Overview

Navigating the world of rental properties can be challenging, and we understand that forming a Limited Liability Company (LLC) may seem like a promising option. However, it’s important to recognize the potential disadvantages that come with this decision. Initial and ongoing costs, financing difficulties, and administrative burdens can weigh heavily on your journey. Moreover, while LLCs offer some level of personal asset protection and operational flexibility, the limitations in liability protection can leave you feeling uncertain.

As you consider this path, it’s crucial to weigh these challenges against the benefits. Are you feeling overwhelmed by the complexities of LLCs? You are not alone. Many potential investors find themselves in similar situations, grappling with the emotional impacts of these decisions.

But there is hope! By exploring alternative business structures, you can optimize your real estate investments and find a solution that resonates with your aspirations. Remember, we are here to support you on this journey, guiding you toward empowering choices that align with your goals.

Introduction

In the ever-changing world of real estate investment, we understand that choosing the right business structure for managing rental properties can feel overwhelming. Among the various options, Limited Liability Companies (LLCs) stand out as a popular choice, offering a comforting blend of liability protection and operational flexibility. As the real estate market flourishes, especially in vibrant states like Texas, many investors are discovering the peace of mind that comes with forming an LLC. This decision not only helps safeguard personal assets but also eases the complexities of property management.

Yet, we recognize that establishing an LLC brings its own set of challenges, including:

- Initial costs

- Financing hurdles

- Regulatory compliance

This article seeks to illuminate the advantages and disadvantages of using LLCs for rental properties, providing insights that empower you to navigate your real estate journey with confidence and clarity.

What is an LLC and Why Consider It for Rental Properties?

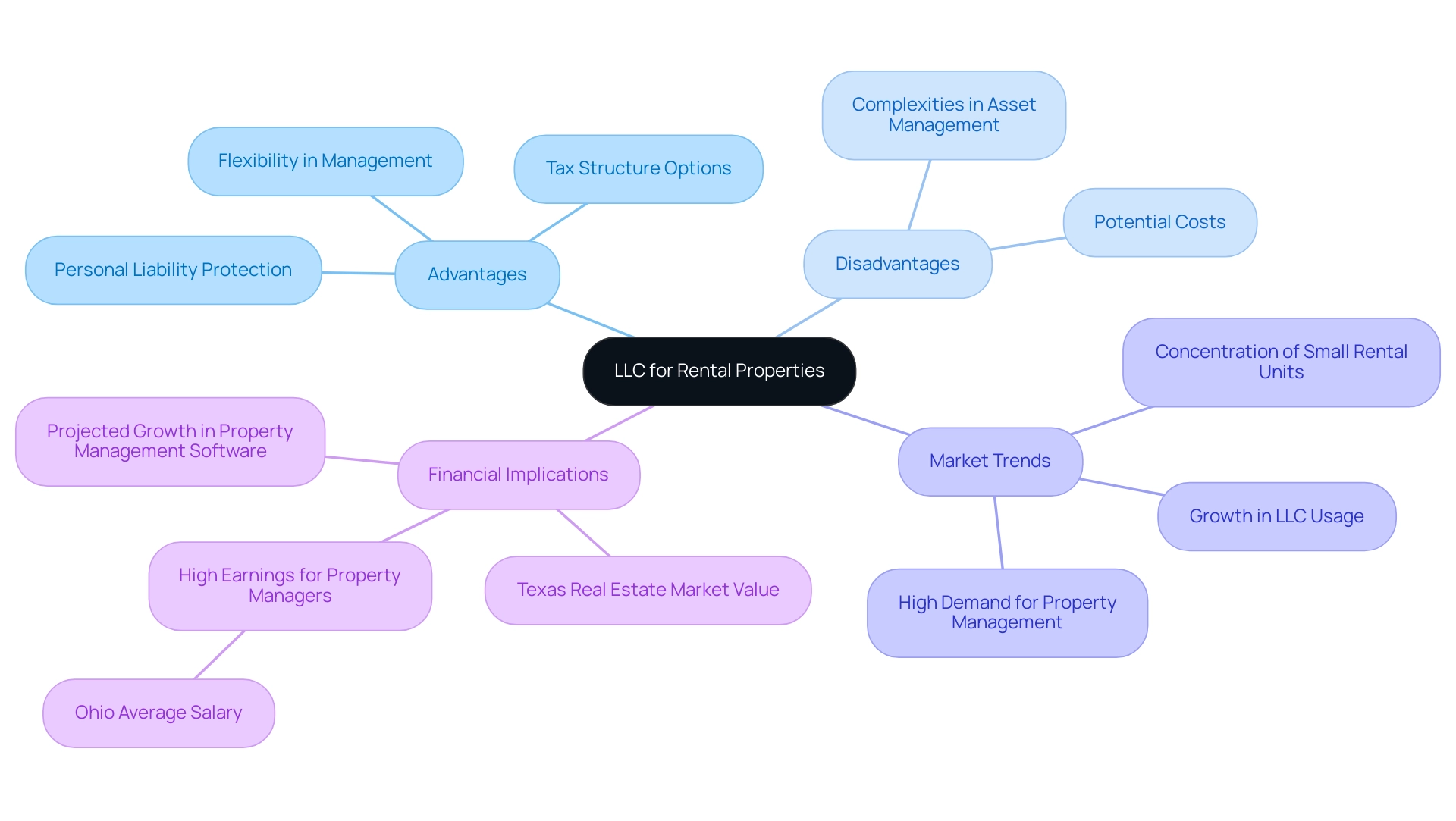

While a Limited Liability Company (LLC) offers a versatile business structure that combines the benefits of both corporations and partnerships, we understand that it’s crucial to consider the potential disadvantages of LLCs for rental property. Although there are advantages for owners of leased real estate, the personal liability protection provided to its members is a significant factor to contemplate. This means that, despite the disadvantages, personal assets are generally safeguarded from business liabilities and legal claims related to rental units, which can provide reassurance for investors.

In 2025, the trend of utilizing limited liability companies among rental unit owners continues to flourish, with many choosing this arrangement to enhance asset security. This is particularly impactful in states like Texas, where the real estate market is valued at approximately USD 53 billion. Here, managers of real estate earn considerably more than the average worker, with the highest-paid managers in Ohio enjoying an annual salary of around USD 122,910. Such figures suggest a robust market and highlight the financial advantages of employing limited liability companies in real estate management.

Limited liability companies also bring flexibility in management and taxation, allowing real estate investors to choose their tax structure—either as a corporation or a pass-through entity—which can lead to tax savings. Furthermore, nearly half (48%) of rental housing units are located in buildings with 1-4 units, making LLCs an attractive option for small-scale investors eager to protect their investments while retaining operational control.

The current landscape indicates that, despite the disadvantages of LLCs for rental property, the use of LLCs is not merely a trend but a strategic decision for real estate investors aiming for long-term success. Establishing an LLC can help investors delineate their personal and business liabilities, yet it’s essential to be aware of the complexities involved in asset management. As Parnell Woodard, a Career Ownership Coach, highlights, this transition can empower individuals to achieve their career aspirations in real estate investment.

Additionally, with one manager for every 694 employed citizens in Ohio, the demand for management services remains strong, further emphasizing the potential for success in this field. You are not alone in navigating these challenges—many have found their path forward through informed decisions and strategic planning.

Key Disadvantages of Forming an LLC for Rental Properties

While establishing an LLC can offer various advantages, it’s important to recognize the potential disadvantages that rental property owners may face. We understand that navigating these challenges can feel overwhelming. Here are some key considerations:

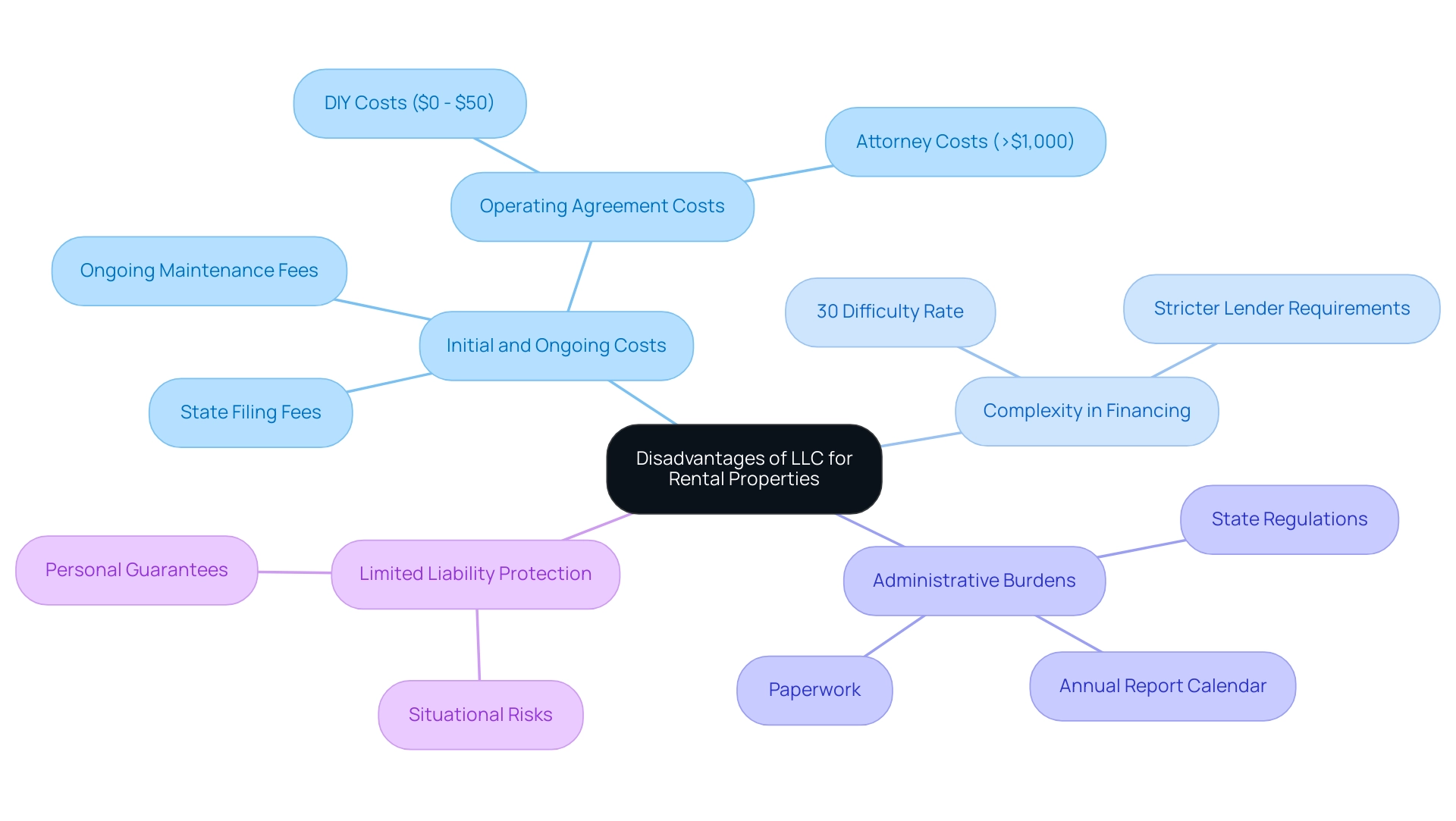

- Initial and Ongoing Costs: Starting an LLC typically involves various expenses, including state filing fees that can vary significantly. In 2025, the average initial costs for forming an LLC range from $50 to over $500, depending on the state.

Moreover, if you choose to draft your operating agreements yourself, it may cost between $0 and $50, while hiring an attorney can exceed $1,000. Ongoing maintenance fees, such as annual report filings and franchise taxes, can accumulate and impact your overall profitability.

-

Complexity in Financing: Securing financing for assets held within an LLC can pose considerable challenges. Lenders often impose stricter requirements on limited liability companies compared to individual borrowers, which can lead to delays or even denials in loan applications. Research indicates that around 30% of limited liability companies encounter difficulties in obtaining financing for investment properties. This is a significant hurdle for real estate investors, and it’s understandable to feel concerned about it.

-

Administrative Burdens: The administrative responsibilities associated with maintaining an LLC can feel daunting. Property owners must navigate a maze of paperwork and comply with various state regulations, which can be both time-consuming and complex. This added layer of bureaucracy may deter some investors from pursuing the LLC route. To help ease this burden, consider creating an annual report calendar and setting automatic reminders to ensure you don’t miss deadlines.

-

Limited Liability Protection: While limited liability companies are designed to provide liability protection, this safeguard isn’t foolproof. In certain situations, such as when personal guarantees are involved or in cases of negligence, personal assets may still be at risk. This limitation highlights the importance of understanding the nuances of liability protection when considering an LLC for property leasing.

In summary, while LLCs can provide valuable benefits, it’s essential for potential investors to evaluate the disadvantages alongside the inherent challenges, particularly in financing and administrative responsibilities. You are not alone in this journey; many face similar concerns. As Parnell Woodard, a Career Ownership Coach, emphasizes, understanding these complexities is crucial for anyone looking to transition into career ownership and navigate the real estate landscape effectively. Together, we can work through these challenges and empower you to make informed choices about your real estate endeavors.

Financial Considerations: Costs and Fees Associated with LLCs

When considering the establishment of an LLC for rental properties, it’s essential to reflect on the various costs that can influence your investment strategy. Formation Fees can be a significant initial consideration. These costs can vary widely, typically ranging from $50 to $500, depending on your state. For instance, states like Wyoming offer minimal fees, with certified copy fees as low as $0, making them appealing options for new business owners.

Next, think about Annual Fees. Many states impose annual fees for maintaining an LLC, which can differ significantly. Understanding these recurring costs is vital, as they can accumulate over time, potentially impacting your overall profitability. You are not alone in your concerns; insights from the case study “Common Questions About LLC Fees” show that many entrepreneurs frequently inquire about these fees, highlighting their importance.

Additionally, consider the Tax Preparation Costs. Operating as an LLC often necessitates more intricate tax filings compared to sole proprietorships. This complexity can lead to increased accounting fees, which should be factored into your financial planning. Romain Gouraud, a writer specializing in business formation, emphasizes the need for accurate and up-to-date information as you navigate these complexities.

Don’t forget about Insurance Costs. While an LLC provides liability protection, property owners may still need to secure additional insurance coverage, which can further elevate overall expenses. This underscores the importance of comprehensive financial forecasting to ensure you’re prepared for all potential costs.

In 2025, the average formation fees for limited liability companies across the United States reflect a growing trend toward more accessible business structures. However, it’s still essential to evaluate the specific costs in your state. For example, states like South Carolina are recognized for their straightforward documentation processes and low recurring charges, making them appealing for startups. Yet, be cautious: failing to file annual payments or necessary paperwork can lead to administrative dissolution of the LLC, exposing you to the disadvantages of LLC for rental property and resulting in the loss of liability protection.

Therefore, a thorough understanding of both initial and ongoing costs is crucial for real estate investors. By acknowledging these challenges, you can navigate the complexities of LLC formation and maintenance with confidence, ensuring your investment strategy aligns with your aspirations.

Understanding Liability Protection Limitations with LLCs

While Limited Liability Companies (LLCs) are designed to protect personal assets from business liabilities, it’s important to acknowledge the limitations of this protection. You may be wondering how these limitations could affect you personally.

-

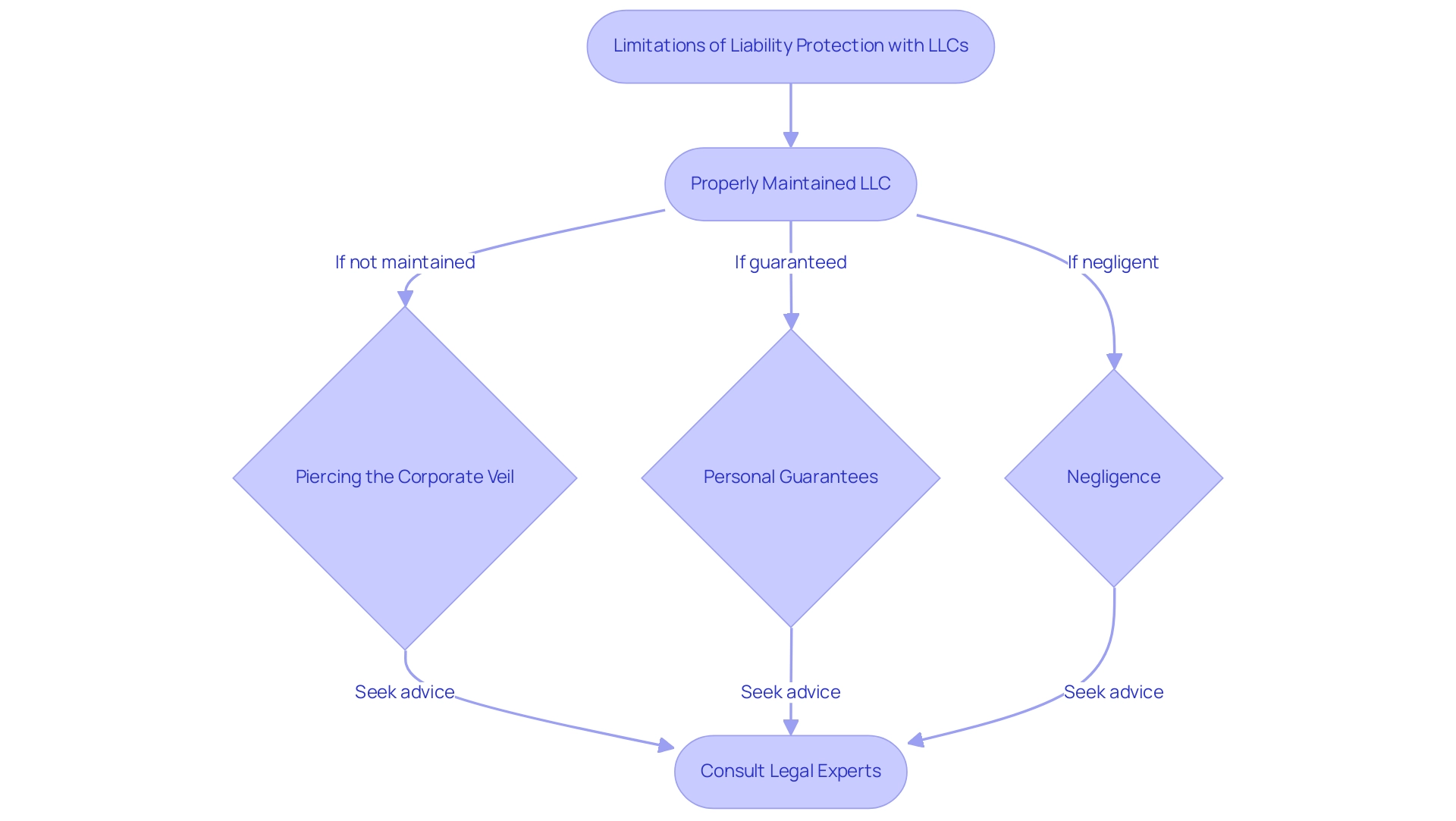

Piercing the Corporate Veil: Courts can allow creditors to reach personal assets if an LLC isn’t properly maintained. For instance, a notable case in Alabama showed that a corporation without sufficient funds at the time of contract formation had its corporate veil pierced. This underscores the importance of adhering to legal formalities. As Azam Nizamuddin, General Counsel with the American Trust Corporation, wisely noted, “With the looming threat of thousands of small businesses failing due to the COVID-19 pandemic, courts should observe restraint and be more stringent in their application of the doctrine of piercing the corporate veil.”

-

Personal Guarantees: If you personally guarantee a loan for your LLC, your personal assets could be at risk in case of a default. This situation highlights the need for LLC owners to carefully weigh the implications of personal guarantees on their liability protection.

-

Negligence: In cases of gross negligence or illegal activities, the protective shield of an LLC may falter. Courts might hold individuals personally liable, which can undermine the intended benefits of the LLC structure.

Understanding the disadvantages of LLCs for rental property is essential for anyone considering this structure for leasing assets. You are not alone in this journey; consulting with legal and financial experts can help ensure compliance with regulations and maintain the integrity of the corporate veil. Recent discussions among industry professionals stress the importance of integrating regulatory compliance into business operations to effectively mitigate legal challenges.

The Entrepreneur’s Source, with over 40 years of experience in Career Ownership Coaching™, is here to empower individuals facing career uncertainties. Their no-cost coaching services offer a structured process that brings clarity to career decisions, much like understanding LLC limitations is crucial for anyone navigating career transitions.

In summary, while LLCs provide significant advantages, it’s vital to remain aware of their disadvantages for rental property. Protecting your personal assets and ensuring sound investment strategies is key to your success.

Navigating Regulatory and Zoning Issues with LLCs

Managing lease assets through a Limited Liability Company (LLC) can feel overwhelming, especially when faced with the challenges associated with LLCs for rental property. The complexities of regulatory and zoning matters can significantly impact your business operations, and we understand how this can weigh on your mind.

-

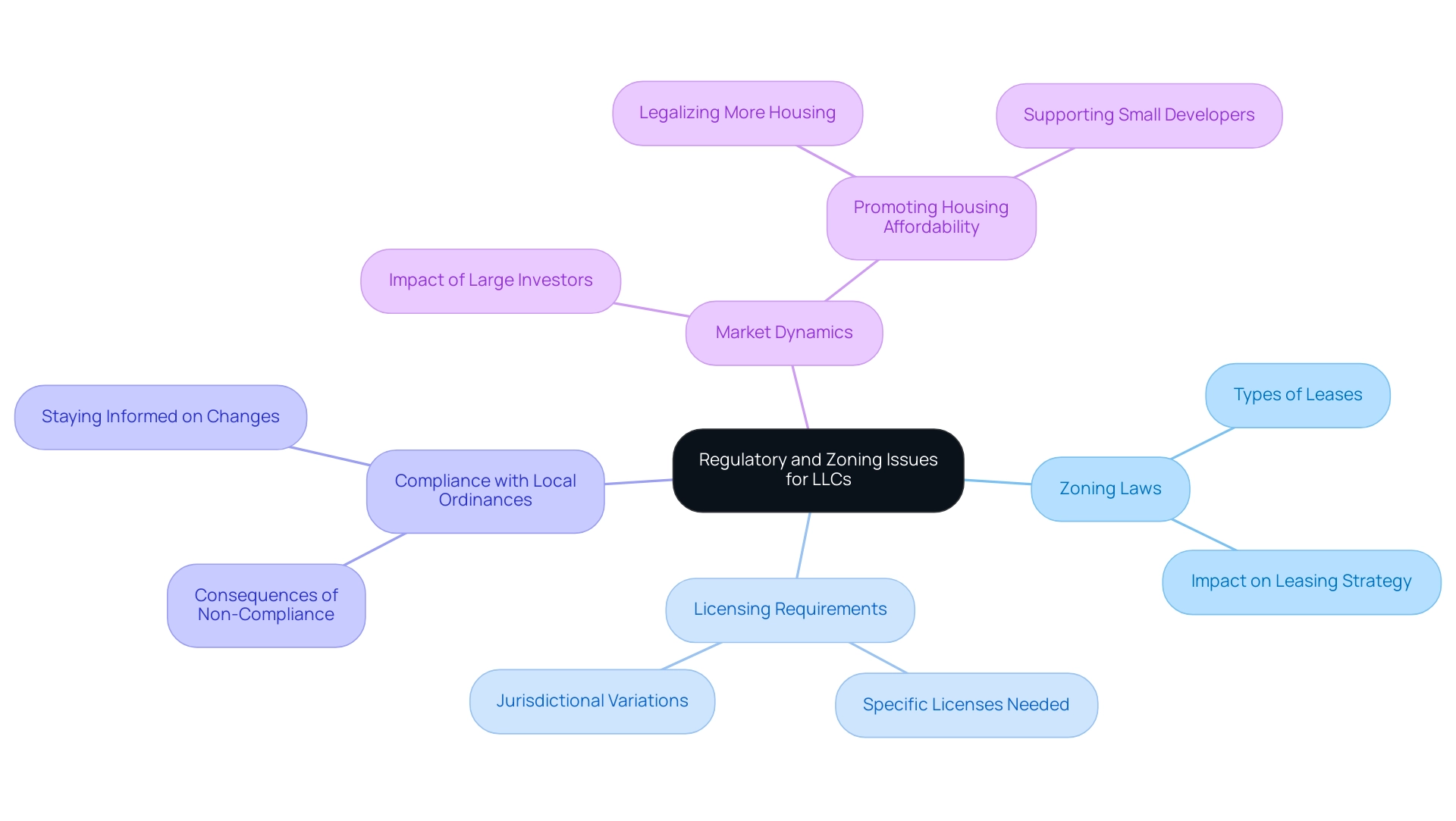

Zoning Laws: Local zoning regulations are crucial in determining how land can be utilized. These laws may impose restrictions on the types of leases permitted, such as short-term versus long-term agreements, which can directly affect your LLC’s leasing strategy. Understanding the disadvantages of LLC for rental property regulations is essential for compliance and maximizing your potential.

-

Licensing Requirements: In 2025, many lease properties will require specific licenses to operate legally. These licenses vary by jurisdiction and may include leasing permits, business licenses, or occupancy permits. To avoid penalties and ensure smooth operations, it’s vital for limited liability companies to obtain all necessary licenses, keeping in mind the disadvantages of LLC for rental property.

-

Compliance with Local Ordinances: Adhering to local ordinances is essential for LLC owners. Non-compliance can highlight the disadvantages of LLC for rental property, leading to fines, legal disputes, or even the revocation of rental licenses. Staying informed about changes in local laws and regulations is crucial for maintaining compliance and protecting your investment.

The regulatory landscape often presents unique challenges for limited liability companies, emphasizing the disadvantages of LLC for rental property in certain cities compared to others. For instance, administrative hurdles can complicate the process of obtaining necessary permits or licenses, leading to delays in your operations.

As market dynamics shift, particularly with the increasing presence of large investors in the single-family home sector, it’s important to consider the disadvantages of LLC for rental property. We encourage local efforts to promote housing affordability, which includes legalizing more housing and supporting small developers. This strategy aims to create a responsive leasing market that benefits limited liability companies by reducing competition from larger corporate entities.

As Parnell Woodard, a Career Ownership Coach, emphasizes, “I am dedicated to helping clients transition from traditional employment to career ownership, empowering them to achieve their career goals.” This empowerment is crucial for individuals navigating the complexities of career transitions, which often include real estate investments.

In summary, limited liability companies managing leased spaces must be proactive in understanding and navigating the regulatory and zoning challenges they encounter. By doing so, you can position yourself for success in a competitive and evolving market, much like the hundreds of thousands of individuals The Entrepreneur’s Source has assisted in assessing their career possibilities.

Exploring Alternatives: Other Business Structures for Rental Properties

As real estate owners navigate the complexities of leasing asset ownership, they face various challenges that can feel overwhelming. Understanding the options available is crucial, and alongside limited liability companies, there are several alternative business formats to consider:

- Sole Proprietorship: This structure offers the most direct path, allowing for total control and ease in management. However, it’s important to recognize that one significant drawback is the lack of liability protection, which can expose you to personal risk in the event of legal issues or debts associated with the property.

- Partnership: For those seeking co-ownership arrangements, partnerships can be beneficial, enabling the sharing of resources and responsibilities. While this fosters collaboration, it also means sharing liability, which can complicate both financial and legal matters.

- Corporation: Corporations provide robust liability protection, safeguarding personal assets from business liabilities. Yet, they come with increased regulatory requirements and the potential for double taxation on profits, which can diminish overall returns.

- Trusts: Trusts can be a wonderful option for privacy and estate planning, allowing asset owners to manage holdings discreetly. They may also facilitate smoother transitions of ownership upon death. However, it’s worth noting that trusts often lack the operational flexibility that LLCs offer, which can be a significant drawback for those actively managing assets.

Current trends indicate a growing percentage of real estate owners exploring these alternatives. Many are finding trusts to be a viable substitute for LLCs. In fact, recent data shows that approximately 15% of leasehold owners are utilizing trusts, reflecting a shift toward more strategic asset management methods. With San Francisco remaining the most costly U.S. leasing market, where average rents exceed $3,000 per month, it’s essential for real estate owners to carefully consider their business structure to maximize returns.

The top asset classes anticipated to offer opportunities over the next 12 to 18 months include industrial and manufacturing, multifamily, and hotel and lodging assets. These trends could significantly influence the choice of business structure for investors. Moreover, as technology continues to transform real estate management—65% of companies are implementing AI-driven tenant screening tools—understanding how these advancements impact operational efficiency is crucial. Notably, the average time to fill a vacant rental property is about 4 weeks, emphasizing the importance of choosing a structure that aligns with your operational needs.

As Tim Coy, a senior research leader in commercial real estate, emphasizes, understanding the implications of these structures in the current market is essential for making informed decisions. Remember, you are not alone in this journey; we understand the complexities you face, and with the right guidance, you can navigate these challenges successfully.

Conclusion

Choosing the right business structure for rental properties can feel overwhelming, and it’s a decision that significantly impacts your success as an investor. Limited Liability Companies (LLCs) present a wonderful blend of liability protection and operational flexibility, making them a favored option among real estate investors, especially in vibrant markets like Texas. The benefits of forming an LLC, such as protecting your personal assets and offering tax-saving opportunities, truly highlight why this structure is increasingly popular.

Yet, it’s important to acknowledge the challenges that come with it. The initial and ongoing costs, the complexities of securing financing, and the administrative responsibilities can weigh heavily on your shoulders. Additionally, the limitations of liability protection are factors you need to consider carefully. By understanding these elements, you can make informed decisions that resonate with your investment goals.

Moreover, navigating the regulatory and zoning landscape can add layers of difficulty for LLC owners. Compliance with local laws and obtaining the necessary licenses are crucial steps in ensuring that your property management is successful. As the market continues to evolve and competition grows, staying informed and proactive is essential for those investing in LLCs.

Ultimately, while LLCs offer significant advantages, being aware of their limitations and exploring alternative business structures is vital for anyone eager to thrive in the real estate investment world. By making informed choices and grasping the complexities involved, you can better position yourself for long-term success in a competitive market. Remember, you are not alone in this journey, and with the right guidance, you can navigate these challenges with confidence.