Overview

The challenges in preparing to leave a stable job for entrepreneurship primarily include emotional turmoil, financial uncertainties, and the need for thorough market research and planning. The article emphasizes that managing these challenges requires recognizing emotional impacts, conducting diligent financial planning, and leveraging mentorship and market insights to navigate the transition successfully.

Introduction

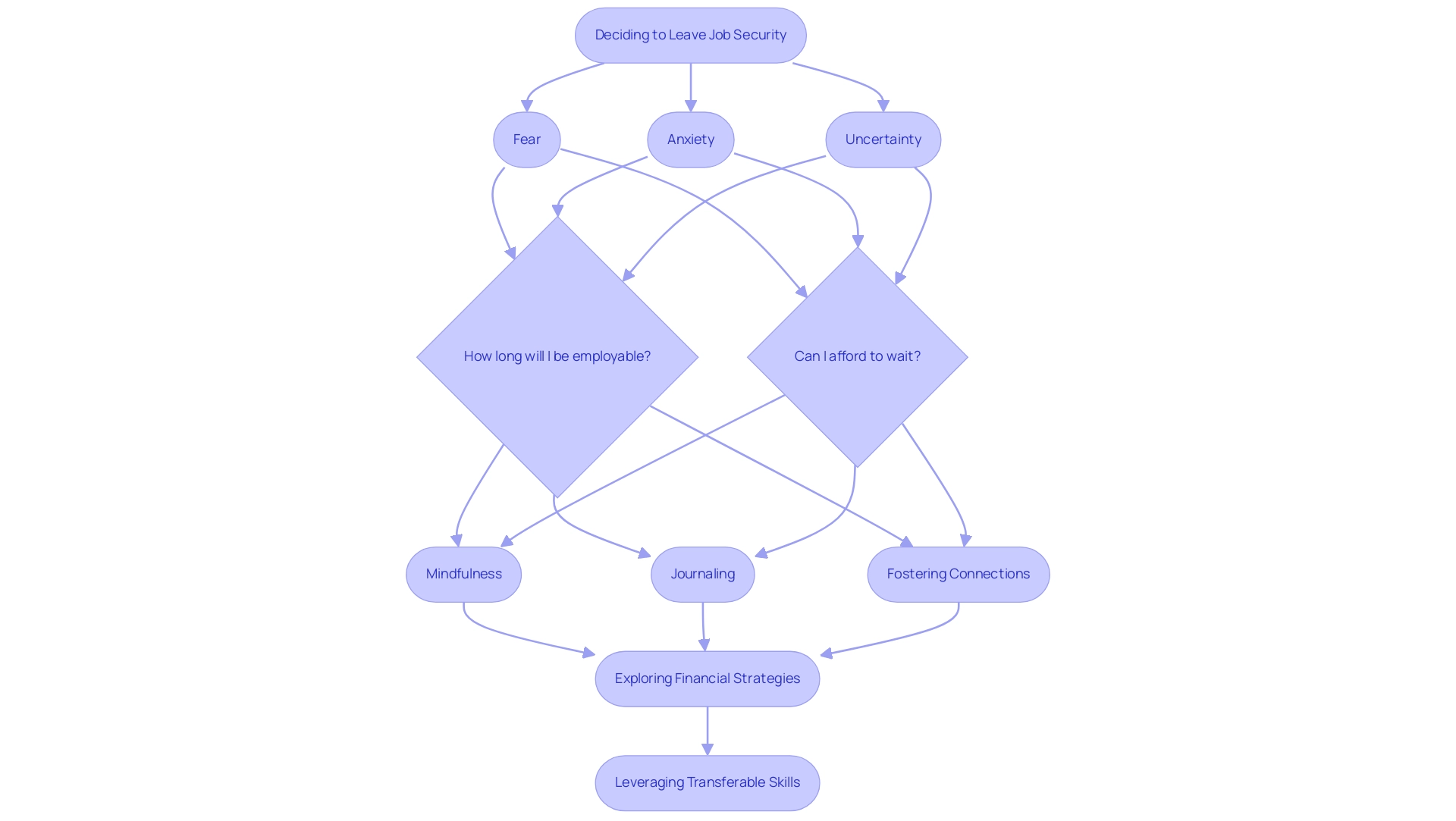

Leaving the comfort of a stable job can evoke a storm of emotions, from fear and anxiety to uncertainty about the future. As individuals grapple with the loss of job security and the identity tied to their roles, it becomes vital to acknowledge that these feelings are a natural part of the transition process.

The journey toward entrepreneurship offers a promising path to personal agency and financial freedom, yet it requires careful consideration of critical questions regarding employability and financial readiness. By employing strategies such as:

- Mindfulness

- Journaling

- Building a support network

those contemplating this leap can better manage their emotions and navigate the complexities of their new venture.

This article explores essential steps for a successful transition to entrepreneurship, the inherent risks involved, the pivotal role of mentorship, and the financial preparations necessary to thrive in an ever-evolving landscape. Through practical insights and guidance, aspiring entrepreneurs can equip themselves with the tools needed to embrace their new opportunities confidently.

Navigating the Emotional Toll of Leaving Job Security

The decision to leave a stable job often highlights the challenges in preparing to leave a stable job for entrepreneurship, inciting a whirlwind of emotions, including fear, anxiety, and uncertainty. Many individuals encounter challenges in preparing to leave a stable job for entrepreneurship, as they wrestle with the dual loss of job security and the identity intertwined with their professional roles. It’s crucial to recognize that these feelings are not only common but also a natural component of the challenges in preparing to leave a stable job for entrepreneurship.

As emphasized in Your Career 2.0: A Survival Guide for The Battered Career Syndrome and Investor Syndrome, empowering oneself through business ownership can offer a route to personal agency and economic independence. However, it is essential to consider critical questions such as:

- How long will I be employable?

- Can I afford to wait to take control of my destiny?

Techniques such as mindfulness, journaling, and fostering connections with friends or mental health professionals can be instrumental in managing these emotions and addressing the challenges in preparing to leave a stable job for entrepreneurship. Additionally, exploring financial strategies to build wealth and security is vital in this transition. Recognizing employees’ hard work, as emphasized in the case study Recognition as a Tool Against Burnout, can enhance morale and alleviate feelings of anxiety during these transitions.

By acknowledging the emotional toll of this significant change and leveraging transferable skills, aspiring entrepreneurs and professionals can equip themselves for the journey ahead, enhancing their resilience and mental preparedness as they embrace new opportunities for lifestyle fulfillment.

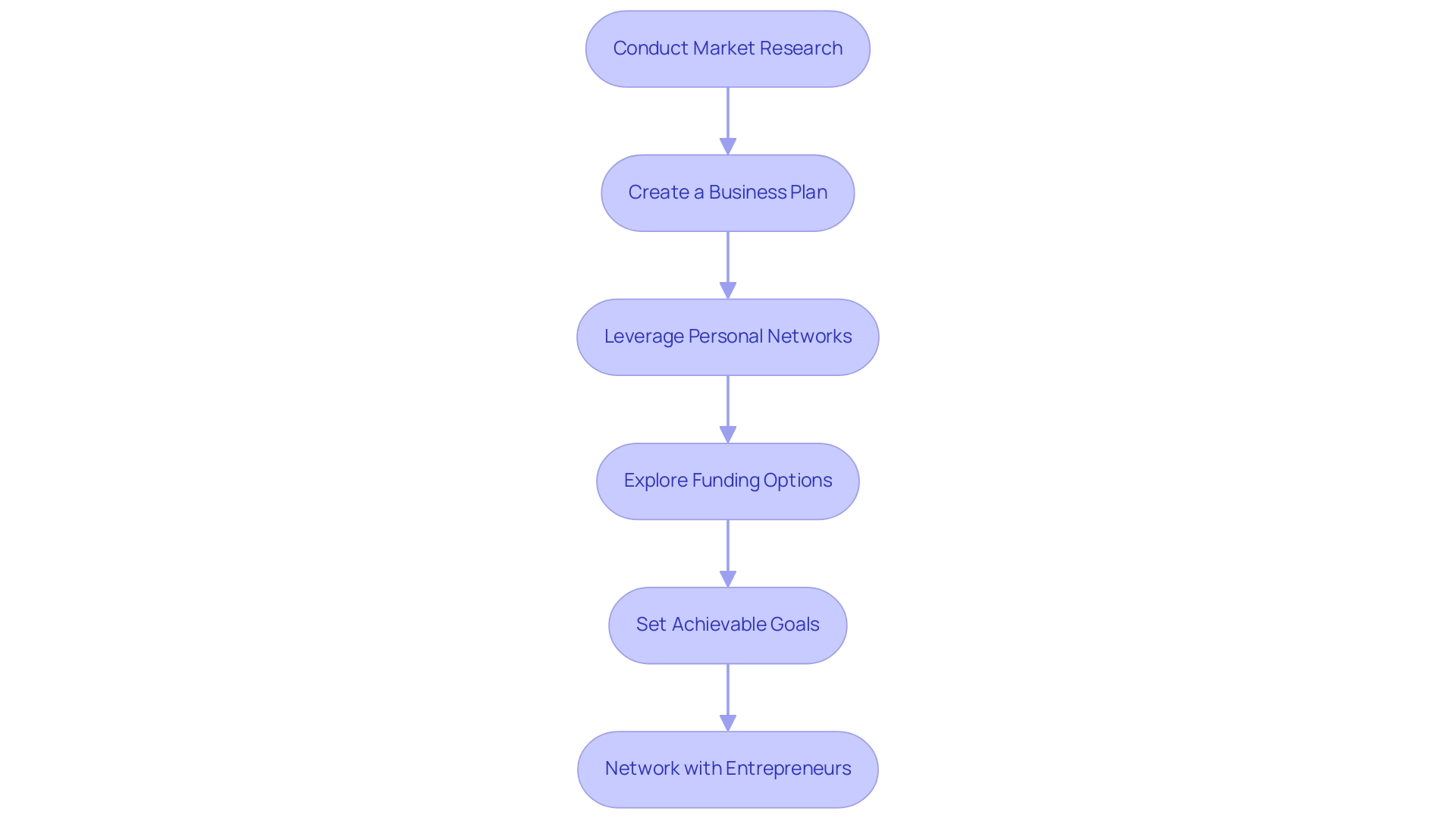

Essential Steps for a Smooth Transition to Entrepreneurship

Transitioning to business ownership requires addressing the challenges in preparing to leave a stable job for entrepreneurship to ensure success in a competitive landscape. A foundational step in this journey is conducting thorough market research, which is essential for validating your business idea. Startups are responsible for over 50% of all innovations, highlighting the significance of understanding market demands and consumer behavior.

In fact, according to a quote from Statista, African-American and Latina female-founded startups in the U.S. raised $3.1 billion in 2020, underscoring the importance of market research in securing funding and promoting diversity in entrepreneurship. Additionally, as a career transitioner, consider leveraging personal networks and exploring funding options available from the U.S. Small Business Administration, such as micro loans and grants, to enhance your resources. Angel investors can also play a crucial role in providing capital and mentorship.

Creating a detailed business plan is another critical step, as it serves as a roadmap for your entrepreneurial venture. Creating a monetary cushion through self-funding methods, such as checking and savings accounts, can offer the necessary support during the initial phases when revenue may be uncertain. Networking with fellow entrepreneurs and potential customers is invaluable; it not only offers insights but also helps you build a robust support system, empowering you to control your destiny and achieve financial freedom.

As you embark on this journey, setting achievable short-term goals can keep you motivated and help you track your progress. Understanding consumer behavior is crucial, as illustrated by the case study on mobile marketing trends, where mobile devices account for more than 60% of global website traffic. Remember, the landscape of business innovation is continually evolving, with trends indicating a record year for tech startup funding in 2021, where U.S. startups raised an impressive $311 billion.

By focusing on these key areas, you’ll be well-equipped to navigate the challenges in preparing to leave a stable job for entrepreneurship. Download your free veteran entrepreneur® Program presentation here.

Understanding the Risks of Entrepreneurship

Entrepreneurship presents numerous uncertainties, which encompass the challenges in preparing to leave a stable job for entrepreneurship, alongside economic instability, market competition, and the ever-looming risk of failure. Recent studies reveal that in 2023, a staggering 82% of companies that closed their doors did so primarily due to cash flow problems, underscoring the financial challenges that new ventures face. Additionally, leveraging technology can play a significant role in enhancing profitability; for instance, AI technology is estimated to boost profits by 71% for the construction industry, highlighting the potential advantages of adopting innovative solutions.

To effectively navigate the challenges in preparing to leave a stable job for entrepreneurship, conducting a SWOT analysis—assessing strengths, weaknesses, opportunities, and threats—can be a critical tool for identifying potential hurdles and crafting strategies to mitigate them. For instance, examining the recent performance of venture-backed U.S. real estate companies, which experienced an average decline of 85% from their offering price, highlights the volatility and risks inherent in startup ventures. Furthermore, collaboration is crucial in entrepreneurship, as evidenced by the fact that 80% of billion-dollar companies launched since 2005 have multiple founders, indicating that teamwork can enhance success.

Insights from experienced entrepreneurs can be invaluable; as the National Small Association points out, one of the challenges in preparing to leave a stable job for entrepreneurship is the cost of health insurance. Utilizing such expert advice can offer aspiring entrepreneurs with practical strategies to avoid common pitfalls and enhance their chances of success.

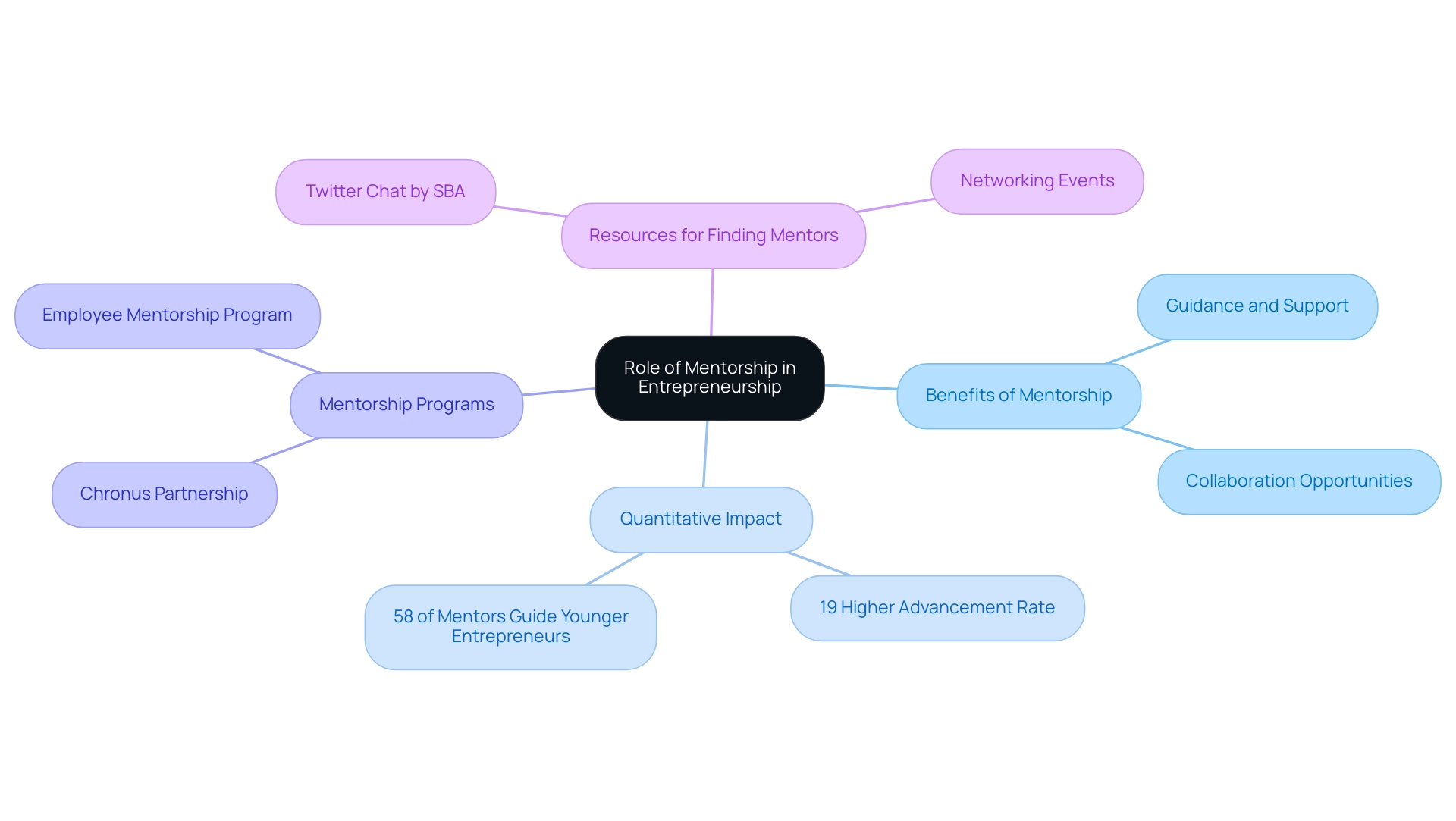

The Role of Mentorship in Overcoming Entrepreneurial Challenges

Mentorship serves as a cornerstone in successfully navigating the complexities of entrepreneurship. It offers invaluable guidance, helping you sidestep common pitfalls through the sharing of experiences and insights. Engaging with a mentor can significantly enhance your learning opportunities and foster collaboration, creating a robust support system.

Notably, a recent partnership between a global relationship-focused tech company and Chronus led to the introduction of an employee mentorship program, which demonstrated that participants experienced a remarkable 19% higher advancement rate compared to their peers who did not participate. This underscores the profound impact mentorship can have on business growth and success rates. In fact, 58% of mentors specifically guide younger business owners, highlighting the importance of support for those at the beginning of their ventures.

As Chronus stated, ‘Since then, they started seeing positive results on a number of metrics,’ emphasizing the effectiveness of mentorship. Furthermore, the Small Business Administration (SBA) will be hosting a Twitter chat on ‘How to Find a Business Mentor’ on February 7 at 3 p.m. ET, providing a timely avenue for aspiring entrepreneurs to seek guidance.

This chat could serve as a valuable resource for establishing a relationship with a mentor, which can be a transformative experience, significantly amplifying your entrepreneurial journey and expanding your professional network—an asset that is indispensable for sustained business growth.

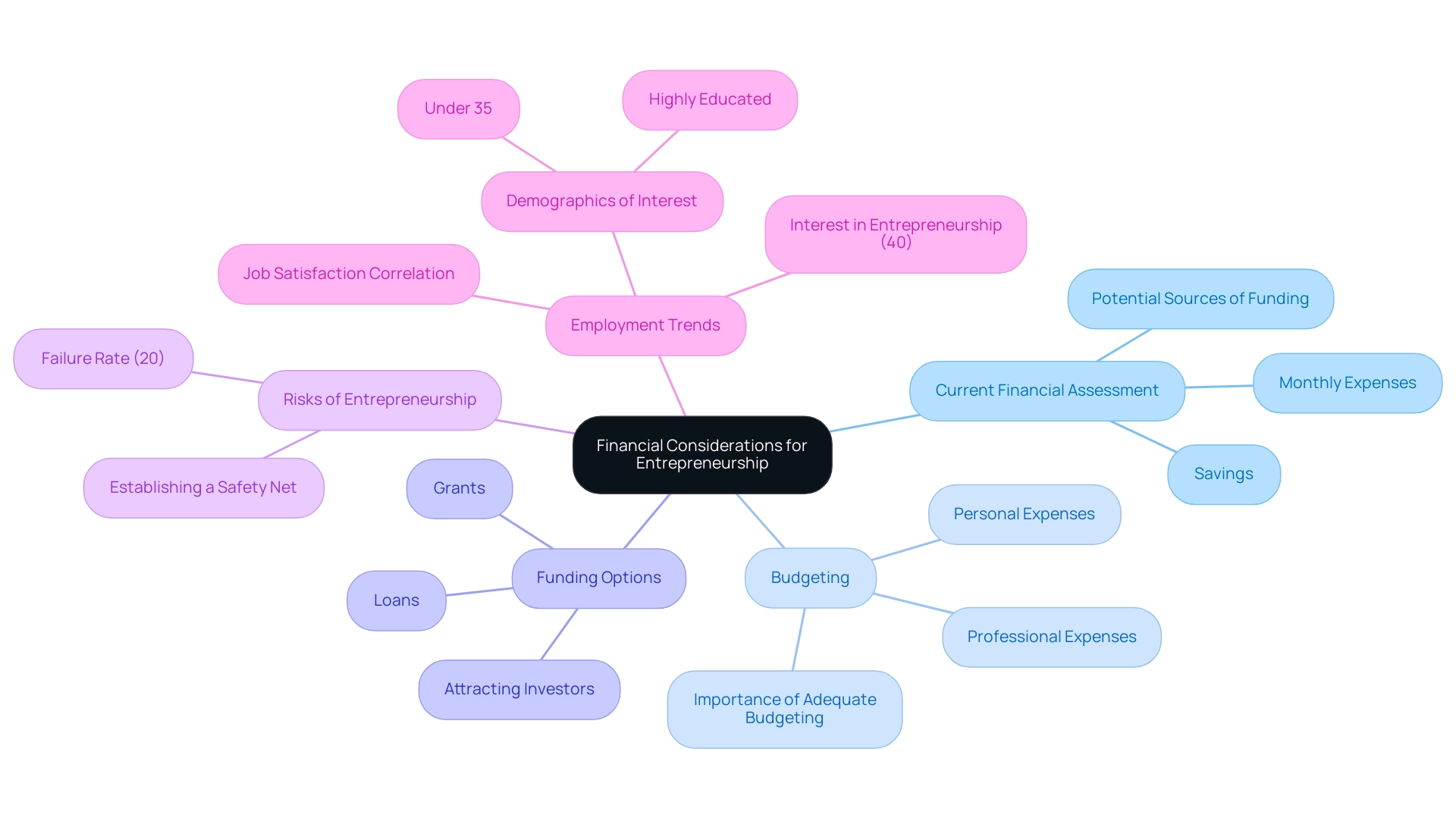

Financial Considerations: Preparing for the Leap into Entrepreneurship

Transitioning to entrepreneurship involves overcoming the challenges in preparing to leave a stable job for entrepreneurship, as meticulous monetary preparation is a crucial foundation for your new venture, as emphasized in ‘Your Career 2.0: A Survival Guide for The Battered Career Syndrome and Investor Syndrome.’ With estimates suggesting that around 27 million Americans would leave their full-time jobs to become self-employed by the end of 2020, it is essential to understand your economic landscape amidst a declining job market. This shift reflects a growing trend toward self-employment, as approximately 15 million entrepreneurs are currently in the US.

Begin by assessing your current financial situation—this includes your savings, monthly expenses, and potential sources of funding. Creating a thorough budget that includes both personal and professional expenses is essential for facilitating a smooth transition. As Graham Isador, a former copywriter turned entrepreneur, emphasizes, ‘Adequate budgeting is key to sustaining your venture beyond its launch.’

Moreover, given that approximately 20% of small enterprises fail within their first year, effective fiscal planning and budgeting are essential in reducing risks and improving employability in this new environment. Exploring various funding options, such as:

- loans

- grants

- attracting investors

can provide you with the necessary capital to kickstart your enterprise. Additionally, establishing a safety net can significantly reduce the stress associated with the challenges in preparing to leave a stable job for entrepreneurship, allowing you to concentrate fully on building your business.

Notably, research shows that nearly 40% of traditionally employed Americans are contemplating entrepreneurship, highlighting job satisfaction and personal agency as significant factors in this decision. By prioritizing monetary planning, as outlined in ‘Your Career 2.0,’ aspiring entrepreneurs can empower themselves for success in their new endeavors. Moreover, understanding the implications of a declining career economy is essential for navigating employability and achieving financial independence.

Conclusion

Transitioning from a stable job to entrepreneurship is an emotional journey filled with fear and uncertainty. Acknowledging these feelings is essential, as is employing techniques like mindfulness and journaling to manage them. Building a strong support network can foster resilience and help individuals navigate this significant life change.

A structured approach enhances the likelihood of success in this transition. The following steps are critical:

- Conducting thorough market research

- Creating a solid business plan

- Establishing financial reserves

Leveraging personal networks and exploring funding options can provide necessary resources, while setting achievable short-term goals helps maintain motivation.

Entrepreneurship inherently involves risks such as financial instability and market competition. Utilizing tools like SWOT analysis can help identify potential challenges and develop strategies to address them. Mentorship is also invaluable, offering guidance that can significantly boost success rates.

Financial preparation is foundational for a successful entrepreneurial journey. The following steps are vital:

- Assessing one’s financial situation

- Crafting a comprehensive budget

- Exploring various funding options

As the trend toward self-employment grows, prioritizing financial planning and understanding the evolving job market will empower aspiring entrepreneurs to navigate their paths confidently. Embracing this journey not only fosters personal growth but also opens the door to fulfilling opportunities and innovation.

Frequently Asked Questions

What emotions do individuals typically experience when preparing to leave a stable job for entrepreneurship?

Individuals often experience fear, anxiety, and uncertainty as they face the dual loss of job security and their professional identity.

Why is it important to recognize the emotional challenges of transitioning to entrepreneurship?

Acknowledging these feelings is crucial as they are common and represent a natural part of the transition process, helping individuals to better prepare for the journey ahead.

What empowering benefits does business ownership offer?

Business ownership can provide a route to personal agency and economic independence.

What critical questions should individuals consider before leaving a stable job for entrepreneurship?

Individuals should consider how long they will be employable and whether they can afford to wait to take control of their destiny.

What techniques can help manage the emotions associated with this transition?

Techniques such as mindfulness, journaling, and connecting with friends or mental health professionals can be instrumental in managing these emotions.

How can financial strategies play a role in the transition to entrepreneurship?

Exploring financial strategies to build wealth and security is vital, as it helps provide a monetary cushion during the initial phases of starting a business.

What role does market research play in transitioning to entrepreneurship?

Conducting thorough market research is essential for validating business ideas and understanding market demands, which is crucial for success in a competitive landscape.

How can personal networks and funding options assist career transitioners?

Leveraging personal networks can provide insights and support, while exploring funding options like micro loans and grants from the U.S. Small Business Administration can enhance available resources.

Why is creating a detailed business plan important?

A business plan serves as a roadmap for the entrepreneurial venture, guiding the entrepreneur through the initial stages and helping to clarify goals and strategies.

What is the significance of setting achievable short-term goals during this transition?

Setting achievable short-term goals helps keep entrepreneurs motivated and allows them to track their progress effectively.

How can networking with fellow entrepreneurs be beneficial?

Networking provides valuable insights and helps build a robust support system, empowering individuals to control their destiny and achieve financial freedom.