Overview

For self-employed individuals, navigating the complexities of finances can be daunting. We understand the pressure to document expenses accurately, especially when it comes to maximizing tax deductions. The Schedule C Expenses Worksheet serves as a vital tool in this journey, not only for compliance with IRS regulations but also for fostering a sense of control over your financial landscape.

Imagine the relief that comes from knowing you have meticulously tracked your expenses. This not only alleviates stress during tax season but also empowers you to make informed financial decisions year-round. By understanding deductible expenses and the importance of thorough record-keeping, you can enhance your overall financial health.

You are not alone in this process. Many self-employed individuals share these concerns, and it’s essential to recognize the emotional weight that financial management can carry. Embracing the Schedule C Expenses Worksheet can transform your approach, turning a daunting task into an opportunity for growth and empowerment.

As you reflect on your own experiences, consider how taking control of your finances can pave the way for greater confidence and stability. By prioritizing accurate documentation, you are not just complying with regulations; you are investing in your future. Let this worksheet be your guide, helping you navigate the path toward financial well-being with clarity and purpose.

Introduction

Navigating the complexities of self-employment can feel overwhelming, especially when it comes to managing finances and ensuring compliance with tax regulations. We understand that these challenges can weigh heavily on your mind. The Schedule C Expenses Worksheet is here to help, serving as a vital tool for sole proprietors and freelancers. It streamlines the reporting of income and business expenses, making the process less daunting.

As we look ahead to 2025, the landscape of entrepreneurship is evolving, and understanding how to effectively utilize this worksheet can significantly impact your financial outcomes. You are not alone in seeking to optimize deductions and maintain accurate records. The insights gained from this resource empower you to minimize tax liabilities and enhance your overall financial health.

With expert advice and real-world examples illustrating its importance, the Schedule C Expenses Worksheet stands as an essential ally for those embarking on their entrepreneurial journeys. Remember, taking control of your finances is not just about compliance; it’s about fostering a sense of security and confidence in your business endeavors.

What is the Schedule C Expenses Worksheet?

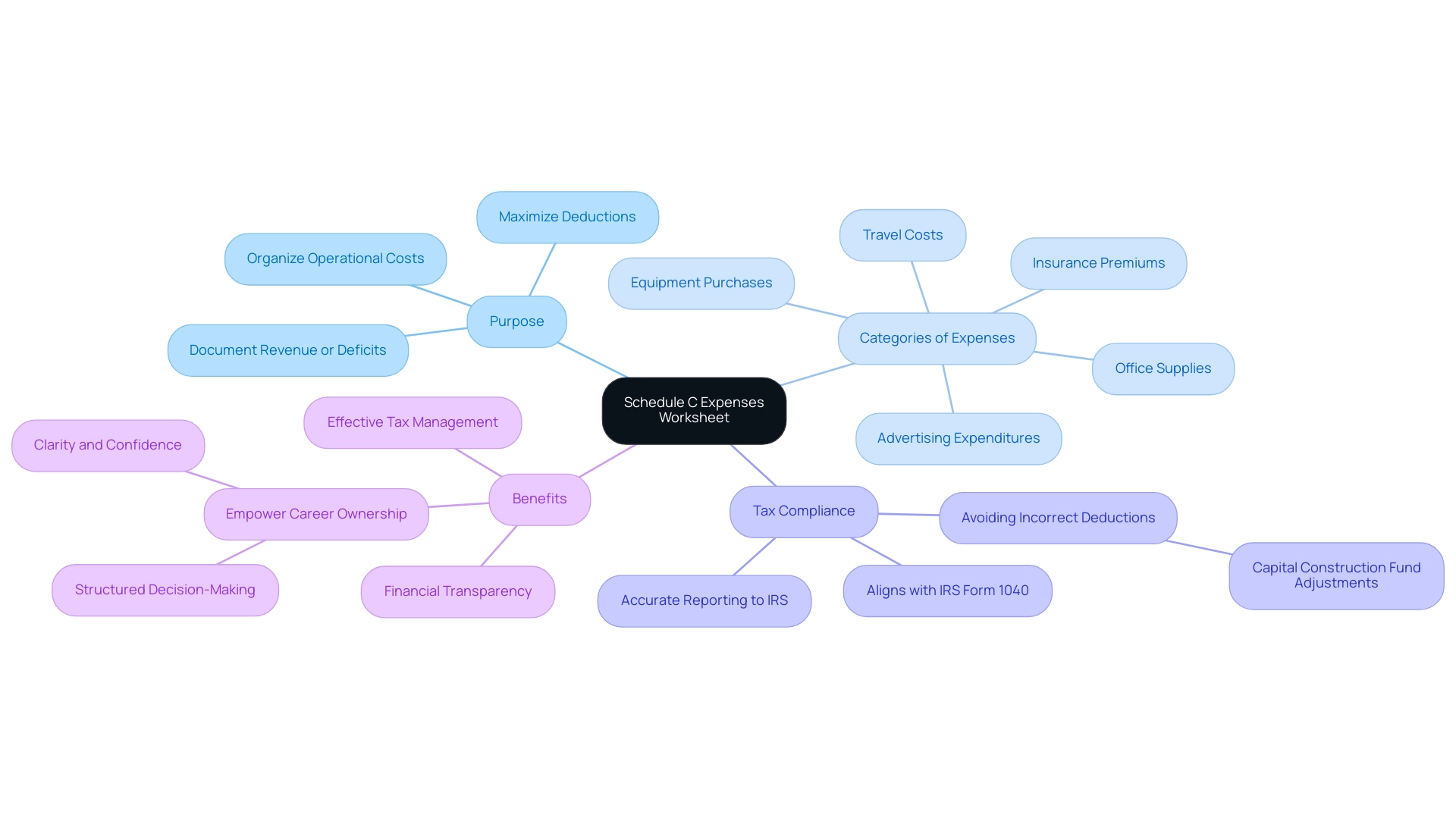

The Schedule C Expenses Worksheet is an invaluable resource for self-employed individuals and sole proprietors in the United States, especially as we approach 2025. This worksheet is thoughtfully designed to help document revenue or deficits from a sole proprietorship, assisting in organizing operational costs. By carefully categorizing expenses, self-employed individuals can maximize their deductions, which is crucial for minimizing taxable income.

In 2025, the significance of the Schedule C Expenses Worksheet truly cannot be overstated. It not only supports accurate reporting to the IRS but also aligns perfectly with IRS Form 1040, particularly Schedule C, ensuring adherence to tax regulations. Tax experts emphasize that using this worksheet is essential for maintaining financial transparency and achieving effective tax management.

As Parnell Woodard, a Career Ownership Coach, wisely notes, “Understanding your financial landscape is key to making informed decisions that empower your career ownership journey.”

Statistics reveal that self-employed individuals can claim a variety of business expenses, including:

- office supplies

- travel costs

- equipment purchases

- insurance premiums

- advertising expenditures

By utilizing the Schedule C Expenses Worksheet, taxpayers can ensure they capture all eligible deductions, which can significantly influence their overall tax liability. However, it’s vital to remember that taxpayers should not claim deductions for contributions to a capital construction fund on Schedule C; instead, they should make adjustments on their Form 1040 or 1040-SR accordingly.

Real-life examples demonstrate the power of using the Schedule C Expenses Worksheet. For instance, a sole proprietor who diligently tracks their expenses with this tool can uncover substantial deductions that might otherwise go unnoticed, leading to a more favorable tax outcome. Moreover, case studies illustrate how individuals who engage in a structured decision-making process, akin to the comprehensive coaching approach offered by The Entrepreneur’s Source, gain clarity and confidence in their financial choices.

In summary, the Schedule C Expenses Worksheet is not just a form; it is a strategic tool that empowers self-employed individuals to navigate the complexities of tax compliance with confidence. By recognizing its significance and utilizing it thoughtfully, you can take charge of your financial journey and enhance your career ownership experience. Remember, you are not alone on this path; we understand the challenges you face and are here to support you every step of the way.

Types of Expenses You Can Deduct on Schedule C

Self-employed individuals often face the challenge of managing their finances effectively, especially when it comes to understanding tax deductions. We understand that navigating these waters can be overwhelming, but there is hope. By utilizing the Schedule C expenses worksheet, you can subtract a broad array of costs, which can significantly lower your taxable income. Here are some key categories of deductible costs to consider:

- Advertising: This includes all expenses associated with promoting your business, like online ads, printed flyers, and business cards. Effective promotion is essential for growth, and these costs can be fully deducted.

- Car and Truck Costs: If you incur vehicle-related expenses during your work, you can deduct these costs. You can either calculate actual expenses (such as gas, repairs, and depreciation) or use the standard mileage rate, which is set at 65.5 cents per mile for 2025.

- Contract Labor: Payments made to independent contractors for services rendered are fully deductible. This covers freelancers or consultants who support your operations.

- Home Office Deduction: If you use part of your home exclusively for work, you can deduct related expenses. This includes a percentage of your rent or mortgage interest, utilities, and home insurance, calculated based on the square footage of your office space.

- Supplies: Expenses for necessary items to run your business, like office supplies, materials, and equipment, can be deducted. Keeping thorough records of these purchases is crucial for optimizing your deductions.

- Utilities: Costs for services that support your operations, such as electricity, water, and internet, are also deductible, helping to lower your overall operational costs.

In 2025, the average deductions claimed by sole proprietors highlight the importance of understanding these categories. Statistics show that self-employed individuals can save significantly on taxes by accurately documenting these costs. Did you know that the IRS issues more than 90% of refunds in less than 21 days? This underscores the importance of accurate reporting and timely filing. Moreover, the qualified business income deduction allows eligible self-employed individuals to deduct up to 20% of their business revenue, subject to specific limitations.

To optimize your deductions on the Schedule C expenses worksheet, it’s essential to maintain detailed records of all expenses and consult tax professionals for personalized advice. Parnell Woodard, a Career Ownership Coach, emphasizes that leveraging all available deductions not only minimizes tax burdens but also enhances overall financial health. Furthermore, The Entrepreneur’s Source offers a comprehensive and personalized approach to career coaching, assisting individuals in understanding and maximizing their deductions.

By understanding and utilizing these deductible expenses, you can navigate your financial journey more effectively. Remember, you are not alone in this process; support is available to help you thrive.

How to Fill Out the Schedule C Expenses Worksheet

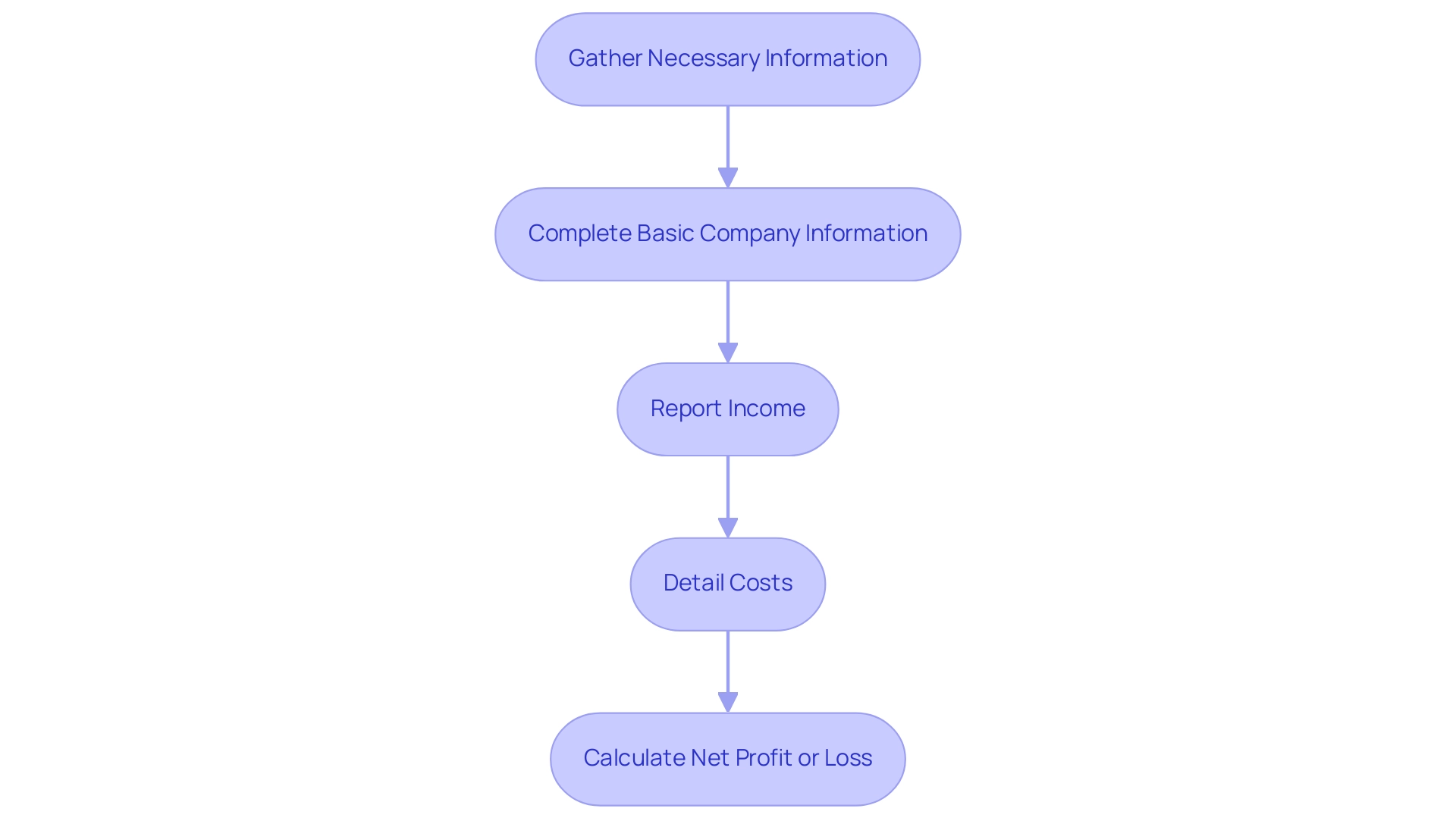

Filling out the Schedule C Expenses Worksheet can feel daunting for freelancers and small business owners, but it’s a crucial step toward taking control of your financial future. Let’s walk through this process together, ensuring accuracy and compliance every step of the way:

-

Gather Necessary Information: Begin by collecting all relevant financial documents, including receipts, invoices, and bank statements. This foundational step is essential for accurate reporting and sets the stage for empowering your financial destiny.

-

Complete Basic Company Information: Take a moment to fill in your company name, address, and specify the type of establishment you operate. This information is vital as it establishes your identity in the entrepreneurial landscape.

-

Report Income: In Part I of the worksheet, list all income generated from your business activities. Accurate income reporting is crucial, as federal payroll taxes account for about 20 percent of all taxes paid at all levels of government. Understanding your income is a key aspect of achieving financial independence, and we’re here to support you in this journey.

-

Please refer to the Schedule C Expenses Worksheet for detailed information. Detail Costs: In Part II of the Schedule C Expenses Worksheet, categorize and list all deductible costs. Providing accurate amounts for each category is essential, as this will directly impact your net profit or loss. Recognizing and maximizing your deductions is a powerful way to build wealth and equity, and you deserve to benefit from every opportunity.

-

Calculate Net Profit or Loss: Subtract total costs from total income to determine your net profit or loss. This figure will be reported on your Form 104, influencing your overall tax liability and reflecting your financial health.

By following these steps meticulously, you can significantly reduce the risk of errors that could lead to audits or penalties. Common mistakes in Schedule C filing can be costly, so attention to detail is paramount. Remember, many freelancers have successfully navigated the complexities of Schedule C by maintaining organized records and seeking expert advice when needed.

As noted by industry professionals, “Accurate completion of Schedule C is not just about compliance; it’s about empowering your financial future.” This sentiment resonates with the words of Larry Page, co-founder of Google, who stated, “You don’t need to have a 100-person company to develop that idea.” This approach not only aids in tax preparation but also aligns with the broader goal of achieving career ownership and financial independence through Find Your Career 2.0 | Career Ownership Coach Parnell Woodard.

By embracing your strengths, engaging with your community, and addressing challenges such as age factor limitations and the need for transferable skills, you can transform your career path and create the lifestyle of your dreams. You are not alone in this journey; we understand the challenges you face and are here to help you succeed.

Who Needs to Use the Schedule C Expenses Worksheet?

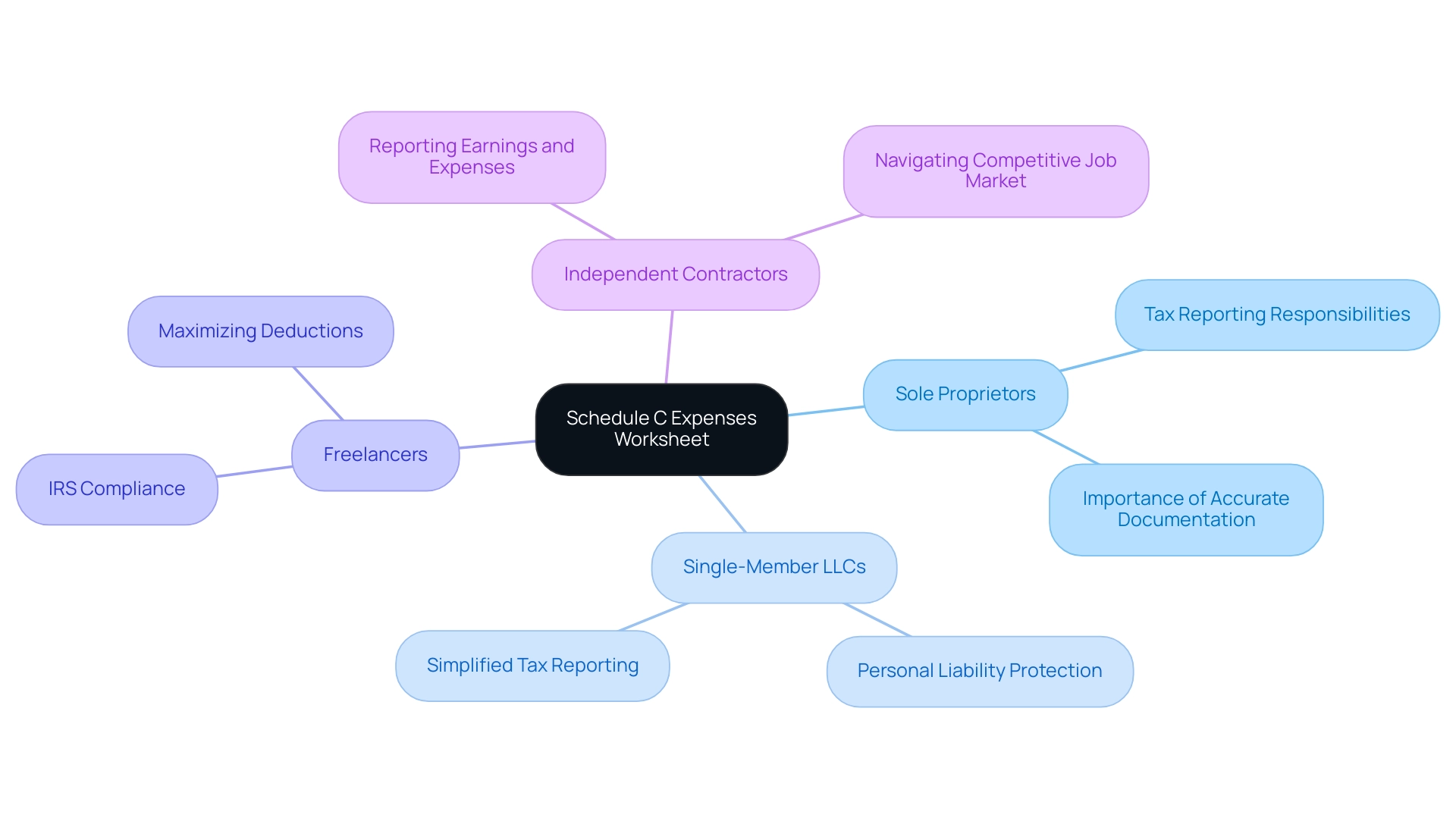

The Schedule C Expenses Worksheet is an essential tool for various business structures, especially for those navigating the journey of career ownership:

-

Sole Proprietors: These dedicated individuals run their own businesses without forming a separate legal entity. They bear the responsibility of reporting all income and expenses directly on their personal tax returns. This makes the Schedule C Expenses Worksheet vital for precise tax reporting and fostering financial independence.

-

Single-Member LLCs: Limited Liability Companies with a single owner also turn to the Schedule C Expenses Worksheet to accurately report their business income and expenses. This structure not only provides personal liability protection but also simplifies tax reporting by treating the LLC as a disregarded entity for tax purposes, empowering individuals as they transition into new careers.

-

Freelancers and Independent Contractors: Those offering services on a contract basis must report their earnings and related expenses. The Schedule C Expenses Worksheet is crucial for ensuring compliance with IRS regulations and maximizing potential deductions, reinforcing their personal agency in an increasingly competitive job market.

In 2020, nearly 40% of sole proprietorships claimed a home office deduction, underscoring the importance of accurately documenting operational expenses. This statistic emphasizes the necessity for those in career transitions to understand and effectively utilize the Schedule C Expenses Worksheet as they navigate their path toward ownership.

Find Your Career 2.0 | Career Ownership Coach Parnell Woodard has been a guiding light for many, assisting individuals in their transition to career ownership through Career Ownership Coaching™. By offering personalized coaching and resources, the company empowers clients to navigate their career changes with confidence. As Larry Page, co-founder of Google, wisely stated, “You don’t need to have a 100-person company to develop that idea.”

This sentiment resonates deeply with those contemplating the leap into entrepreneurship, highlighting the transformative potential of ‘Your Career 2.0: A Survival Guide for The Battered Career Syndrome and Investor Syndrome.’

For anyone fitting these descriptions, utilizing the Schedule C Expenses Worksheet is crucial for effectively reporting business activities to the IRS and ensuring that all eligible deductions are claimed. To support your journey further, be sure to get your copy of ‘Your Career 2.0’ to explore specific insights and benefits that can aid in your transition. The unique value proposition of Find Your Career 2.0, including its no-cost services and structured process, makes it a trusted partner for those navigating these transitions, guiding them toward successful career ownership.

Common Mistakes to Avoid When Completing Schedule C

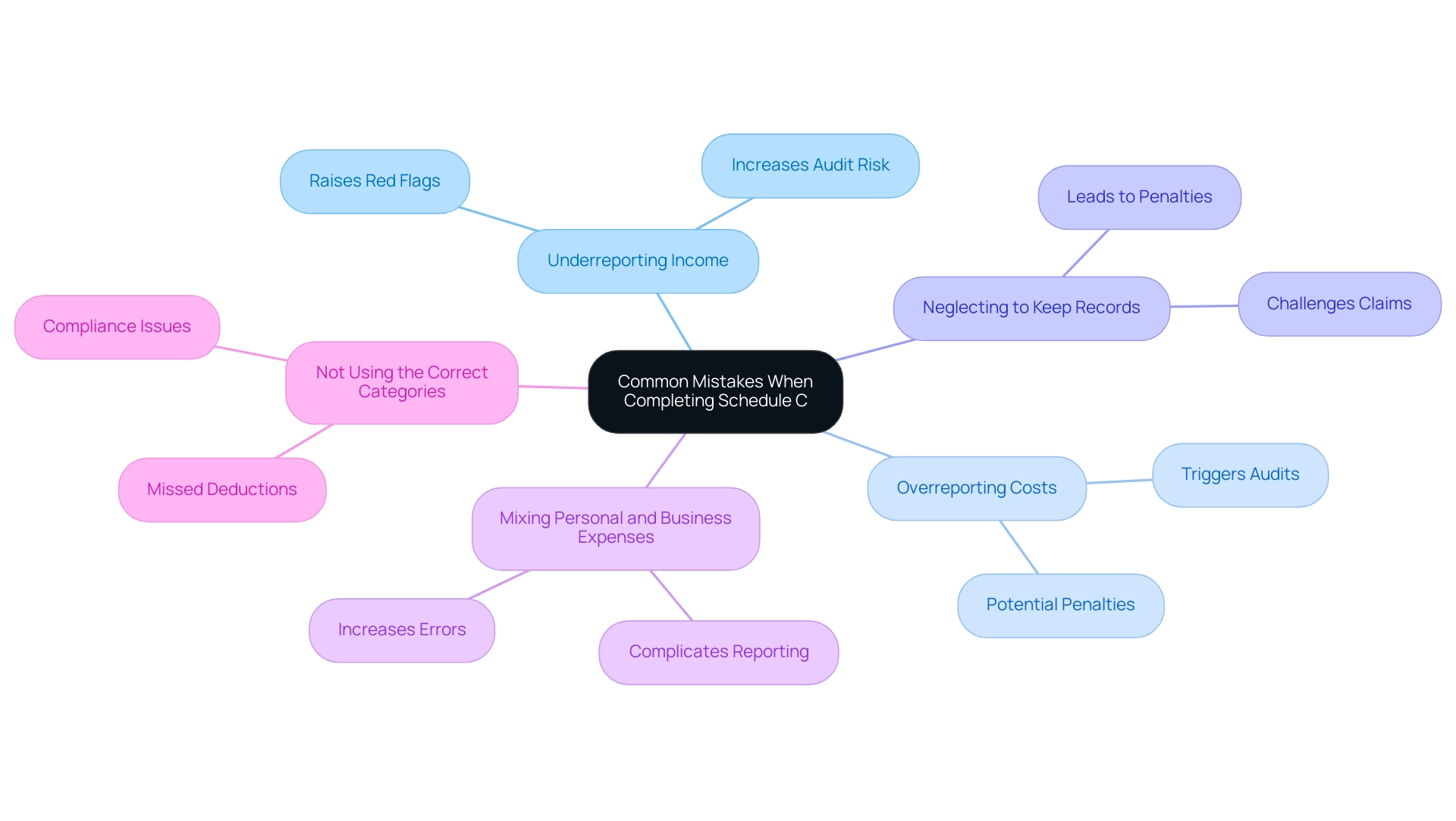

When completing the Schedule C Expenses Worksheet, self-employed individuals often encounter challenges that can lead to complications with the IRS. We understand how daunting this can feel, but recognizing these common mistakes is the first step toward smoother financial management:

- Underreporting Income: Accurately reporting all income is crucial. Discrepancies can raise red flags, leading to audits that are increasingly common for self-employed individuals in 2025. At The Entrepreneur’s Source, we have assisted hundreds of thousands of people in assessing their career possibilities, underscoring the importance of accurate tax reporting as you navigate new professional paths.

- Overreporting Costs: It is vital to report only valid operational costs on the Schedule C Expenses Worksheet. Inflated costs can trigger audits, and with the IRS estimating a gross tax gap of $696 billion for tax year 2022, scrutiny on self-reported figures is heightened. This reality highlights the need for careful reporting to avoid potential penalties.

- Neglecting to Keep Records: Maintaining thorough records, including a Schedule C Expenses Worksheet, receipts, and documentation, is essential for substantiating deductions. Without proper documentation, claims may be challenged, leading to potential penalties that can feel overwhelming.

- Mixing Personal and Business Expenses: Keeping personal and business finances separate simplifies reporting and minimizes confusion, especially when filling out the Schedule C Expenses Worksheet. This practice not only aids in accurate reporting but also protects you against inadvertent errors, allowing you to focus on what truly matters.

- Not Using the Correct Categories: Properly categorizing expenses in the Schedule C Expenses Worksheet is necessary to maximize deductions and comply with IRS guidelines. Misclassification can result in missed opportunities for legitimate deductions, adding to the stress of tax season.

Additionally, as tax expert Laudenslager notes, “Form 8962 is required if the taxpayer, their spouse, or anybody they claim as a dependent is enrolled in this type of health insurance.” By being aware of these common pitfalls, self-employed individuals can significantly enhance their tax filing accuracy and reduce the risk of audits, ensuring a smoother financial journey.

The no-cost coaching services and structured processes provided by The Entrepreneur’s Source can further assist you in navigating these complexities, empowering you to take control of your financial future. Remember, you are not alone in this journey; we are here to support you every step of the way.

The Importance of Accurate Record-Keeping for Schedule C

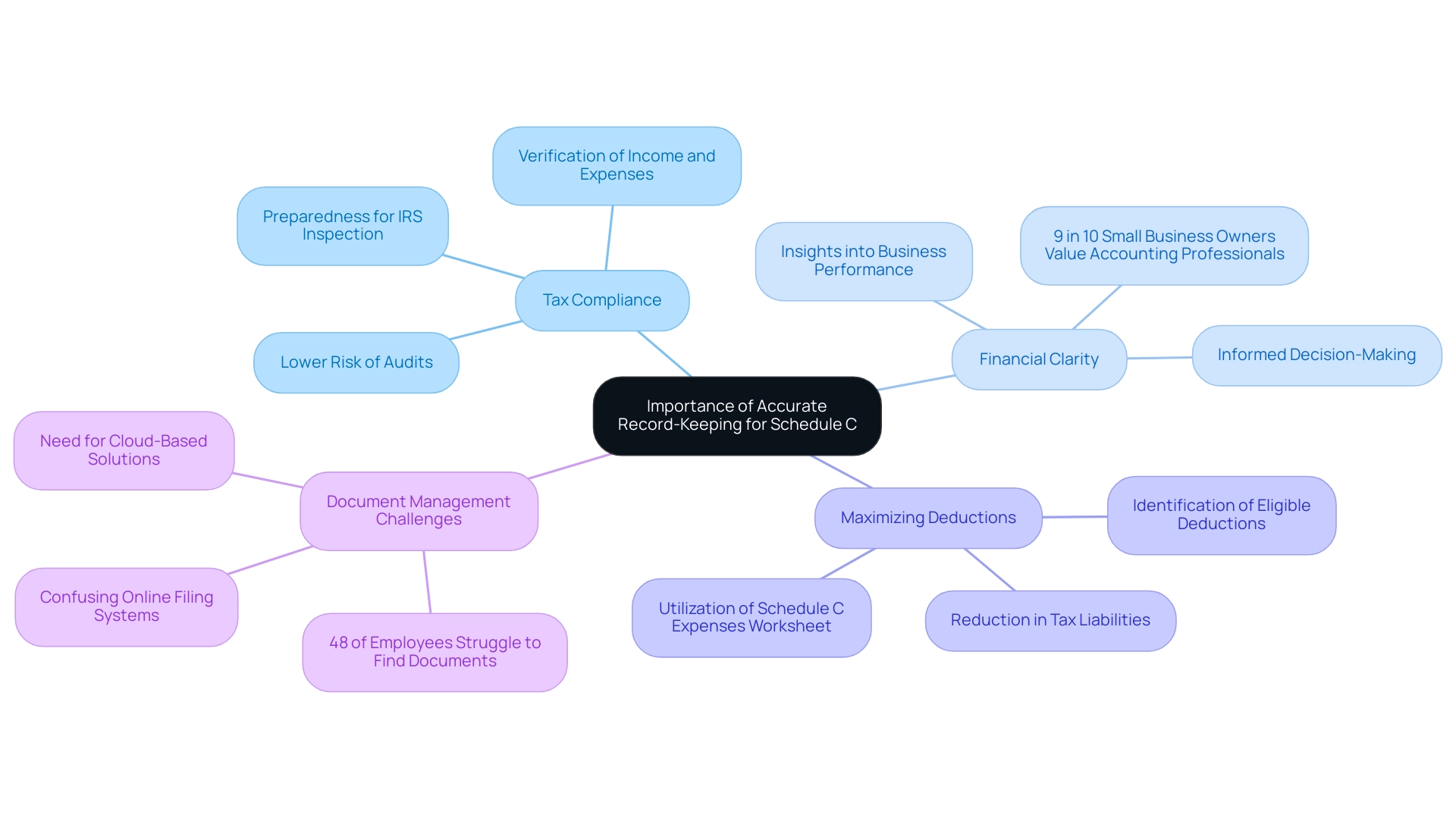

Accurate record-keeping is essential for self-employed individuals, and it comes with several important benefits that can ease your journey:

- Tax Compliance: Keeping detailed records is crucial for verifying all income and expenses when tax season arrives. This careful documentation can significantly lower the risk of audits, helping you stay compliant with IRS regulations. By maintaining organized records, you not only ensure compliance but also have everything ready for IRS inspection, which can make the process smoother and less stressful.

- Financial Clarity: Organized records provide vital insights into your business performance. This clarity empowers you to make informed decisions about your operations, ultimately leading to better financial outcomes. A recent survey found that 9 in 10 small business owners believe their accounting professionals play a key role in their success, emphasizing the importance of having well-organized financial records to support effective accounting.

- Maximizing Deductions: Comprehensive record-keeping allows you to make the most of the schedule C expenses worksheet, helping you identify all eligible deductions. This can lead to significant reductions in your tax liabilities, enhancing your overall financial health, especially when preparing for tax season. By having all necessary documents at your fingertips, you can save time and alleviate stress as deadlines approach.

Implementing a proactive record-keeping strategy is not just a best practice; it’s a vital step toward safeguarding your financial well-being and ensuring compliance with tax regulations. As Myranda Mondry highlights, 71% of small business owners report that being a business owner has improved their financial security. This underscores how diligent record-keeping can contribute to your financial stability. Moreover, a 2023 Adobe Acrobat survey revealed that 48% of employees struggle to find documents quickly, showing that poor document management can impede effective financial management.

This reality emphasizes the importance of adopting effective document management solutions to maintain your financial health. Remember, you are not alone in this journey, and taking these steps can lead to a more secure and empowered future.

Resources and Tools for Managing Schedule C Expenses

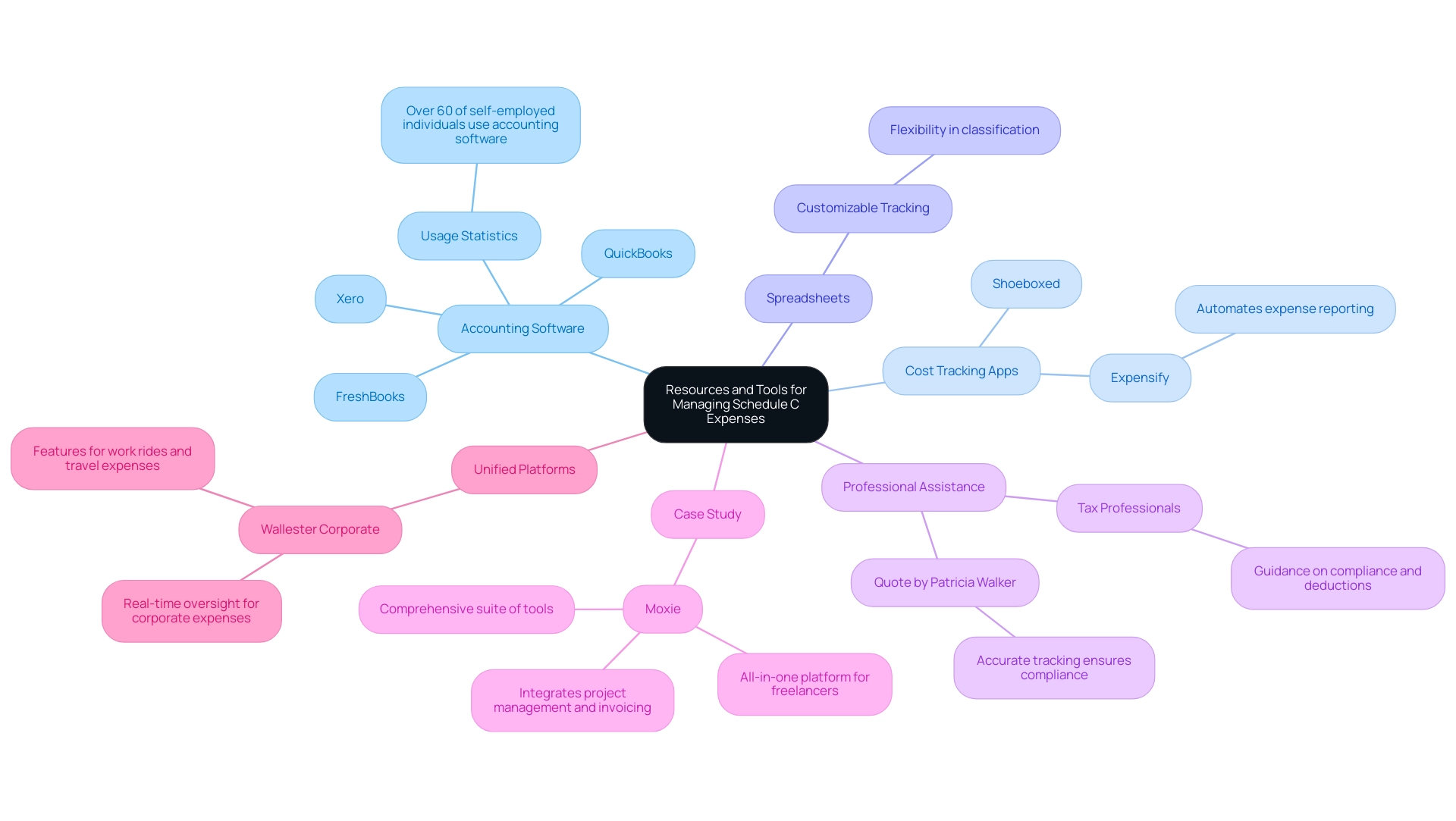

Managing Schedule C expenses can feel overwhelming for self-employed individuals, but there are resources and tools available that can make this process more manageable and less stressful.

-

Accounting Software: Programs like QuickBooks, FreshBooks, and Xero are not just tools; they are invaluable partners in tracking your income and expenses. They generate detailed reports and simplify tax preparation, making your financial journey smoother. Did you know that over 60% of self-employed individuals rely on accounting software? This shows how effective these platforms can be in managing finances efficiently.

-

Cost Tracking Apps: Mobile applications such as Expensify and Shoeboxed are designed to empower you to capture receipts and categorize costs effortlessly while on the go. With Expensify, for instance, the reporting process becomes automated, reducing your administrative workload and allowing you to monitor expenditures in real-time. Imagine how much easier your financial management could be with these tools!

-

Spreadsheets: If you prefer a more hands-on approach, customizable spreadsheets can be created to track your expenses manually. This method offers flexibility in classification and can be tailored to meet your specific needs, making it a popular choice among self-employed professionals who value control over their finances.

-

Professional Assistance: Sometimes, seeking help from a tax professional or accountant can provide the personalized guidance you need. Their expertise ensures compliance with tax regulations and can help you uncover potential deductions that might otherwise be overlooked. As Patricia Walker wisely noted, “Precise monitoring of costs guarantees adherence to company policies and industry regulations.”

-

Case Study: Consider Moxie, an all-in-one platform for freelancers that integrates project management, invoicing, and sales processes. It showcases how tools can be effectively utilized to manage deliverables and client relationships, illustrating a successful real-world application of these resources.

-

Unified Platforms: Wallester Corporate offers a unified platform for managing corporate expenses, providing real-time oversight for various needs, including work rides, travel expenses, and online media buying.

By utilizing these resources, you can enhance your efficiency in managing business finances while ensuring accurate reporting on your Schedule C expenses worksheet. This ultimately contributes to a smoother tax filing experience. Remember, if you sold $5,000 or more of consumer products, you may need to file an information return. This highlights the importance of compliance in your financial practices. You are not alone in this journey; there are solutions available to help you navigate these challenges.

Conclusion

Navigating the world of self-employment, especially when it comes to tax management, can feel overwhelming. We understand that the Schedule C Expenses Worksheet is an essential tool for sole proprietors and freelancers, making it easier to report income and expenses while maximizing potential deductions. By recognizing its vital role in ensuring compliance with IRS regulations, self-employed individuals can confidently manage their financial responsibilities and improve their tax outcomes.

This article discusses various deductible expenses that can significantly lighten your taxable income, such as:

- Advertising

- Vehicle costs

- Home office deductions

It’s crucial to maintain meticulous records to support these claims, enhancing your financial clarity and reducing the chances of audits. Furthermore, taking a structured approach to filling out the Schedule C Expenses Worksheet empowers you to take charge of your financial journey, reinforcing the idea that thoughtful financial planning is key to achieving long-term stability and success in entrepreneurship.

In conclusion, embracing the Schedule C Expenses Worksheet not only simplifies tax reporting but also nurtures a sense of financial security and independence for self-employed individuals. By utilizing available resources, steering clear of common pitfalls, and keeping accurate records, you can navigate the complexities of self-employment with confidence. Remember, taking proactive steps in financial management leads to better outcomes, ensuring that your entrepreneurial journey is both rewarding and sustainable. You are not alone in this; support is available as you take these important steps toward career ownership.

Frequently Asked Questions

What is the Schedule C Expenses Worksheet?

The Schedule C Expenses Worksheet is a tool designed for self-employed individuals and sole proprietors in the United States to document their revenue and expenses, helping them organize operational costs and maximize tax deductions.

Why is the Schedule C Expenses Worksheet important for 2025?

In 2025, the Schedule C Expenses Worksheet is crucial for accurate reporting to the IRS, ensuring compliance with tax regulations and aligning with IRS Form 1040, specifically Schedule C.

What types of expenses can self-employed individuals claim using the Schedule C Expenses Worksheet?

Self-employed individuals can claim various business expenses, including office supplies, travel costs, equipment purchases, insurance premiums, and advertising expenditures.

Can taxpayers claim deductions for contributions to a capital construction fund on Schedule C?

No, taxpayers should not claim deductions for contributions to a capital construction fund on Schedule C; instead, they should make adjustments on their Form 1040 or 1040-SR.

How can the Schedule C Expenses Worksheet benefit self-employed individuals?

By using the Schedule C Expenses Worksheet, taxpayers can capture all eligible deductions, potentially leading to a more favorable tax outcome and reduced overall tax liability.

What are some key categories of deductible costs for self-employed individuals?

Key categories of deductible costs include advertising, car and truck costs, contract labor, home office deduction, supplies, and utilities.

How is the standard mileage rate for vehicle-related expenses calculated for 2025?

For 2025, the standard mileage rate for vehicle-related expenses is set at 65.5 cents per mile.

What is the qualified business income deduction?

The qualified business income deduction allows eligible self-employed individuals to deduct up to 20% of their business revenue, subject to specific limitations.

How can self-employed individuals optimize their deductions on the Schedule C Expenses Worksheet?

To optimize deductions, self-employed individuals should maintain detailed records of all expenses and consult tax professionals for personalized advice.

What support is available for self-employed individuals navigating their financial journey?

Support is available through career coaching services, such as those offered by The Entrepreneur’s Source, which help individuals understand and maximize their deductions.