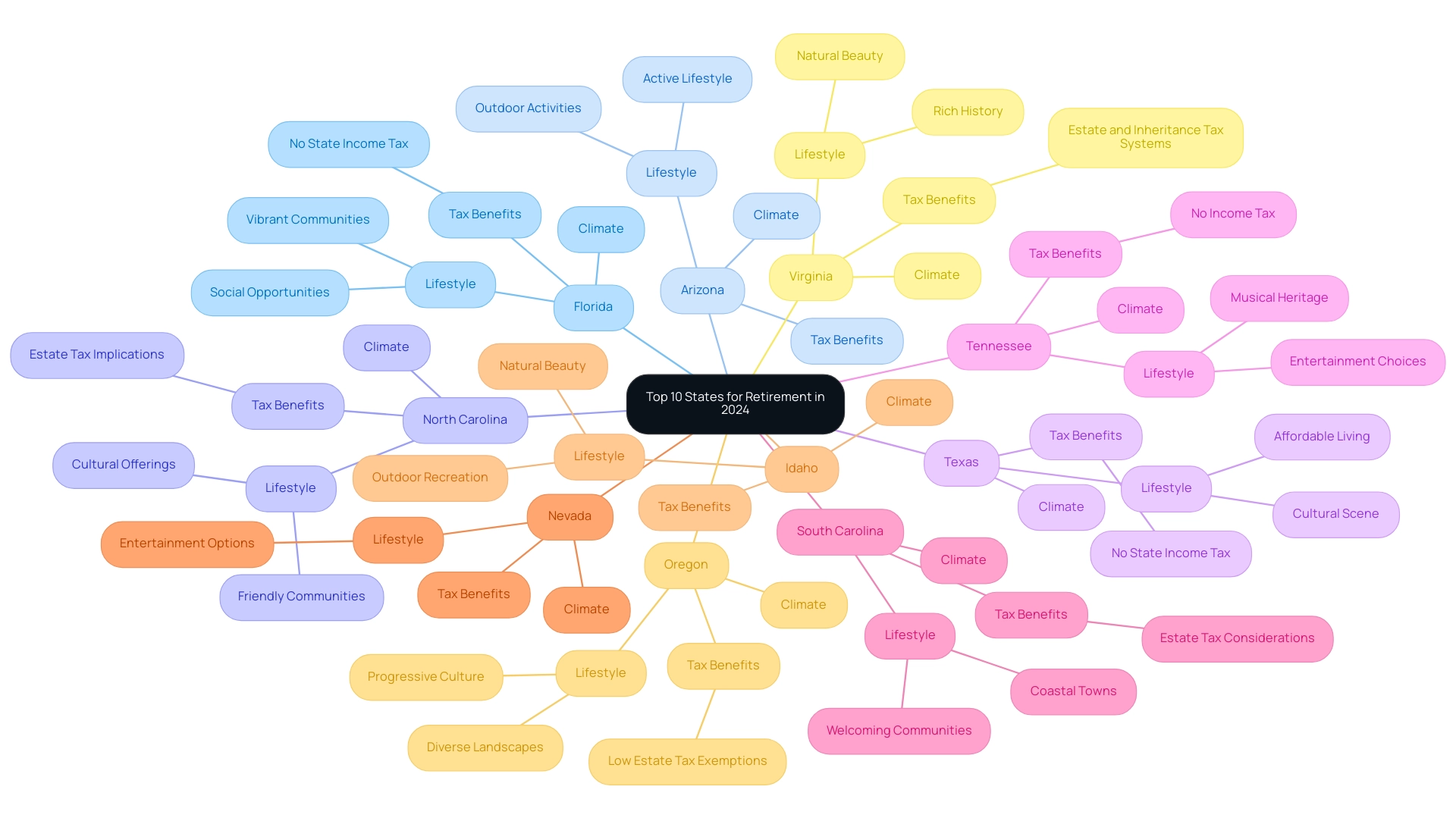

The Top 10 States for Retirement in 2024

-

Florida is considered one of the best retirement states, famous for its warm climate and lack of a state income tax, and it continues to draw those seeking sun and leisure. With its vibrant communities, older adults often express their satisfaction with life in the Sunshine State, noting the plethora of activities and social opportunities that enhance their quality of life. Additionally, Florida is recognized as one of the best retirement states because of its favorable financial environment, which significantly attracts individuals seeking to maximize their savings.

-

Arizona – Arizona’s stunning desert landscapes and active lifestyle make it a prime spot for those looking to unwind in a beautiful setting. The state’s numerous outdoor activities contribute to a relaxed yet vibrant atmosphere, appealing to those seeking both adventure and tranquility. Paul Deer, a CERTIFIED FINANCIAL PLANNER™, emphasizes that financial considerations are crucial for those who have stopped working, especially when incomes decrease in retirement.

-

North Carolina – Combining mild weather with breathtaking mountains and picturesque beaches, North Carolina is a haven for individuals who cherish diverse landscapes. The state’s rich cultural offerings and friendly communities further enhance its appeal to those in their golden years. However, individuals who have stopped working should be aware of the estate tax implications that can affect their financial planning.

-

Texas – With a low cost of living and a vibrant cultural scene, Texas is among the best retirement states, making it an attractive option for retirees. Its diverse cities offer a mix of affordable living and engaging experiences, making it an ideal choice for those looking to enjoy a fulfilling retirement. Furthermore, Texas is often listed among the best retirement states because of its absence of income tax, which adds to its financial appeal.

-

Tennessee – Tennessee is considered one of the best retirement states because it has no income tax and a rich musical heritage, making it an ideal destination for culture-loving seniors. The region’s vibrant ambiance and plenty of entertainment choices guarantee that seniors can relish an active lifestyle, making it one of the best retirement states while also gaining from advantageous tax circumstances.

-

South Carolina – South Carolina is often listed among the best retirement states, known for its charming coastal towns and pleasant climate, which provide a relaxed lifestyle for retirees. The state’s welcoming communities and beautiful beaches contribute to its reputation as one of the best retirement states, creating a serene environment perfect for unwinding. Retirees should consider the financial implications of estate taxes when planning their move.

-

Nevada – With its favorable tax structure and endless entertainment options, Nevada is frequently listed among the best retirement states for those seeking excitement. The region’s unique attractions and lively atmosphere ensure an engaging retirement experience, positioning it among the best retirement states with financial benefits that support a comfortable lifestyle.

-

Idaho – Idaho’s breathtaking natural beauty and outdoor recreational opportunities make it a haven for nature-loving individuals. The state’s stunning landscapes offer a peaceful retreat, ideal for those looking to immerse themselves in nature without the burden of high taxes.

-

Oregon – Oregon’s diverse landscapes and progressive culture attract individuals seeking vibrant communities. However, it is important to note that Oregon has low estate tax exemptions, which can significantly impact individuals’ financial planning and asset transfer.

-

Virginia – Rich in history and natural beauty, Virginia provides a balanced lifestyle for individuals who appreciate both cultural experiences and outdoor exploration. The region’s delightful towns and picturesque views foster a welcoming ambiance for individuals in their later years, but prospective seniors should be aware of the local estate and inheritance tax systems.

Key Factors Influencing Retirement State Rankings

Several critical factors play a significant role in determining the best locations for seniors, particularly in 2024:

- Cost of Living: For individuals on fixed incomes, affordability becomes a cornerstone of a comfortable life. Crafting a comprehensive budget that accounts for both fixed and variable costs is essential for financial health. This includes distinguishing between essential expenses, such as housing and healthcare, and discretionary expenses, like entertainment and dining out. In Montana, total expenditures average $54,741, and those who have stopped working must be mindful of their budgets, especially since it is considered one of the best retirement states with a comfortable phase of life estimated to cost around $65,689 annually. In contrast, Nevada’s total expenditures amount to $59,428, with a comfort buffer of $11,886, leading to an annual cost of a comfortable retirement, making it one of the best retirement states, of approximately $71,314.

- Healthcare Quality: Access to high-quality healthcare is paramount for individuals in their later years, ensuring they receive the necessary medical attention as they age. States with robust healthcare systems can greatly enhance the quality of life for older adults. The significance of healthcare quality is emphasized by the fact that 45% of 55-year-olds find it challenging to sustain relationships as they age, showcasing the social aspect of retirement.

- Climate: Many individuals in their later years are attracted to warmer climates, which promote outdoor activities and a more active lifestyle throughout the year. This preference significantly impacts their overall happiness and well-being.

- Tax Policies: Favorable tax structures can greatly affect the financial security of those in retirement. The best retirement states are those that minimize tax burdens on pensions and savings, enabling retirees to maximize their income.

- Recreational Opportunities: Access to parks, cultural events, and social activities enriches the experience of those in their later years. Participating in community events nurtures connections that are essential, particularly as 45% of 55-year-olds indicate challenges in sustaining relationships as they grow older. Moreover, the Ticket to Work program demonstrates how individuals can move towards financial independence while receiving disability benefits, enabling them to explore opportunities in the best retirement states during their later years. This program exemplifies the importance of education in financial empowerment, as it provides tools for individuals to manage their finances effectively. As mentioned by Dylan Tyson, President of Retirement Strategies at Prudential, America’s 55-year-olds have the chance to reimagine and safeguard their financial outcomes for the future with a new set of tools that can assist them in safely growing their nest egg while also ensuring a dependable stream of lifetime income. These insights highlight the transformative influence of education in making informed investment choices, stressing that considering not only the financial elements of later life but also the overall quality of existence in selected regions is vital.

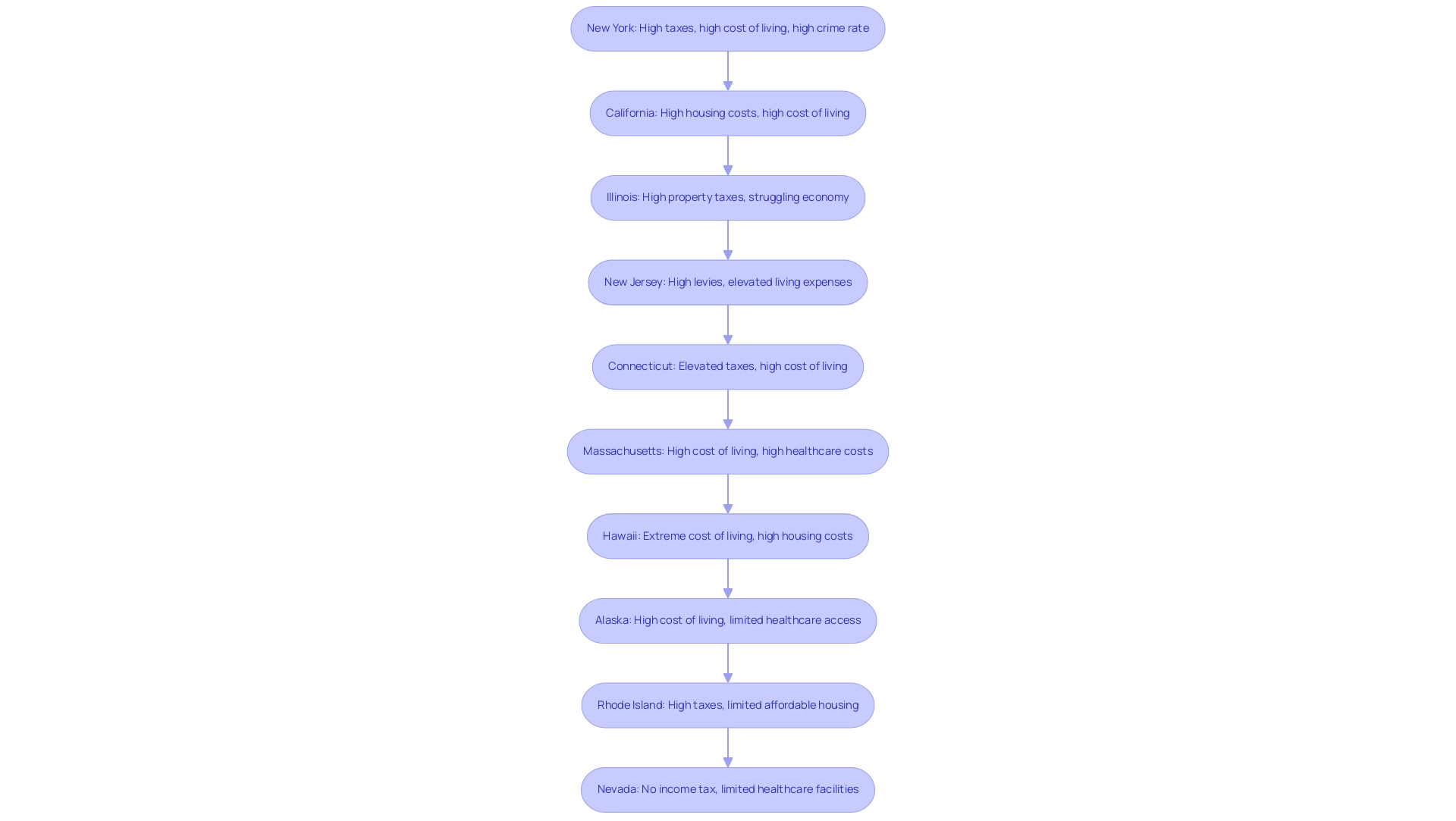

The 10 Worst States for Retirement in 2024

- New York – Retirees often find New York daunting due to its high taxes and exorbitant cost of living, which significantly reduce disposable income. Based on the FBI’s 2022 Crime Explorer, New York also has a higher crime rate in comparison to other regions, further complicating the experience of leaving the workforce. While the state boasts vibrant culture and amenities, these come at a price that can strain savings for later years.

- California – Renowned for its breathtaking scenery, California offers a mixed blessing; its lovely surroundings are countered by high housing costs and considerable levies, making it a difficult location for older individuals to handle their finances efficiently. Additionally, the cost of living in California is among the highest in the nation, which can be prohibitive for many.

- Illinois – With property tax rates among the highest in the nation and a struggling economy, Illinois ranks poorly for retirement. The financial burden of maintaining a comfortable lifestyle is compounded by these economic challenges, making it a less favorable option for retirees.

- New Jersey – Often condemned for its high levies and elevated living expenses, New Jersey may be a less appealing option for those pursuing affordability and financial security in their later years. The high cost of living here is often mentioned as a primary reason for older individuals to consider relocating.

- Connecticut – Like its neighboring state New Jersey, Connecticut encounters difficulties with elevated taxes and a high cost of living, rendering it an unappealing choice for many individuals seeking to maximize their savings. The limited affordable housing options further complicate the situation.

- Massachusetts – While rich in history and culture, Massachusetts’s high cost of living poses a significant barrier for retirees, who often find their budgets stretched thin in this picturesque state. The combination of high healthcare costs and living expenses can deter many from settling here.

- Hawaii – Despite its breathtaking scenery, Hawaii is notorious for its extreme cost of living, which can make leaving the workforce financially untenable for many individuals seeking a serene lifestyle in paradise. Housing and basic necessities can take a significant toll on savings for later years.

- Alaska – The high cost of living, combined with severe winters, can discourage older individuals from selecting Alaska as their post-career destination, despite its natural beauty and adventurous opportunities. The limited access to healthcare facilities in rural areas can also be a concern for retirees.

- Rhode Island – High taxes and limited affordable housing options contribute to Rhode Island’s low ranking as a retirement destination, leaving many potential individuals seeking alternatives. The region’s economic difficulties can create obstacles for individuals to achieve financial stability.

- Nevada – Although Nevada provides some appealing advantages, such as no regional income tax, the absence of healthcare facilities in rural regions presents a considerable disadvantage for individuals who prioritize access to medical care. This concern is particularly relevant for those with ongoing health needs.

In contrast, regions like Delaware, which takes the No. 1 spot for the best region to retire in 2024 according to Alex Gailey, provide a more favorable environment for retirees. Missouri and Michigan are also considered among the best retirement states because of their lower cost of living, making them more attractive for those aiming to maximize their savings. Moreover, regions such as Colorado, Florida, and Virginia are considered among the best retirement states for their lower ratings for later life living, which further highlights the significance of assessing different factors prior to making a relocation choice.

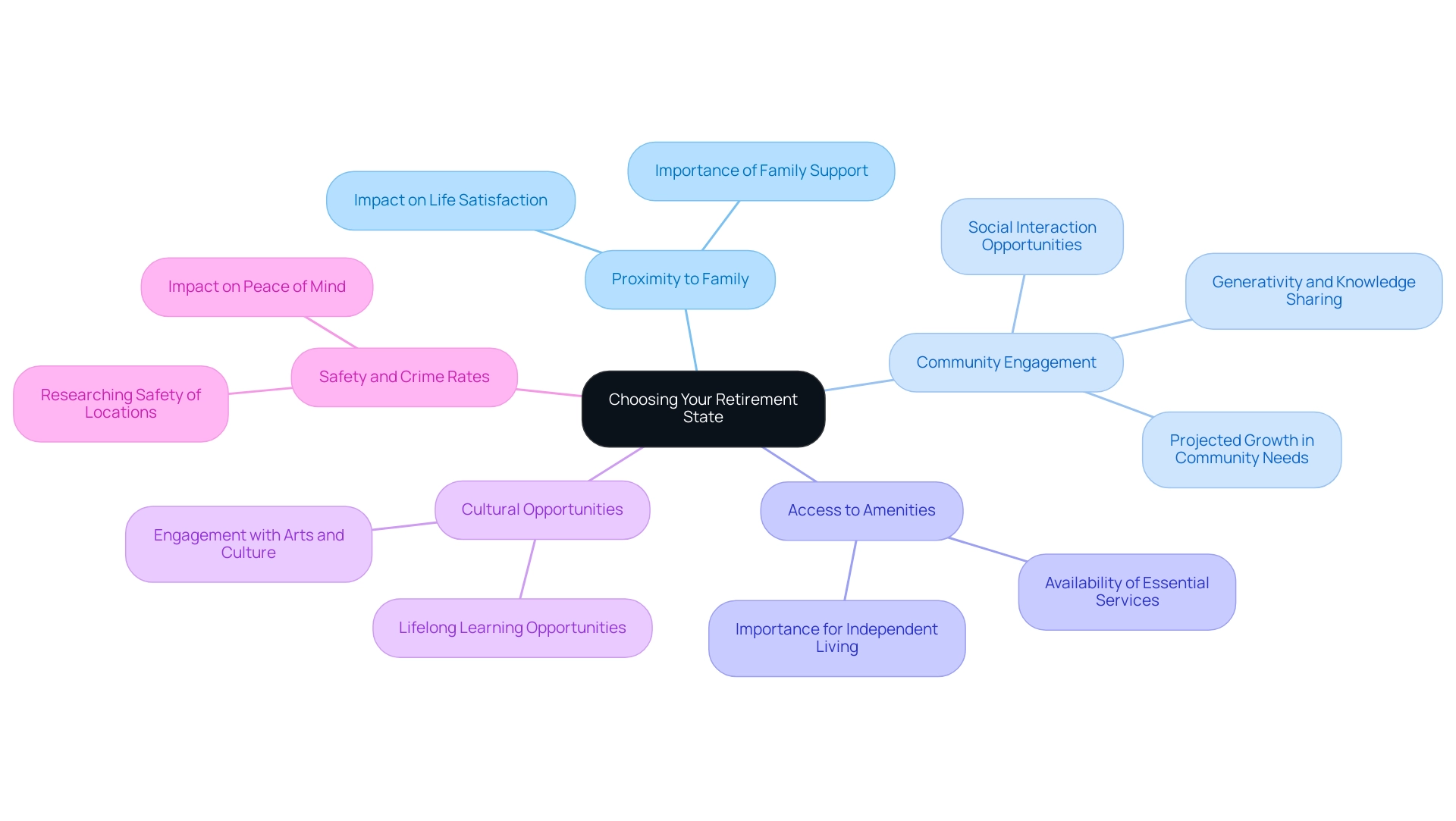

Important Considerations for Choosing Your Retirement State

When choosing an ideal location for this new phase of life, several important factors should be considered to ensure a fulfilling experience:

- Proximity to Family: Being near loved ones is crucial for enhancing life satisfaction during this period. Research indicates that family proximity significantly impacts satisfaction in later life, with those living close to family members reporting higher levels of happiness and support. As Oliver Arranz Becker highlights, the dynamics of familial relationships play a crucial role in this stage of life, particularly as the aging population expands; around half of the current dental workforce in Australia is expected to step down by 2026, emphasizing the significance of family support during such transitions.

- Community Engagement: Opting for regions with lively communities for seniors can result in enhanced social interaction and a feeling of belonging. Active engagement in community events not only fosters friendships but also contributes to overall well-being. Generativity remains a crucial element of life after work, allowing retirees to share their knowledge and stay connected. In fact, community engagement is projected to grow, with statistics indicating that the number of adults with any ADL care gap is expected to rise by approximately 31.6% by 2050, underscoring the need for robust community networks.

- Access to Amenities: Ensure that essential services such as grocery stores, healthcare facilities, and recreational centers are readily available. This accessibility is crucial for maintaining an independent and active lifestyle, particularly as one ages.

- Cultural Opportunities: Explore states that host cultural events, museums, and recreational activities aligned with your interests. Engaging with the arts and local culture can enhance your later years experience and provide lifelong learning opportunities.

- Safety and Crime Rates: Research the safety of potential locations for later years to ensure peace of mind. A secure environment contributes to a relaxed lifestyle, allowing those in their later years to fully enjoy their newfound freedom without concern for personal safety.

In conclusion, each of these considerations plays a significant role in shaping a fulfilling life experience, emphasizing the importance of community connections and family support, especially in the context of the best retirement states for an aging population.

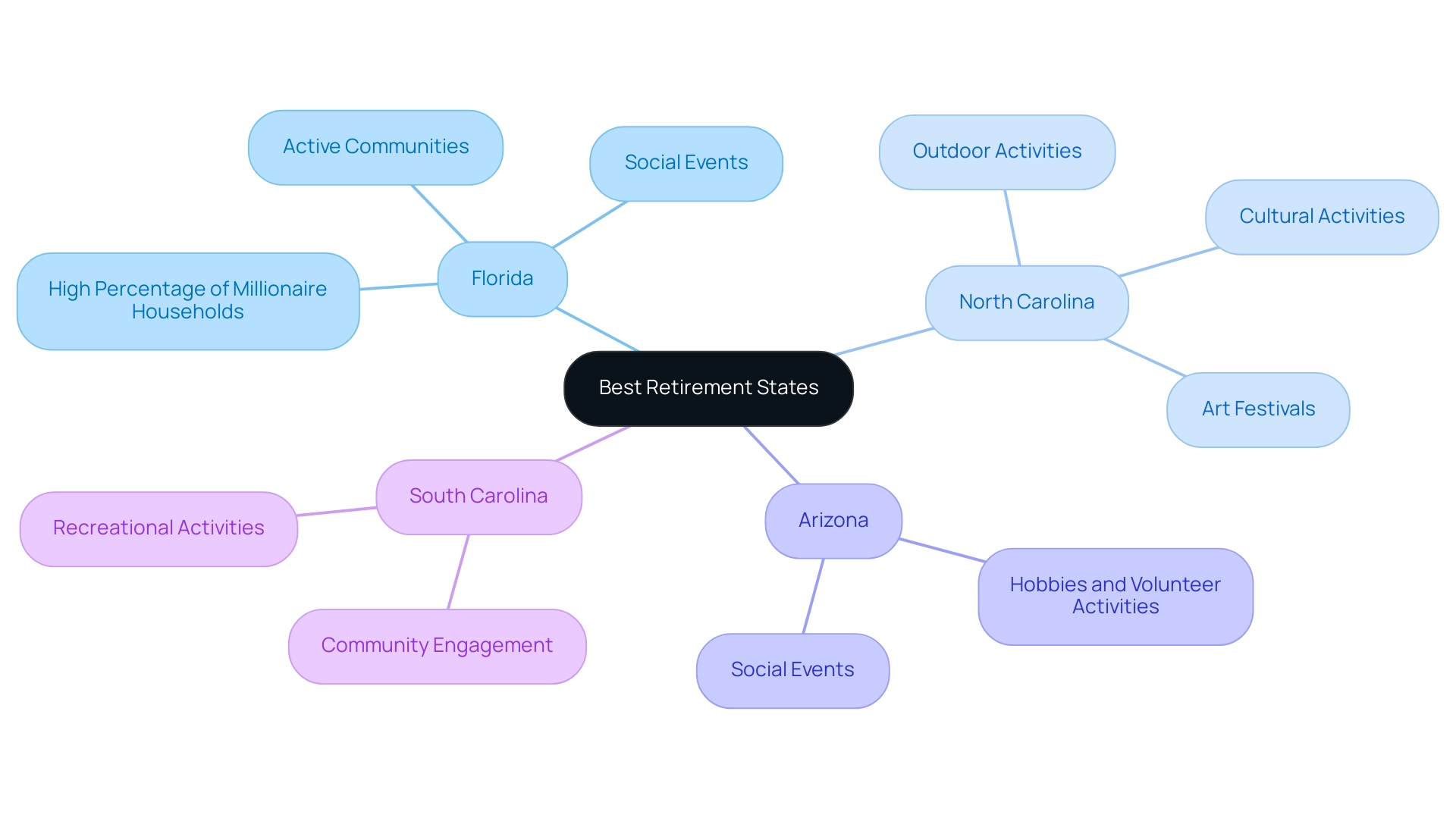

Lifestyle and Community in the Best Retirement States

When evaluating the best retirement states, it’s essential to look beyond just favorable living conditions; lively communities play a significant role in enhancing the experience of those in their later years. Florida is recognized as one of the best retirement states, featuring active retirement communities that serve as hubs for social events promoting engagement and interaction among residents. For example, many Florida communities arrange regular gatherings, clubs, and recreational activities that cater to diverse interests, making it easy for older adults to forge new friendships.

Notably, Florida has one of the highest percentages of millionaire households, which may suggest a higher quality of life and financial security for those in their later years. In contrast, North Carolina is considered one of the best retirement states, providing a unique mix of outdoor activities and rich cultural experiences, with numerous opportunities for hiking, art festivals, and local history tours that encourage individuals to immerse themselves in the community. Moreover, regions such as Arizona and South Carolina are recognized as some of the best retirement states for offering numerous opportunities for individuals to partake in hobbies, volunteer activities, and social events.

However, it’s important to consider that choosing warmer states for retirement may lead to higher costs due to rising temperatures and natural disasters, which can affect electric bills and homeowners insurance. Insurers are adjusting rates and coverage in these areas, making financial planning essential. In 2024, lifestyle benefits such as these remain a priority for many retirees seeking an enriching environment where they can thrive socially and personally.

Conclusion

As the landscape of retirement destinations evolves in 2024, it becomes evident that the choice of state plays a crucial role in shaping a fulfilling lifestyle during one’s golden years. The article highlights a range of states that cater to retirees’ needs, emphasizing the importance of factors such as:

- Climate

- Healthcare access

- Tax policies

- Recreational opportunities

From the sun-soaked shores of Florida to the serene mountains of North Carolina, the best states for retirement offer diverse environments that cater to varying preferences and lifestyles.

Conversely, the article also sheds light on states that may present challenges for retirees, primarily due to high costs of living and unfavorable tax structures. States like New York and California exemplify how financial burdens can overshadow the allure of vibrant culture and scenic beauty. This dichotomy underscores the necessity for retirees to carefully evaluate their options based on personal priorities and financial considerations.

Ultimately, the journey to finding the ideal retirement state is deeply personal and should factor in individual values, community engagement, and proximity to loved ones. By thoughtfully considering these elements, retirees can make informed decisions that enhance their quality of life and ensure a rewarding experience in their later years. The insights provided serve as a valuable resource, guiding individuals towards a retirement that aligns with their aspirations and promotes a fulfilling lifestyle.

Frequently Asked Questions

Why is selecting the right retirement state important?

Selecting the right retirement state is vital for ensuring a satisfying lifestyle during one’s golden years, as it impacts factors such as climate, tax advantages, healthcare quality, and recreational opportunities.

What are some of the best retirement states recognized in 2024?

Some of the best retirement states recognized in 2024 include Alaska, New Hampshire, Florida, Arizona, North Carolina, Texas, Tennessee, South Carolina, Nevada, Idaho, Oregon, and Virginia.

What are the tax advantages of retiring in Alaska?

Alaska boasts the lowest tax burden at just 5.06%, making it financially appealing for retirees.

What makes Washington D.C. a top destination for older adults in 2025?

Washington D.C. is recognized for its abundance of healthcare providers and diverse leisure activities, making it an attractive destination for older adults.

How do individual preferences influence the choice of retirement state?

Individual preferences, such as urban versus rural living, climate, and community, greatly influence the decision-making process when selecting a retirement location.

What are some benefits of retiring in Florida?

Florida is known for its warm climate, lack of state income tax, vibrant communities, and numerous activities that enhance the quality of life for retirees.

Why is Arizona considered a prime retirement spot?

Arizona offers stunning desert landscapes, an active lifestyle, and numerous outdoor activities, appealing to those seeking both adventure and tranquility.

What should retirees consider in North Carolina?

North Carolina combines mild weather with diverse landscapes, but retirees should be aware of the estate tax implications that can affect their financial planning.

What are the financial benefits of retiring in Texas?

Texas features a low cost of living, a vibrant cultural scene, and no state income tax, making it financially appealing for retirees.

How does Tennessee cater to retirees?

Tennessee has no income tax, a rich musical heritage, and a vibrant atmosphere, providing culture-loving seniors with an active lifestyle.

What makes South Carolina a desirable retirement state?

South Carolina is known for its charming coastal towns, pleasant climate, and welcoming communities, creating a relaxed lifestyle for retirees.

Why is Nevada frequently listed among the best retirement states?

Nevada offers a favorable tax structure and endless entertainment options, ensuring an engaging retirement experience.

What are the advantages of retiring in Idaho?

Idaho is known for its breathtaking natural beauty and outdoor recreational opportunities, providing a peaceful retreat for nature-loving individuals.

What should retirees be aware of when considering Oregon?

While Oregon has diverse landscapes and vibrant communities, it has low estate tax exemptions that can significantly impact financial planning.

What does Virginia offer retirees?

Virginia provides a balanced lifestyle with rich history and natural beauty, but retirees should be mindful of local estate and inheritance tax systems.