Overview

The best legal essentials for starting a business include selecting the appropriate legal structure, navigating compliance requirements, protecting intellectual property, understanding tax obligations, and establishing clear contracts. The article supports this by detailing how each of these elements plays a crucial role in ensuring legal protection, financial stability, and operational efficiency for new ventures, thereby laying a solid foundation for sustainable growth.

Introduction

In the dynamic world of entrepreneurship, the legal landscape can often feel overwhelming. From selecting the right legal structure to navigating compliance requirements, every decision carries significant implications for a business’s future. Entrepreneurs must grapple with choices that affect personal liability, tax obligations, and the ability to secure funding.

As startups strive to carve out their niche, understanding the nuances of intellectual property protection and establishing robust contracts becomes paramount. This article delves into essential legal considerations that can empower business owners to make informed decisions, minimize risks, and lay a solid foundation for sustainable growth.

By exploring these critical areas, entrepreneurs can navigate their journey with confidence, ensuring they are well-equipped to face the challenges ahead.

Choosing the Right Legal Structure for Your Business

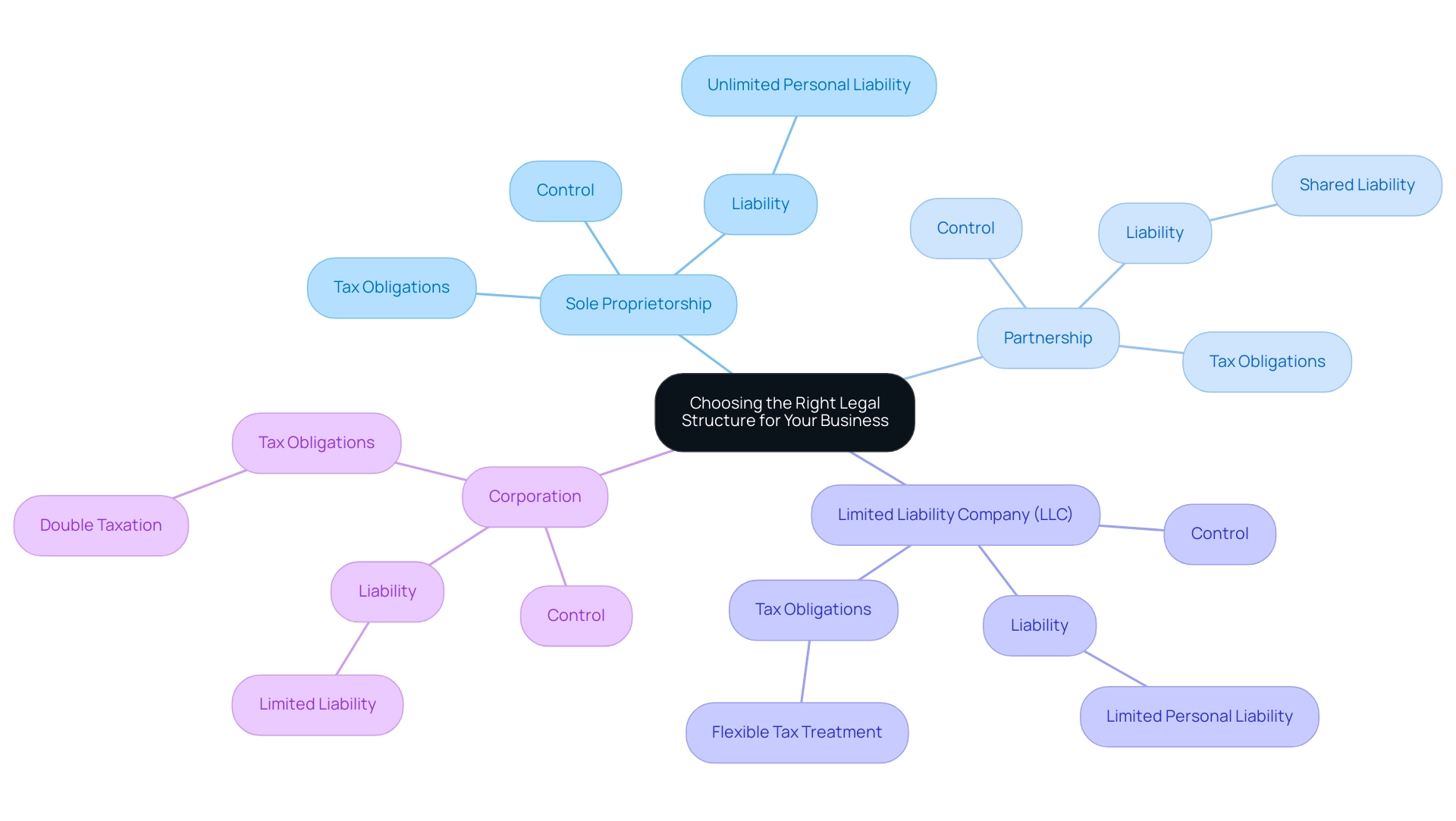

Choosing the best Legal essentials for starting a business is crucial to your entrepreneurial journey. Each option—whether a sole proprietorship, partnership, limited liability company (LLC), or corporation—has distinct implications, tax obligations, and varying degrees of personal liability, making it crucial to know the best legal essentials for starting a business. A sole proprietorship, for example, is the most straightforward model, granting the owner full control but also subjecting them to unlimited personal liability.

Conversely, an LLC provides crucial limited liability protection, allowing owners to separate their personal assets from debts incurred by the enterprise, while also offering flexibility in tax treatment. It’s important to consider the financial implications of your choice; loans for enterprises, credit cards, and lines of credit account for a significant portion of financing for new firms, making the best Legal essentials for starting a business crucial for securing funding. Recent insights reveal that approximately 31% of commercial real estate investors are looking to invest in proptech companies, illustrating the evolving landscape of organizational structures as industries adapt.

Furthermore, as highlighted by Small Business Trends, one in four enterprises, according to a survey by the NSBA, faced challenges in obtaining essential funding, often due to ambiguous regulatory frameworks. This underlines the importance of not only choosing the right framework but also understanding the best Legal essentials for starting a business and their implications for growth. Furthermore, about 61 percent of small enterprise owners are investing in social media marketing to expand their brand and reach new customers, demonstrating how the choice of organizational structure can impact marketing strategies and overall growth.

As you navigate this decision, aligning your organizational goals with the most appropriate regulatory framework is essential for maximizing potential and minimizing risks.

Navigating Legal Requirements and Compliance for Startups

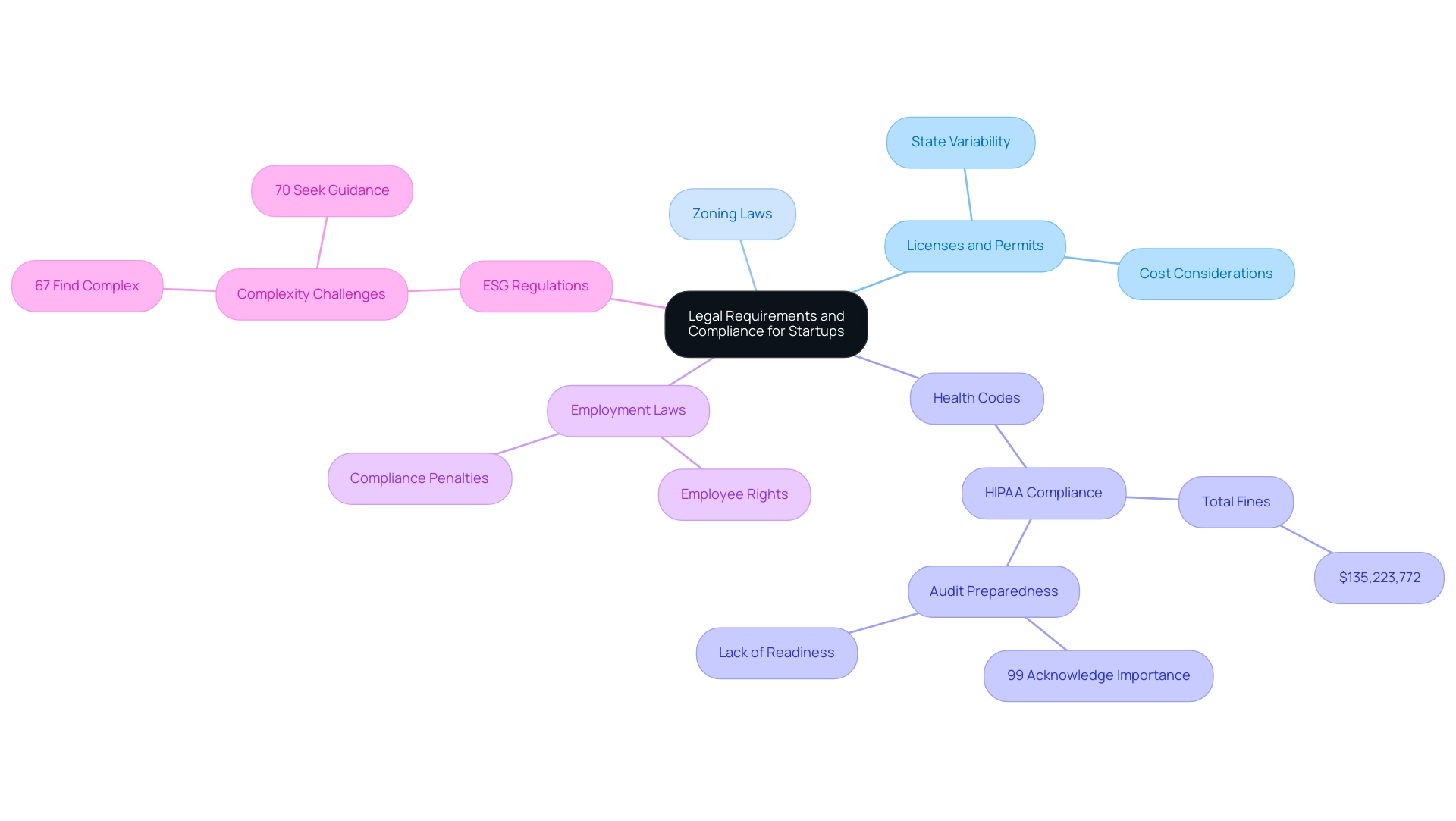

Navigating the landscape of the best Legal essentials for starting a business and compliance measures is a critical step for every startup aiming to operate lawfully and efficiently. Entrepreneurs must secure the appropriate licenses and permits, which can vary significantly in cost by state, and must also adhere to zoning laws, health codes, and safety regulations. Understanding employment laws, including employee rights, is equally vital, as failure to comply with these regulations can result in severe penalties, fines, or even the closure of the business.

Notably, as of May 31st, 2023, total HIPAA fines have reached a staggering $135,223,772, highlighting the financial repercussions of non-compliance in healthcare. A recent study revealed that while 99% of healthcare organizations acknowledge the importance of HIPAA compliance, many remain unprepared for potential audits and cyber threats. This gap in readiness highlights the necessity for startups to conduct thorough research and seek advice from professionals, especially given the complexities of current regulations.

In fact, 67% of global executives find ESG regulations challenging, with 70% of them looking for more regulatory guidance. To address these challenges, the compliance automation toolset provides visibility into compliance status while saving time and money, offering practical solutions for startups. As John Minnix states, “Ready to get started?

Contact Bright Defense today!”

By prioritizing the best Legal essentials for starting a business and leveraging expert insights, entrepreneurs can confidently navigate the intricate web of requirements and position their startups for sustainable success.

Protecting Your Intellectual Property: A Key Business Essential

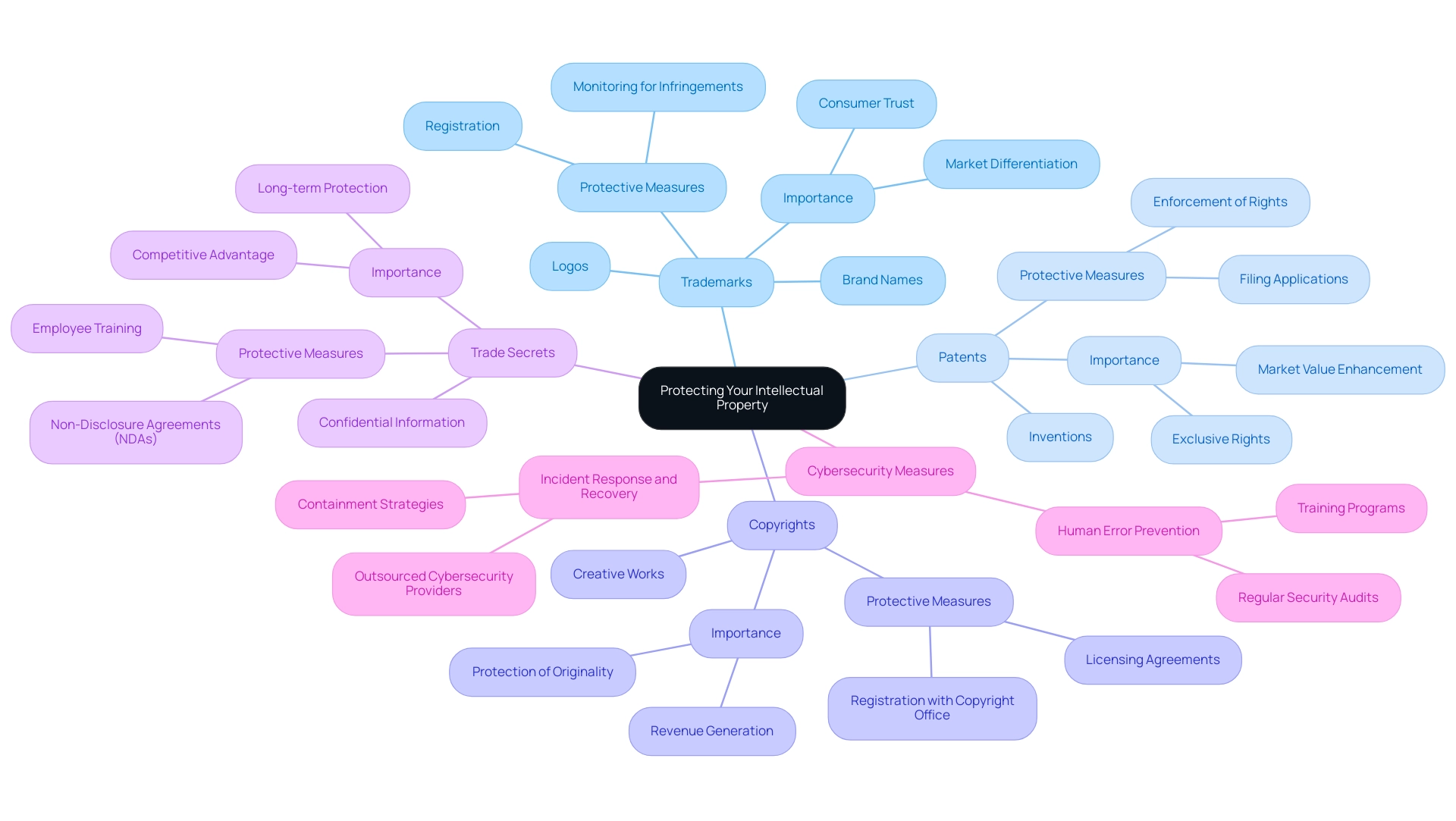

In today’s fiercely competitive commercial landscape, safeguarding your intellectual property (IP) is more vital than ever. Intellectual property encompasses various forms, including trademarks, patents, copyrights, and trade secrets. For instance, trademarks protect brand names and logos, while patents secure inventions for a designated period, granting exclusive rights to the inventor.

The significance of strong IP protection cannot be overstated; it not only shields your enterprise from competitors but also significantly enhances its market value. Recent statistics reveal a staggering increase in the cost of American intellectual property theft, soaring from $822.3 million to $1.12 billion—a sharp rise of 36%. This alarming trend underscores the necessity for entrepreneurs to proactively register their IP with relevant governmental bodies and vigilantly monitor for potential infringements.

Furthermore, with the U.S. government unable to effectively oversee counterfeit items, it is crucial for enterprises to take self-protective measures. Entrepreneurs can also explore resources like CrowdStrike’s free 15-day trial, which offers cybersecurity solutions designed for small enterprises. As one expert aptly noted,

Remember that human error caused 95% of data breaches, so one breach can be a big problem.

In the event of a cyber attack, organizations should be prepared to implement incident response and recovery strategies, as highlighted in case studies where many small enterprises depend on outsourced cybersecurity providers to manage the aftermath of attacks effectively and ensure quick recovery. By taking these steps, organizations can fortify their assets against theft and ensure long-term success.

Understanding Tax Obligations and Financial Responsibilities

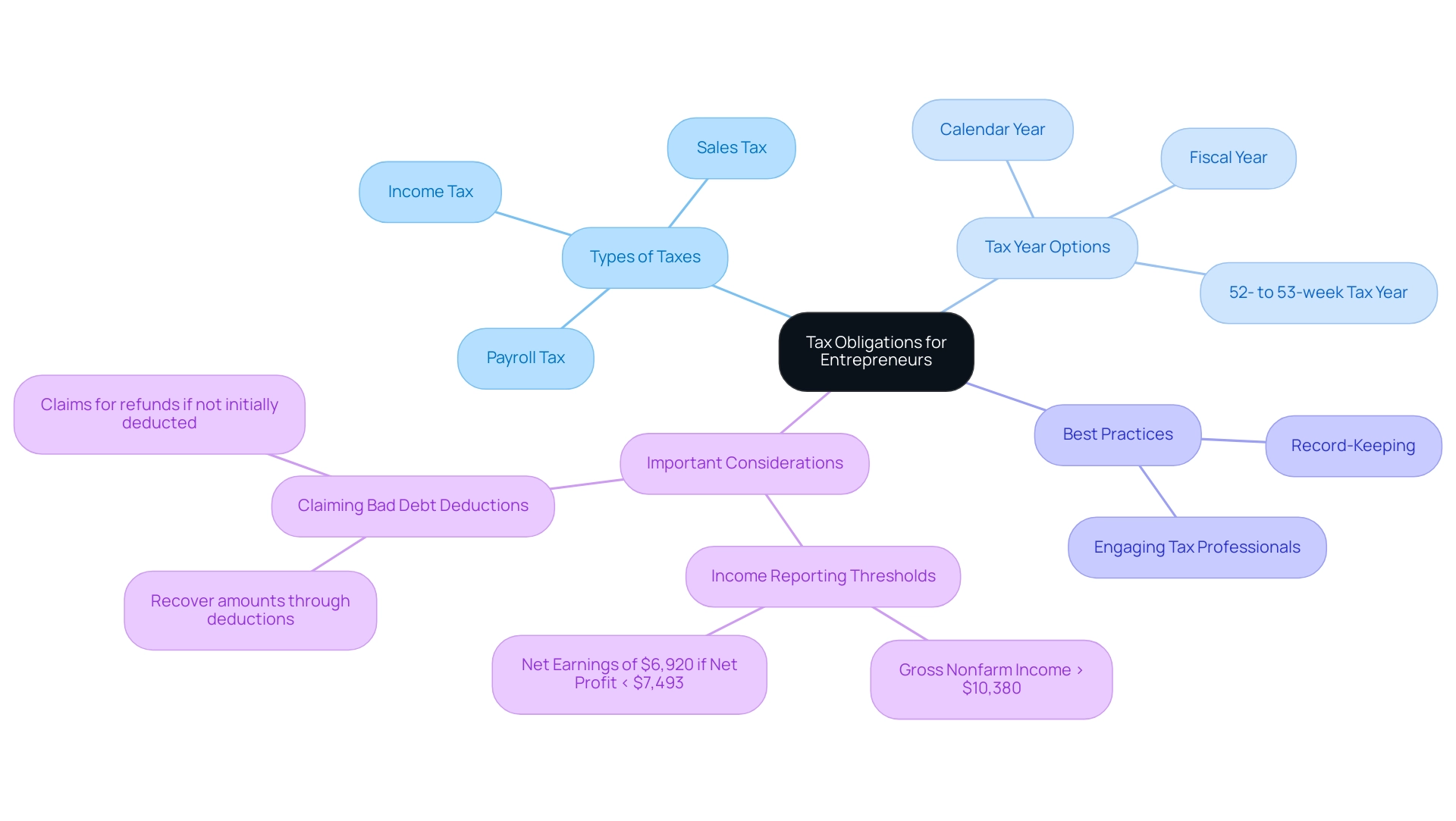

Navigating your tax obligations is a critical aspect of establishing a successful enterprise. As an entrepreneur, it’s essential to familiarize yourself with various tax types that impact your operations, including:

- Income tax

- Sales tax

- Payroll tax

alongside their respective deadlines for filing. If your gross nonfarm income exceeds $10,380, you can report net earnings of $6,920 if your net profit is less than $7,493.

Additionally, small enterprises have the flexibility to choose their tax year for reporting income and expenses, with options including:

- A calendar year

- Fiscal year

- A 52- to 53-week tax year

It’s important to note that if you opt for a tax year other than the calendar year, you must apply the tax rate and maximum earnings limit in effect at the beginning of that tax year. Accurate financial record-keeping not only streamlines tax preparation but also ensures compliance with tax laws.

Many new entrepreneurs find it advantageous to engage with a tax professional who can assist in formulating strategies that effectively minimize tax liabilities while maximizing deductions. For instance, the Taxpayer Advocate Service emphasizes its mission, stating,

TAS strives to protect taxpayer rights and ensure the IRS is administering the tax law in a fair and equitable way.

This proactive approach to understanding tax responsibilities can help avert potential financial complications.

Furthermore, consider the example of claiming bad debt deductions—taxpayers can recover amounts through deductions or claims for refunds if they did not initially deduct a bad debt when it became worthless. By being informed and prepared, you position your enterprise for success in the ever-evolving landscape of tax obligations.

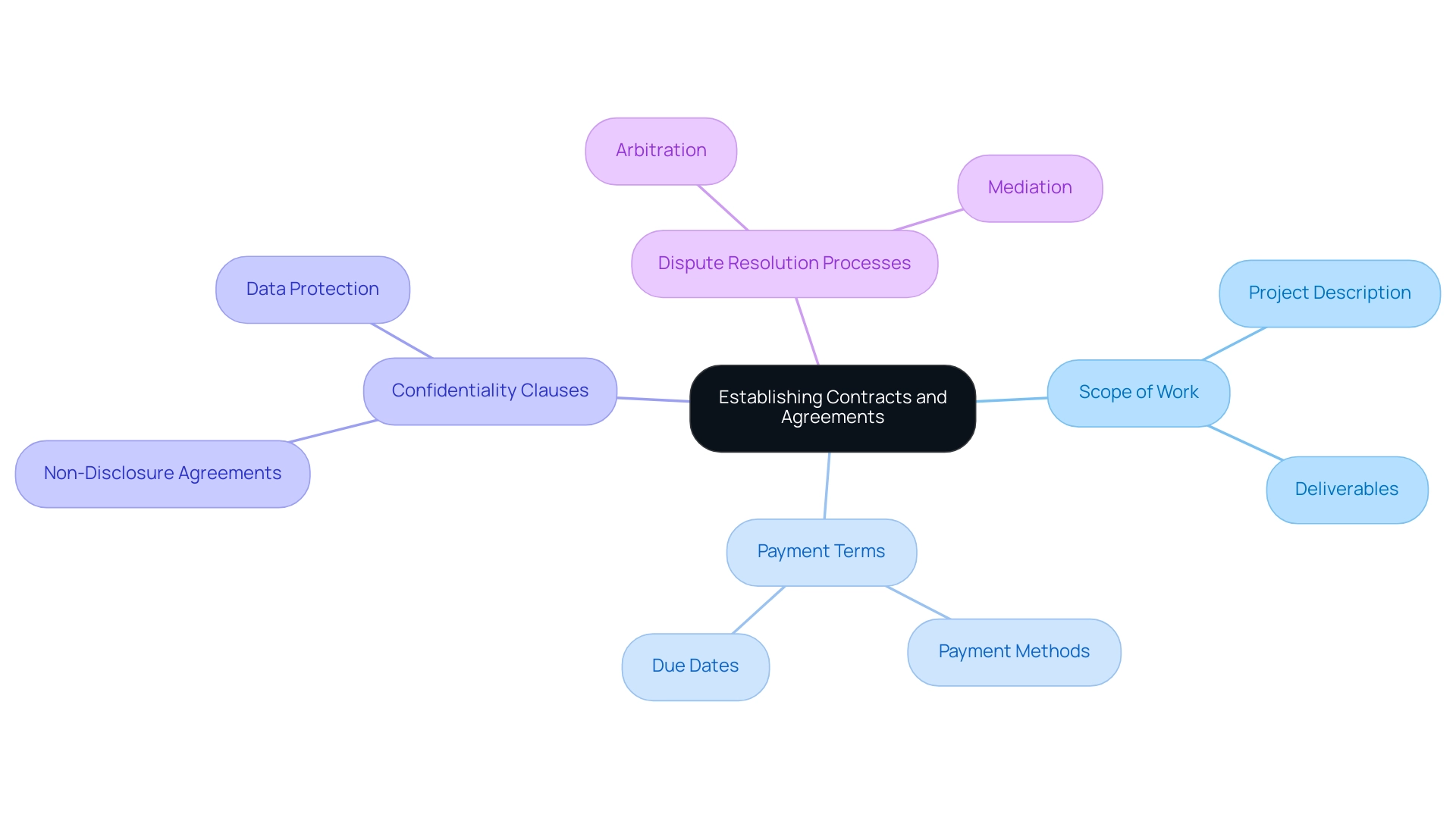

Establishing Contracts and Agreements: Securing Business Relationships

Creating clear agreements and arrangements is one of the best Legal essentials for starting a business and is crucial for strengthening professional relationships. These legally binding documents are among the best Legal essentials for starting a business, as they outline the terms of agreements between parties and encompass various aspects such as partnerships, employment, and client services. Significantly, agreement formation, negotiation, and approval make up 18% of a company’s sales cycle, highlighting how essential effective agreements are for operational efficiency.

A significant percentage of businesses face disputes due to the lack of formal agreements, which highlights the importance of understanding the best Legal essentials for starting a business. Essential elements of an agreement include:

- The scope of work

- Payment terms

- Confidentiality clauses

- Dispute resolution processes

Each of these elements plays a vital role in preventing misunderstandings and minimizing the potential for disputes.

Furthermore, with professionals reportedly spending up to two hours searching for specific language in documents, this inefficiency highlights the urgent need for streamlined management processes. Entrepreneurs should prioritize the best Legal essentials for starting a business by having their agreements reviewed by legal experts to eliminate ambiguity and safeguard their interests. As Rezvan Golestaneh states,

AI-driven automation is expected to be implemented in 75% of organizations for business-critical operations by 2025,

underscoring the shift towards more efficient management practices.

Well-drafted contracts not only help prevent misunderstandings but also establish a clear framework for resolving disputes, should they arise, thereby enhancing the overall effectiveness of business operations.

Conclusion

Navigating the legal landscape is crucial for entrepreneurs seeking success. Choosing the appropriate legal structure—be it a sole proprietorship, LLC, or corporation—affects personal liability, tax obligations, and funding opportunities. Aligning business goals with the right framework is essential for maximizing potential and minimizing risks.

Compliance with legal requirements is equally vital. Startups must secure necessary licenses and adhere to regulations to avoid costly penalties. Seeking expert guidance can help simplify complex compliance issues and streamline operations.

Protecting intellectual property (IP) is critical in a competitive marketplace. With increasing costs of IP theft, proactive registration and vigilant monitoring are necessary to safeguard business assets. Additionally, having strategies in place to address potential cyber threats is essential for long-term security.

Understanding tax obligations is fundamental for business operations. Familiarity with various tax types, deadlines, and accurate record-keeping can help minimize liabilities. Consulting with tax professionals can further enhance financial strategies.

Establishing clear contracts solidifies business relationships and prevents disputes. Well-drafted agreements outline expectations and provide mechanisms for resolution, contributing to operational efficiency.

In summary, a holistic approach to legal considerations—including selecting the right structure, ensuring compliance, protecting IP, managing tax obligations, and formalizing contracts—empowers entrepreneurs to build a solid foundation for growth and success. Staying informed and proactive in these areas will enable a confident navigation of challenges ahead.

Frequently Asked Questions

Why is choosing the best legal structure important for starting a business?

Choosing the best legal structure is crucial as it has distinct implications for tax obligations, personal liability, and control over the business. Different structures like sole proprietorships, LLCs, and corporations offer varying levels of protection and flexibility.

What are the characteristics of a sole proprietorship?

A sole proprietorship is the most straightforward business model, granting the owner full control. However, it subjects the owner to unlimited personal liability for business debts.

How does a Limited Liability Company (LLC) differ from a sole proprietorship?

An LLC provides limited liability protection, allowing owners to separate their personal assets from business debts, while also offering flexibility in tax treatment, unlike a sole proprietorship.

What financial implications should entrepreneurs consider when choosing a legal structure?

Entrepreneurs should consider how their choice of legal structure affects their ability to secure funding through loans, credit cards, and lines of credit, as these are significant financing sources for new businesses.

What challenges do businesses face in obtaining funding?

Approximately one in four enterprises face challenges in obtaining essential funding, often due to ambiguous regulatory frameworks, highlighting the importance of selecting the right legal structure.

How does the choice of organizational structure impact marketing strategies?

The choice of organizational structure can influence marketing strategies and overall growth, as evidenced by the fact that about 61% of small business owners are investing in social media marketing to expand their brand.

What compliance measures must startups adhere to?

Startups must secure appropriate licenses and permits, comply with zoning laws, health codes, safety regulations, and understand employment laws to avoid severe penalties or business closure.

What are the financial repercussions of non-compliance in the healthcare sector?

As of May 31st, 2023, total HIPAA fines reached over $135 million, illustrating the significant financial risks associated with non-compliance in healthcare.

What challenges do executives face regarding ESG regulations?

A significant number of global executives find ESG regulations challenging, with many seeking more regulatory guidance to navigate compliance effectively.

How can startups ensure they comply with legal requirements?

Startups should conduct thorough research, seek professional advice, and consider compliance automation tools to gain visibility into their compliance status and position themselves for sustainable success.