Overview

Opening a Starbucks franchise can feel like a daunting journey, especially when considering the costs involved. We understand that the initial investment, which can range from $315,000 to $2.9 million, may evoke feelings of uncertainty. This figure encompasses various expenses such as:

- Licensing fees

- Construction

- Equipment

All of which can weigh heavily on your mind. However, it’s essential to recognize the importance of financial stability and operational independence as a prospective licensee. You are not alone in this process; many have navigated these challenges and found success. By focusing on your aspirations and understanding the support available, you can take confident steps toward your career ownership.

Introduction

In the ever-changing world of coffee retail, we understand that embarking on a journey with a brand like Starbucks can feel both exciting and daunting. Starbucks is not just known for its iconic beverages; it also offers a unique approach to business expansion through licensing, which can be a nurturing path for aspiring entrepreneurs. This model allows you to operate a licensed Starbucks store, providing the flexibility you desire while ensuring that you uphold the brand’s high standards.

As the coffee market evolves rapidly, many potential licensees are drawn to the lucrative prospects of aligning their business with a globally recognized brand. However, we recognize that navigating the complexities of this opportunity can be overwhelming. It requires a thorough understanding of financial qualifications, initial investments, and ongoing operational costs. You are not alone in feeling this way.

As coffee culture continues to thrive, exploring the intricacies of Starbucks’ licensing model becomes essential for those of you looking to carve out your niche in this competitive landscape. Together, we can empower you to take the first steps toward career ownership, transforming challenges into opportunities for growth and success.

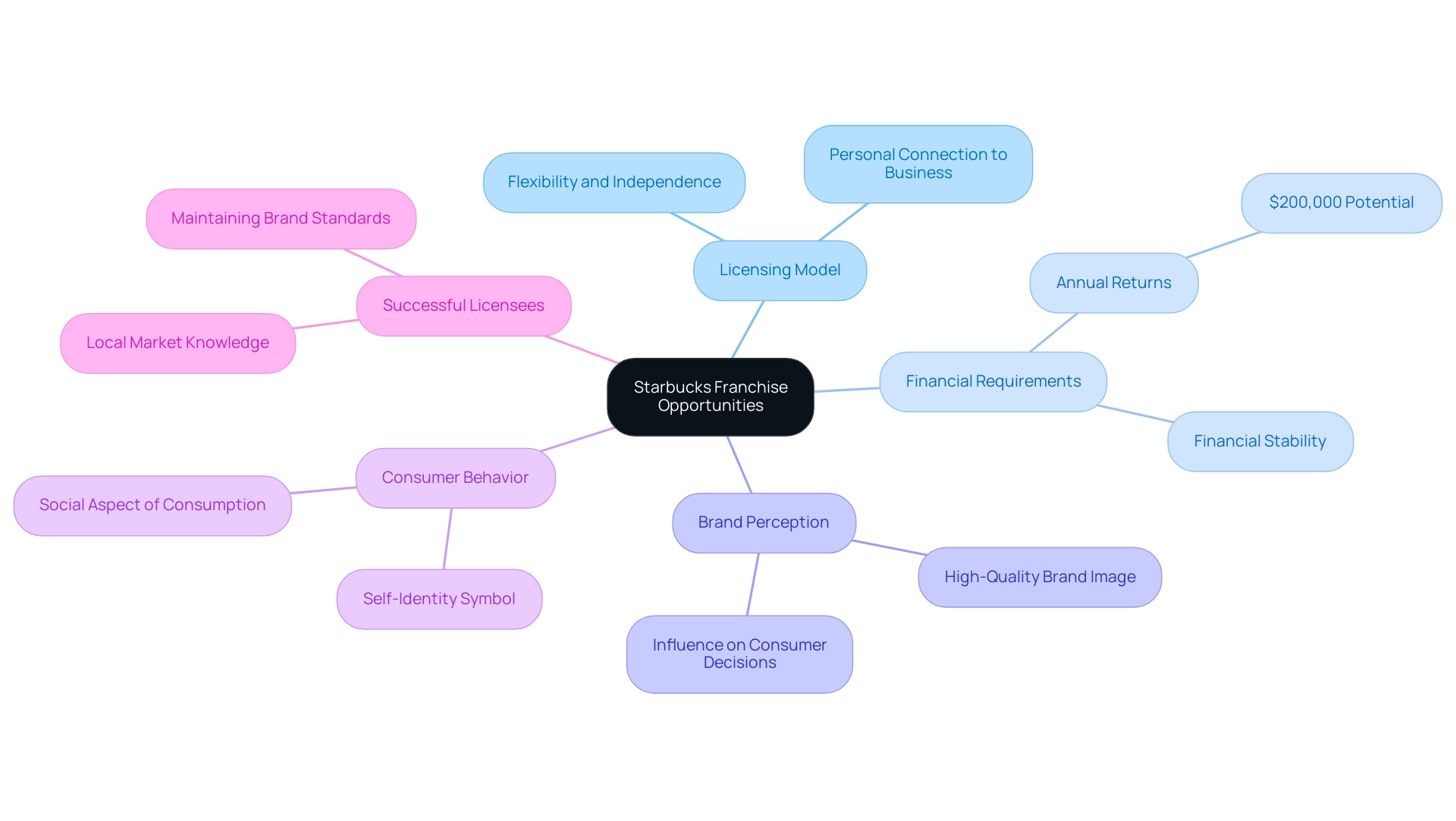

Overview of Starbucks Franchise Opportunities

The coffee chain presents a unique opportunity through its licensing model, which differs from traditional franchising. This approach offers a distinct pathway for those eager to enter the coffee retail market, providing prospective licensees with the chance to manage a licensed coffee shop. This model grants greater flexibility and independence compared to conventional franchise agreements, allowing for a more personal connection to the business. To qualify, applicants are encouraged to demonstrate their financial stability and a strong commitment to upholding the company’s rigorous brand standards.

As we look toward 2025, the coffee retail landscape is shifting, and licensing opportunities are becoming increasingly appealing. Industry experts suggest that expanding this model could lead to highly sought-after opportunities, especially given the potential for significant returns. For those who align with the brand’s values and operational standards, owning a coffee shop franchise can yield annual returns of up to $200,000, making it a promising venture.

Recent studies, including one focused on college students’ purchasing behaviors in Taiwan, reveal the strong brand image of the coffee chain and its profound influence on consumer decisions. The research indicates that the coffee shop is perceived as a high-quality brand, playing a crucial role in shaping the coffee consumption habits of younger demographics. This perception underscores the importance of brand identity in the coffee retail sector, particularly for potential licensees who must embody these values.

The study identified various lifestyle groups and highlighted the social aspect of coffee consumption, positioning the brand as a symbol of self-identity and social activity. For aspiring entrepreneurs, understanding the costs associated with a Starbucks franchise and how the coffee chain’s licensing operates is vital. Unlike franchising, where franchisees operate under a more rigid structure, licensing allows for a degree of independence while still adhering to the brand’s established guidelines. This model fosters a sense of ownership and encourages innovation within the framework of the company’s operational standards.

Successful licensee stories further illustrate the potential of this model. Many licensees have thrived by leveraging their local market knowledge while maintaining the high standards expected by the brand. This synergy between local entrepreneurship and brand integrity distinguishes the licensing opportunity of this coffee chain from traditional franchising, making it an appealing option for those looking to invest in the coffee retail industry. As one reviewer noted about their experience, “At first, it seemed a little overpowering, as the peppery notes from the olive oil kind of masked the espresso. But after a few sips, it became more appealing,” highlighting the nuanced customer experience that aligns with the brand standards.

Initial Investment Breakdown: What to Expect

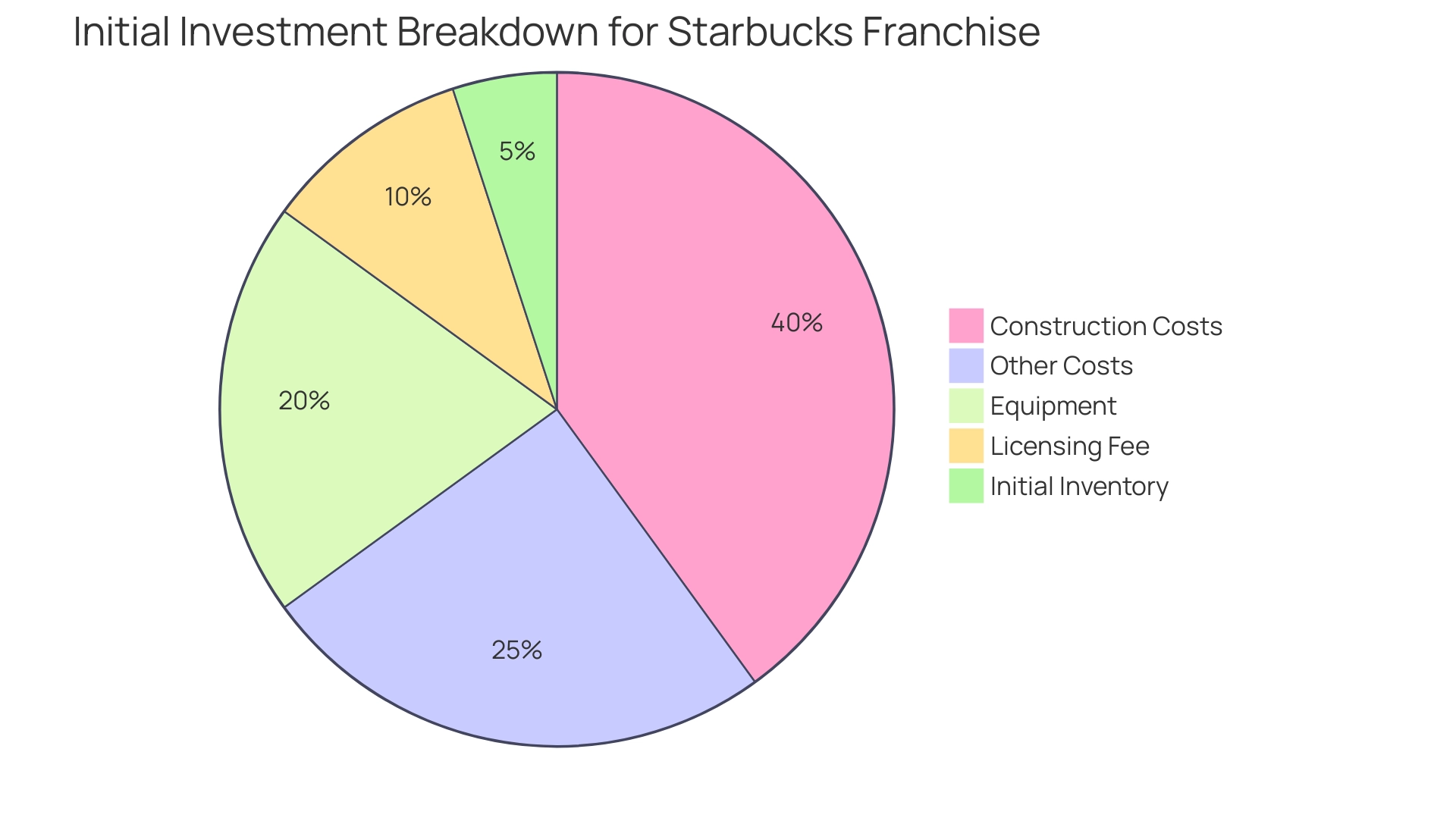

When contemplating the cost of a Starbucks franchise, it’s essential to recognize the significant initial investment required to open a licensed location, typically ranging from $315,000 to $2.9 million. This investment includes various critical components, such as the licensing fee, construction and build-out costs, equipment, and initial inventory. Understanding how much a Starbucks franchise costs can feel overwhelming, but you’re not alone in this journey. The licensing fee alone is about $315,000, illustrating the financial commitment involved for franchisees.

Construction expenses can vary greatly, influenced by factors like location, store size, and local regulations. Urban areas, for example, may face higher build-out costs due to increased labor and material expenses. It’s crucial for prospective franchisees to prepare a detailed budget that captures all these elements, ensuring they account for potential fluctuations in costs. Remember, taking the time to plan can alleviate some of the stress associated with these financial decisions.

In 2025, financial experts emphasize the importance of comprehensive economic planning when considering a coffee shop franchise. A well-structured budget not only aids in managing initial investments but also prepares franchisees for ongoing operational costs. This proactive approach can help mitigate unexpected financial burdens, enhancing the likelihood of a successful business venture. You deserve to feel confident in your financial planning.

Moreover, understanding the costs associated with opening a Starbucks franchise is vital for making informed decisions. For instance, the average costs to open a licensed coffee store in 2025 encompass not just the licensing fee but also equipment expenses, which can range from $50,000 to $150,000, and initial inventory, potentially requiring an additional $20,000 to $30,000. By thoroughly examining these figures, you can make informed choices regarding your investment and strategically plan your entry into the coffee franchise system.

Additionally, a recent analysis titled “The Coffee Chain’s Financial and Operational Strategy Analysis” highlights the company’s significant sales and net income growth from 2021 to 2022, while also addressing challenges like changing consumer attitudes and increased competition. This context is essential for understanding the current landscape, and it’s okay to feel uncertain—many franchisees do.

Furthermore, Meiyi Chen noted that the coffee chain recently unveiled its strategic vision for China 2025, which could enhance the company’s development potential. This forward-looking perspective is crucial for franchisees considering long-term investments. You are not alone in navigating these complexities.

Lastly, it’s important to recognize that the coffee company’s liquidity, profitability, and valuation ratios are gradually improving post-pandemic, indicating a positive economic trajectory that could benefit franchise owners. However, being aware of the challenges the company faces will help you navigate this business opportunity with greater confidence. Remember, with the right planning and support, you can embark on this exciting journey.

Ongoing Fees and Royalties: Budgeting for Success

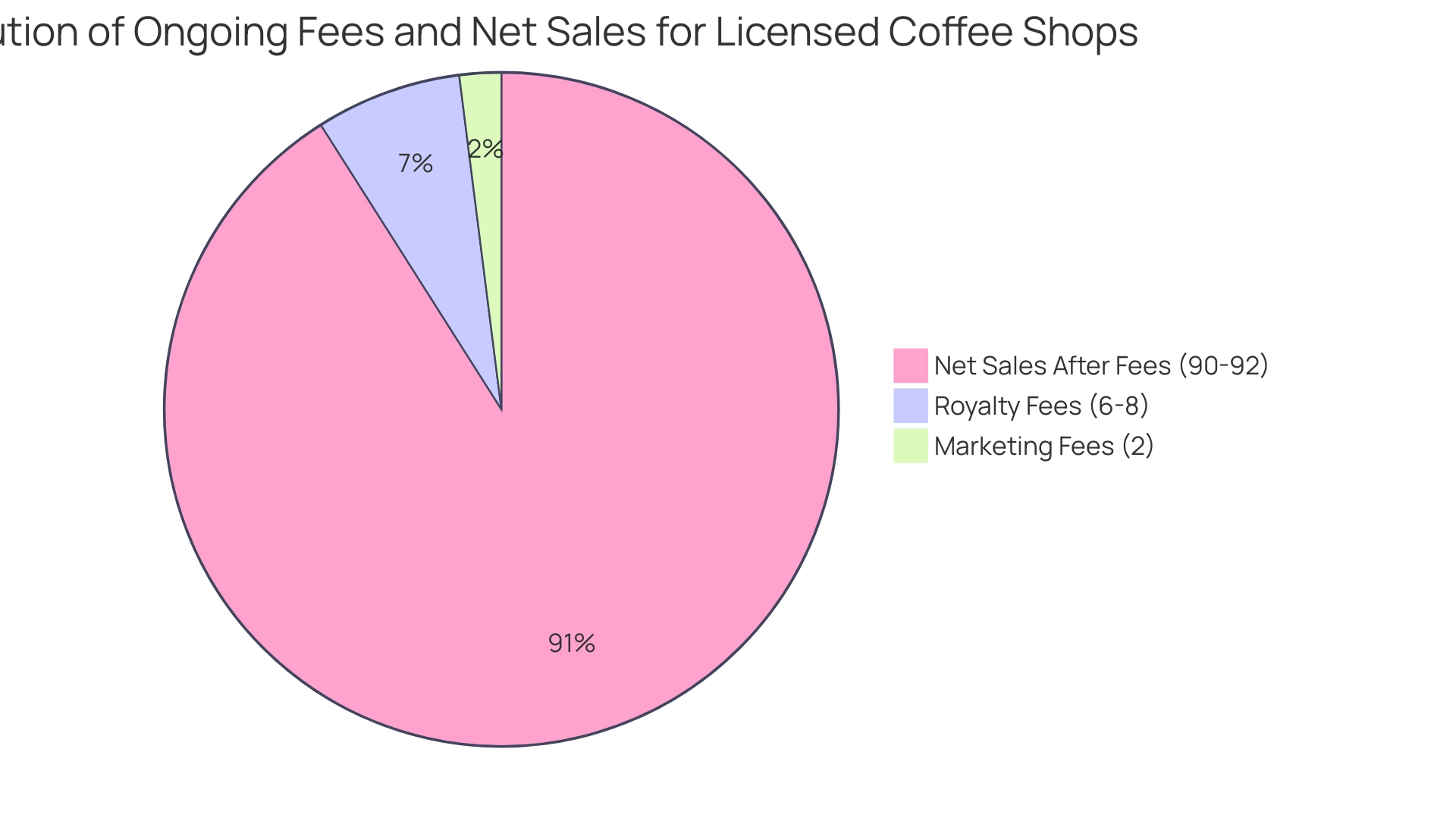

Once operational, licensed coffee shops face ongoing fees that can significantly impact their financial performance. We understand that the royalty fee, typically ranging from 6% to 8% of gross sales, along with a marketing fee of about 2% of gross sales, represents a substantial commitment. These fees are essential for upholding Starbucks’ brand standards and facilitating effective marketing initiatives, but they can feel overwhelming.

For instance, if a store achieves $1 million in sales, the royalty fee could total between $60,000 and $80,000 annually. This is a considerable financial obligation that requires careful planning to maintain sustainable profitability. You are not alone in feeling the weight of these costs; understanding their impact on overall profitability is crucial for licensees.

In the early stages of operation, when cash flow may be limited, these ongoing fees can challenge the economic viability of the business. Prospective franchise owners should reflect on how much a Starbucks franchise costs in their economic forecasts and budgeting plans, preparing themselves for the financial realities of running a licensed coffee shop.

In addition to the direct costs associated with royalties and marketing fees, it’s vital to consider the broader implications of these expenses on your overall business strategy. Efficient resource management, including meticulous budgeting for ongoing expenses, can empower franchisees to navigate the complexities of operating within the coffee chain while enhancing their potential for success. As Parnell Woodard, a Career Ownership Coach, emphasizes, “Transitioning to career ownership requires a keen understanding of monetary management to ensure long-term success.”

Furthermore, integrating customer loyalty programs, such as Starbucks’ Rewards program, can indirectly enhance economic performance. By allowing customers to accumulate ‘Stars’ for rewards, franchisees can foster loyalty, potentially leading to increased sales that help offset some of the ongoing fees. This mirrors IKEA’s experience, where revamping its loyalty program resulted in members contributing to 58% of total sales, showcasing the effectiveness of loyalty initiatives in driving revenue.

Lastly, franchisees should be aware of the commensurate with income standard, which allows for adjustments to transfer prices based on actual income generated by intangibles. This insight can help customize monetary strategies to align better with revenue streams, ultimately supporting the journey toward successful career ownership and personal fulfillment in a changing job market. In the context of ‘Your Career 2.0: A Survival Guide for The Battered Career Syndrome and Investor Syndrome,’ understanding these economic dynamics is essential for career transitioners seeking monetary independence and navigating the challenges of business ownership.

Financial Qualifications for Aspiring Franchisees

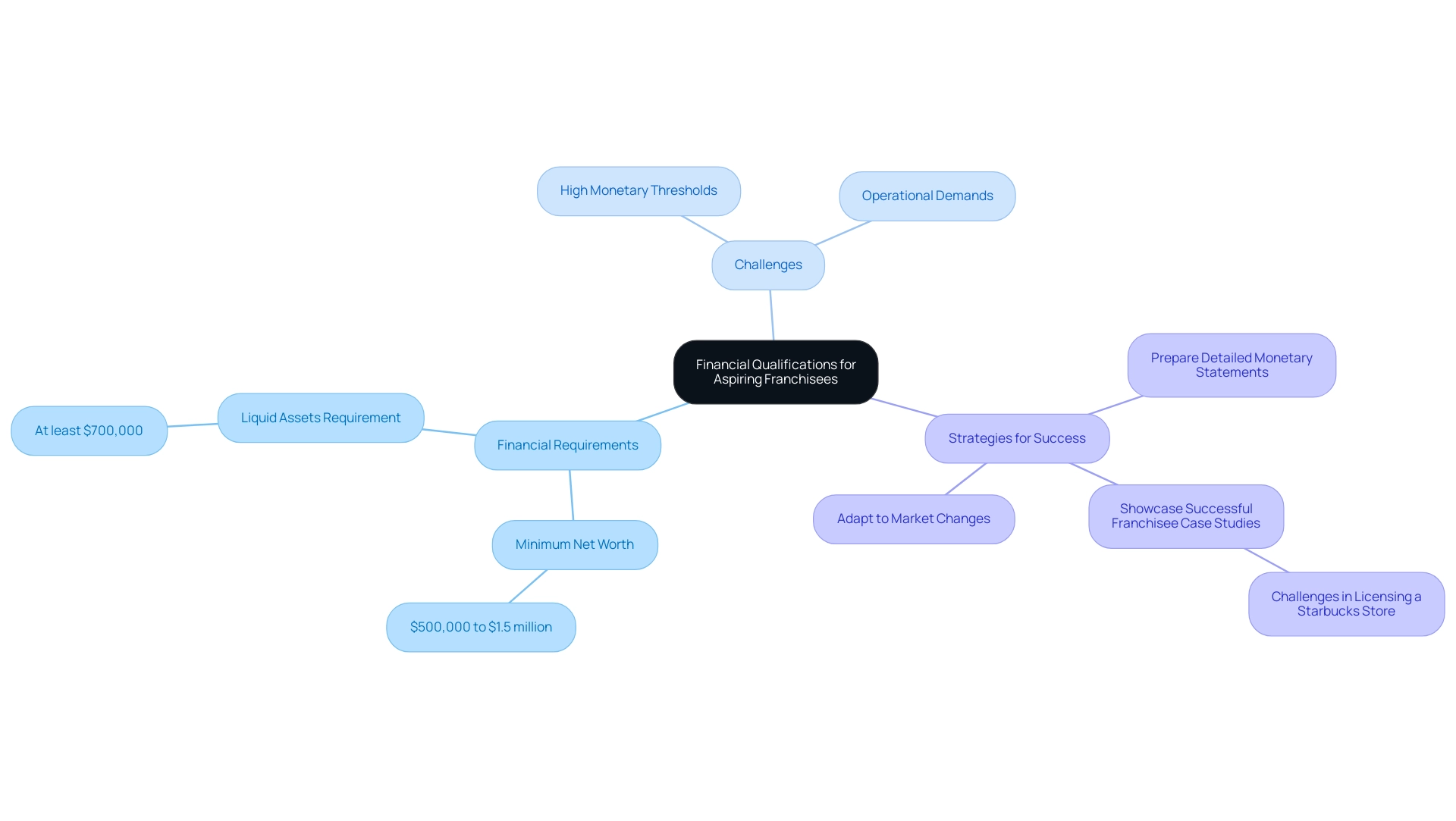

Qualifying for a coffee shop license can feel daunting, but we understand that many aspiring entrepreneurs share similar challenges. Applicants typically need to demonstrate considerable economic stability, with a minimum net worth ranging from $500,000 to $1.5 million. Among these assets, it’s essential to have at least $700,000 in liquid form. This financial readiness is not just a formality; it plays a crucial role in the application process. The company seeks to partner with individuals who possess the necessary resources to thrive in a competitive market.

We encourage prospective licensees to prepare detailed monetary statements that clearly outline their economic capabilities. Doing so can significantly enhance your chances of approval, showcasing your commitment to meeting the rigorous standards set by the company. The challenges related to licensing a coffee shop are substantial, including high monetary thresholds and operational demands. These hurdles necessitate effective marketing strategies and solid business acumen.

As highlighted in the case study ‘Challenges in Licensing a Starbucks Store,’ these obstacles can be significant for hopeful entrepreneurs. However, remember that successful Starbucks licensees often illustrate their economic preparation through compelling case studies that showcase their journey. These examples reveal how comprehensive planning and a clear understanding of the market can lead to successful outcomes, even in a landscape dominated by competitors like Dunkin’, McDonald’s McCafe, and Peet’s Coffee. As industry insider The Wolf of Franchises wisely notes, ‘Grasping the economic qualifications is crucial for both new and existing franchise owners to achieve success.’

In this context, ‘Your Career 2.0: A Survival Guide for The Battered Career Syndrome and Investor Syndrome’ serves as an essential resource for those navigating career transitions. It emphasizes the importance of personal agency and economic freedom in managing the complexities of business ownership. To further assist you in overcoming the economic and operational hurdles mentioned, we invite you to ‘Get the Book’ and explore strategies that can enhance your journey toward business ownership.

As the coffee sector evolves, it’s vital for aspiring business owners to remain alert and adaptable, ensuring they meet the monetary criteria needed for licensing in 2025. The Entrepreneur’s Source has supported hundreds of thousands of individuals in assessing their career possibilities, reinforcing the significance of financial preparedness in navigating career transitions. Remember, you are not alone in this journey—together, we can work towards your dreams of business ownership.

Licensing vs. Franchising: Key Considerations

The fundamental distinction between licensing and franchising revolves around the level of control and the nature of operational guidelines provided. In a franchise arrangement, the franchisor typically outlines a comprehensive business model, offering extensive operational support to ensure consistency across locations. However, licensing allows licensees greater autonomy, enabling them to adapt their business practices while still adhering to essential brand standards.

Consider the coffee chain that exemplifies this licensing model. Here, licensees enjoy a higher level of operational independence compared to traditional franchisees. This flexibility empowers them to tailor their offerings and management strategies to better suit local market conditions, all while maintaining the core elements of the brand. For potential investors, understanding this distinction is vital as it directly impacts their business goals and management style.

Have you noticed how operational independence is becoming increasingly significant in the coffee industry? Many successful coffee brands are adopting similar licensing strategies, fostering growth and adaptability. In fact, the coffee sector has seen a notable increase in the number of licensed locations, reflecting a broader trend towards flexibility in business operations. According to a case study on top-ranked franchises, the food industry, including coffee brands, continues to dominate the franchising landscape. This emphasizes the importance of understanding these models for prospective investors.

As Chris Wright, co-founder and CPO, aptly puts it, “He hates talking about himself, which is why this bio is so short. He’d rather talk to you about franchises.” This perspective highlights the importance of operational independence in franchise discussions.

Additionally, understanding copyright licensing is crucial. It grants permission to use a copyright holder’s work while protecting the creator’s rights, which is relevant to the operational guidelines for licensees of the brand. Thus, prospective investors should carefully evaluate how the licensing model aligns with their vision for operational management and brand representation. You are not alone in navigating these complexities; we understand the importance of making informed decisions.

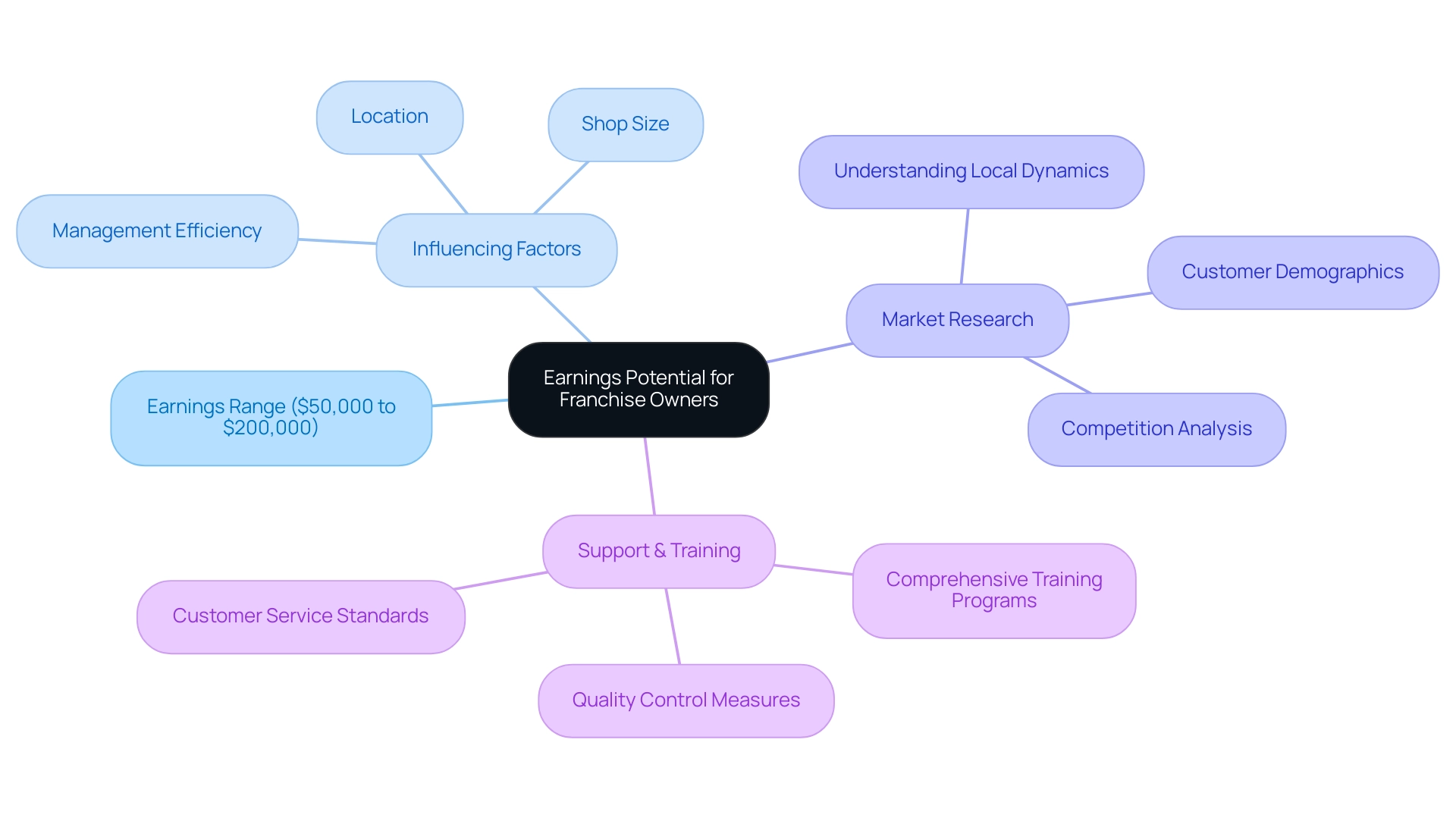

Earnings Potential: What Franchise Owners Can Expect

Earnings for licensed Starbucks proprietors can vary significantly, typically ranging from $50,000 to $200,000 annually. This wide range is influenced by several critical factors, including location, shop size, and management efficiency. Have you ever wondered how a well-managed store in a bustling, high-traffic area can yield substantially higher profits than one in a less favorable environment? Understanding these dynamics is essential for anyone considering this opportunity.

In 2025, the average annual income for the coffee chain’s licensees reflects the brand’s strong market presence and customer loyalty. However, we understand that prospective licensees face the daunting task of conducting comprehensive market research and financial forecasting to accurately gauge their expected earnings. It’s crucial to grasp the local market dynamics, including customer demographics and competition, to maximize profitability.

Moreover, the coffee chain offers extensive support and training to its licensed business owners, ensuring consistent product quality and customer service, which are vital for maintaining a loyal customer base. This assistance can greatly influence a shop’s revenue capability. As Parnell Woodard, a Career Ownership Coach, emphasizes, “Transitioning to career ownership empowers individuals to achieve their career goals,” highlighting the importance of the support available for franchisees in navigating the complexities of business ownership.

As we analyze the profits of current coffee shops, it becomes evident that those with strong management practices and strategic locations consistently outperform their peers. This underscores the importance of not only selecting the right location but also implementing effective operational strategies to enhance profitability. For investors, comprehending the earnings capability is vital; the profits of the coffee chain serve as essential markers of the company’s economic well-being, influencing decisions related to potential investments.

In summary, while the earnings potential for licensed Starbucks store owners can be lucrative, it is imperative to approach this opportunity with a thorough understanding of the factors that influence profitability, including the brand’s gross margin of 25.09%. This ensures informed decision-making and strategic planning, empowering career transitioners to take control of their futures and navigate the challenges of a changing job market. As outlined in ‘Your Career 2.0: A Survival Guide for The Battered Career Syndrome and Investor Syndrome,’ addressing employability concerns and the need for financial independence is crucial for success in this venture. Remember, you are not alone; we are here to support you on this journey.

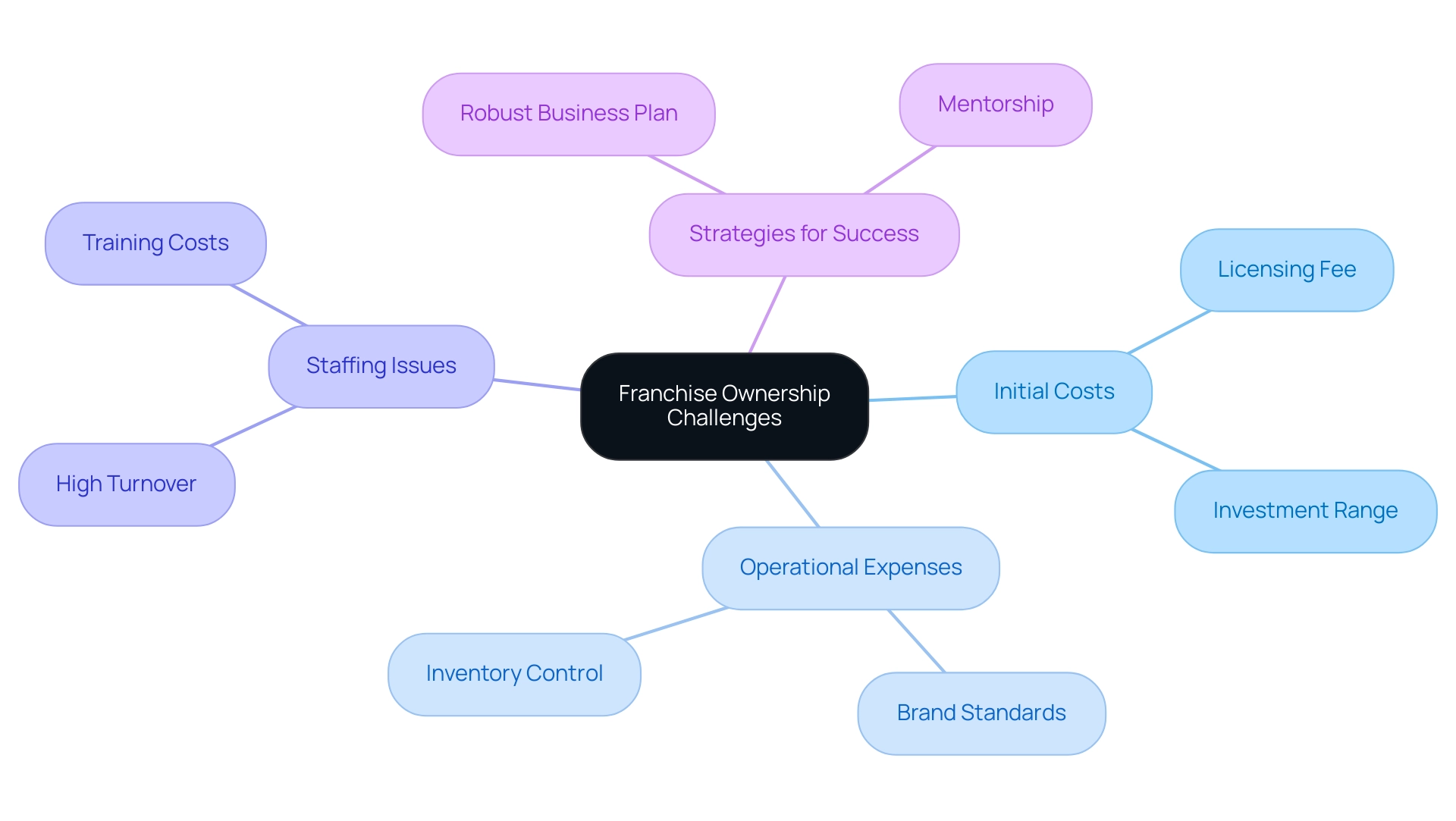

Challenges and Considerations in Franchise Ownership

Owning a licensed coffee shop can be both an exciting and daunting journey, especially in today’s unpredictable job market. Many aspiring entrepreneurs find themselves grappling with significant challenges. We understand that the coffee chain does not currently offer franchise opportunities; therefore, potential owners are encouraged to explore other franchise options. The initial investment for a licensed coffee shop can be quite substantial, prompting the question: how much does a Starbucks franchise cost? Costs can vary widely, ranging from $228,620 to $2,888,700 depending on the location and size of the establishment.

Additionally, it’s important to recognize that licensees must pay a licensing fee of $315,000 and meet a net worth requirement of at least $700,000. These upfront expenses can feel overwhelming, but understanding them is the first step in navigating this complex landscape.

Beyond these initial costs, ongoing operational expenses can significantly affect profitability. Licensees are required to maintain strict brand standards, ensuring consistent quality in products and customer service. Managing a coffee shop involves various challenges, including staffing, inventory control, and maintaining high levels of customer satisfaction. These operational hurdles can be particularly intimidating for those new to the franchise model. For instance, many licensees face staffing issues, which can lead to high turnover and increased training costs.

Expert insights stress the importance of crafting a robust business plan that addresses these challenges directly. Parnell Woodard, a Career Ownership Coach, emphasizes the transformative power of career ownership, stating, “Empowering clients to achieve their career goals is essential in navigating these complexities.” This perspective resonates deeply with the principles outlined in “Your Career 2.0: A Survival Guide for The Battered Career Syndrome and Investor Syndrome,” which encourages individuals to take charge of their career paths through business ownership.

To assist you on this journey, we encourage you to consider obtaining “Your Career 2.0” as a vital resource for navigating these challenges. Seeking mentorship from seasoned business owners can also provide invaluable insights and strategies for operating a licensed coffee shop.

Despite the hurdles, there remains a promising opportunity for substantial earnings for well-managed coffee shops, with annual profits reported between $50,000 and $200,000. By embracing these realities and preparing adequately, potential licensees can enhance their chances of achieving success in this competitive market, ultimately fostering economic independence and personal growth. Remember, you are not alone on this journey; with the right support and resources, you can thrive.

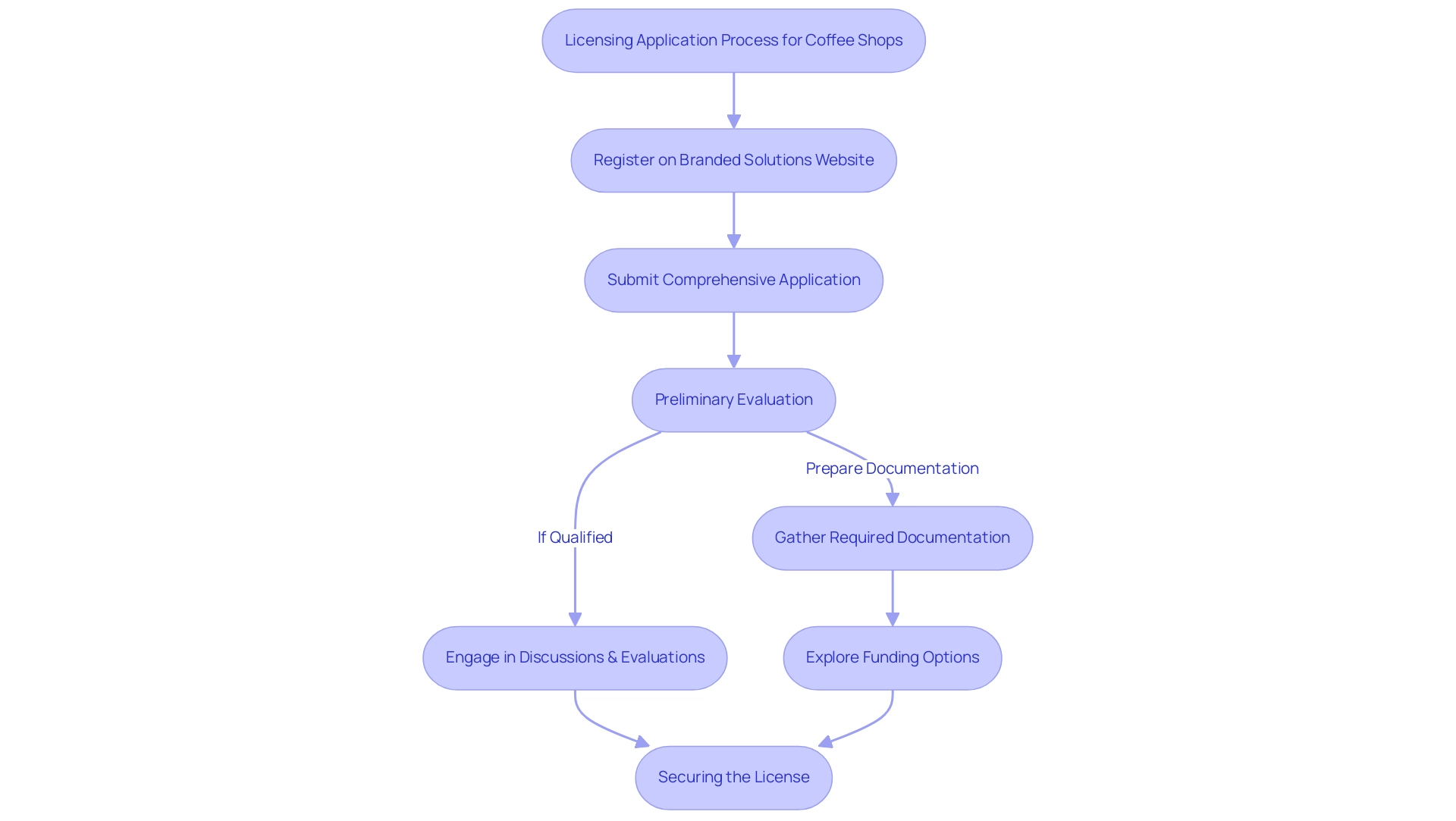

Navigating the Licensing Application Process

Navigating the process of obtaining a coffee shop license can feel overwhelming, but you are not alone. It’s structured and requires careful attention to detail, which can be daunting for many. Initially, prospective licensees must register on the Branded Solutions website of the company, where they will submit a comprehensive application that outlines their business experience and demonstrates financial stability. This initial submission is crucial, as it sets the stage for the subsequent steps.

Once the application is submitted, the company undertakes a preliminary evaluation to assess your qualifications. If your application meets the necessary criteria, you will be invited to engage in further discussions and evaluations. This stage often involves interviews and additional documentation to ensure that you align with the brand values and operational standards of the company.

It’s important to note that this entire process can span several months, underscoring the need for patience and thorough preparation. Gathering all required documentation in advance can help streamline your experience. In addition to preparing your application, consider your funding options. Self-funding through checking and savings accounts, along with cash equivalents, can offer a solid economic foundation for your venture.

This approach allows you to maintain control over your investment and can be a viable alternative to traditional financing methods. Moreover, exploring funding options available from the U.S. Small Business Administration (SBA) can provide additional financial resources to help launch your franchise. These loan programs are designed to support small businesses and can complement your self-funding strategies.

As you embark on this journey, remember that being well-prepared can significantly enhance your chances of success in securing a license. Starbucks is well-positioned to capitalize on trends such as plant-based options and digital convenience, as noted in the case study on the company’s future. This emphasizes the importance of customer loyalty and a unique coffee experience for continued success. You have the potential to create something meaningful, and with the right preparation, you can achieve your aspirations.

Conclusion

Owning a licensed Starbucks store can be a wonderful opportunity for aspiring entrepreneurs eager to step into the coffee retail market. This licensing model, which differs from traditional franchising, offers you greater operational flexibility while still requiring a commitment to the brand’s high standards. With potential annual returns between $50,000 and $200,000, it’s clear that partnering with a globally recognized brand like Starbucks can lead to significant financial rewards. However, it’s important to be aware of the challenges that come with this venture.

Understanding the financial requirements is crucial for anyone considering this path. The initial investment can be quite substantial, with costs ranging from $315,000 to nearly $2.9 million, depending on various factors. Additionally, you’ll need to consider ongoing fees and royalties in your financial planning to ensure sustainable profitability. Effective budgeting and financial management will be your allies in navigating these complexities and achieving long-term success.

Moreover, the licensing application process requires thoughtful preparation and a strong demonstration of financial stability. As a prospective licensee, you’ll need to show your commitment to upholding Starbucks’ brand values and operational standards. By leveraging your local market knowledge and focusing on customer satisfaction, you can thrive even in a competitive landscape.

In summary, the journey to owning a licensed Starbucks store can be both rewarding and challenging. With the right preparation, financial acumen, and dedication to the brand’s ethos, you can turn this opportunity into a successful business endeavor. The coffee market is ever-evolving, and those who are ready to adapt will discover ample potential for growth and success within the Starbucks licensing framework. Remember, you are not alone on this journey; with support and determination, you can achieve your aspirations.

Frequently Asked Questions

What is the licensing model offered by the coffee chain?

The licensing model allows individuals to manage a licensed coffee shop, providing greater flexibility and independence compared to traditional franchising. It encourages a personal connection to the business while adhering to the company’s brand standards.

What are the qualifications needed to become a licensee?

Applicants are encouraged to demonstrate financial stability and a strong commitment to upholding the company’s rigorous brand standards.

What are the potential financial returns for coffee shop franchise owners?

Owning a coffee shop franchise can yield annual returns of up to $200,000 for those who align with the brand’s values and operational standards.

How does the brand image influence consumer behavior?

The coffee chain is perceived as a high-quality brand, significantly influencing consumer decisions, particularly among younger demographics, and shaping their coffee consumption habits.

What distinguishes the licensing model from traditional franchising?

Unlike franchising, which operates under a more rigid structure, licensing allows for a degree of independence while still adhering to the brand’s established guidelines, fostering innovation and a sense of ownership.

What are the initial investment costs associated with opening a licensed Starbucks location?

The initial investment typically ranges from $315,000 to $2.9 million, including the licensing fee, construction and build-out costs, equipment, and initial inventory.

What factors influence construction costs for a Starbucks franchise?

Construction costs can vary based on location, store size, and local regulations, with urban areas often facing higher expenses due to increased labor and material costs.

What ongoing financial considerations should prospective franchisees keep in mind?

It is important to prepare a detailed budget that accounts for both initial investments and ongoing operational costs to mitigate unexpected financial burdens.

What additional costs should be considered when opening a licensed coffee store?

Additional costs may include equipment expenses ranging from $50,000 to $150,000 and initial inventory, which could require an additional $20,000 to $30,000.

How has the coffee chain’s financial performance changed recently?

The coffee chain has shown significant sales and net income growth from 2021 to 2022, although it faces challenges such as changing consumer attitudes and increased competition.

What is the strategic vision for the coffee chain in China by 2025?

The coffee chain has unveiled a strategic vision for 2025, which could enhance its development potential and is crucial for franchisees considering long-term investments.

What improvements have been observed in the company’s financial ratios post-pandemic?

The coffee company’s liquidity, profitability, and valuation ratios are gradually improving post-pandemic, indicating a positive economic trajectory that could benefit franchise owners.