Overview

The benefits of financial planning for new entrepreneurs include improved decision-making, enhanced economic stability, and proactive risk management, all of which contribute to long-term business success. The article supports this by detailing how structured budgeting, forecasting, and cash flow management not only increase survival rates and growth potential but also empower entrepreneurs to navigate financial challenges effectively.

Introduction

Navigating the world of entrepreneurship can be both exhilarating and daunting, especially for those just starting out. At the heart of a successful venture lies the often-overlooked yet crucial element of financial planning. This foundational practice not only lays the groundwork for a business’s financial health but also serves as a strategic guide for achieving long-term sustainability.

A well-structured financial plan empowers entrepreneurs to:

- Identify funding needs

- Establish realistic financial goals

- Develop actionable strategies

As the landscape of business continues to evolve, understanding the importance of financial planning becomes paramount, equipping new entrepreneurs with the tools they need to thrive amid uncertainties and seize opportunities for growth.

Through exploring the benefits, resources, and common pitfalls of financial planning, this article provides a comprehensive roadmap for aspiring business owners to enhance their chances of success in a competitive marketplace.

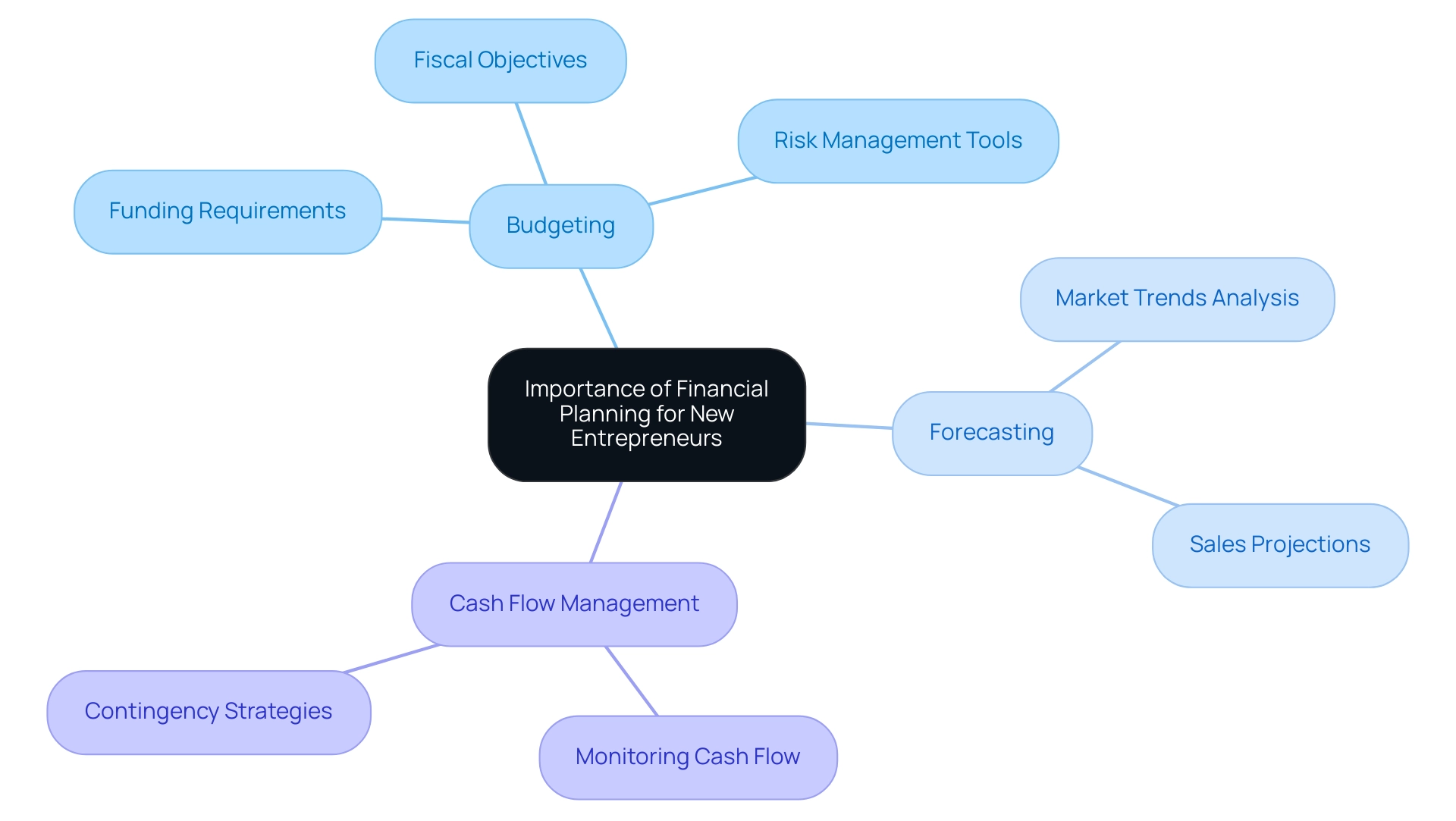

The Importance of Financial Planning for New Entrepreneurs

Budgeting serves as a cornerstone for new business owners, illustrating the benefits of financial planning for new entrepreneurs by offering the essential framework for ensuring their venture’s economic health and long-term sustainability. A thorough monetary plan exemplifies the benefits of financial planning for new entrepreneurs by allowing business owners to clearly determine their funding requirements, establish attainable fiscal objectives, and create practical strategies to achieve them. The benefits of financial planning for new entrepreneurs include essential elements like:

- Budgeting

- Forecasting

- Cash flow management

All of which enable business owners to make informed choices that can greatly improve their chances of success.

Significantly, efficient resource management also provides entrepreneurs with risk management tools, preparing them to navigate possible monetary challenges with contingency strategies established. Indeed, the evidence is compelling: enterprises that recognize the benefits of financial planning for new entrepreneurs showcase an impressive 70% survival rate beyond the initial five years, highlighting that effective monetary management is not merely advantageous but crucial. Furthermore, companies that seek expert advice or employ strategic software are more likely to experience a 30% rise in growth, which underscores the benefits of financial planning for new entrepreneurs.

On the other hand, individuals lacking an accounting expert are less inclined to indicate robust financial well-being, highlighting the importance of professional assistance in financial management. Additionally, enterprise strategizing clarifies roles and responsibilities, facilitating effective delegation and enhancing communication within teams, which leads to increased job satisfaction and productivity. Think of it as a roadmap, guiding entrepreneurs through the intricate landscape of starting and managing a business, which highlights the benefits of financial planning for new entrepreneurs, ultimately leading to greater satisfaction and productivity within their teams.

Key Benefits of Financial Planning for Startups

The benefits of financial planning for new entrepreneurs are extensive and essential for long-term success. A comprehensive monetary plan significantly enhances decision-making by illustrating the benefits of financial planning for new entrepreneurs through a structured approach to evaluating monetary options and potential investments. Entrepreneurs equipped with a strong monetary strategy can leverage the benefits of financial planning for new entrepreneurs to better evaluate the feasibility of their concepts, ultimately making informed strategic choices that align with their economic objectives.

Moreover, the benefits of financial planning for new entrepreneurs foster economic stability by offering insight on cash flow, costs, and revenue projections. This stability is essential in attracting investors and securing necessary funding; in fact, approximately 70% of businesses with a strategic business plan survive beyond the first five years. Significantly, 65% of firms with robust fiscal management report much better economic performance than their counterparts, emphasizing the tangible advantages of such strategies.

Additionally, the benefits of financial planning for new entrepreneurs enable them to identify potential risks proactively and develop mitigation strategies, empowering them to navigate uncertainties with confidence. Practical tips such as managing cash flow, controlling costs, and planning for taxes are vital for growing startups. A study conducted at the University of Oregon underscores this importance, revealing that businesses with a detailed business plan are 152% more likely to launch successfully and 129% more likely to scale beyond the startup phase.

It is also crucial for startups to regularly review their strategies, as almost a quarter of organizations only assess their implementations once a year. Ultimately, a well-crafted budget plan not only bolsters operational efficiency but also demonstrates the benefits of financial planning for new entrepreneurs, positioning startups for sustainable growth and competitive success in the marketplace.

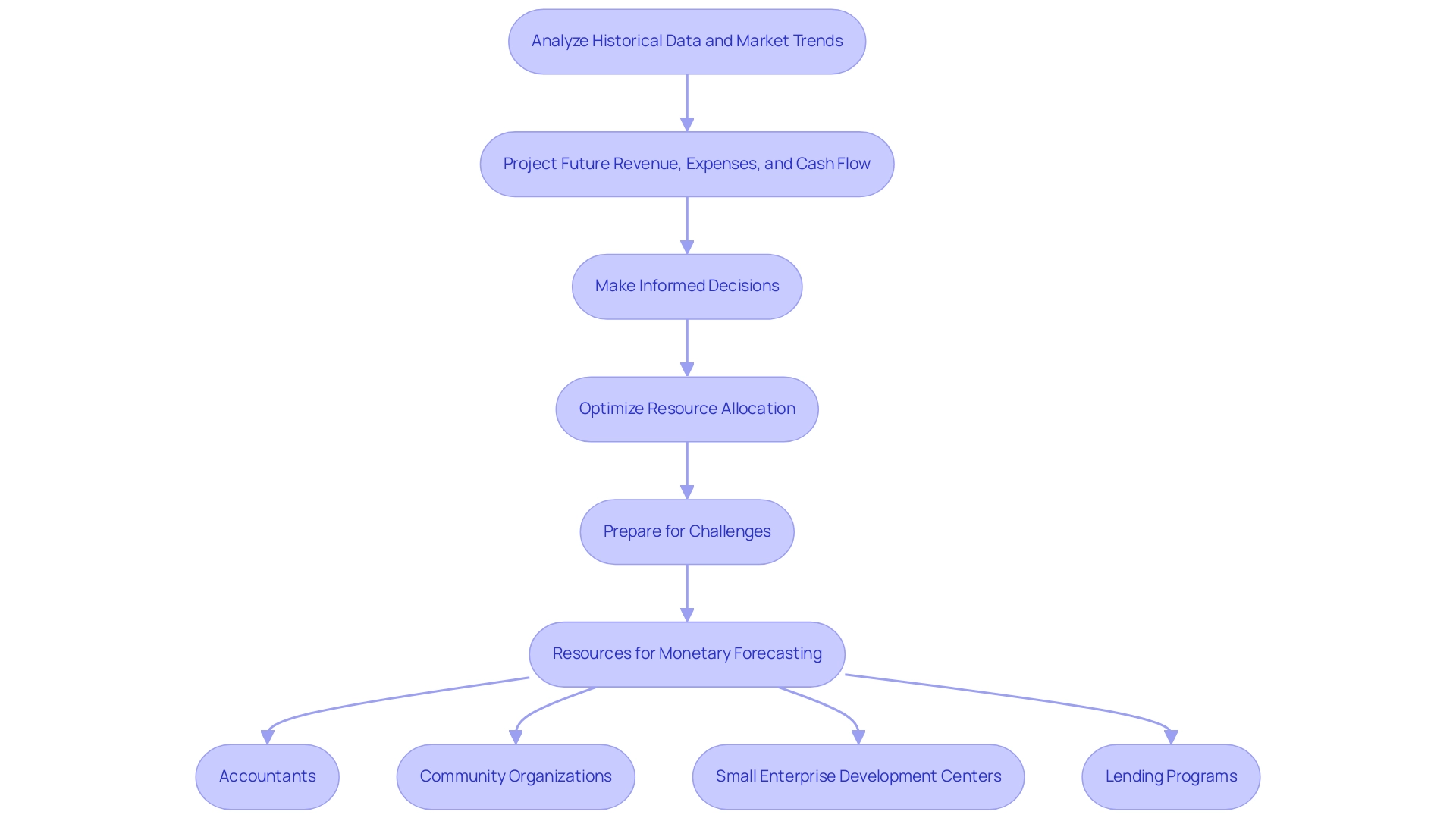

Financial Planning Tools and Resources for Entrepreneurs

Entrepreneurs today have access to an array of financial planning tools that can significantly streamline their financial management processes. Not only can they utilize software like QuickBooks and FreshBooks for budgeting and expense tracking, but they can also explore self-funding options through checking and savings accounts, as well as cash equivalents. Checking and savings accounts function as self-funding tools by enabling individuals to manage their cash flow effectively, ensuring that they have immediate access to funds for operational needs without incurring debt.

This strategy allows for a more immediate and controlled approach to funding, showcasing the benefits of financial planning for new entrepreneurs. In fact, two out of three companies spend about 60 days a year pitching for and accessing funds, underscoring the importance of efficient resource management tools like Vice versa, which can reduce this time to just 3 days. For those aiming to develop detailed business plans with budget forecasts, platforms like LivePlan provide comprehensive solutions that address various business needs.

Additionally, the U.S. Small Business Administration provides vital services such as loan guarantees, mentorship programs, and access to funding resources, which can support entrepreneurs in their self-funding efforts. As Kathy Evans wisely points out,

These 10 leading apps and tools can assist you in saving money while preparing for your future.

However, it’s important to recognize that some management applications, like Monarch, may present a steep learning curve due to their many features, which could be challenging for some users.

Moreover, budgeting tools can aid in tax preparation by monitoring expenses and revenues, offering practical advantages for business owners. Online courses centered on money literacy can improve a business owner’s comprehension of budgeting and monetary management strategies. Interacting with colleagues through networking and participating in local professional groups can offer practical insights and shared experiences that enhance decision-making regarding finances.

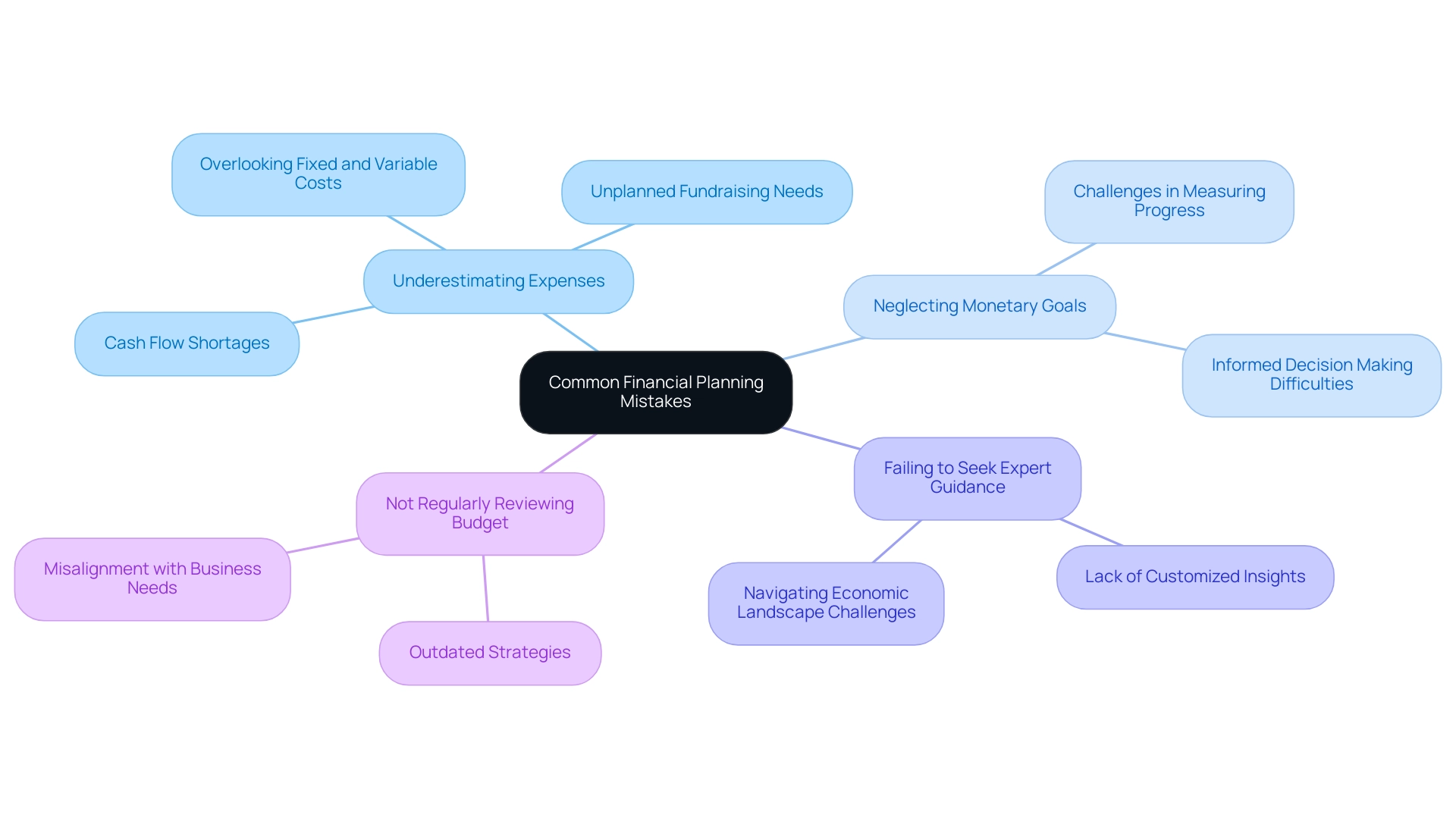

By utilizing these resources, including the funding options available from the U.S. Small Business Administration, individuals can take proactive measures to explore the benefits of financial planning for new entrepreneurs in aligning their monetary strategies with their overarching objectives. Such tools not only aid in effective monetary organization but also enable small enterprises to handle the intricacies of resource management with assurance.