Introduction

Acquiring an existing business can be a transformative step for aspiring entrepreneurs, but navigating the complexities of financing such a venture requires careful consideration and strategic planning. Understanding the various types of acquisition loans, from traditional bank options to government-backed SBA loans, is crucial for aligning financial choices with personal and business objectives.

Crafting a robust business plan not only enhances the likelihood of securing funding but also serves as a guiding framework for success post-acquisition. As interest rates fluctuate and the economic landscape evolves, being equipped with the right knowledge and tools can empower buyers to make informed decisions, ultimately paving the way for a successful transition into business ownership.

This article delves into essential insights and practical tips that will help prospective buyers confidently navigate the acquisition process and secure the financing needed to thrive.

Understanding Loans for Business Acquisition

When looking to acquire a current enterprise, one may wonder, can you take out a loan to buy a business, as this often requires particular financial instruments known as purchase financing from banks, credit unions, or alternative lenders. Understanding the nuances of these loans—such as terms, interest rates, and repayment schedules—is vital, as these elements directly impact the total cost of the acquisition. A comprehensive budget that balances both fixed and variable costs is essential here; this means not only identifying your essential expenses, like rent and utilities, but also understanding your discretionary spending, such as marketing and employee perks.

Recent statistics reveal that the Small Business Administration (SBA) approved approximately 65% of small enterprise loan applications, underscoring the importance of being well-prepared before seeking financing. As interest rates continue to rise, potential borrowers should remain vigilant. Finance writer Janet Gershen-Siegel observes, ‘But as times change and the Fed continues to raise interest rates, small enterprise finance will evolve accordingly, and entrepreneurs may be more inclined to borrow in order to move beyond surviving and begin thriving.’

This emphasizes the importance of evaluating one’s economic well-being and being informed about possible risks linked to acquiring debt, especially when asking, can you take out a loan to buy a business. Moreover, empowering yourself through knowledge of various investment vehicles can transform potential financial concerns into tangible opportunities. The SBA’s allocation of more than 14 million credits valued at $764 billion during the pandemic highlights the essential role of government assistance in small enterprise financing, offering a context for comprehending the present environment of funding.

A well-designed strategy not only assists in obtaining financing but also acts as a guide for managing the challenges that may occur during the purchasing process. By developing a robust plan that encompasses a comprehensive budget and comprehension of financing terms, aspiring entrepreneurs can tackle the acquisition with assurance and precision, reducing possible challenges resulting in venture failure.

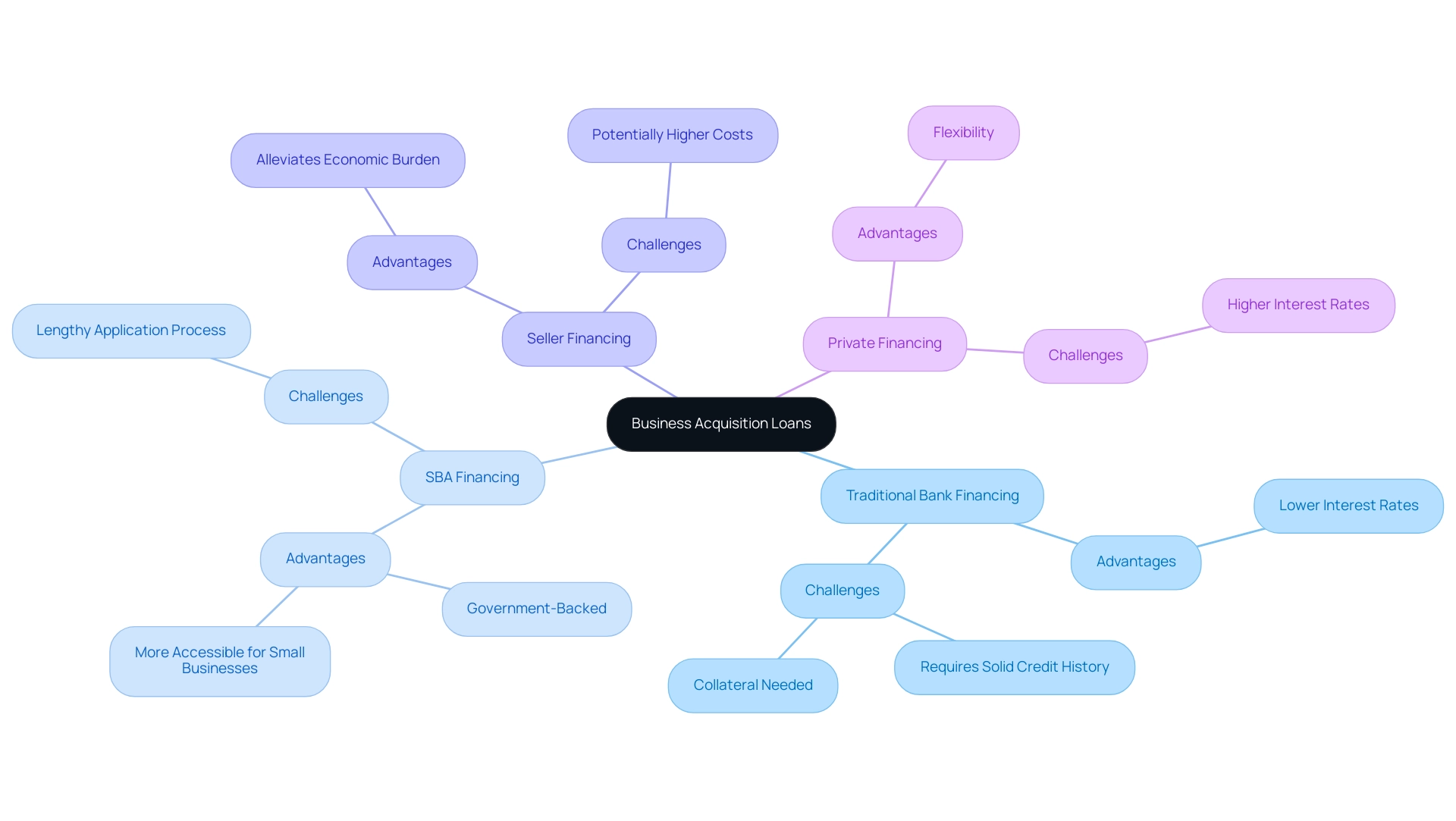

Exploring Different Types of Business Acquisition Loans

When evaluating the financing options for acquiring a business, an important question to consider is, can you take out a loan to buy a business, as it’s essential to understand the various types of financial assistance available, each with its unique advantages and challenges. Traditional bank financing options are a popular choice, often offering lower interest rates, typically capped at the base rate plus 3.0% for amounts exceeding $350,001. However, these financial products usually require a solid credit history and collateral, making them suitable for financially stable buyers.

On the other hand, Small Business Administration (SBA) financing offers a government-backed alternative that can be more accessible for small businesses. Although their application process can be lengthy, the benefits often outweigh the drawbacks, especially for those who may find traditional financing challenging to secure. SBA District Offices provide valuable assistance during this process, offering in-person, online, or telephone support, which can help streamline the experience.

Seller financing is another viable option, allowing the seller to finance a portion of the purchase price. This arrangement can significantly alleviate the economic burden on purchasers who may not satisfy the strict requirements of conventional financing. Private financing, while less common, can also serve as a means of funding, providing flexibility but often at higher interest rates.

Understanding these options is crucial for determining if you can take out a loan to buy a business that aligns with your personal financial circumstances and goals. As mentioned by the Business Purchase team at BankProv, the funding process involves several key steps:

- Initial Conversation. During your fundraising period, or once you’ve stopped actively raising, meet with our Business Acquisition lending team to discuss your background, investors you have gathered, outline your thesis, and review your objectives.

This proactive approach not only aids in guaranteeing a smooth and efficient financing process but also emphasizes the significance of speed and efficiency throughout the procurement journey. Furthermore, as detailed in the case study on the company purchase loan process, clients can anticipate a structured pathway that assists with documentation submission and improves their overall experience, allowing them to make informed choices as they move into ownership.

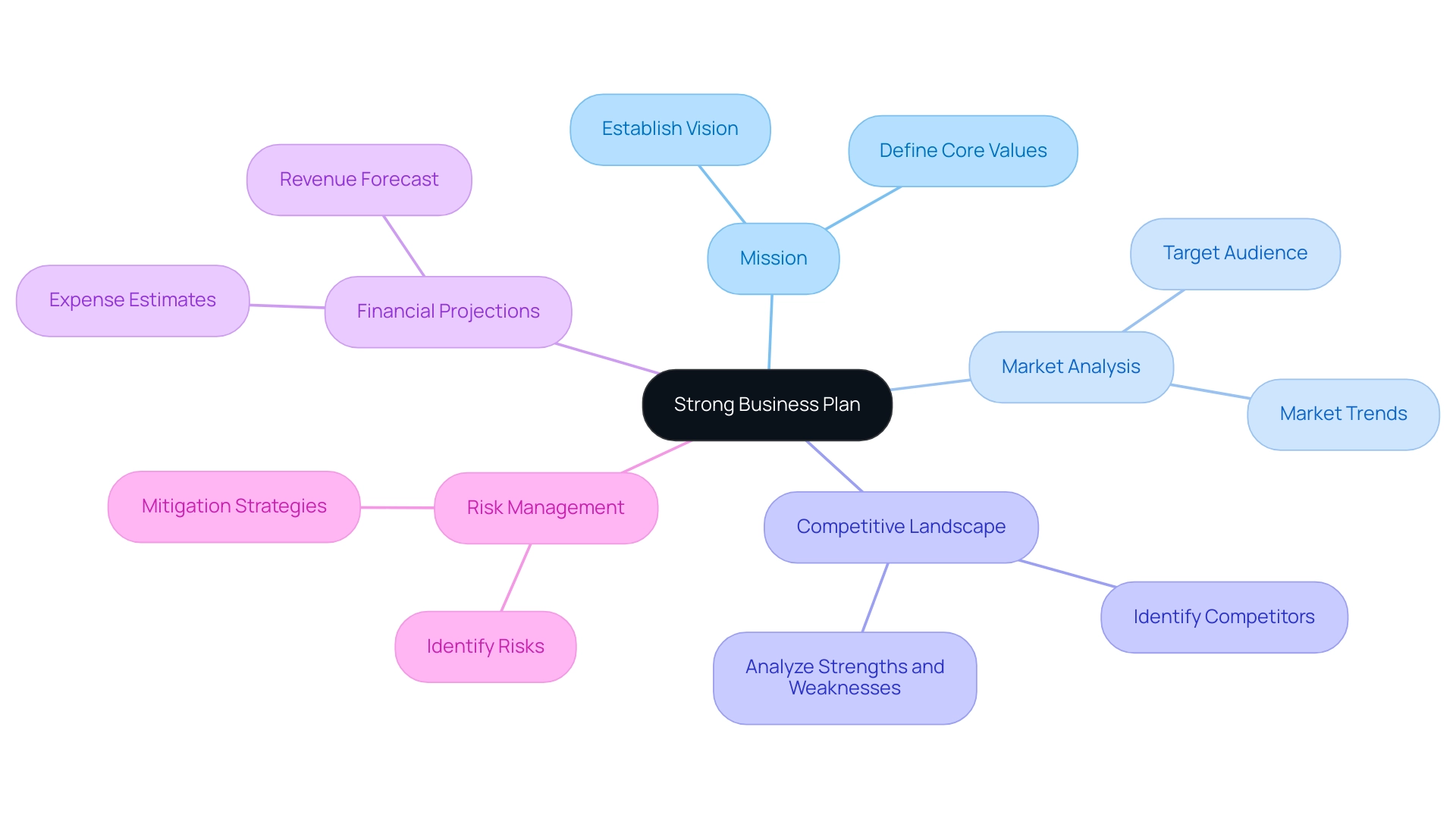

The Critical Role of a Strong Business Plan

Developing a strong plan is essential for anyone asking, can you take out a loan to buy a business for an acquisition? This plan should meticulously detail the organization’s mission, conduct a thorough market analysis, articulate the competitive landscape, and present realistic financial projections. Lenders rely heavily on this comprehensive document to evaluate both the viability of the venture and the buyer’s grasp of the market dynamics, especially when considering if you can take out a loan to buy a business.

Recent studies suggest that enterprises with well-organized strategies are significantly more successful in securing funding, which is essential considering that only half of small enterprises endure beyond five years. For instance, Fred Smith, the founder of FedEx, took a significant risk by betting the company’s last $5,000 on an idea that ultimately transformed the shipping industry. This gamble exemplifies how a well-thought-out strategy can lead to substantial rewards.

Furthermore, this plan acts as a strategic compass for the buyer, ensuring that they remain aligned with their operational goals throughout the transition. As management guru Peter Drucker wisely noted,

The greatest danger in times of turbulence is not the turbulence—it is to act with yesterday’s logic.

Adopting a forward-looking strategy in your plan not only improves your chances of financing approval but also prepares you for sustainable growth in a constantly changing marketplace, especially if you are considering whether you can take out a loan to buy a business.

By stepping out of comfort zones and taking calculated risks, aspiring entrepreneurs can navigate the complexities of acquisition financing more effectively.

Essential Tips for Securing Your Business Loan

Obtaining a commercial financing option necessitates a strategic method, starting with the essential action of guaranteeing your credit rating is in excellent shape. A strong credit score not only affects the terms and interest rates of potential financing but also opens up various funding options available from the U.S. Small Business Administration (SBA), such as the 7(a) program and microloans. As Lisa Maas, Director of Government Guaranty Lending, emphasizes, ‘Providing complete enterprise fiscal statements not only fulfills your lender’s requirements but demonstrates your company’s economic health, stability, and ability to repay a small enterprise loan.’

This underscores the necessity of compiling all required documentation, including:

- Detailed financial statements

- Tax returns

to present a comprehensive view of your financial situation. Additionally, practicing your pitch to lenders is vital; clearly articulating your business plan and qualifications can significantly enhance your appeal. Establishing and nurturing relationships with commercial bankers is equally important.

For instance, a case study of a local cafe that secured a 7(a) loan illustrates how maintaining good communication with bankers led to favorable financing terms and a successful loan application. Moreover, exploring funding opportunities while working on your credit score empowers you to take control of your financial future. Connecting with other entrepreneurs and seeking referrals can further enhance your credibility, ultimately increasing your chances of obtaining the necessary funding for your venture in 2024.

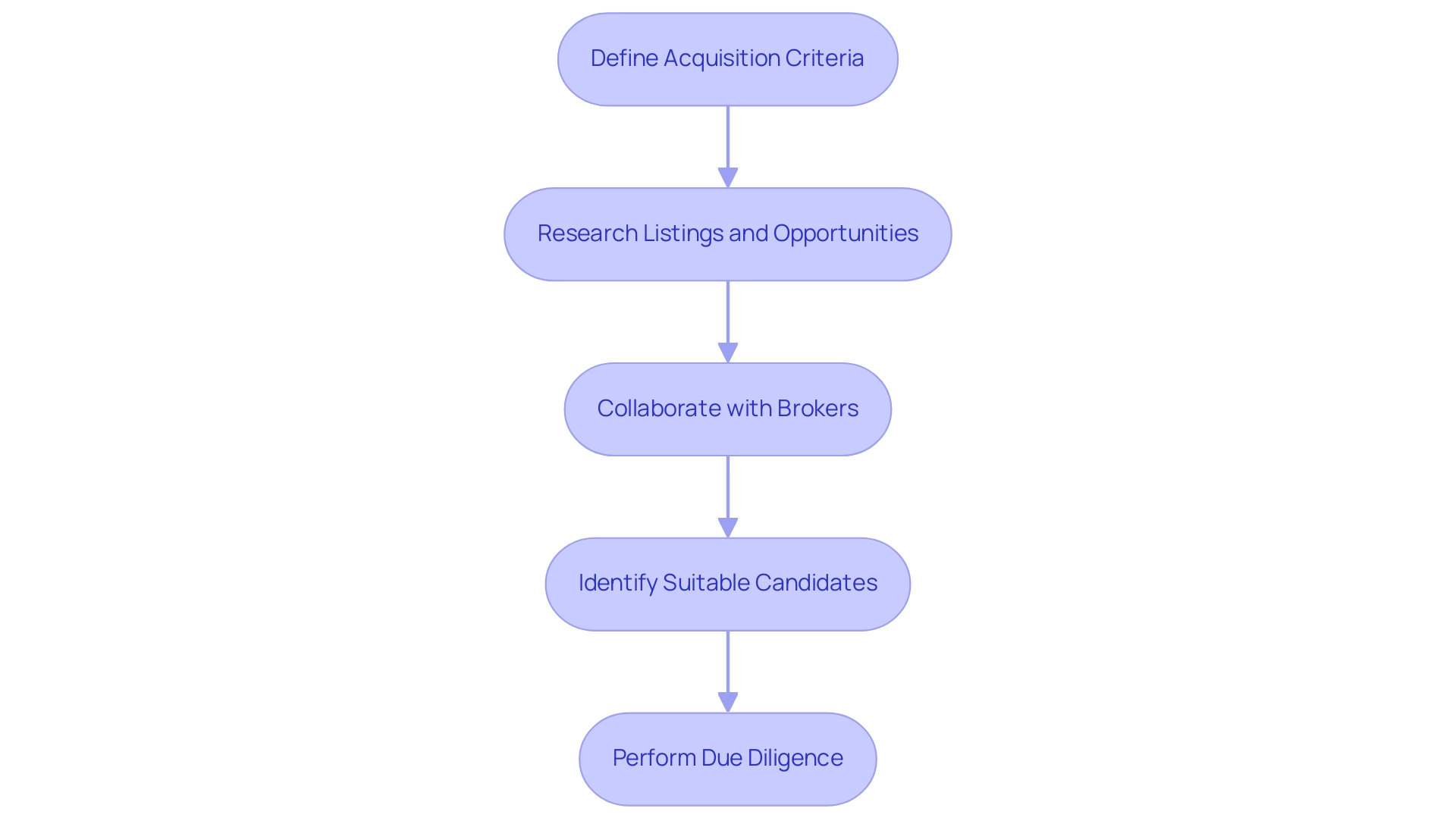

Finding Your Ideal Business Acquisition

Finding the right business to acquire requires meticulous research and strategic planning. Begin by clearly defining your criteria for the ideal purchase, which should encompass factors such as:

- Industry

- Size

- Location

- Financial performance

Recent statistics indicate that many buyers prioritize these elements when considering potential acquisitions.

Utilize listings, online marketplaces, and industry networks to uncover opportunities that fit your defined criteria. Collaborating with a broker can significantly improve your search. Brokers possess extensive networks and access to a broader array of listings, enabling them to provide insights that you might not find independently.

After spotting suitable candidates, it’s essential to perform comprehensive due diligence—a process highlighted by specialists who stress that due diligence is vital to grasping the economic stability and operational feasibility of an organization. This diligent approach not only protects your investment but also ensures that the purchase aligns with your career aspirations and financial goals. As analysts forecast the S&P 500 index will hit 6,500 points by the conclusion of 2025, propelled by economic expansion and profits, the market exhibits signs of recovery, creating a favorable moment to investigate the realm of business purchases.

Furthermore, the scrutiny surrounding Google’s deal with Anthropic highlights the complexities involved in strategic acquisitions, reinforcing the necessity of due diligence in navigating such challenges.

Conclusion

Acquiring a business requires a clear understanding of financing options, strategic planning, and careful execution. Prospective buyers must navigate various acquisition loans, from traditional bank loans to SBA and seller financing, each with its own advantages and challenges. Aligning these financial choices with personal goals and the business’s needs is essential for success.

A strong business plan is critical, serving as both a roadmap and a persuasive tool for securing funding. By detailing the mission, conducting market analysis, and providing realistic financial projections, a well-structured plan enhances credibility and increases the likelihood of loan approval.

Additionally, securing a business loan requires a strategic approach, starting with a solid credit profile and thorough documentation. Building relationships with lenders and practicing effective communication can lead to better loan terms. Staying proactive in exploring funding opportunities and refining financial strategies is vital in an evolving economic landscape.

In summary, the business acquisition journey offers significant potential for growth. By equipping themselves with the right knowledge—understanding financing options, crafting a solid business plan, and approaching the loan process strategically—prospective buyers can confidently navigate their acquisition journey and lay a strong foundation for future success in business ownership.

Frequently Asked Questions

Can you take out a loan to buy a business?

Yes, it is possible to take out a loan to buy a business, often through financial instruments known as purchase financing from banks, credit unions, or alternative lenders.

What factors should be considered when acquiring a business?

Important factors include understanding the terms, interest rates, and repayment schedules of loans, as these elements affect the total cost of the acquisition. A comprehensive budget that balances fixed and variable costs is also essential.

What is the approval rate for small enterprise loan applications?

The Small Business Administration (SBA) approved approximately 65% of small enterprise loan applications, highlighting the importance of being well-prepared before seeking financing.

What types of financing options are available for acquiring a business?

Financing options include traditional bank financing, SBA financing, seller financing, and private financing. Each option has its unique advantages and challenges.

What are the advantages of SBA financing?

SBA financing offers a government-backed alternative that can be more accessible for small businesses, despite a potentially lengthy application process. It is beneficial for those who may find traditional financing hard to secure.

What is seller financing?

Seller financing allows the seller to finance a portion of the purchase price, which can alleviate the financial burden on buyers who may not meet the strict requirements of conventional financing.

Why is a strong business plan important when seeking financing?

A well-organized business plan helps in securing funding by demonstrating the buyer’s understanding of market dynamics and the viability of the venture. It acts as a strategic guide throughout the acquisition process.

What documentation is required to apply for a business loan?

Required documentation includes detailed financial statements and tax returns, which provide a comprehensive view of your financial situation to lenders.

How can maintaining a good credit score affect financing options?

A strong credit score can improve the terms and interest rates of potential financing and open up various funding options available from the SBA and other lenders.

What steps should be taken when searching for a business to acquire?

Begin by defining criteria for the ideal purchase, such as industry, size, location, and financial performance. Utilize listings, online marketplaces, and consider collaborating with a broker for better access to opportunities.

What is due diligence in the context of acquiring a business?

Due diligence is the process of thoroughly evaluating a potential acquisition to understand the economic stability and operational feasibility of the organization, protecting your investment and ensuring alignment with your goals.