Overview

The best financial planning for new entrepreneurs involves mastering cash flow management, comprehensive budgeting, and establishing a reserve fund to ensure a robust economic future. The article supports this by emphasizing that effective budgeting and financial oversight are critical for decision-making, resource allocation, and preparing for unexpected costs, which are essential for sustaining startup success.

Introduction

In the dynamic world of entrepreneurship, financial planning emerges as a critical foundation for success. New entrepreneurs often find themselves navigating a complex landscape filled with both opportunities and challenges, making it essential to master key financial principles.

From effective cash flow management to the establishment of a reserve fund, understanding these elements can significantly influence a startup’s trajectory. As the entrepreneurial ecosystem continues to evolve, the importance of strategic financial oversight cannot be overstated.

This article delves into practical strategies, the role of financial advisors, and the common pitfalls to avoid, equipping aspiring business owners with the insights needed to foster sustainable growth and resilience in their ventures.

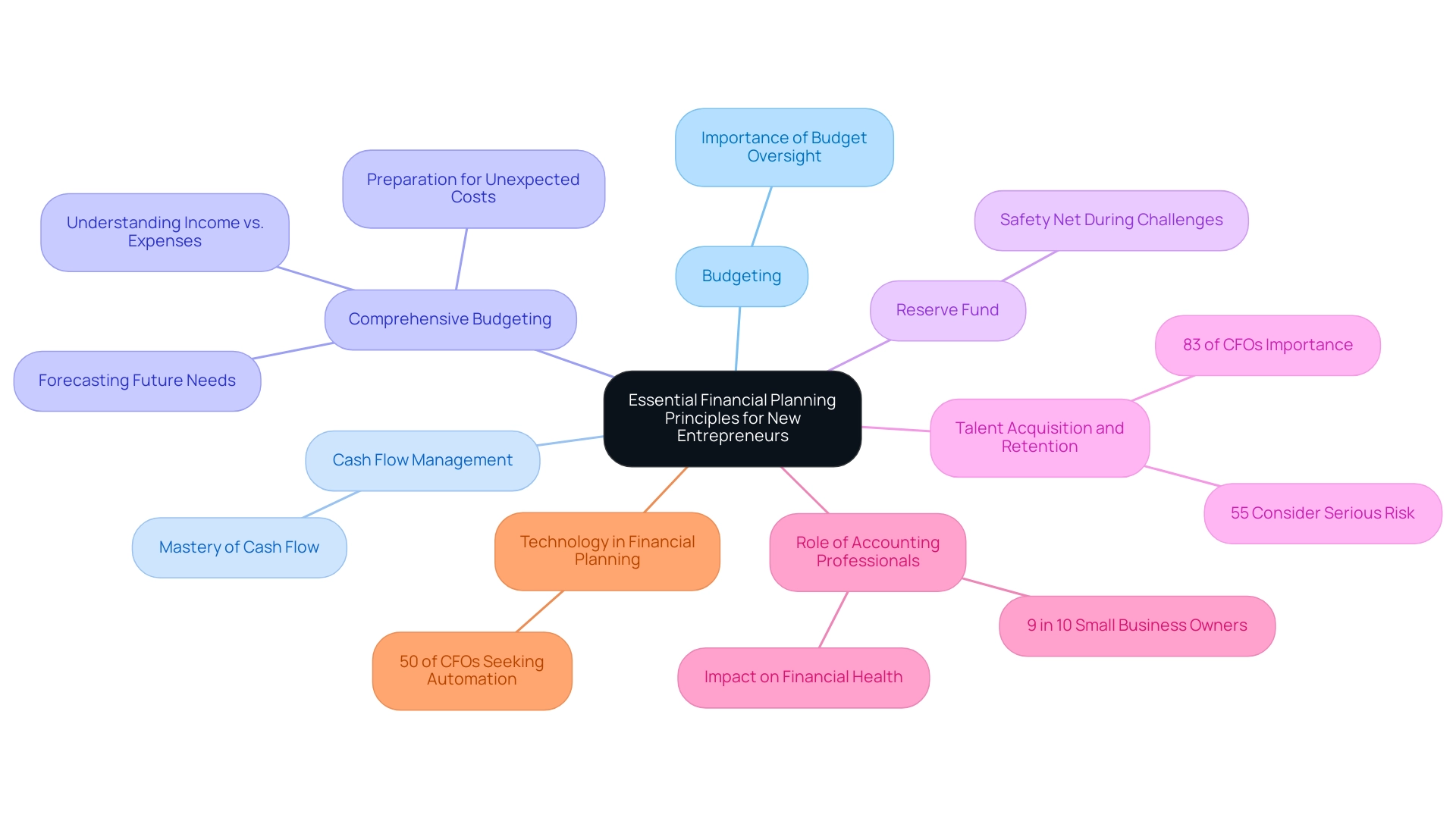

Essential Financial Planning Principles for New Entrepreneurs

Budgeting is essential for the best financial planning for new entrepreneurs, laying the groundwork for a robust economic future. Central to this process are several key principles, particularly:

- Mastery of cash flow management

- Comprehensive budgeting

- Establishment of a reserve fund

With 83% of CFOs indicating that hiring and retaining talent is very important to growth—more than even the CHRO—it becomes evident that budget oversight must be a priority from the outset.

To effectively manage their finances, entrepreneurs need the best financial planning for new entrepreneurs, which includes:

- A clear understanding of their income versus expenses

- Enabling precise forecasting of future monetary needs

- Preparation for unexpected costs

An effective budget not only streamlines decision-making but also ensures optimal resource allocation, while a reserve fund acts as a crucial safety net during challenging periods. Significantly, nine out of ten small business owners think their accounting experts play a crucial role in their business’s success, as emphasized in a case study indicating that businesses lacking an accounting professional are less likely to report robust economic health or confidence in passing an audit.

Furthermore, as Christina Ross, CFO and CEO of Cube, points out, “More than 50% of CFOs are looking to finance automation software to help them generate insights,” emphasizing the importance of leveraging technology in financial planning. By adhering to these principles, entrepreneurs can enhance their day-to-day operations and strategically position themselves for the best financial planning for new entrepreneurs.

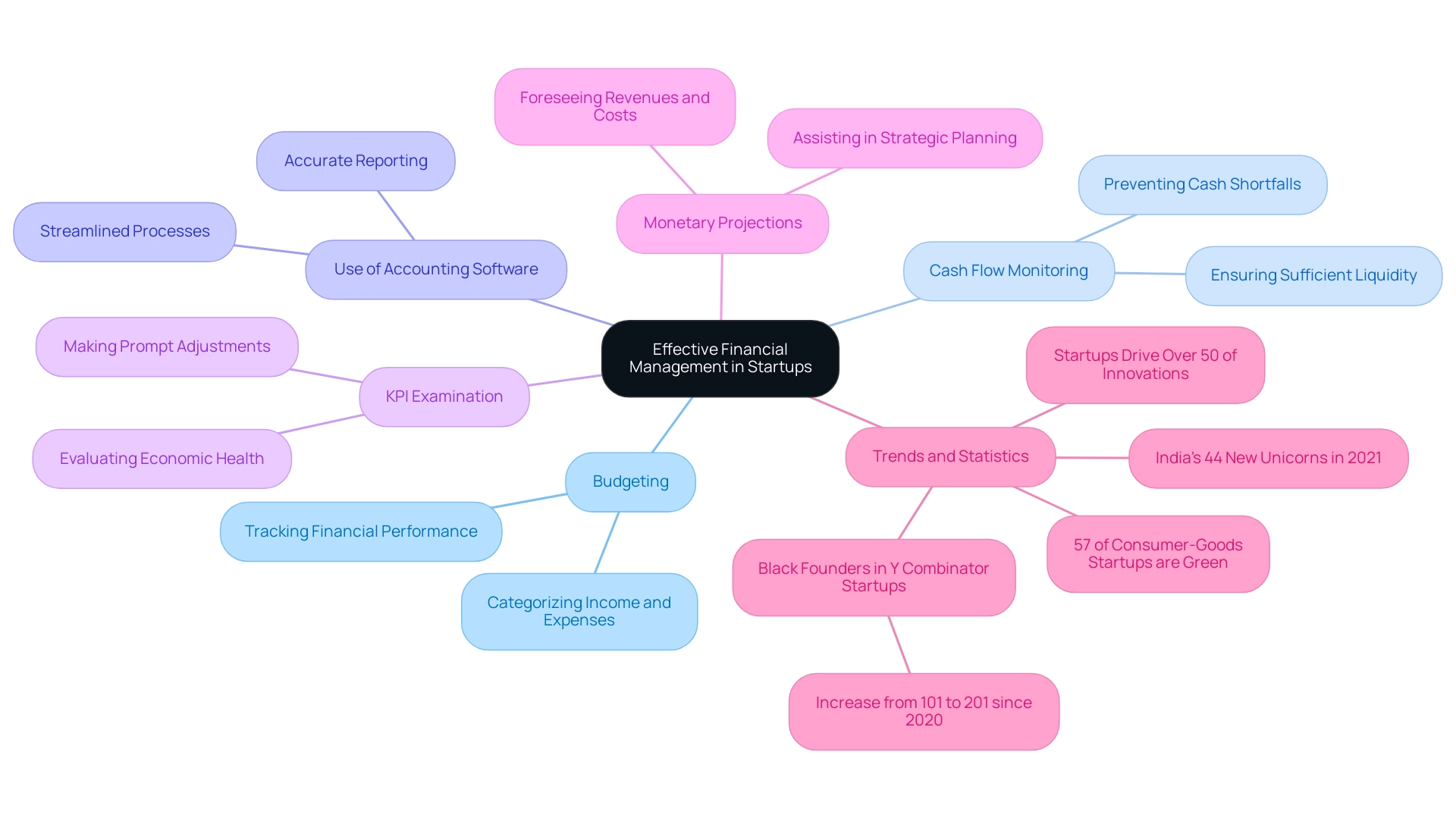

Practical Strategies for Effective Financial Management in Startups

Effectively managing finances in a startup involves the best financial planning for new entrepreneurs and the implementation of several essential strategies. Central to the best financial planning for new entrepreneurs is the maintenance of a detailed budget that categorizes all income and expenses, which is vital for tracking financial performance accurately. This practice not only helps in identifying spending patterns but also empowers entrepreneurs to make informed decisions.

Monitoring cash flow closely is equally crucial; implementing the best financial planning for new entrepreneurs to ensure sufficient liquidity can prevent cash shortfalls that threaten business operations. Many successful new ventures utilize accounting software for budgeting, which is considered the best financial planning for new entrepreneurs, facilitating streamlined processes and accurate reporting. Interestingly, it is completely free to open a company in Rwanda and Slovenia, making these locations attractive for new entrepreneurs.

As per McKinsey & Company, 57% of new ventures in the consumer-goods sector are ‘green companies,’ emphasizing a trend towards sustainability in resource management. Furthermore, the representation of black founders in Y Combinator-backed ventures, which rose from 101 to 201 since 2020, highlights the significance of diversity in the entrepreneurial ecosystem. Additionally, India included 44 new firms in its unicorn list in 2021, highlighting the worldwide expansion of startups and the importance of the best financial planning for new entrepreneurs in this context.

Consistently examining statements and key performance indicators (KPIs) is also essential to evaluating economic health and making prompt adjustments. Developing a monetary projection allows business owners to foresee upcoming revenues and costs, assisting in strategic planning and investment choices. As the landscape evolves, the best financial planning for new entrepreneurs is not just beneficial but essential for startup success in 2024 and beyond.

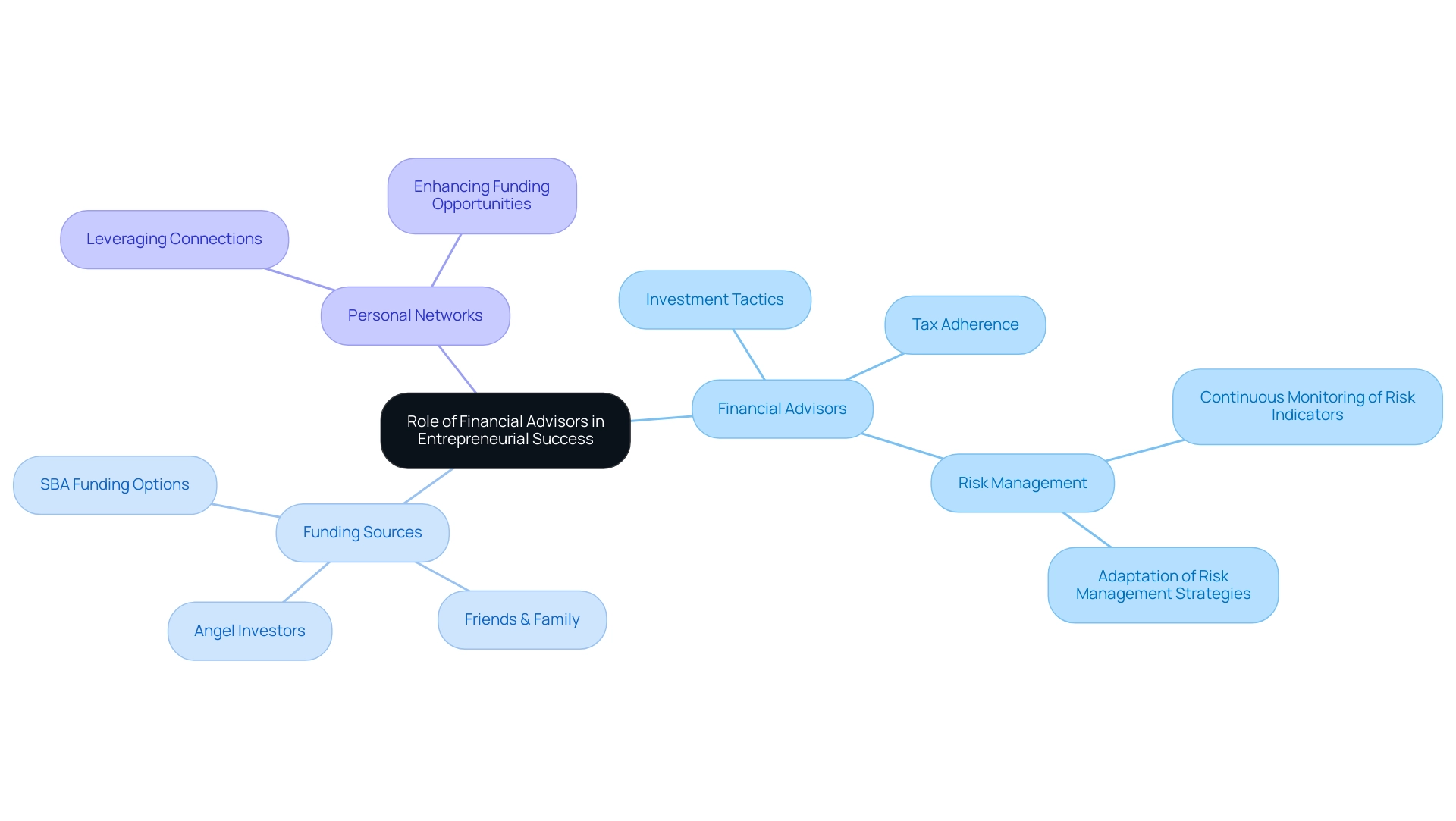

The Role of Financial Advisors in Supporting Entrepreneurial Success

The participation of monetary consultants is crucial for new business owners aiming to achieve the best financial planning for new entrepreneurs while maneuvering through the complex terrain of money management. These specialists assist in creating the best financial planning for new entrepreneurs by guiding business owners through investment tactics and ensuring tax adherence. Notably, angel investors play a crucial role in funding, providing capital in exchange for equity stakes.

Additionally, friends, family, and colleagues can offer valuable support, whether through direct funding or by connecting entrepreneurs with potential investors. Leveraging personal networks can significantly enhance funding opportunities. Furthermore, the U.S. Small Business Administration offers various funding options that can be beneficial for small enterprises, complementing the support provided by financial advisors.

Statistics indicate that advisors typically offer equity ranging from 0.25% to 1%, with the latter reflecting a high level of expertise. As one seasoned advisor aptly stated, ‘But handshakes and smiley face emojis don’t hold up in court – put everything in writing!’ This highlights the necessity of formal agreements in business partnerships.

Moreover, only 40% of investors depend on robo-advisors for trustworthy guidance, highlighting the significance of human advisors in offering personalized assistance to business owners. By leveraging their insights into market trends and funding opportunities, including those available through angel investors and the SBA, advisors ensure the best financial planning for new entrepreneurs to make informed decisions. They provide specific services such as risk assessment, forecasting, and strategic planning, ensuring continuous monitoring of risk indicators.

This enables new ventures to adapt their risk management approaches effectively. As a result, entrepreneurs can maintain focus on their core business activities, confident that their economic health is being expertly managed. The choice of an advisor should be deliberate; as illustrated by the case study on assessing personal contributions, advisors must evaluate their skills and networks to ensure they can genuinely add value.

This evaluation process is crucial, as it ensures that advisors only accept roles where they can make meaningful contributions, thereby translating their expertise into tangible support for entrepreneurial growth. The influence of monetary guidance on the success of startups cannot be overstated, as it often determines the trajectory of new ventures.

Setting and Monitoring Financial Goals for Sustainable Growth

Establishing and monitoring economic goals is paramount for the best financial planning for new entrepreneurs in any entrepreneurial endeavor. Entrepreneurs should begin by outlining both short-term and long-term monetary objectives, focusing on critical metrics such as revenue targets, profit margins, and cost management goals, as part of the best financial planning for new entrepreneurs. Regularly reviewing these goals and adjusting them based on actual performance is essential to ensure alignment with the overarching business strategy.

Significantly, merely 20% of managers are assured in their organization’s capacity to transfer staff between units, emphasizing the difficulties leaders encounter in adjusting their economic strategies. The use of monetary dashboards serves as a powerful tool in achieving the best financial planning for new entrepreneurs, enabling them to track progress and make informed, data-driven decisions. Furthermore, celebrating milestones not only encourages teams but also highlights the importance of the best financial planning for new entrepreneurs in achieving wider organizational goals.

According to the OKR Impact Report 2022, a significant majority of decision-makers would suggest structured frameworks like OKRs for aligning monetary objectives, which represents the best financial planning for new entrepreneurs, averaging a high satisfaction rate of 8.5/10. Furthermore, the case study titled “Reporting Best Practices from an Outsourced CFO” illustrates how effective reporting can guide strategic decisions and support overall business performance. Outsourced CFOs offer the best financial planning for new entrepreneurs by providing strategic guidance for goal setting and collaborating with leadership to develop strategies that support long-term objectives.

This demonstrates the increasing acknowledgment of the need for clear monetary goals in fostering entrepreneurial success, especially as we near 2024, when the emphasis on sustainable growth will be more essential than ever.

![]()

Avoiding Common Financial Pitfalls in Entrepreneurship

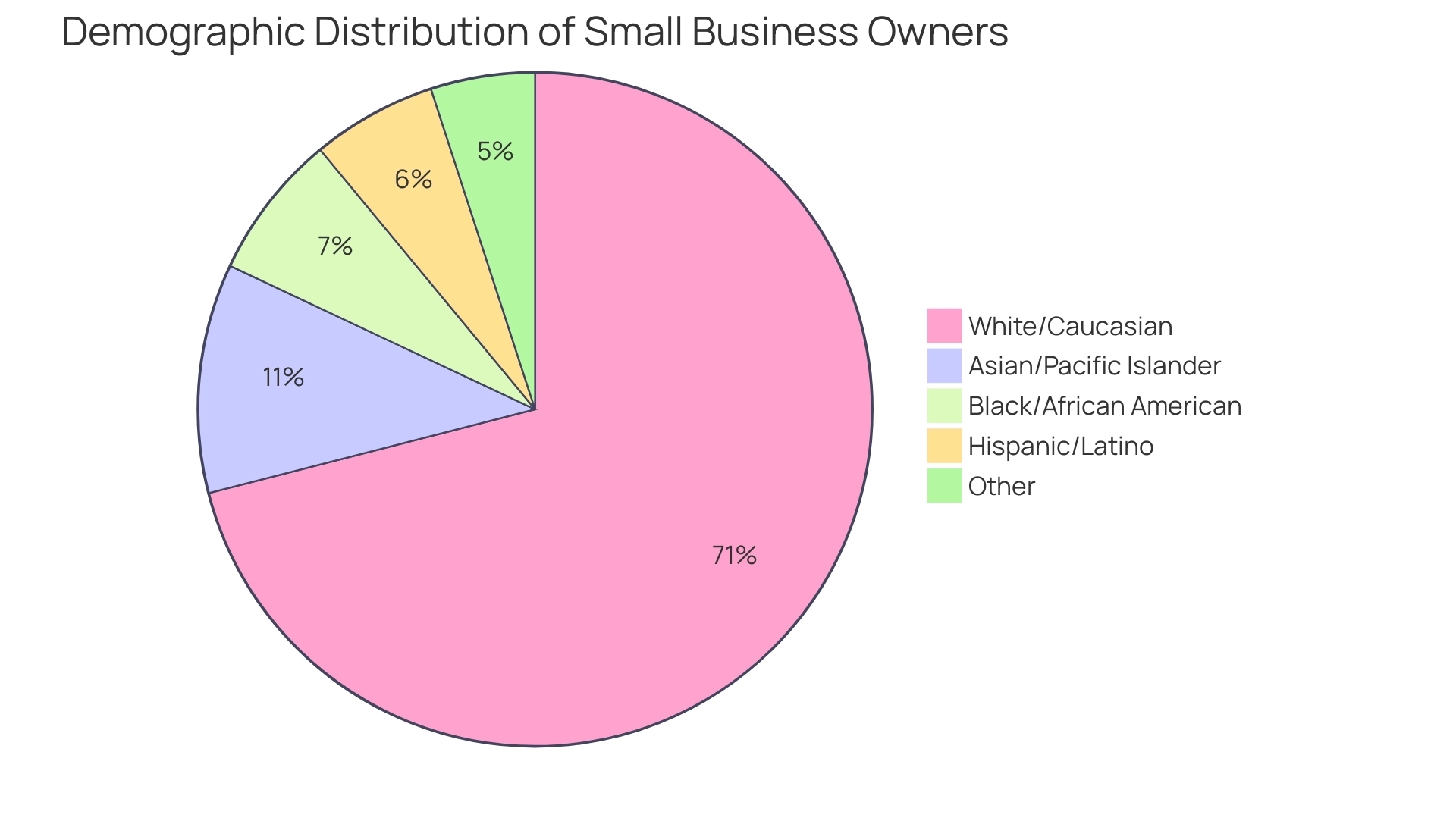

Navigating the entrepreneurial landscape can be fraught with financial challenges that highlight the need for the best financial planning for new entrepreneurs. A key issue is the tendency to underestimate startup costs, a miscalculation that can lead to cash flow problems—evidenced by the troubling statistic that 82% of enterprises that failed in 2023 cited such issues as their primary cause. Furthermore, it’s important to recognize that:

- 71% of small business owners are White/Caucasian

- 6% are Hispanic/Latino

- 7% are Black/African American

- 11% are Asian/Pacific Islander

- 5% identify as Other

This demographic disparity emphasizes the need for more varied viewpoints in entrepreneurship, as typical monetary pitfalls impact a wide array of founders. To mitigate these risks, aspiring business owners should conduct meticulous market research to better estimate their costs and implement the best financial planning for new entrepreneurs by developing a robust, detailed budget. This process aids in differentiating personal expenses from business expenditures, which is essential for precise tax reporting and ensuring clarity in accounts.

Regular monetary assessments and discussions with a consultant can further illuminate potential risks, enabling business owners to adjust their strategies before challenges escalate. As a vital reminder, founders of previously successful ventures enjoy a 30% chance of success with their next endeavor, while first-time business owners face only an 18% chance. This underscores the importance of the best financial planning for new entrepreneurs.

By learning from common financial mistakes, such as those highlighted in case studies of startups that overcame early financial hurdles, new entrepreneurs can better position themselves for sustainable growth and success.

Conclusion

Establishing a solid financial foundation is essential for new entrepreneurs aiming for long-term success. By mastering key financial principles such as cash flow management, budgeting, and the creation of a reserve fund, entrepreneurs can navigate the complexities of the business landscape with greater confidence. The insights gathered throughout this article emphasize the importance of strategic financial oversight in fostering sustainable growth.

Implementing practical strategies for financial management, such as maintaining detailed budgets and closely monitoring cash flow, equips entrepreneurs to make informed decisions that can significantly impact their business trajectory. The role of financial advisors cannot be overlooked, as they provide crucial guidance in navigating funding opportunities and developing comprehensive financial plans. Their expertise can empower entrepreneurs to adapt to market changes and avoid common pitfalls that may jeopardize their ventures.

Setting clear financial goals and regularly assessing progress towards these objectives is vital for sustaining growth. By leveraging tools like financial dashboards and celebrating milestones, entrepreneurs can foster a culture of financial discipline within their teams. Ultimately, avoiding common financial missteps and learning from past challenges can enhance an entrepreneur’s chances of success, particularly in an ever-evolving marketplace. Embracing these strategies and insights will not only contribute to a thriving business but also lay the groundwork for a resilient future in entrepreneurship.